Lately, it seems much of the market’s excitement has concentrated in a few areas with perhaps the hottest concepts being:

- Carbon Neutrality

- Shortage of housing

The market is correct to be excited about these areas and boatloads of money will be made, but the question is … by whom?

Far too much investor attention is focused on the hot topics and far too little focuses on which entity within the industry vertical will reap the rewards. The blind excitement is pouring capital into the stocks that are most obviously associated with these trends.

The obvious stocks, however, are rarely the best.

Within the broad concept of carbon neutrality, there are many stocks that are obviously associated, and almost invariably these trade at high or extremely high multiples.

- Electric vehicles

- Hydrogen fuel cells

- Battery technology

Within the concept of housing shortage, the most obviously associated stocks are the home builders, and much like the carbon-neutral stocks, capital has poured into them making the prices lofty.

Despite all of this enthusiasm, I would posit that it is not the EVs, fuel cells, or battery companies that are positioned to capture the value of the surging demand for carbon neutrality.

Similarly, it is not the home builders that are positioned to capture the value of the demand for more housing.

Studying the industry verticals reveals that it is a different section of each vertical that has the strategic advantage. In fact, this strategic advantage allows them to pull profit margin from the hot stocks into their own profit margin.

The strategically advantaged point in a vertical

An industry vertical essentially consists of the entire supply chain from creation to consumption, and in any given industry vertical, certain participants are able to put the squeeze on the rest of the chain and capture the lion’s share of value.

In economics 101, they teach that the overall magnitude of value creation is equal to the consumer’s surplus plus the producer’s surplus. Well, outside of the simplified example employed in the classroom, the producer’s surplus does not go to a single entity but rather is split between each link of the supply chain. So, how do we spot which section of the vertical is capturing most of the value?

Well, it’s a matter of input costs and output revenues. If a business is selling at a high price point, but their input costs are just about as high, they are not capturing much value. So, really what we are looking for is the link in the chain that has low input costs and high output value.

Let us examine each industry vertical and it should become clear where the strategic advantage lies.

The Carbon Neutral vertical

The market’s capital has poured into dozens of these hot stocks but few if any of the highfliers seem to have strong gross margins.

The reason for that is strategic in nature. Quite simply, the suppliers seem to have a competitive advantage over the consumer-facing companies which tend to be the popular ones in the stock market.

Batteries and EVs require rare earth metal inputs and electrolysis requires energy inputs to regenerate hydrogen.

So, even as the consumer-facing companies are able to charge high prices to the consumer, their input costs are also high. That is not where one wants to be for strategic value capture.

A closer look at Plug Power (PLUG) reveals that one of its suppliers is the strategic winner that is able to capture the value from the rest of the chain. PLUG does a variety of different things in the hydrogen space and is arguably the front runner at least in terms of popularity as evinced by its $22B market cap.

Ideally, the way it works is a vehicle powered by hydrogen emits water vapor as its exhaust and then the hydrogen is cleanly regenerated from water using electrolysis. Electrolysis requires a ton of electricity, so in order for this process to be fully green, one cannot just use grid power which is still largely coal, natural gas, and other fossil fuels, but must instead use green energy.

So, the vertical goes from the production of green energy to the PEM electrolysis machines that PLUG makes to the hydrogen fuel produced and finally the end-user of the hydrogen. So, who is winning in this supply chain? Well, PLUG’s product is highly demanded so they are able to sell it at a high price point, but PLUG is also buying power at a very high cost. Specifically, they buy power from Brookfield Renewable Partners (BEP) (BEPC), and as far as I can tell, Brookfield is eating their lunch.

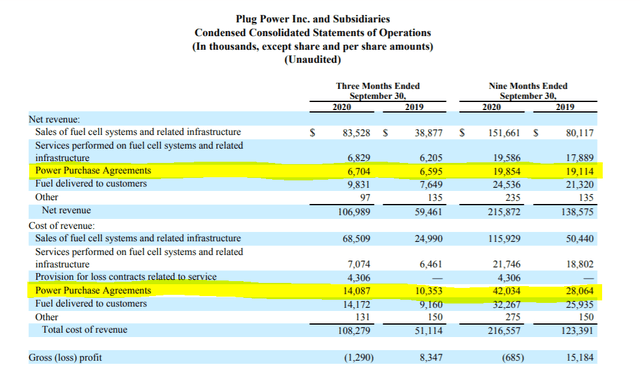

Note in Plug Power’s 10-Q that the revenue generated from the power purchase agreements is substantially lower than the cost of the power purchase agreements.

PLUG is willing to do this because it enhances their green image.

Brookfield is capturing all the value, however, in dollar terms. The reason BEP is able to sell its power at such a high rate is because it is one of very few utility-scale producers of energy that is entirely clean energy.

Most of the utility companies are mixed where they have some fossil fuel production and some green production, but because BEP is a pure-play producer of clean energy, the buyer knows the energy is clean and is willing to pay a premium on a per kilowatt basis.

Although there are many different ways to produce clean energy for individuals, such as rooftop solar, the efficiency is much higher when it is done at utility scale. That is where the bottleneck is. There are only a few utility-scale producers and even fewer utility-scale producers that are pure-play green producers.

Seemingly, much of the carbon neutrality concept eventually funnel down into demand for clean energy, and I firmly believe it will be the green energy producers like BEP that capture the lion’s share of the value.

BEP is a clear example of low input costs and high output value. It builds and operates power plants at maximal utility efficiency and sells that power at high prices generating a double-digit IRR.

The housing shortage concept

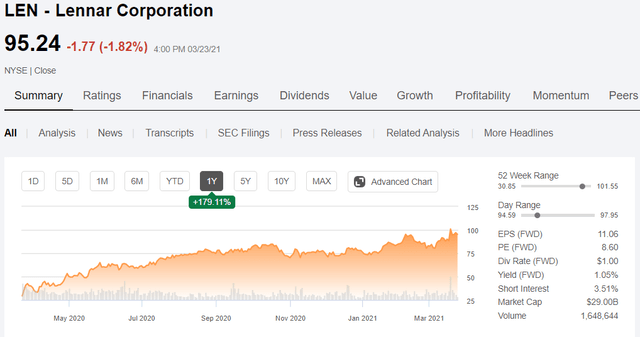

The housing shortage undoubtedly is creating a huge demand for homebuilding which makes homebuilders seem like a no-brainer. Investor capital has piled into companies like Lennar (LEN), which is up 179% in the last year.

While it is not necessarily overvalued at a PE of 11X, I think it would be a mistake to think LEN is positioned to capture the value of the boom in homebuilding.

This vertical demonstrates an unequal share of the value capture. Specifically, the homebuilders are having their margins pinched by the combination of rising mortgage financing rates and elevated input costs while the sawmills are capturing most of the value.

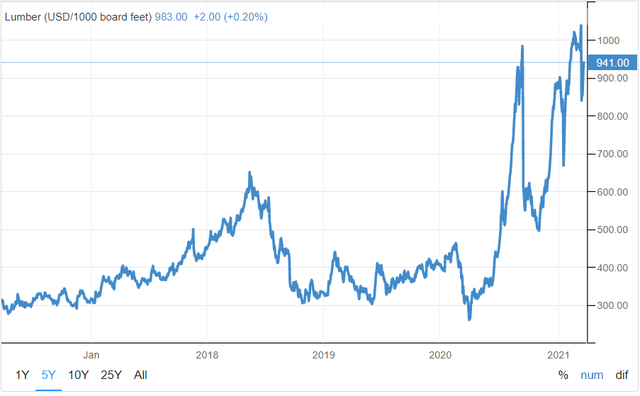

One of the largest input costs to homebuilding is lumber which has almost tripled over the past year or so.

According to the National Association of Home Builders, lumber price increases are causing the cost of building a home to increase by $24,386 since April of 2020.

So far, the homebuilders have been able to pass that increase along to consumers, so it isn’t really hurting their gross margins, but it's not helping either. In contrast, the sawmills have dramatically gained gross margin because they are selling lumber for about 180% more than they were before and input costs haven’t budged at all. Thus, gross margin for mills has increased dramatically.

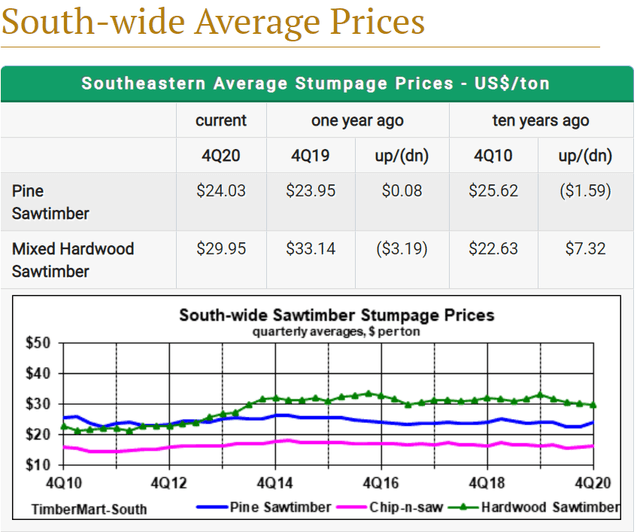

Note that timber prices (as opposed to lumber) have not moved up at all, and for pine timber, prices are actually down over the past 10 years.

This is a very clean example of low input prices and high output value.

The sawmills are buying cheap oversupplied timber and milling that into high-value lumber to sell to the homebuilders.

They can do this because Georgia and the surrounding states have extremely plentiful forests while the mills are undersupplied. Mills are the bottleneck in the supply chain and are using that advantage to capture most of the value.

Weyerhaeuser (WY) owns both the timberlands and the sawmills making it a good way to play the housing shortage theme. It supplies its own mills with timber and can sell its lumber products at very high prices. It is capturing a disproportionate share of the value relative to the homebuilders.

Wrapping it up

While we all want to participate in these hot market themes, it pays to be smart about it. The most obvious names are often not the best. I would much rather go with the strategically positioned companies poised to capture a disproportionate share of the value. The Portfolio Income Solutions portfolio contains what I view to be the single most opportunistic stock to capture the value of the housing shortage theme.

For a full toolkit on building a growing stream of dividend income, please consider joining Portfolio Income Solutions. As a member you will get:

- Access to a curated Real Money REIT Portfolio

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Portfolio Income Solutions, we don’t only share our ideas, we also discuss best trading practices and help you become a better investor.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $33.25/month (paid annually) before it expires!