Keurig Dr. Pepper, Inc. (NASDAQ:KDP) continues to prove itself to be a worthy component of Nasdaq-100 due to its market capitalization and untouched performance amidst the pandemic despite its quite underwhelming growth in recent years. Given the impressive FY 2020 results and the potential increase in dividends, it continues to show a rosy and secure future to its stakeholders. Moreover, the stock price may be potentially overvalued, given the price ratios. But the upward pattern remains evident as it agrees with the optimism and the Dividend Discount Model.

Company Financials

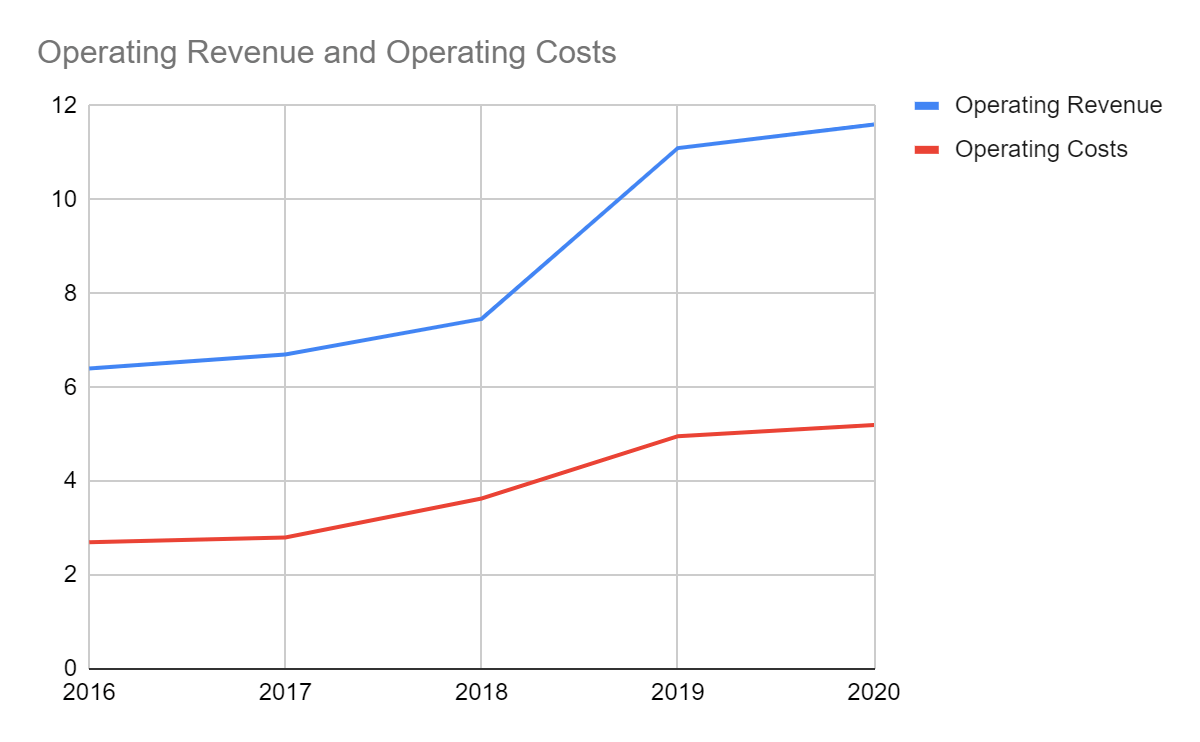

The expanding core operations of the company have been impeccable with steady revenue and gross profit growth. But it still had to work on efficiency to determine the optimal production level and better manage its costs and expenses. The addition of Dr. Pepper Snapple drove its growth momentum as revenues shifted upward and showed a positive effect of the expansion and acquisition.

Operating Revenue and Operating Costs

Founded in 1981, Green Mountain Coffee Roasters had its humble beginnings as a specialty coffee roaster store in Vermont before expanding to other states in the late '80s and had its IPO in 1993. Its boom started with its further expansion in APAC and the launching of Keurig which became more evident in 2006 as its revenues and gross profit margin started to speed up, primarily driven by its K-Cup pods for home and office use. It increased its popularity for the following years and eventually changed its name to Keurig Green Mountain in 2014. Drastic changes happened when the company was acquired by JAB Holding Company and combined with Dr. Pepper Snapple Group. With the changes and transitions it has been through, the company continued to flourish and proved its resilience and adaptability to market, product, and structural changes.

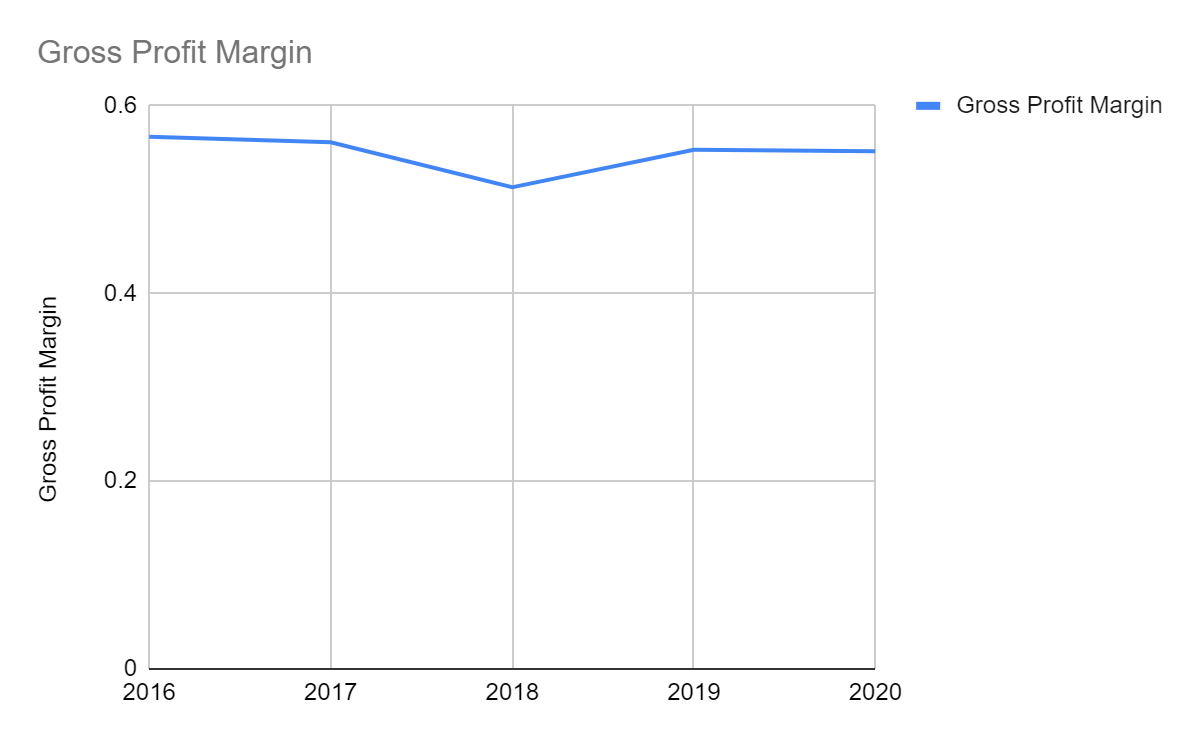

Over the past decade, its operating revenue has consistently increased and showed its increased demand and capacity. This was driven by its strategic partnerships, acquisitions, and continuous launching of new products. It had a partnership with The Coca-Cola Company (KO) with a stockholder stake as part of its support of a Keurig-developed cold beverage system. When it changed to Keurig Green Mountain in 2014, it seemed to add to its popularity and appeal to the market. In four years, the operating revenue has changed from $5.6 billion to $6.1 billion. Although revenue has been quite underwhelming, its growth remained consistent. It continued to increase to $6.7 in 2017 despite the changes in ownership, structure, and trading status and proved its already established market position. In 2018, it had one of its biggest milestones and transitions as it acquired Dr. Pepper Snapple Group and changed to its current name, Keurig Dr. Pepper, Inc. With that, its production of hot and cold beverages has become official and added value to the company. Its revenue immediately rose to $7.4 billion in the same year and had its highest increase by 48% as it reached $11.1 billion in 2019. The continuous expansion, product launching, and addition have become effective in achieving stable revenue increase although it has not been rapid. Meanwhile, as it continued to increase its size, it ensured its capacity to sustain it by maintaining efficiency to optimize its costs and realize increased gross profits. From 2010 to 2019, the operating costs more than doubled but one could see that although they increased faster, they were handled well and kept lower as the values did not reach 50% of revenues. Although it remained visible that they increased faster, the company continued to maintain its efficiency as gross profit margin remained stable above 50%. Also, the decreasing pattern in 2010-2018 at 60% to 51% bounced back in 2019-2020 at 55%-56% which proved the maintained efficiency and viability of the core operations.

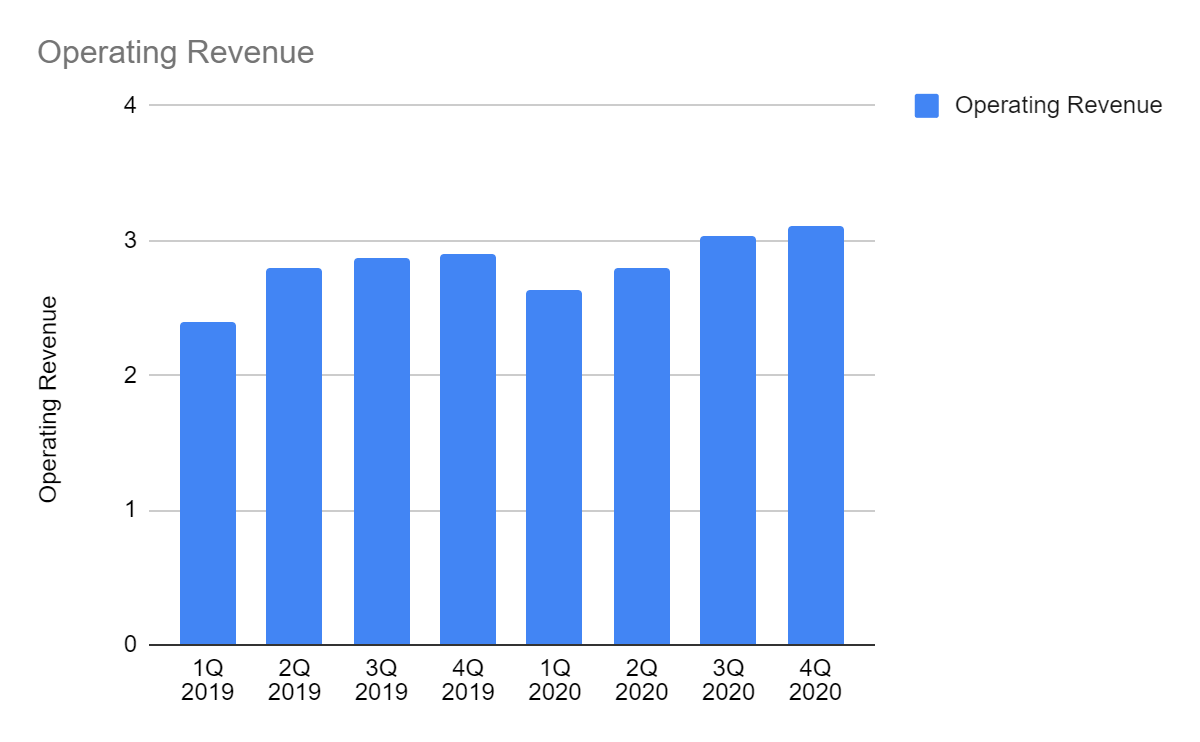

Moreover, even at the height of the pandemic which made the environment more challenging, its operations remained unfazed. One may infer that the work-from-home setup and quarantine measures that forced people to stay home made Keurig brewing and cold beverage products and systems more enticing, especially for coffee and chocolate lovers. This observation may still be questionable as it remains on the behavioral side and quite hard to quantify. But with the studies which show that it has become more stressful and demanding, it seems that there have been no substantial changes in terms of work and process. The thought of homes as another workstation and the reduced expenses on transportation and food could give logic to the increased preference for Keurig's products and systems. With that, it is not surprising to see the revenues go up in all quarters which amounted to $11.6 billion while the gross profit margin remained at 55%-56%. If not for the offsetting effect due to office shutdowns, growth would have been more substantial. Hence, despite market uncertainties, Keurig remained in demand which enabled it to expand its production while maintaining its efficiency to become more viable. Meanwhile, as the vaccination ramps up, the economy continues to reopen which may increase the business reopenings, jobs, and the purchasing power of more consumers. But the current work setup may remain, or if not, a hybrid work setup may continue which may further push its demand and revenues, especially from coffee and coffeemakers upward this FY.

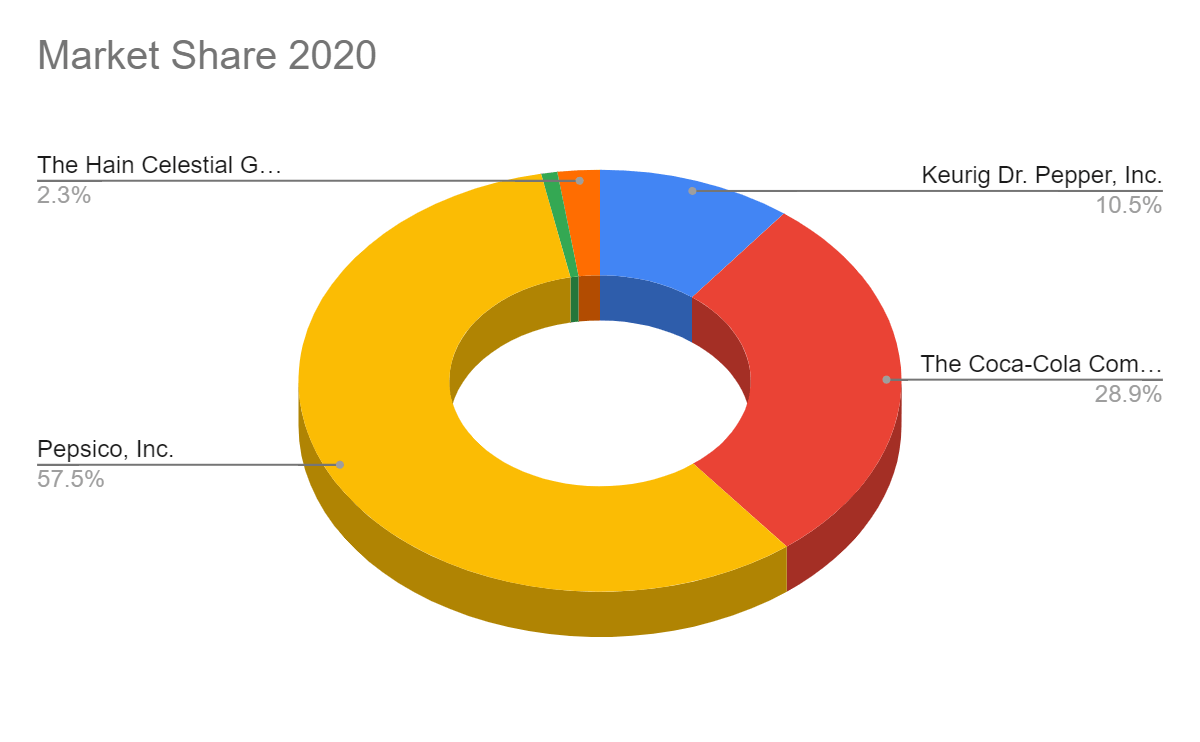

Meanwhile, compared to other beverage companies, one could see that in five years, KDP became more significant with an almost 80% increase in market share, becoming the third-largest beverage company in the region. Thanks to its continuous expansion and the acquisition of Dr. Pepper Snapple. Also, even in the time of the pandemic, its revenues increased although it remained a dwarf compared to KO and PepsiCo, Inc. (PEP). Note that these are the publicly traded beverage companies in Bevindustry’s list and the focus is on companies in the US with products similar to KDP’s. Also, KO is a primary shareholder and shows support which was evident when KDP was acquired by JAB and had its M&A with Dr. Snapple. Indeed, the revenue of the company continued to grow and became more significant in the industry. With its continuous expansion and the increased preference for its products, especially in FY 2020, KDP remains promising but one must not expect it to be as large as the giants in the list soon.

Taken from Macrotrends

Taken from Macrotrends

Taken from Macrotrends

Taken from Macrotrends

Taken from Macrotrends

Net Income

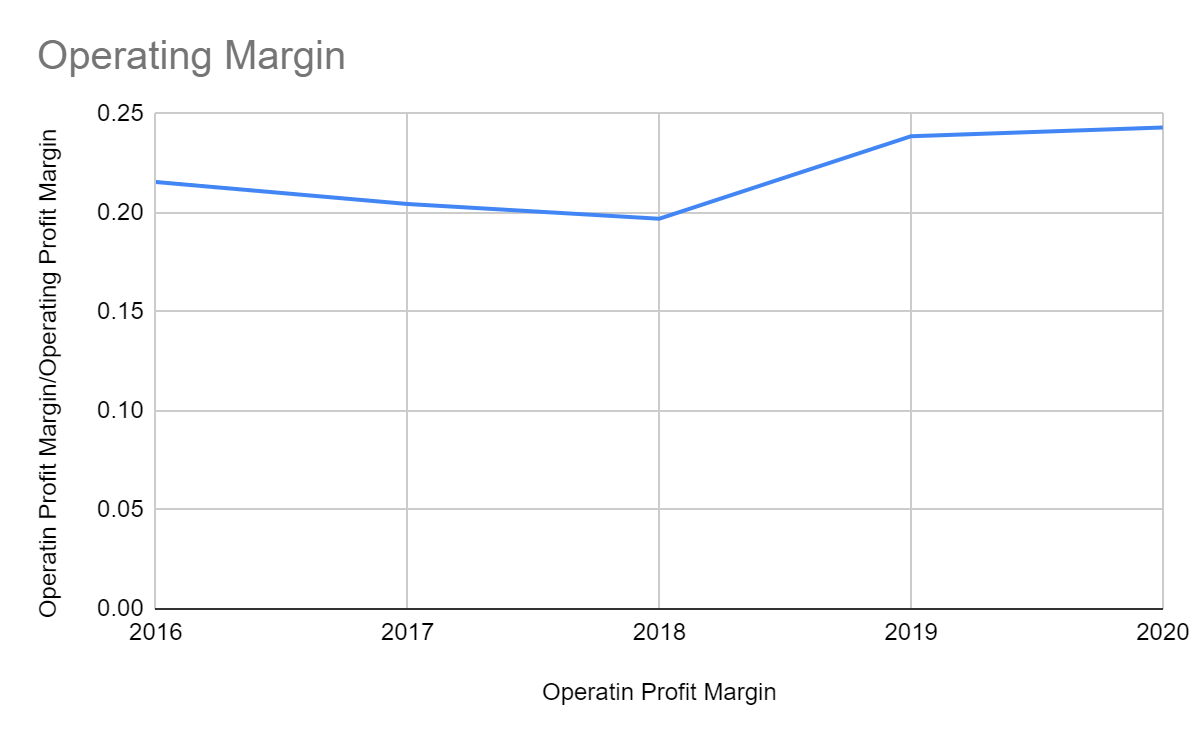

The other side of the core operations which comprises the Selling, General, and Administrative Expenses (“SG&A”) continued to increase which was expected as the company expanded its size and capacity. But due to more substantial changes in revenues, costs and expenses were easily offset. With that, operating profit has increased continuously although the operating margin followed the trend of gross profit margin. Although KDP showed maintained efficiency, it could be seen that for every added production, costs and expenses increased faster which reduced profit margins of the core operations. This may be normal as it was expanding substantially, but with the official acquisition of Dr. Pepper Snapple, the gross profit margin and operating margin increased again in 2019-2020.

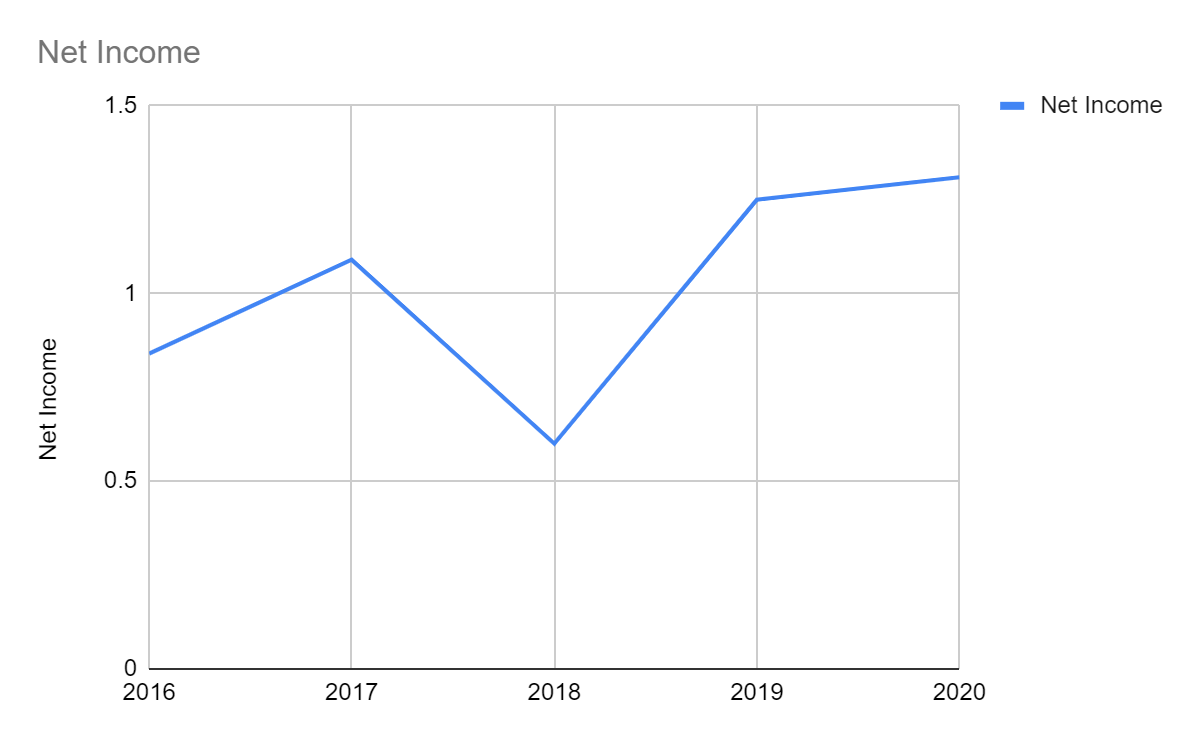

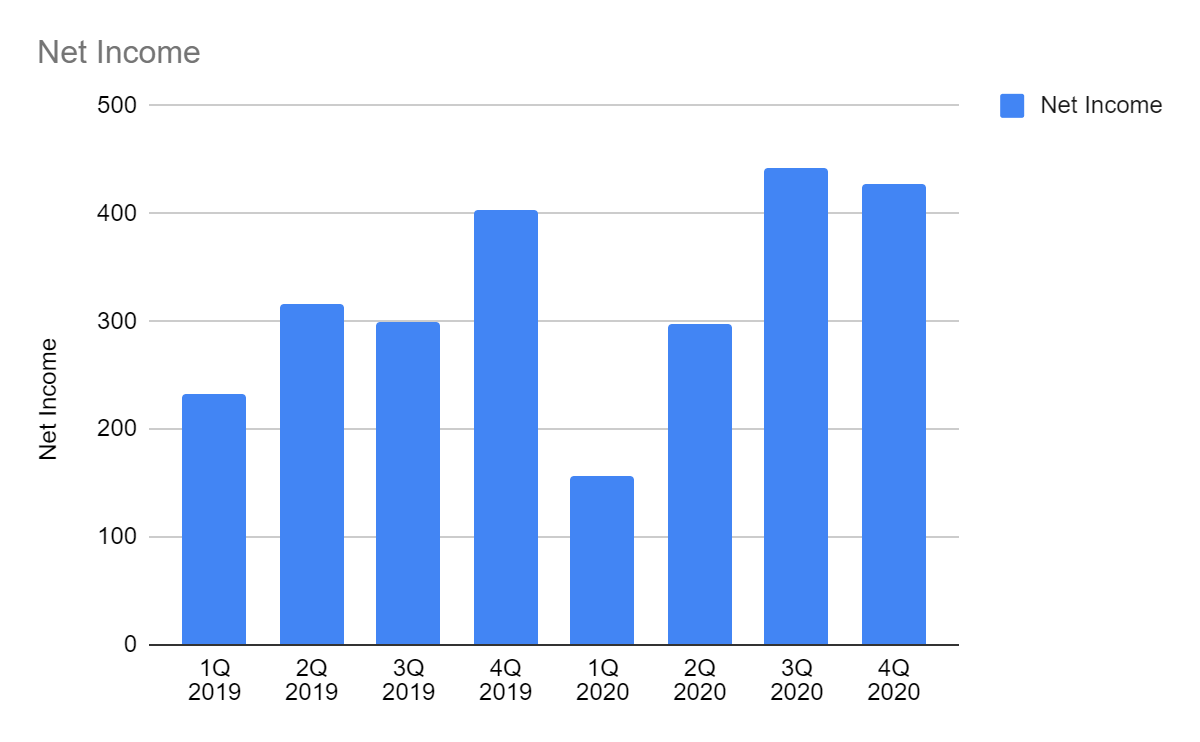

The non-core operating transactions showed the other effect of the company’s continuous expansion over the past decade. For example, borrowings increased, especially when it acquired Dr. Pepper Snapple, which also increased interest expenses. With more fixed assets, intangibles, financial assets, and inventories, more provisions for impairment and disposal were recorded which increased the exceptional expenses. But since the advantageous effect of the expansion was higher, net income has been generally increasing as well which shows the coordination of the core and non-core operations. With that, one could see that the company maintained ideal core operations as revenues and income continued to increase. This showed that with its continuous expansion, it continued to increase its viability although it would still have to work on better managing its costs and expenses to have a higher margin. Nevertheless, viability became more evident in 2019-2020 as even at the height of the pandemic which proved its durability and resilience.

Taken from Macrotrends

Taken from Macrotrends

Taken from Macrotrends

Liquidity and Growth

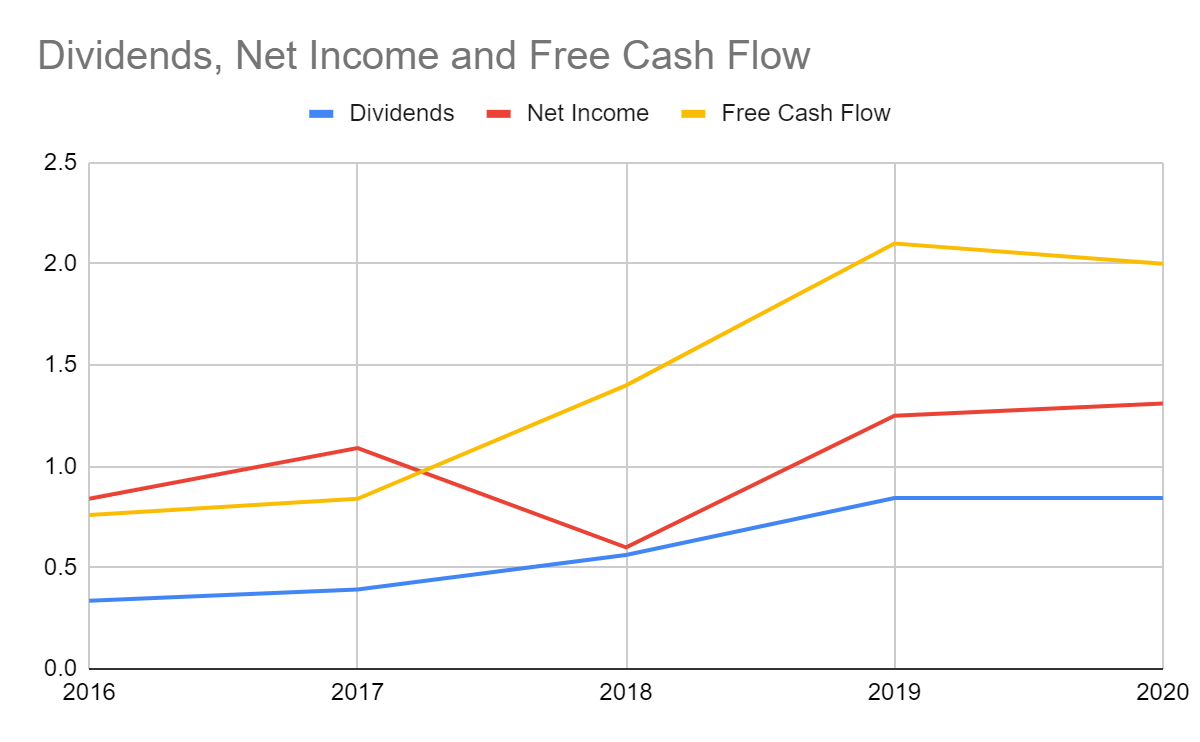

As Keurig Dr. Pepper, Inc. continued to expand, it had positive cash inflows in a generally increasing trend over the past decade. This shows that if the focus will be solely on actual cash items and transactions, the company remains liquid and capable to expand and pay its financial obligations, given the sustained operating assets and dividend payments. From $760 million in 2016, Free Cash Flow (“FCF”) has almost tripled to $2 billion in 2020 which showed a positive effect of the continuous expansion to income and cash inflows. Given the stable operations of the company with increased revenue, income, and cash inflows, it remains adequate to suffice itself even in times of uncertainties. With that, it increases the capacity of KDP to continue its expansion or even acquire smaller ones with similar niches. With the reopening of the economy, a work-from-home or hybrid-work setup with increased employment is anticipated. Its operating capacity may further increase as it may spend further on increasing its inventories and fixed assets to match with the expected demand. Hence, as higher cash outflows may be seen in the expansion, cash inflows from its revenues and income may further be stimulated.

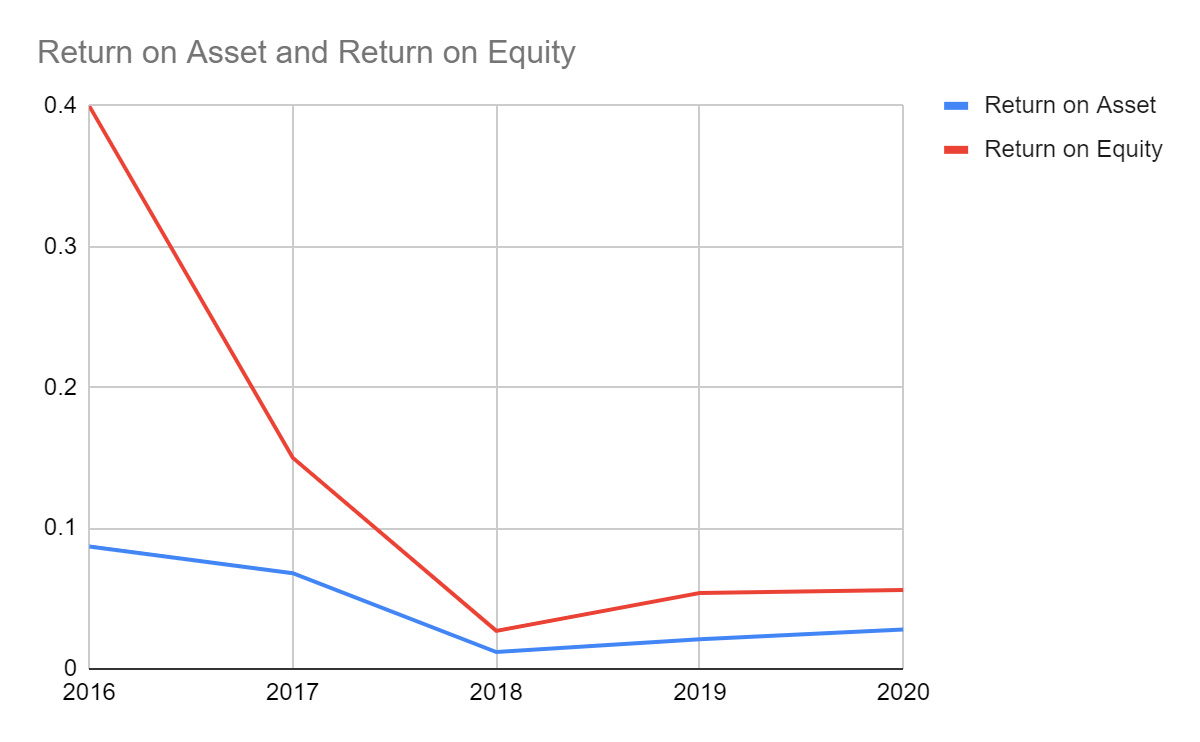

On the other hand, as it remains clear that the operations and financials of the company remain stable, its actual growth has been quite underwhelming, especially in 2018-2020. This may be understandable as the Return on Asset has been ideal between 6%-8% in 2010-2017 before the acquisition of Dr. Pepper Snapple. In 2018, it slumped to 1.2% as the assets more than tripled after the acquisition. This shows that the assets increased faster than they earned which may be the reason for the decreased gross profit and operating margin in 2014-2018 when the expansion sped up. Nevertheless, it remained viable and income continued to increase although it has not matched with the increased assets yet. Also, in 2019-2020, ROA doubled to 2.5%-3% which gradually showed the advantageous effect of the acquisition and its solid and intact operations amidst market disruptions. Meanwhile, the Return on Equity (“ROE”) followed the trend of ROA, with their gap narrowing which proved the consistency of its financial position and the balance in its financial leverage between borrowings and equity. Hence, the financials and the improving macroeconomic condition point us to its stability and growth potential for the next fiscal years.

Taken from Macrotrends

What’s in Store for the Investors?

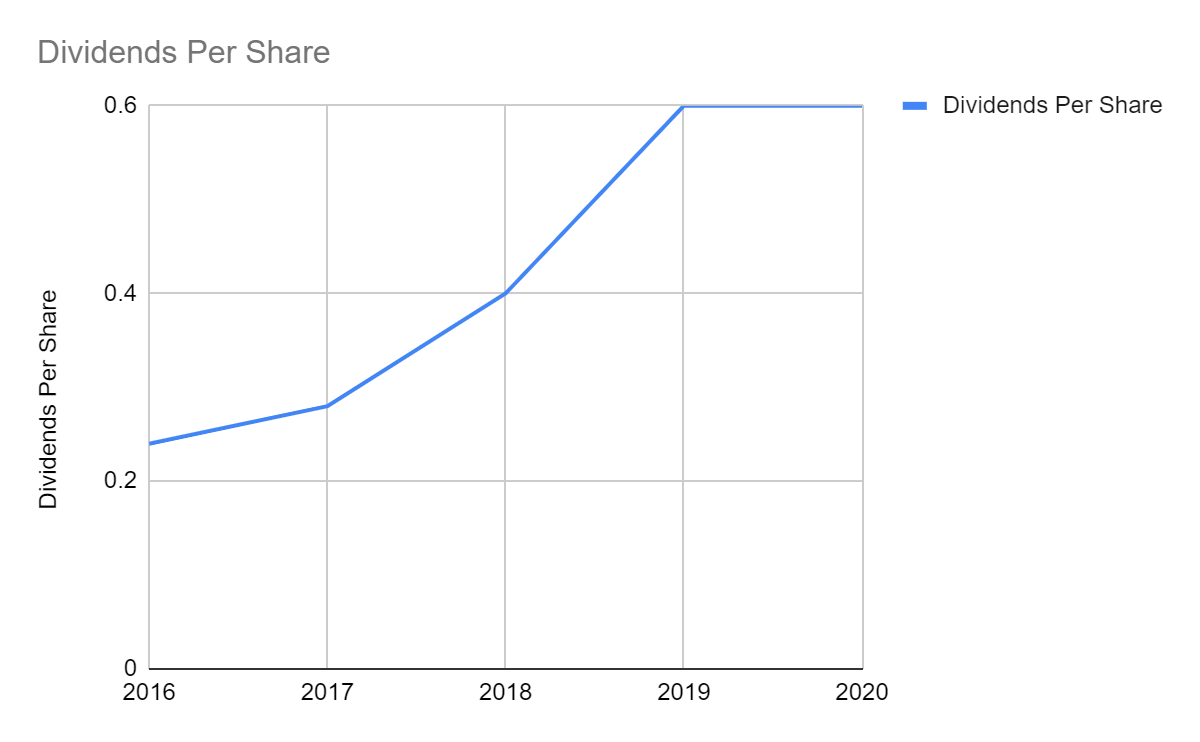

Dividends Per Share

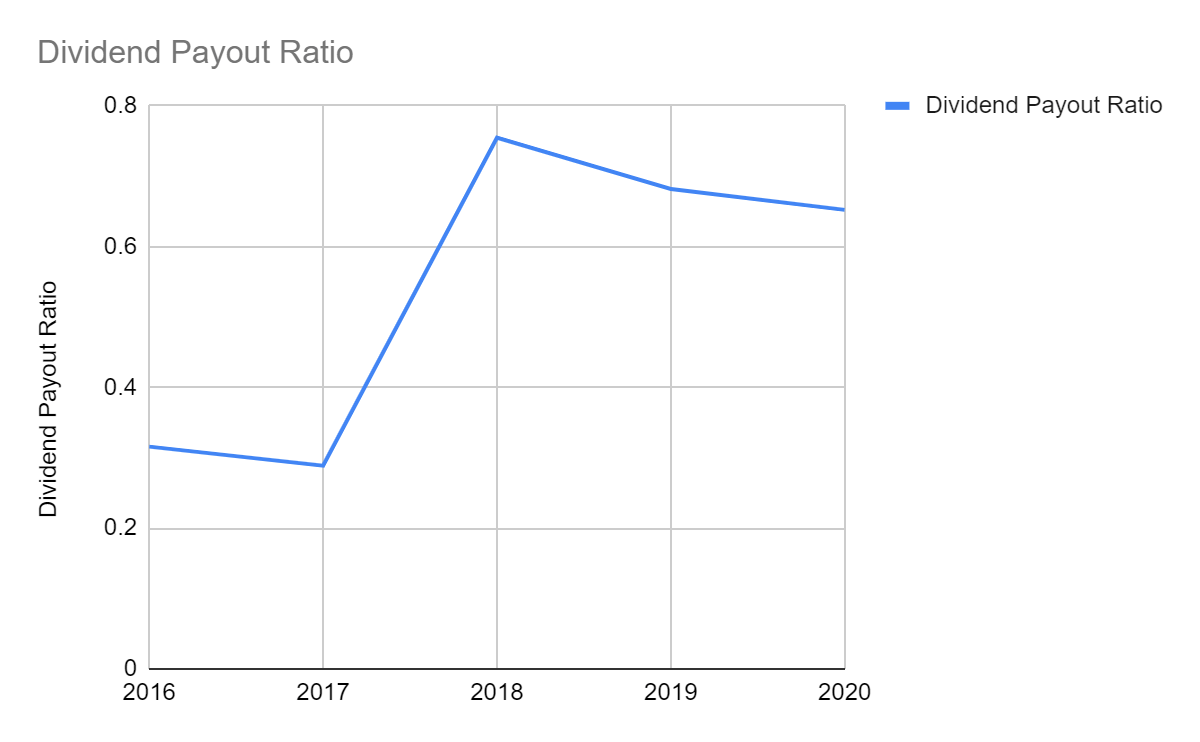

After more than a decade since its IPO, KDP distributed its first payout at $0.15 per share. Since then, the increase became more substantial, and the value became 10 times larger at $1.92 per share in 2015. Even if it was acquired in 2016 and temporarily became private, dividend payments continued and even increased for the next two years at $2.12 per share and $2.32 per share. In 2018, after the M&A with Dr. Pepper Snapple, dividends per share rose substantially driven by special payments, although its quarterly values slumped in 3Q at $0.15 per share and did not change since then. It was primarily due to the issuance of shares which increased by about 10 times. And if one will adjust the value relative to the number of shares, he may observe that dividends per share will still move an increasing trend. Relative to net income and FCF, the company remained adequate to suffice and increase it. In 2016-2017, the Dividend Payout Ratio remained low at about 30% before jumping to 76% in 2018. Despite the higher costs and expenses after the M&A, the company remained profitable and able to pay dividends. It remained more manageable in 2019-2020 at 65% on average. It shows that while it tries to expand, it puts dividend payments in its priorities despite operating in a more challenging environment.

Taken from Nasdaq: Dividend History

Taken from Macrotrends and Nasdaq: Dividend History

Taken from Macrotrends and Nasdaq: Dividend History

Stock Price

A visible uptrend in the stock price has been observed from 2008 to the first half of 2018. It reached its peak and exceeded $120, but slumped to $20-$30 due to the acquisition of Dr. Pepper Snapple. It publicly traded again on the NYSE and started to increase before decreasing in December 2019, eventually crashing in the first quarter of 2020 and hit $19.18 last March 16. It went back in a few weeks and when it switched on Nasdaq, it became one of NASDAQ-100. This seemed to have added to its value and speed up price increase and the bullish trend remains evident at its most recent price of $34-$35. But the PE Ratio of 37.89 and the PEG Ratio of 2.84 do not seem to agree with the upward pattern of the stock price as they both convey potential overvaluation. On the other hand, the PB Ratio of 2.008 shows that the price is valued precisely while the Dividend Discount Model conveys potential undervaluation with its derived value of $35.79. With that, investors must observe it closely, especially since the 1Q 2021 Report may be released soon which may have an impact on price changes for the next few weeks or even months. But with the current momentum of the stock price and the stable financials, the bullish pattern may continue for the next few weeks.

Potential Growth Catalysts

The Reopening of the Economy

The spread of the pandemic resulted in lockdowns for a long period in most parts of the world, especially in the US. K-cup pods, Keurig brewers and coffee makers, and packaged beverages remained a staple despite the current work setup and the weakness in the office coffee channel. The gradual reopening of the economy as vaccination speeds up may further stimulate its growth potential. First, the strength in the office coffee channel may be restored as the office and hybrid-work setup may continue this FY. Also, the reopening of most businesses and the increase in employment increase the purchasing power of consumers which may push the demand for most products upward. It is logical for KDP to expect growth as it remains one of the key companies in the beverage industry in terms of revenues, size, and market capitalization.

Conclusive Thoughts

Keurig Dr. Pepper, Inc. has already grown substantially with a series of transitions from its products to partnerships and M&As. Over the past decade, revenue and income remained generally increasing with more than 50% margin in the core operations. Its FCF proves the stable financials of the company as it remains adequate to sustain its operations and cover dividend payments. With the addition of Dr. Pepper Snapple, it continued to expand its coverage and market share. Although its actual growth slowed down as ROA fell to 2%, its increase in FY 2020 to 3% shows that its growth potential remains, not to mention its ideal Balance Sheet and the prudent management of financial leverage. The reopening of the economy may bolster financial stability and speed up its growth. Meanwhile, the optimistic view of its financials agrees with the upward pattern of the stock price despite the contradiction in the four models to assess its value. With its current momentum, it may continue to increase, but price growth or increase may remain slow and underwhelming. With that, the release of the 1Q Report and the reopening of the economy may play a big role in its financial growth and price changes. KDP remains promising with a potential dividend increase and stable and adequate financials.