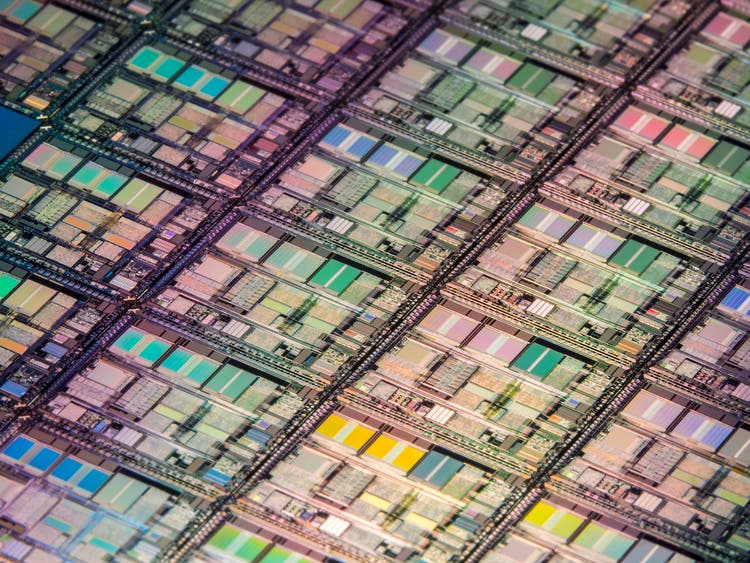

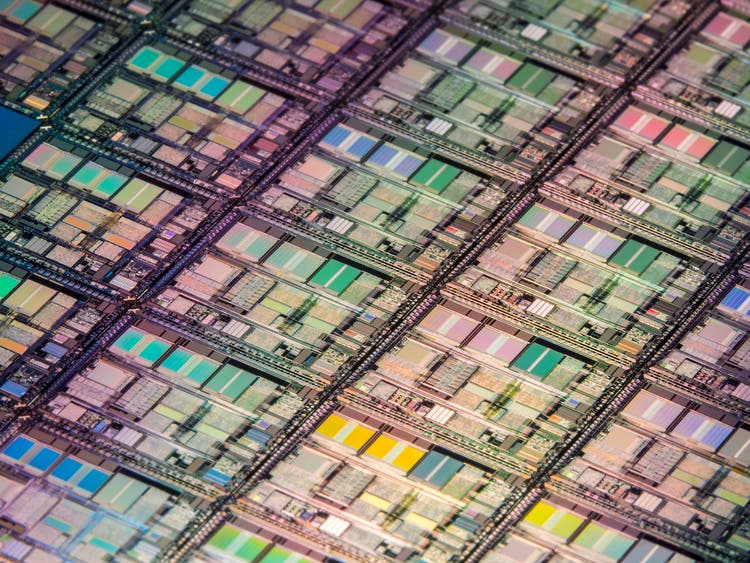

As most investors realize, what I refer to as the "21st Century of Technology" requires semiconductors to power nearly every device we use throughout a typical day. That being the case, the current semiconductor shortage is causing significant

As most investors realize, what I refer to as the "21st Century of Technology" requires semiconductors to power nearly every device we use throughout a typical day. That being the case, the current semiconductor shortage is causing significant

Analyst’s Disclosure:I am/we are long AVGO SMH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.