Investment Thesis

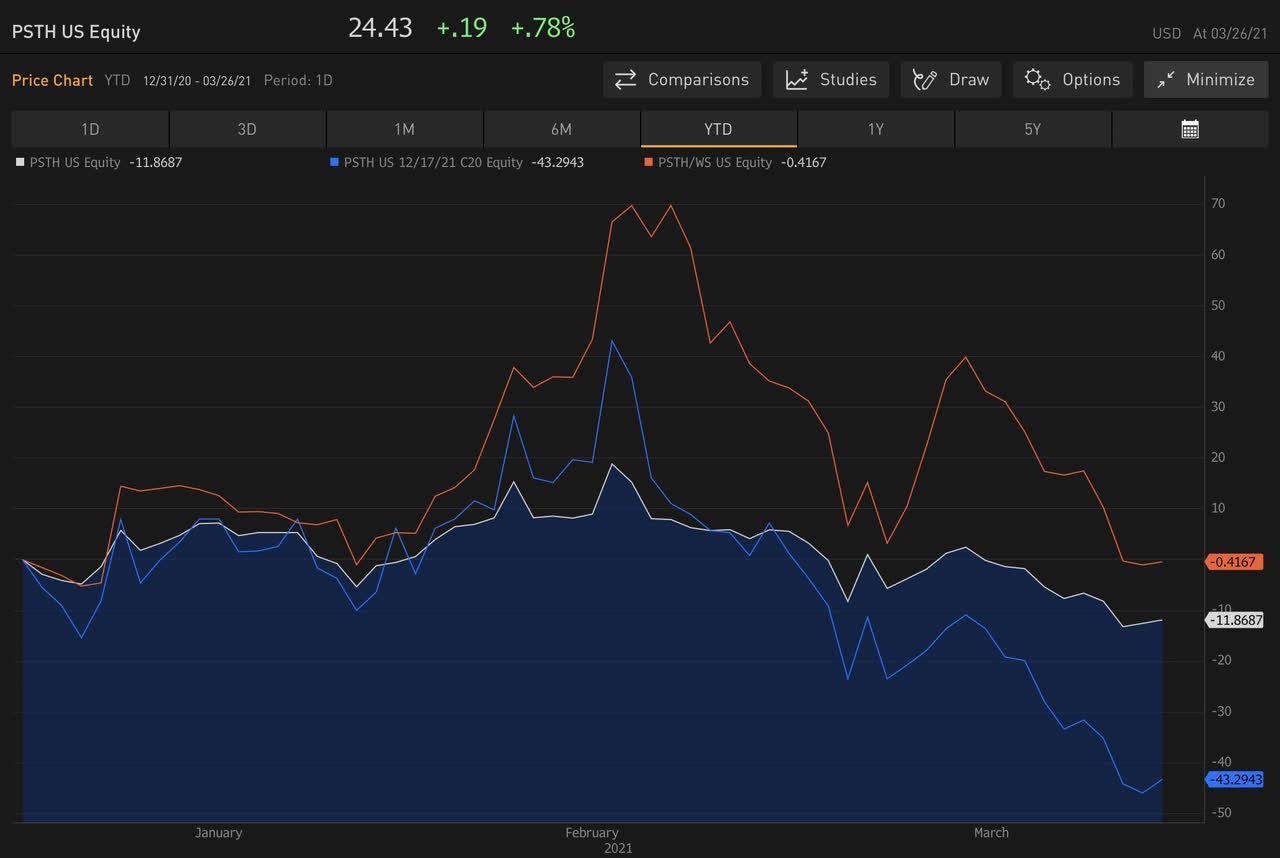

Recent market selloff has caused the call options of Pershing Square Tontine Holdings (PSTH) to underperform PSTH common share and PSTH warrant (PSTHWS) by a large margin. For example, PSTH 12/17/2021 $20 call option declined 43% year to date while PSTH common share was down 12% and PSTHWS down only 0.42% during the same period.

Given its very strong sponsor (Bill Ackman) and more shareholder-friendly SPAC terms, it is highly likely PSTH would be able to execute a well-received merger by year-end 2021 (if not sooner) and generate solid return for the SPAC shareholders despite the current market volatility.

PSTH call options have the best risk-reward relative to common share and warrant in the capital structure. The upside could be at least 3x upon a deal announcement while the downside is expiring worthless if PSTH does not announce a deal before the call option expiration date (December 17, 2021).

PSTH vs. PSTHWS vs PSTH 12/14/21 $20 Call (Percentage Change of Price)

Source: Bloomberg.

PSTH vs. PSTHWS vs PSTH 12/14/21 $20 Call (Dollar Change of Price)

Source: Bloomberg.

Market Observations

Current market dynamics could be summarized in a chart that includes the following indicators:

1) Fear/Panic: CBOE Volatility Index (VIX)

2) Interest Rate: iShares 20+ Year Treasury Bond ETF (TLT)

3) Growth (Tech/SPACs): ARK Innovation ETF (ARKK)

4) Value: Berkshire Hathaway Inc Class B (BRK.B)

5) Excess Liquidity/Inflation: Bitcoin (BTC-USD).

Year to Date Chart of VIX, ARKK, TLT, BRK-B and Bitcoin

Source: Bloomberg.

Topics on rising interest rate and "growth to value" rotation have been widely covered by the media and investment communities since the market started to sell-off in mid-February. This has certainly been reflected in the chart via TLT, ARKK and BRK.B. However, what surprised us in the chart is that VIX remained at a depressed level. This could either suggest that at least