The eurozone economy beat expectations in March, showing a much better than anticipated expansion thanks mainly to a record surge in manufacturing output.

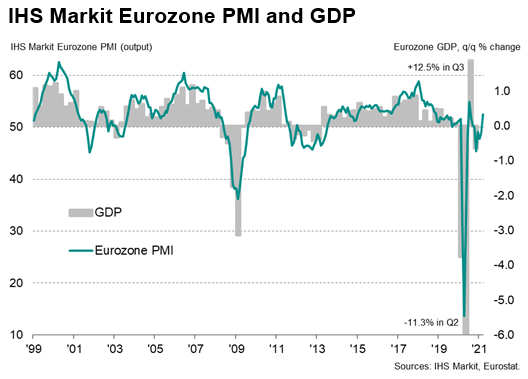

The headline IHS Markit Eurozone Composite PMI® rose from 48.8 in February to 52.5 in March, according to the preliminary 'flash' reading. By rising above 50.0, the latest reading indicated the first increase in business activity since last September, with the current expansion the largest recorded since last July and the second-steepest seen over the past 28 months.

Manufacturing surges but services struggle

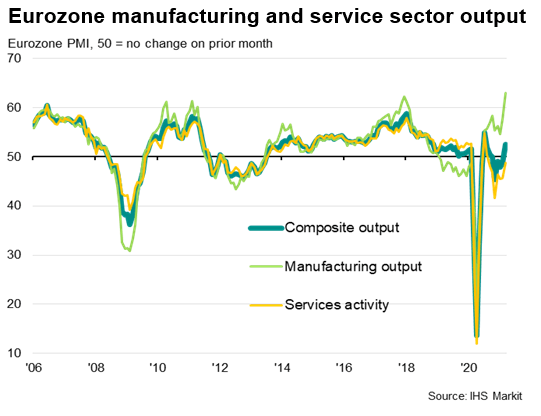

Divergent trends were seen by sector. While manufacturing output growth accelerated sharply to the highest since data were first available in 1997, the service sector continued to be constrained by the coronavirus disease 2019 (COVID-19) pandemic, with social distancing restrictions leading to a seventh successive monthly fall in business activity.

The service sector, therefore, remained the economy's weak spot, but even here the rate of decline moderated in March as companies benefited from the manufacturing sector's upturn, customers adapted to life during a pandemic and prospects remained relatively upbeat.

Germany leads the upturn

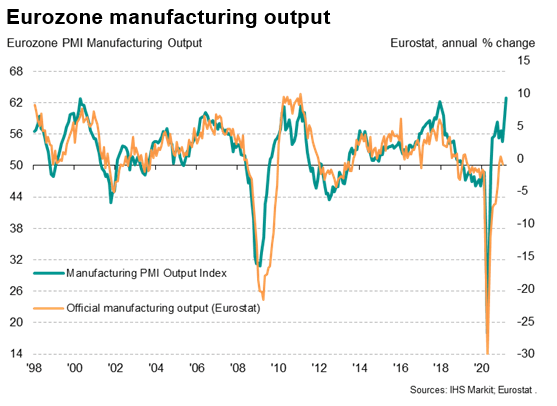

The manufacturing upturn was led by a record surge of factory production in Germany, accompanied by the fastest production growth since January 2018 in both France and the rest of the region as a whole.

Germany also outshone in terms of service sector performance, recording the first (albeit modest) expansion of activity for six months while France and the rest of the euro area merely saw rates of contraction moderate.

Looking at growth over both sectors combined, Germany's resulting upturn was the strongest for just over three years (the composite PMI rising from 51.1 to 56.8), contrasting with a decline in France for the seventh successive month (albeit with the index at 49.5, up from 47.0 in February). The rest of the region saw a modest return