(Source: Telegraph, caption by the Author)

History is, allegedly, kind to those who re-write it (Sic) ….

Your vaccines or your life.

(Source: smithsonianmag, caption by the Author)

The dominoes are falling and the blame is being apportioned in the Eurozone.

A poor COVID-19 vaccination process, in the Eurozone, is being blamed for causing the first quarter economic reversal of fortune. The EU has then responded by blaming the vaccine program on the bloc’s generosity in manufacturing and exporting vaccines to trade partners. Subsequently, the EU announced that it was reviewing its policy on guaranteeing global vaccine supplies. This announcement was swiftly followed by a further edict to unilaterally renege on legal contracts made by vaccine companies within its borders, thereby, restricting global vaccine supplies. In my opinion, the EU is no longer a legal or trustworthy actor on the global stage.

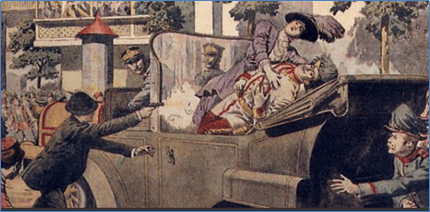

All these political microaggressions ominously echo the automatic timetable of events that escalated the nations towards World War I after the assassination of Archduke Ferdinand. People will die as a consequence of the EU’s actions. The world has become less safe, even though it is allegedly being made safer by the rollout of vaccines.

The Eurozone is struggling to see itself as it really is. The disconnect is being promoted, by EU policymakers and the ECB, to frame perceptions of what currently is and what can be in the future. The real picture is one of political diversity and divergent economic behavior. COVID-19 has sharpened the real image, thereby, challenging policymakers and central bankers to become even more creative in their artifice to portray otherwise.

When the data conflicts with the desired image and message, it is simply adjusted and restated. Thus, the current narrative that is colloquially known as the Reflation Trade has been overwritten and