Shaky foundations have been reinforced…

Long-standing concerns about the stability of the eurozone and its member states' public finances stem from a combination of structural challenges at national level and an inadequate infrastructure for the currency union. While the former remains a concern (discussed below), some welcome progress has been made on the latter.

Various institutional improvements and support mechanisms have been introduced since the Global Financial Crisis. These include 2012's creation of the European Stability Mechanism (ESM), with a total lending capacity of EUR 500bn, plus 2020's agreement on the Recovery and Resilience Facility (RRF), providing financial support to vulnerable member states, including via grants.

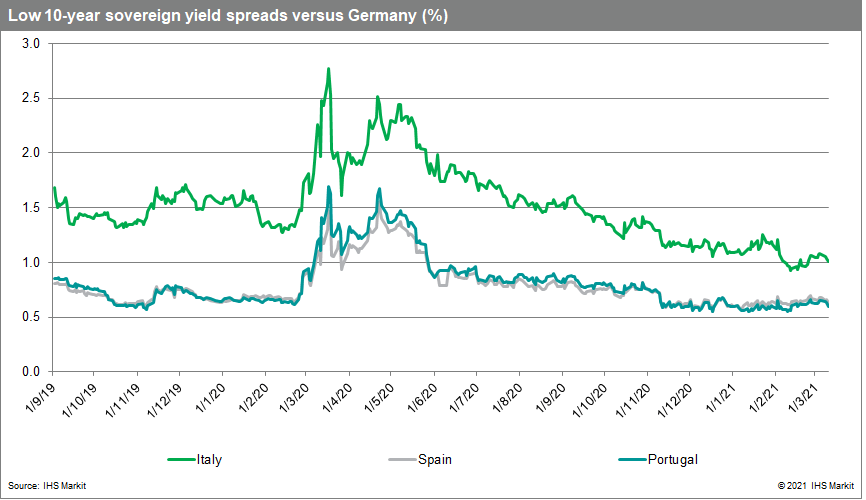

The ECB has also demonstrated its willingness to do whatever it takes to preserve eurozone financial stability via the creation of the Outright Monetary Transactions (OMT) framework in 2012 and its subsequent large-scale asset purchases under various programs, including the current Pandemic Emergency Purchase Program (PEPP). After a surge in the initial wave of COVID-19 in spring 2020, intra-eurozone yield spreads have remained relatively low and stable since.

…but high debt ratios will remain a source of vulnerability

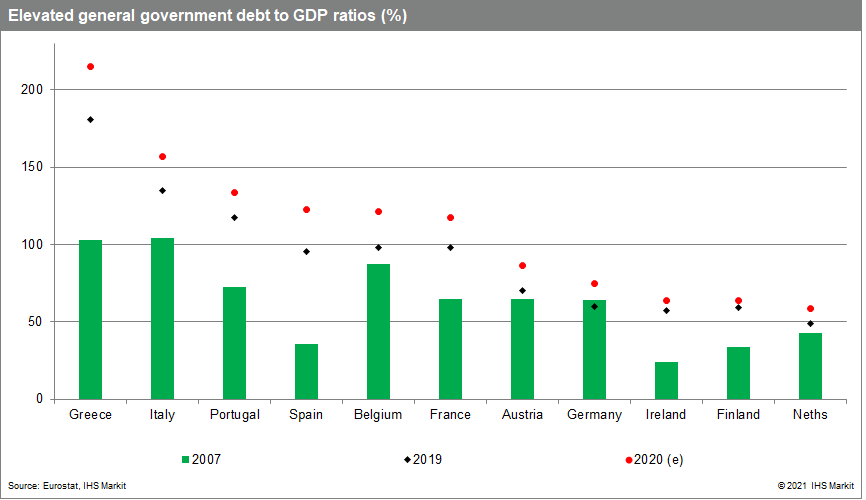

While the chances of another full-blown crisis engulfing the eurozone have reduced given the changes above, there is still cause for concern. In particular, the vulnerabilities associated with persistently high public debt to GDP ratios in the aftermath of the COVID-19 shock. Six eurozone member states have ratios well in excess of 100%.

The debt to GDP ratio is not the sole metric determining sustainability. As long as interest expenditure remains low, elevated debt to GDP ratios can be sustained for some time. However, a sudden loss of investor confidence and a jump in financing costs can quickly destabilize the situation, with far-reaching consequences for economic and financial stability.

While the eurozone now has various support