Editors' note: This article is meant to introduce the new Marketplace service Portfolio Income Solutions.

I really enjoy discussing investments and am fortunate that having written on SA for nearly a decade brings me a constant stream of intelligent people with whom to converse. A reader approached me with an interesting problem to which I thought I had a satisfactory answer. I quickly realized, however, that I did not.

The Problem – In an environment in which most of the market is overvalued, which sets up for a low return going forward, how can I responsibly generate a strong return on investment?

My Answer - High returns are still possible by carefully selecting the individual securities that have strong fundamentals and are trading at discounted valuations.

While I firmly believe that high returns can be achieved in this way, I realize now that I was essentially telling a business owner who already works about 60 hours a week to do the thousands of hours of research necessary to uncover these pockets of opportunity.

It works for me because investing is my life, but I get that it might not be feasible for the majority of people. I enjoy doing the research and dedicate thousands of hours to finding these high-return stocks. Let me do the work for you so you can focus on your own work or spend more time with your family.

That's why I have created Portfolio Income Solutions. It allows me to distill my analysis into actionable ideas and a portfolio with high return potential.

The Purpose - Portfolio Income Solutions is designed to help members generate a market-beating return on investment through a combination of capital gains and growing dividends.

Admittedly that's a generic goal. Who wouldn’t want a higher return? The differentiating factor for Portfolio Income Solutions is how we intend to actually achieve that goal. It occurs through two steps:

- Deep research into property types, management teams, supply chains, etc., and interpreting that information with experience to form stock picks.

- Relaying the analysis and stock picks to subscribers of Portfolio Income Solutions such that you can easily implement them into action in your own portfolios.

With that in mind, let me get into the weeds a bit to show you what that research consists of and then I will go on to show how this is translated into actionable ideas.

The Research Process

There are 20 REIT property sectors, each with a different set of fundamental drivers, but for brevity let us just look at the industrial sector.

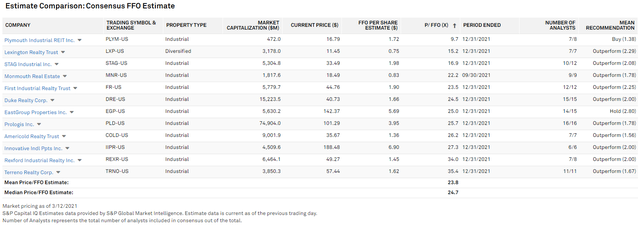

On Portfolio Income Solutions we regularly post data sets including the Price to Funds From Operations (P/FFO) of every REIT that has a consensus estimate. This is a good starting point for the analysis.

For the industrial subsector within REITs it looks like this. In particular, pay attention to the P/FFO column.

The industrial sector is broadly loved by the market for good reason - e-commerce growth is causing a boom in demand for logistics space. As a result, the sector as a whole trades at a high multiple with the mean and median (P/FFO) at 23.8X and 24.7X, respectively.

In response to the strong outlook, development is coming in rapidly. Given this new supply I think it would be a mistake to pay such high multiples. As such, the value end of the spectrum is where we want to be.

There are no shortcuts here. Blindly buying the lowest P/FFO multiple or the highest dividend yield is not proper fundamental analysis. Often, the cheapest stock in a sector is cheap for a reason.

So what’s wrong with Plymouth (PLYM)?

Well, nothing is fundamentally wrong with it. It's a good company, and in meeting with Jeff Witherell and the rest of the team it became clear that these guys really understand real estate. However, the problem is that it just isn’t anywhere near as cheap as it looks. The FFO multiple that any data aggregator pulls up will reference the FFO relative to the current share count.

A few years back, PLYM raised capital through a convertible instrument that will eventually become a large number of common shares. The capital was accretively put to work, but if we factor in the true diluted share count, the multiple is much higher than the 9X that gets displayed. There will probably be times when I invest in PLYM again, but the pricing isn’t great at the moment.

Next cheapest is Lexington (LXP) which, in my opinion, is just not a good company. I was not impressed by management and they perennially chase the hot sector. LXP used to be mostly office but as industrial got hot they transitioned over. The problem here is that when one sells the cold sector to buy the hot sector, pricing is rough on both ends of the transaction, so they took a substantial hit to net operating income and FFO in order to make the swap.

LXP has been around for decades, and if one examines its history you will see that chasing the ball rather than anticipating where the ball is going has been their standard practice. Its valuation is somewhat attractive, but the quality is weak in my opinion.

Finally, STAG Industrial (STAG) is my pick for the sector. At 16.9X FFO the valuation is reasonably cheap but it's the fundamental quality and growth that really make it work.

- Great balance sheet

- Great management

- Organic growth and external acquisition growth

- Well located properties

Much of this information is nearly unknowable if one were to just look at a snapshot of today’s data. Most people who look at Plymouth have no idea what their real diluted share count is because the way in which the deal was structured it doesn’t show up in the number on their balance sheet. Most people do not know how much value Lexington has destroyed.

The only reason I know these things is because I was there. I’ve met with the management. I already was following Plymouth when the unusual financing was underwritten. I watched as Lexington sold vacant office properties at large losses.

This is why I think we can beat the market. I have been running the real money portfolio of Portfolio Income Solutions since 7/1/16 and the landing page details the portfolio’s return track record since inception. Being deeply integrated into REITs for close to a decade gives me a knowledge set that I believe helps to differentiate the good from the bad.

How this Information/Knowledge/Analysis is Conveyed to Subscribers

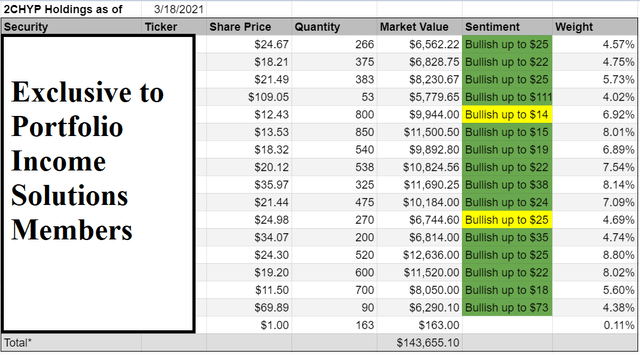

The Portfolio Income Solutions Marketplace Service has a continuous stream of actionable analysis and data sets. Any REIT data you could want is most likely going to be in the data tables that we publish and update. That said, the bread and butter of Portfolio Income Solutions is the portfolio.

The entire set of data and analysis will be available to all Portfolio Income Solutions subscribers, but there are the two main ways I imagine people will use it - time-saving or deep analysis.

Time-Saving Route to Strong Investment

Members have 24/7 access to the live portfolio (a few minutes delayed on upload), and since I put out trade alerts, including the reason for making the trade, whenever I trade the portfolio you can capture opportunities as they surface. To the extent you deem this investment strategy to be suitable for your individual needs you can buy or sell the same stocks.

In so doing, your returns are likely to be similar to my forward returns. That's a great way to use the service and I suspect it will be popular among busy people.

Deep analysis to Maximize Investment Returns

The other target audience for Portfolio Income Solutions is the investor who wants to dive deep and really master REIT investing.

While I want this to be a time-efficient service for you, at the same time, I want you to be able to verify that these stock picks are solid. I'm the type of person who wants to know what I'm investing in and I suspect many of you are as well. That is why along with the portfolio we put out an abundance of research and data.

- Subscribers get unlimited access to about 600 analytical reports with about 10-20 more coming each month.

- Fundamental analysis on every position in the portfolio.

- Updated AFFO, EV, NAV, FFO and Yield data on over 150 REITs.

- Special situation analysis: Key buying opportunities due to secondary offerings or other events.

How does this differ from what I already do on Seeking Alpha?

I will continue to publish a few articles per week to the public site, but the bulk of the portfolio and my top picks will be exclusive to Portfolio Income Solutions members.

Join me on the journey to responsibly growing wealth and investment income.

20% Discount to first 40 subscribers

Now is the time to get in because I’m offering a special discount to the first 40 people who subscribe to Portfolio Income Solutions.

The annual package costs just $399 for the first 40 subs after which point it will go to its regular price of $499.

You can subscribe monthly at $59, but basic arithmetic shows the annual package is much cheaper. Even though I get more money for a monthly subscription, I would much rather see people go annual because Portfolio Income Solutions is about long-term investment. It considers not only when to buy, but when to sell.

It’s not a get-rich-quick scheme. It’s responsible long-term investment in carefully-selected securities.

Also, if you join today, we give you a free 14-day trial so you can test it out with no obligation.

I'm really excited to be able to more fully share my ideas with you and look forward to discussing investments in the Portfolio Income Solutions chat room!