Main Thesis

The purpose of this article is to evaluate the iShares Core Dividend Growth ETF (NYSEARCA:DGRO) as an investment option. This has been a holding of mine for a while, and its 2021 performance has been impressive so far. Looking ahead, I see merit in holding on to DGRO here, as the fund holds some of the top performing large-cap companies. With a rising dividend stream and a discount to the market, in terms of P/E, the fund seems like a smart choice.

However, I see reasons for caution as well. While DGRO has an objective different than mirroring the S&P 500, the two are still pretty correlated. Therefore, if broader markets do drop, DGRO's stock is likely to go down with it. Importantly, while DGRO has a lower P/E than the S&P 500, it is still quite high in isolation for the fund, which is an important indicator. Given the optimism we are seeing in the markets, valuations are getting increasingly stretched, and that is something that I feel will pressure U.S. equities going forward, including dividend funds like DGRO.

Background

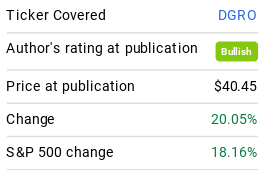

First, a little background on DGRO. The fund is managed by BlackRock (BLK) and its objective is to "track the investment results of an index composed of U.S. equities with a history of consistently growing dividends." Currently, DGRO is trading at $48.56/share and yields 2.16% annually. I remained bullish on DGRO heading into Q4 last year, and that thesis has played out. While the broader market has continued to soar, DGRO has actually outpaced the S&P 500, as shown below:

Source: Seeking Alpha

Looking ahead, I will continue to hold DGRO, and I remained convinced this is a good product for a long-term hold. However, I also believe the market is getting a bit ahead of itself. This outlook weaves its way

Please consider the CEF/ETF Income Lab