Focus of Article:

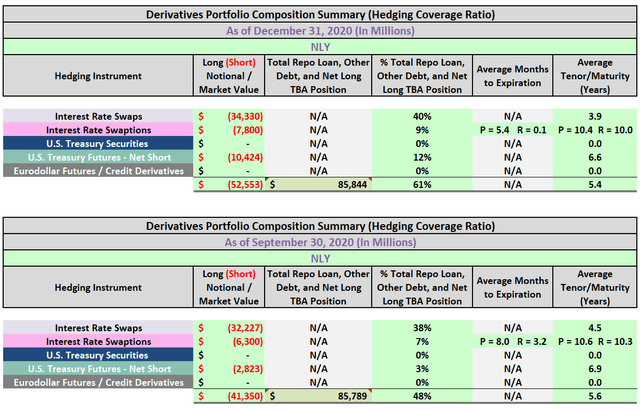

The focus of PART 1 of this article is to analyze Annaly Capital Management Inc.’s (NYSE:NLY) recent results and compare several of the company’s metrics to nineteen mortgage real estate investment trust (mREIT) peers. This analysis will show past and current data with supporting documentation within three tables. Table 1 will compare NLY’s mortgage-backed securities (“MBS”)/investment composition, recent leverage, hedging coverage ratio, BV, and economic return (loss) to the nineteen mREIT peers. Table 1 will also provide a premium (discount) to estimated CURRENT BV analysis using stock prices as of 3/26/2021. Table 2 will show a quarterly compositional analysis of NLY’s agency MBS portfolio while Table 3 will show the company’s recent hedging coverage ratio over the past two quarters (only contributor/team to provide continuous detailed hedging metrics).

I am writing this two-part article due to the continued requests that such an analysis be specifically performed on NLY versus its mREIT peers at periodic intervals. This article also discusses the importance of understanding the composition of NLY’s MBS/investment and derivatives portfolios when it comes to projecting the company’s future quarterly results as interest rates/yields fluctuate. Understanding the characteristics of a company’s MBS/investment and derivatives portfolios can shed some light on which companies are overvalued or undervalued strictly per a “numbers” analysis. This is not the only data that should be examined to initiate a position within a particular stock/sector. However, I believe this analysis is a good “starting point” to begin a discussion on the topic.

At the end of this article, there will be a conclusion regarding the following comparisons between NLY and the nineteen mREIT peers: 1) trailing twelve-month economic return (loss); 2) leverage as of 12/31/2020; 3) hedging coverage ratio as of 12/31/2020; and 4) premium (discount) to my estimated CURRENT BV (BV as of 3/26/2021). My BUY, SELL, or HOLD recommendation and updated price target for NLY will be in the “Conclusions Drawn” section of this article. This includes providing a list of the mREIT stocks I currently believe are undervalued (a buy recommendation), overvalued (a sell recommendation), or appropriately valued (a hold recommendation).

Overview of Several Classifications within the mREIT Sector:

I believe there are several different classifications when it comes to mREIT companies. For purposes of this article, I am focusing on five. It should be noted in light of several prior acquisitions and certain changes in overall investment strategies, some mREIT companies have minor portfolios outside each entity’s main concentration. However, I have continued to group certain mREIT companies in each entity’s main classification for purposes of this article. Some market participants (and even some mREIT companies) have different classifications when compared to Table 1. Some market participants/companies base classifications on the percentage of capital deployed in each entity’s investment portfolio. However, my preference is to base a company’s classification on the monetary “fair market value” (“FMV”) of each underlying portfolio (which, for a fact, is what drives valuation fluctuations). In my professional opinion, there is no “uniform” methodology when it comes to classifying mREIT companies but more of an underlying preference. Readers should understand this as the analysis is presented below.

First, there are mREIT companies who earn a majority of income from investing in fixed-rate agency MBS holdings. These investments consist of commercial/residential MBS, collateralized mortgage obligations (“CMO”), and agency debentures for which the principal and interest payments are guaranteed by government-sponsored enterprises/entities (“GSE”). In the recent/current environment, this was/is extremely important to understand (especially when markets incorrectly priced in this notion last year). Since these investments typically have higher durations versus most other investments within the broader mREIT sector, companies within this classification typically utilize higher hedging coverage ratios in times of rising mortgage interest rates/U.S. Treasury yields (or a projected rise over the foreseeable future). NLY, AGNC Investment Corp. (AGNC), Arlington Asset Investment Corp. (AAIC), ARMOUR Residential REIT Inc. (ARR), Cherry Hill Mortgage Investment Corp. (CHMI), Dynex Capital Inc. (DX), Invesco Mortgage Capital Inc. (IVR) (fairly recently moved to an agency mREIT), Orchid Island Capital Inc. (ORC), and Two Harbors Investment Corp. (TWO) are currently classified as a fixed-rate agency mREIT.

Second, there are mREIT companies who earn a majority of income from investing in variable-rate agency MBS holdings. These investments generally are commercial/residential MBS for which the principal and interest payments are also guaranteed by a GSE. More specifically, variable-rate MBS generally consists of adjustable-rate mortgages(“ARM”) that have varying interest rate reset periods. ARM holdings are usually classified together based on each security’s average number of months to coupon reset. This is also known as the security’s “months-to-roll”. This is a typical indicator of asset duration which helps identify each security’s price sensitivity to interest rate movements. If a security’s months-to-roll is high, then this type of investment can also be described as a hybrid ARM holding. Capstead Mortgage Corp. (CMO) is currently classified as a variable-rate agency mREIT.

Third, there are mREIT companies who earn varying portions of income from investing in agency MBS holdings, non-agency MBS holdings, other securitizations, and non-securitized mortgage-related debt investments. This type of company is known as a “hybrid” mREIT. In regard to non-agency MBS, this includes (but is not limited to) Alt-A, prime, subprime, and re/non-performing loans where the principal and interest are not guaranteed by a GSE. Since there is no “government guarantee” on the principal or interest payments of non-agency MBS, coupons are generally higher when compared to agency MBS of a similar maturity. However, borrowing costs (including repurchase agreements) for these specific investments are also higher (no government guarantee; credit risk). Due to the subtle yet identifiable differences between agency and non-agency MBS, I like to differentiate between an agency and a hybrid mREIT company. Since there is credit risk when it comes to non-agency MBS, leverage ratios are typically lower when investing in these securitizations when compared to agency MBS (even when credit risk remains low). That said, last year’s historical volatility within this specific sector has temporarily caused most mREIT peers to deleverage which has caused some temporary “disruptions” when it comes to leverage ratios. Over time, this should return to more historical averages (will take time though). Chimera Investment Corp. (CIM), Ellington Financial Inc. (EFC) (converted to a REIT in 2019), MFA Financial Inc. (MFA), AG Mortgage Investment Trust Inc. (MITT), and Western Asset Mortgage Capital Corp. (WMC) are currently classified as a hybrid mREIT.

Fourth, there are mREIT companies that invest in (but are not limited to) a combination of agency MBS, non-agency MBS, credit risk transfers (“CRT”), other mortgage-related investments (including direct originations of mortgages and/or correspondent production), non-securitized debt investments (including multifamily and commercial loans), and mortgage servicing rights (“MSR”). I believe New Residential Investment Corp. (NRZ), New York Mortgage Trust Inc. (NYMT), and PennyMac Mortgage Investment Trust (PMT) should currently be classified as a “multipurpose” mREIT. Since NRZ currently has a majority of the company’s investment portfolio in MSR and MSR-related investments which act as an “indirect” hedge (the same can be said regarding interest only [IO] securities), this company currently does not need to utilize a high hedging coverage ratio (some could even argue to not have derivative instruments in place, if anything perhaps “contra” hedges to counter a drop in rates/yields). Indirect hedges are not calculated within each company’s hedging coverage ratio (not the main purpose of these investments). As I have pointed out in the past, these investments actually benefit, from a valuation standpoint, in a rising interest rate environment as prepayment risk (and in a majority of scenarios credit risk) decreases while there is an increase in projected future discounted cash flows (and vice versa).

Finally, there are mREIT companies that invest in (but are not limited to) non-securitized, commercial whole loans with underlying collateral (real estate) tied to offices, multifamily units, hotels, retail stores, industrial complexes, and other miscellaneous types of properties. Regarding the two commercial whole loan mREIT peers I currently cover, Blackstone Mortgage Trust, Inc. (BXMT) and Granite Point Mortgage Trust Inc. (GPMT), these companies typically originate/invest in variable-rate, interest-only senior secured (typically first lien) debt. Since BXMT and GPMT both had 99% of their investment portfolio in variable-rate debt as of 12/31/2020, respectively, these companies currently do not need to utilize a high hedging coverage ratio (some could even argue to not have derivative instruments in place, if anything perhaps “contra” hedges to counter a drop in rates/yields). Now let us start the comparative analysis between NLY and the nineteen mREIT peers.

Leverage, Hedging Coverage Ratio, BV, Economic Return (Loss), and Premium (Discount) to Estimated Current BV Analysis - Overview:

Let us start this analysis by first getting accustomed to the information provided in Table 1 below. This will be beneficial when explaining how NLY compares to the nineteen mREIT peers in regard to the metrics stated earlier.

Table 1 – Leverage, Hedging Coverage Ratio, BV, Economic Return (Loss), and Premium (Discount) to Estimated Current BV Analysis

(Source: Table created by me, obtaining historical stock prices from NASDAQ and each company’s 9/30/2020 and 12/31/2020 BV per share figures from the SEC’s EDGAR Database)

(Source: Table created by me, obtaining historical stock prices from NASDAQ and each company’s 9/30/2020 and 12/31/2020 BV per share figures from the SEC’s EDGAR Database)

Table 1 above provides the following information on NLY and the nineteen mREIT peers (see each corresponding column): 1) generalized MBS/investment portfolio composition as of 12/31/2020 (metric solely for the REIT Forum subscribers); 2) on-balance sheet leverage ratio as of 12/31/2020; 3) at-risk (total) leverage ratio as of 12/31/2020; 4) hedging coverage ratio as of 12/31/2020 (metric solely for the REIT Forum subscribers); 5) hedging weighted average tenor/maturity (metric solely for the REIT Forum subscribers); 6) BV per share at the end of the third quarter of 2020; 7) BV per share at the end of the fourth quarter of 2020; 8) BV per share change during the fourth quarter of 2020 (percentage); 9) economic return (loss) (change in BV and dividends accrued for/paid) during the fourth quarter of 2020 (percentage); 10) economic return (loss) during the trailing twelve-months (percentage); 11) my estimated CURRENT BV per share (BV as of 3/26/2021); 12) stock price as of 3/26/2021; 13) 3/26/2021 premium (discount) to my estimated CURRENT BV (percentage); 14) 2/21/2020 BUY, SELL, or HOLD recommendation (pre market sell-off due to coronavirus [COVID-19]); 15) 4/3/2020 BUY, SELL, or HOLD recommendation (post majority of market sell-off due to COVID-19); 16) 3/26/2021 BUY, SELL, or HOLD recommendation; and 17) BUY, SELL, and HOLD recommendation range, relative to my estimated CURRENT BV (metric solely for the REIT Forum subscribers).

Analysis of NLY:

As of 12/31/2020, NLY’s investment portfolio consisted of 83% and 1% fixed- and variable-rate agency MBS holdings, respectively (based on FMV). When compared to 9/30/2020, NLY’s percentage of fixed- and variable-rate agency MBS remained unchanged. NLY also had a 2% multifamily agency MBS sub-portfolio which was also unchanged. NLY continued to invest in non-agency MBS and non-MBS holdings which accounted for 14% of the company’s investment portfolio balance as of 12/31/2020 which was unchanged. This included NLY’s investments in commercial debt/real estate, preferred equity, corporate debt, middle market (“MM”) lending, seniors housing, and MSRs.

Using Table 1 above as a reference, when excluding borrowings collateralized by assets held in “securitization trusts” (non-recourse debt), NLY had an on-balance sheet leverage ratio of 4.7x while the company’s at-risk (total) leverage ratio, when including its off-balance sheet net long “to-be-announced” (“TBA”) MBS position, was 6.2x as of 12/31/2020. NLY had an on-balance sheet and at-risk (total) leverage ratio of 4.7x and 6.2x as of 9/30/2020, respectively. As such, NLY kept both the company’s on-balance sheet and at-risk (total) leverage unchanged during the fourth quarter of 2020. This was partially due to the FMV fluctuations NLY’s investment portfolio.

As of 12/31/2020, NLY had the fourth lowest at-risk (total) leverage ratio when compared to the nine other agency mREIT peers within this analysis. Due to the notable impacts from the COVID-19 pandemic to the mREIT sector when it comes to the quick “spike” in leverage and liquidity risk (rising credit risk more of a longer-term impact regarding all non-agency investments), outside the commercial whole loan mREIT peers (BXMT and GPMT), all sector peers I currently cover had various strategies at play when it comes to investment portfolio composition and risk management strategies. Even when several mREIT peers had very similar MBS/mortgage-related investments, 2020 strategies notably differed from company-to-company. Directly dependent on the amount/percentage of margins calls on certain outstanding borrowings (and the underlying investments pledged as collateral) and derivative instruments, most mREIT peers had a notable change in 2020 leverage ratios. Due to NLY’s overall size and asset composition, this company was not “forced” to de-lever to the same extent as some of the smaller-capitalized agency mREIT peers earlier this year (more “cushion” when it came to its existing capital base).

Previously, management implied NLY had a fairly “defensive posture” in regard to leverage during 2017-2018 due to the risk of widening spreads/lower MBS prices as Federal (“Fed”) monetary policy dictated broader market dynamics (in particular, the Fed Funds Rate and the Fed Reserve’s non-reinvestment of U.S. Treasuries and agency MBS). However, with the Fed’s more “dovish” rhetoric in 2019 regarding U.S. monetary policy over the foreseeable future, I previously correctly anticipated NLY would increase leverage which was consistent with agency mREIT sector trends as net spreads narrowed. This benefited most mREIT peers during the fourth quarter of 2019.

However, this led to more severe BV declines during the first quarter of 2020 when the COVID-19 “pandemic panic” occurred across all financial markets (especially March). This was partially offset during the second quarter of 2020 as MBS pricing/valuations (and most other mortgage-related investments outside some CMBS and commercial whole loans) rebounded in price/valuation as financial panic/stress eased (mainly due to the Fed’s swift response regarding financial assistance and monetary policy). This general trend continued into the third and fourth quarters of 2020 as broader market pricing/valuations (outside isolated pockets) rebounded further. As such, most mREIT peers reported BV increases during the third and fourth quarters of 2020 (including NLY).

NLY had a BV of $8.70 per common share at the end of the third quarter of 2020. NLY had a BV of $8.92 per common share at the end of the fourth quarter of 2020. This calculates to a quarterly BV increase of $0.22 per common share or 2.53%. When including NLY’s quarterly dividend of $0.22 per common share, the company had an economic return of $0.44 per common share or 5.06% for the fourth quarter of 2020. Similar to most mREIT peers, this was a fairly strong quarterly performance and helped erase a portion of the extremely severe decrease in BV during the first quarter of 2020. When compared to fixed-rate agency mREIT peers like AGNC and DX, a minor-modest quarterly underperformance.

As disclosed to readers in prior mREIT articles (as it was occurring during the quarter), a notably more positive relationship between agency MBS/mortgage-related investment pricing and derivative instrument valuations quickly developed during April 2020 when compared to the first quarter of 2020. This ultimately led to nearly all agency mREIT peers to report an increase in BV as of 6/30/2020 when compared to 3/31/2020. In other words, basically most agency/non-agency/mortgage-related investment MBS net valuation gains slightly-notably “trumped” derivative/MSR net valuation losses. This general positive trend continued into the third and fourth quarters of 2020. While there were less enhanced agency MBS valuation gains during the third and fourth quarters of 2020 when compared to the second quarter, this was mainly offset by more favorable derivative valuation gains as the yield curve steepened. Simply put, spread/basis risk remained “tamped down”.

I correctly projected most agency mREIT companies would experience a minor-modest BV increase within the following Marketplace Service article:

Scott Kennedy's Weekly Series: mREIT And BDC Recommendations (And Price Targets) As Of 12/31/2020

Within that article, I projected NLY would report (prior to any other sector peer reporting) a BV as of 12/31/2020 of $9.00 per share with a range of $8.65-$9.35 per share. In comparison, NLY reported a BV as of 12/31/2020 of $8.92 per share which was well within my projected range. I classify this as nearly an exact match (at or within 1.0%; some could argue a very minor underperformance).

Let us now discuss NLY’s MBS and derivatives portfolios to spot certain characteristics which will impact future results. Table 2 below provides NLY’s proportion of fixed- and variable-rate agency MBS holdings as of 12/31/2020 versus 9/30/2020 (the vast majority of the company’s investment portfolio).

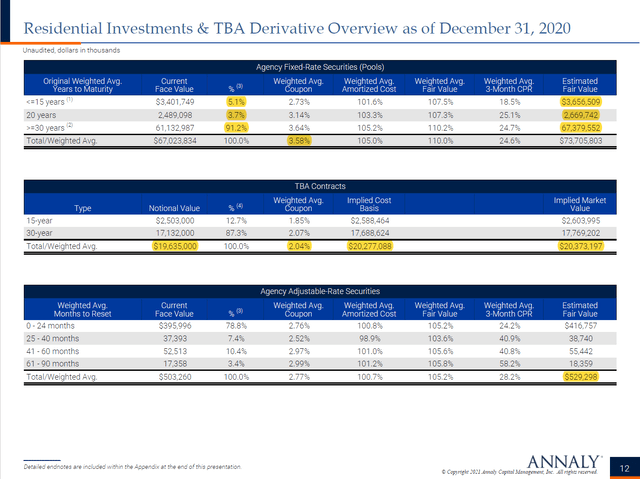

Table 2 – NLY Agency MBS Portfolio Composition (12/31/2020 Versus 9/30/2020)

(Source: Table obtained [with added highlights] from NLY’s quarterly shareholder presentation for second and third quarters of 2020. Permission for use has previously been granted by NLY’s investor relations department [copyright shown in slides].)

Using Table 2 above as a reference, NLY continued to maintain a portfolio heavily invested in 30-year fixed-rate agency MBS holdings during the fourth quarter of 2020. NLY’s proportion of 15-year fixed-rate agency MBS holdings very slightly increased from 5.0% to 5.1% during the quarter (based on par/face value). NLY’s proportion of 20-year fixed-rate agency MBS holdings slightly decreased from 4.2% to 3.7%. As such, NLY’s proportion of 30-year fixed-rate agency MBS slightly increased from 90.8% to 91.2%. When compared to a fixed-rate agency mREIT peer like ARR, NLY continued to have a higher proportion of 30-year fixed-rate agency MBS holdings during the fourth quarter of 2020. NLY had a similar proportion when compared to AGNC.

NLY’s on-balance sheet fixed-rate agency MBS holdings had a weighted average coupon (“WAC”) of 3.58% as of 12/31/2020 which was a (7) basis points (“bps”) decrease when compared to 9/30/2020. This provides direct evidence NLY had some higher coupon fixed-rate agency MBS sales/“roll-off”/prepayments during the quarter. Continuing a trend from the past four quarters, NLY’s TBA MBS position had a notably lower WAC of just 2.04% which was consistent with a few other fixed-rate agency mREIT peers regarding forward/generic MBS strategies (lower coupons generally equate to less prepayment risk). In addition, NLY’s weighted average three-month conditional prepayment rate (“CPR”) increased from 22.7% to 24.4% which was also a fairly consistent trend across the sector as mortgage interest rates decreased during the first, second, third, and fourth quarters of 2020 (a bit of a “delayed” impact to this metric; including seasonal trends). Let us now move on to NLY’s derivatives portfolio.

While management has, in the past, diversified the company’s investment portfolio into less interest rate sensitive holdings (lower durations), a majority of the company’s investment portfolio (from a valuation standpoint) was still in fixed-rate agency MBS. Along with the “plummet” in the Fed Funds Rate to near 0% in March 2020 (which also caused a proportionately large decrease to the London Interbank Offered Rate (“LIBOR”) across all tenors/maturities and all other applicable short-term funding/interest rates) and subsequent margin calls in certain derivative instruments, NLY notably reduced the company’s hedging coverage ratio during the first quarter of 2020. As NLY entered into new interest rate swap contracts during the second, third, and fourth quarters of 2020 (at notably more attractive terms), management “rebuilt” the company’s derivatives portfolio. To highlight the recent activity within NLY’s derivatives portfolio, Table 3 is presented below.

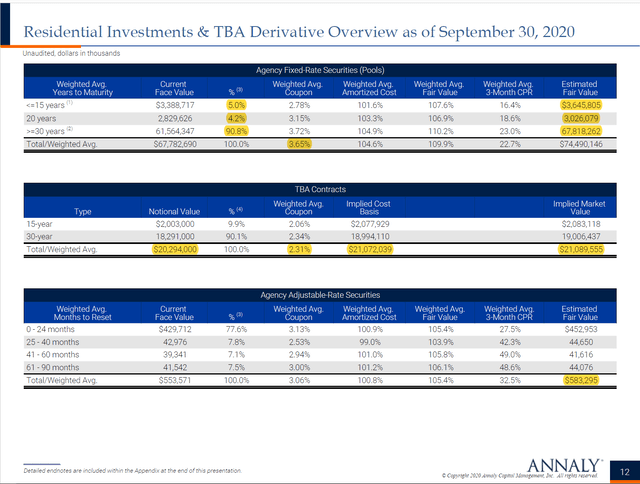

Table 3 – NLY Hedging Coverage Ratio (12/31/2020 Versus 9/30/2020)

(Source: Table created by me, partially using NLY data obtained from the SEC’s EDGAR Database [link provided below Table 1])

Using Table 3 above as a reference, NLY had a net (short) interest rate swap and swaptions position of ($32.2) and ($6.3) billion as of 9/30/2020, respectively (based on notional value). NLY also had a net (short) U.S. Treasury futures position of ($2.8) billion. When calculated, NLY had a hedging coverage ratio of 48% as of 9/30/2020. When compared to the nine other agency mREIT peers within this analysis, this was slightly above the average hedging coverage ratio of 45% as of 9/30/2020.

NLY had a net (short) interest rate swap and swaptions position of ($34.3) and ($7.8) billion as of 12/31/2020, respectively. NLY also had a net (short) U.S. Treasury futures position of ($10.4) billion. When calculated, NLY’s hedging coverage ratio increased to 61% as of 12/31/2020. This was slightly above the agency mREIT average hedging coverage ratio of 52% as of 12/31/2020.

Once again using Table 1 above as a reference, as of 3/26/2021 NLY’s stock price traded at $8.97 per share. When calculated, NLY’s stock price was trading at a 1.93% premium to my estimated CURRENT BV (BV as of 3/26/2021). Simply put, NLY’s stock price traded at a minor (less than a 5%) premium to my estimated CURRENT BV and at a slightly-modestly higher valuation when compared to the average of other agency mREIT peers within Table 1. When tracking historical trends, NLY typically trades at a higher valuation (less of a discount/more of a premium) to the company’s agency mREIT peers. I continue to believe NLY “deserves” to trade at modestly higher valuation (which has been explained in various mREIT sector articles and through the REIT Forum discussions). As such, as stated later in the article, I currently believe NLY is appropriately valued from a stock price perspective.

Comparison of NLY’s Recent Leverage, Hedging Coverage Ratio, BV, Economic Return (Loss), and Valuation to Nineteen mREIT Peers:

The REIT Forum Feature

Conclusions Drawn (PART 1):

PART 1 of this article has analyzed NLY and nineteen mREIT peers in regard to the following metrics: 1) trailing twelve-month economic return (loss); 2) leverage as of 12/31/2020; 3) hedging coverage ratio as of 12/31/2020; and 4) premium (discount) to my estimated CURRENT BV.

First, NLY’s trailing twelve-month economic return was more attractive versus the agency and broader mREIT sector average. NLY outperformed most of the company’s agency mREIT peers regarding this metric and nearly matched the performance of one of its closest sector peers, AGNC. This was mainly due to the recent composition of NLY’s MBS/investment and derivatives portfolio and the net movement of mortgage interest rates/U.S. Treasury yields during this timeframe. Due to NLY’s overall size and agency MBS liquidity, this company fared much better versus most mREIT sector peers during the COVID-19 pandemic.I believe this specific metric clearly shows this notion.

Second, NLY’s at-risk (total) leverage as of 12/31/2020 was modestly above the mREIT sector average. However, when compared to the company’s fixed-rate agency mREIT peers within this analysis, NLY’s at-risk leverage ratio remained slightly below average. Over the prior several years, NLY typically ran below average leverage versus the company’s fixed-rate agency mREIT peers. As such, no change on that front/metric.

Third, NLY’s hedging coverage ratio remained slightly above the agency mREIT average as of 12/31/2020. As a whole, most mREIT peers notably decreased their hedging coverage ratios during the first half of 2020. While this is would certainly “ring the alarm bells” if markets experienced a rapid rise in mortgage interest rates/U.S. Treasury yields, this scenario basically did not play out during 2020. As such, most mREITs “got away” with utilizing a lower number of derivative instruments when compared to 2018-2019. That said, mortgage interest rates/medium- to long-term U.S. Treasury yields have modestly-notably increased. However, especially for agency mREITs, these ratios have recently increased once again as the yield curve has gradually steepened which is generally a correct strategy (to mitigate MBS valuation losses). Last year, I correctly anticipated NLY’s hedging coverage ratio would “gravitate” toward the agency mREIT average as 2020 progressed.

Finally, NLY’s current valuation, when compared to my estimate of each mREIT’s CURRENT BV (BV as of 3/26/2021), was now at a slightly-modestly higher valuation versus the mREIT peer average within this analysis. Still, through the metrics provided within this two-part sector comparison article (including factors/metrics not discussed), I believe NLY “deserves” to trade at a modest premium valuation to most mREIT peers (and in some cases a notable premium valuation). As such, this is one of the reasons why I continue to believe NLY is appropriately valued. I would strongly suggest readers consider CURRENT BVs (as opposed to prior period BVs) when assessing whether a stock is attractively valued or not. The REIT Forum subscribers have access to weekly BV updates.

When taking a look at the events/trends that have occurred during the first quarter of 2021, most agency MBS pricing has experienced modest-notable price decreases while there have been modest-notable valuation increases within most derivative instruments.A neutral-slightly negative relationship between agency MBS pricing and derivative instrument valuations has recently occurred. Generally speaking, option adjusted spreads (“OAS”) modestly-notably tightened during January 2021 but have widened out during February-March 2021. As such, results across the broader mREIT sector will modestly-notably vary from peer-to-peer, dependent upon specific asset classification and risk management strategy. The metrics I provided above give readers a much better sense which mREIT peers are in “good shape” versus “bad shape” when it comes to operational performance for the first quarter of 2021.

The relationship between MBS/investment pricing and derivative instrument valuations needs to be constantly monitored (which I continually perform throughout the quarter). If I start to see a more notable positive/negative relationship unfold, I will inform readers through several avenues within Seeking Alpha (through articles, the live chat feature of The REIT Forum, and/or comments).

My BUY, SELL, or HOLD Recommendation:

From the analysis provided above (using Table 1 as a reference), including additional catalysts/factors not discussed within this article, I currently rate NLY as a SELL when I believe the company’s stock price is trading at or greater than a 5% premium to my projected CURRENT BV (BV as of 3/26/2021; $8.80 per share), a HOLD when trading at less than a 5% premium through less than a (5%) discount to my projected CURRENT BV, and a BUY when trading at or greater than a (5%) discount to my projected CURRENT BV. These percentage ranges are unchanged when compared to my last public NLY article (approximately 2.5 months ago; subscribers of the REIT Forum get weekly updates on recommendation range changes).

Therefore, I currently rate NLY as a HOLD.

As such, I currently believe NLY is appropriately valued from a stock price perspective. My current price target for NLY is approximately $9.25 per common share.This is currently the price where my recommendation would change to a SELL. The current price where my recommendation would change to a BUY is approximately $8.35 per common share.

Along with the data presented within this article, this recommendation considers the following mREIT catalysts/factors: 1) projected future MBS/investment price movements; 2) projected future derivative valuations; and 3) projected near-term dividend per share rates. These recommendations also consider the eight Fed Funds Rate increases by the Federal Open Market Committee (“FOMC”) during December 2016-2018 (a more hawkish tone/rhetoric when compared to 2014-2016), the three Fed Funds Rate decreases during 2019 due to the more dovish tone/rhetoric regarding overall monetary policy as a result of recent macroeconomic trends/events, and the very quick “plunge” in the Fed Funds Rate to near 0% in March 2020. This also considers the previous wind-down/decrease of the Fed Reserve’s balance sheet through gradual runoff/partial non-reinvestment (which began in October 2017 which increased spread/basis risk) and the prior “easing” of this wind-down that started in May 2019 regarding U.S. Treasuries and August 2019 regarding agency MBS (which partially reduced spread/basis risk when volatility remained subdued). This also considers the early Spring 2020 announcement of the start of another round of “quantitative easing” that includes the Fed specifically purchasing agency MBS (and “rolling over” all principal and interest payments into new agency MBS) which should bolster prices while keeping long-term/mortgage interest rates near historical lows (which has lowered spread/basis risk for some time now when volatility remains subdued).

mREIT Sector Recommendations as of 2/21/2020, 4/3/2020, and 3/26/2021:

Finally, once again using Table 1 above as a reference, I want to highlight to readers what I/we conveyed to readers when it came to sector recommendations as of 2/21/2020 (pre COVID-19 sell-off), 4/3/2020 (post COVID-19 sell-off), and 3/26/2021 (currently).

As of 2/21/2020, I/we had a BUY recommendation on the following mREIT stocks analyzed above (in no particular order): 1) ANH.

As of 2/21/2020, I/we had a HOLD recommendation on the following mREIT stocks analyzed above (in no particular order): 1) AI; 2) ARR; 3) CHMI; 4) MITT; 5) GPMT; 6) NRZ; 7) NYMT; and 8) PMT.

As of 2/21/2020, I/we had a SELL recommendation on the following mREIT stocks analyzed above (in no particular order): 1) AGNC; 2) CMO; 3) NLY; 4) ORC; 5) DX; 6) EFC; 7) MFA; 8) IVR; 9) TWO; and 10) WMC.

As of 2/21/2020, I/we had a STRONG SELL recommendation on the following mREIT stocks analyzed above (in no particular order): 1) CIM; and 2) BXMT.

So, prior to the COVID-19 sell-off, as of 2/21/2020 I/we had 0 mREITs rated as a STRONG BUY, only 1 rated as a BUY, 8 rated as a HOLD, 10 rated as a SELL (including NLY), and 2 rated as a STRONG SELL. Simply put, out of my seven years of covering this particular sector on Seeking Alpha, this was one of the most “bearish” overall weekly recommendation range classifications I have provided. Investors who “heeded” this advice were, at least, able to “lock-in” some notable gains (as sector valuations “ran up” after positive Q4 2019 earnings) which helped offset subsequent sector/market losses. At this general point in time, this was in direct contradiction to most contributors that continually cover the mREIT sector. As disclosed at the end of this article, in February 2020 I sold medium-large sector positions in ARR, IVR, NRZ, and TWO (in “real-time”).

As of 4/3/2020, I/we had aSTRONG BUY recommendation on the following mREIT stocks analyzed above (in no particular order): 1) AGNC; 2) AAIC; 3) ARR; 4) CHMI; 5) CMO; 6) DX; 7) IVR; 8) NLY; 9) ORC; 10) TWO; 11) ANH; 12) CIM; 13) WMC; 14) NRZ; 15) PMT; 16) BXMT; and 17) GPMT.

As of 4/3/2020, I/we had a BUY recommendation on the following mREIT stocks analyzed above (in no particular order): 1) EFC; and 2) NYMT.

As of 4/3/2020, I/we had a HOLD recommendation on the following mREIT stocks analyzed above (in no particular order): 1) MFA; and 2) MITT.

So, my/our outlook notably reversed course during late March-April 2020 as the market “pummeled” both strong and weak mREIT peers (notable price dislocations; in particular most agency mREIT peers). Our service quickly moved most recommendations to BUYS or STRONG BUYS immediately when this notable price dislocation was occurring. In addition, we quickly added proportionately large positions across several sector peers and “never looked backed” (subscribers to our service can attest to these positions as we disclose our trades in “real time” (the same day we place a place). As disclosed at the end of this article, in late March 2020 I purchased very large positions in AGNC and NLY. I subsequently purchased add-on positions in AAIC, CHMI, and GPMT in March-May 2020, along with several mREIT preferred stock and debt positions.

Still using Table 1 above as a reference, I want to highlight to readers what I/we are conveying to subscribers when it comes to sector recommendations as of 3/26/2021 (last week’s close).

As of 3/26/2021, I/we have a BUY recommendation on the following mREIT stocks analyzed above (in no particular order): 1) AAIC.

As of 3/26/2021, I/we currently have a HOLD recommendation on the following mREIT stocks analyzed above (in no particular order): 1) AGNC; 2) DX; 3) NLY; 4) TWO; 5) EFC; 6) WMC; 7) NRZ; 8) PMT; and 9) GPMT.

As of 3/26/2021, I/we currently have a SELL recommendation on the following mREIT stock analyzed above (in no particular order): 1) ARR; 2) CHMI; 3) CMO; 4) IVR; 5) CIM; 6) MFA; 7) MITT; and 8) NYMT.

As of 3/26/2021, I/we currently have a STRONG SELL recommendation on the following mREIT stocks analyzed above: 1) ORC; and 2) BXMT.

So, as of 3/26/2021 we now have 0 mREITs rated as a STRONG BUY, 1 rated as a BUY, 9 rated as a HOLD, 8 rated as a SELL, and 2 rated as a STRONG SELL. Simply put, a notable difference in value/outlook when compared to late March-April 2020. Still, there are currently a couple attractively-valued stocks in the mREIT sector (just not nearly as attractive as last year). As such, generally speaking, caution should be the main takeaway when it comes to this sector regarding current valuations.

Each investor's BUY, SELL, or HOLD decision is based on one's risk tolerance, time horizon, and dividend income goals. My personal recommendation will not fit each reader’s current investing strategy. The factual information provided within this article is intended to help assist readers when it comes to investing strategies/decisions.

Current/Recent mREIT Sector Stock Disclosures:

On 3/18/2020, I initiated a position in NLY at a weighted average purchase price of $5.05 per share (large purchase). This weighted average per share price excludes all dividends received/reinvested.

On 1/31/2017, I initiated a position in NRZ at a weighted average purchase price of $15.10 per share. On 6/29/2017, 7/7/2017, and 12/21/2018, I increased my position in NRZ at a weighted average purchase price of $15.775, $15.18, and $14.475 per share, respectively. When combined, my NRZ position had a weighted average purchase price of $14.912 per share. This weighted average per share price excluded all dividends received/reinvested. On 2/6/2020, I sold my entire NRZ position at a weighted average sales price of $17.555 per share as my price target, at the time, of $17.50 per share was surpassed. This calculates to a weighted average realized gain and total return of 17.7% and 41.2%, respectively. I held this position, on a weighted average basis, for approximately 20 months.

On 9/22/2020, I once again initiated a position in NRZ at a weighted average purchase price of $7.645 per share. On 1/28/2021, I increased my position in NRZ at a weighted average purchase price of $9.415 per share. When combined, my NRZ position has a weighted average purchase price of $8.53 per share This weighted average per share price excludes all dividends received/reinvested.

On 6/29/2017, I initiated a position in CHMI at a weighted average purchase price of $18.425 per share. On 10/6/2017, 10/26/2017, 11/6/2017, 1/29/2018, 10/12/2018, 6/6/2019, 7/23/2019, 9/5/2019, 3/16/2020, and 4/6/2020 I increased my position in CHMI at a weighted average purchase price of $18.015, $18.245, $17.71, $17.145, $17.235, $16.315, $15.325, $12.435, $8.55, and $3.645 per share, respectively. When combined, my CHMI position has a weighted average purchase price of $7.735 per share (yes, my last 3 purchases were proportionately large). This weighted average per share price excludes all dividends received/reinvested. On 3/10/2021, I sold my entire CHMI position at a weighted average sales price of $10.405 per share as my price target, at the time, of $10.40 per share was surpassed. This calculates to a weighted average non-annualized realized gain and total return of 34.5% and 52.2%, respectively. I held this position, on a weighted average basis, for approximately 14 months. This calculates to a weighted average annualized total return of 44.0%.

On 8/31/2017, I initiated a position in CHMI’s Series A preferred stock, (CHMI.PA). On 9/12/2017 and 4/6/2020, I increased my position in CHMI-A at a weighted average purchase price of $25.145 and $10.945 per share, respectively. When combined, my CHMI-A position had a weighted average purchase price of $18.071 per share. This weighted average per share price excluded all dividends received/reinvested. On 6/8/2020, I sold my entire CHMI-A position at a weighted average sales price of $24.273 per share. This calculates to a weighted average realized gain and total return of 34.3% and 49.4%, respectively. I held this position, on a weighted average basis, for approximately 1.7 years. This calculates to a weighted average annualized total return of 29.7%.

On 1/29/2018, I initiated a position in TWO at a weighted average purchase price of $15.155 per share. On 4/17/2019, I increased my position in TWO at a weighted average purchase price of $13.165 per share. When combined, my TWO position had a weighted average purchase price of $13.825 per share. This weighted average per share price excluded all dividends received/reinvested. On 2/3/2020, I sold my entire TWO position at a weighted average sales price of $15.355 per share as my price target, at the time, of $15.25 per share was surpassed. This calculates to a weighted average realized gain and total return of 11.0% and 25.2%, respectively. I held this position, on a weighted average basis, for approximately 13 months.

On 3/8/2018, I initiated a position in NYMT’s Series D preferred stock, (NYMTN). On 4/6/2018, 4/27/2018, 10/12/2018, 12/7/2018, 12/18/2018, and 3/22/2019 I increased my position in NYMTN. When combined, my NYMTN position had a weighted average purchase price of $22.379 per share. This weighted average per share price excluded all dividends received/reinvested. On 12/8/2020 - 12/9/2020, I sold my entire NYMTN position at a weighted average sales price of $23.287 per share. This calculates to a weighted average realized gain and total return of 4.1% and 24.0%, respectively. I held this position, on a weighted average basis, for approximately 27 months.

On 10/12/2018, I initiated a position in GPMT at a weighted average purchase price of $18.155 per share. On 5/12/2020, 5/27/2020, 5/28/2020, 8/26/2020, 9/10/2020, and 9/11/2020, I increased my position in GPMT at a weighted average purchase price of $4.745, $5.144, $5.086, $6.70, $6.19, and $6.045 per share, respectively. My last two purchases make up approximately 50% of my total position (to put things in better perspective). When combined, my GPMT position has a weighted average purchase price of $6.234 per share. This weighted average per share price excludes all dividends received/reinvested.

On 10/12/2018, I initiated a position in MITT at a weighted average purchase price of $17.105 per share. On 4/17/2019 and 6/3/2019, I increased my position in MITT at a weighted average purchase price of $16.22 and $15.52 per share, respectively. When combined, my MITT position had a weighted average purchase price of $15.946 per share. This weighted average per share price excludes all dividends received/reinvested. On 5/11/2020, I sold my entire MITT position at a weighted average sales price of $2.115 per share as my price target, at the time, was surpassed (as MITT’s estimated BV as of 4/30/2020 was even lower versus my previously projected (75%) quarterly BV decrease [6/30/2020 versus 3/31/2020]). This was my first “realized total loss” within either the mREIT or business development company (“BDC”) sector since I began writing here on Seeking Alpha in 2013. With that said, my proportional allocation in MITT (versus the rest of the mREIT sector) was small.

On 6/3/2019, I initiated a position in ARR at a weighted average purchase price of $17.545 per share. On 9/10/2019, I increased my position in ARR at a weighted average purchase price of $16.785 per share. When combined, my ARR position had a weighted average purchase price of $16.975 per share. This weighted average per share price excluded all dividends received/reinvested. On 2/20/2020, I sold my entire ARR position at a weighted average sales price of $21.045 per share as my price target, at the time, of $20.90 per share was surpassed. This calculates to a weighted average non-annualized realized gain and total return of 24.0% and 31.0%, respectively. I held this position, on a weighted average basis, for approximately 6 months.

On 6/3/2019, I initiated a position in IVR at a weighted average purchase price of $15.49 per share. This weighted average per share price excludes all dividends received/reinvested. On 2/14/2020, I sold my entire IVR position at a weighted average sales price of $17.965 per share as my price target, at the time, of $17.95 per share was surpassed. This calculates to a weighted average non-annualized realized gain and total return of 16.0% and 25.0%, respectively. I held this position for approximately 8 months.

On 11/22/2019, I initiated a position in Anworth Mortgage Asset Corp. (ANH) at a weighted average purchase price of $3.475 per share. This weighted average per share price excluded all dividends received/reinvested. On 12/23/2020, I sold my entire ANH position at a weighted average sales price of $2.75 per share as my price target, at the time, was surpassed. This was my second “realized total loss” within either the mREIT or BDC sector since I began writing here on Seeking Alpha in 2013. With that said, my proportional allocation in ANH (versus the rest of the mREIT sector) was very small (less than 0.5% at the time of sale).

On 11/22/2019, I initiated a position in AAIC’s Senior Notes Due 2023 (AIW) at a weighted average purchase price of $24.13 per share ($25 being par). On 3/10/2020, 3/13/2020, and 3/19/2020, I increased my position in AIW at a weighted average purchase price of $23.50, $19.75, and $9.31 per share, respectively. When combined, my AIW has a weighted average purchase price of $14.804 per share. This weighted average per share price excludes all interest received/compounded.

On 12/31/2019, I initiated a position in AAIC’s Senior Notes Due 2025 (AIC) at a weighted average purchase price of $24.00 per share ($25 being par). On 3/10/2020 and 3/19/2020, I increased my position in AIC at a weighted average purchase price of $23.72 and $8.71 per share, respectively. When combined, my AIC has a weighted average purchase price of $16.182 per share. This weighted average per share price excluded all interest received/compounded. On 9/2/2020-9/4/2020, I sold my entire AIC position at a weighted average sales price of $23.55 per share. This calculates to a weighted average non-annualized realized gain and total return of 45.5% and 51.1%, respectively. I held this position for approximately 6.5 months.

On 1/2/2020, I initiated a position in AAIC at a weighted average purchase price of $5.57 per share. On 1/9/2020, 3/16/2020, and 9/24/2020, I increased my position in AI at a weighted average purchase price of $5.59, $3.25, and $2.53 per share, respectively. When combined, my AAIC position has a weighted average purchase price of $3.276 per share. This weighted average per share price excludes all dividends received/reinvested.

On 3/18/2020, I once again initiated a position in AGNC at a weighted average purchase price of $7.115 per share (large purchase). This weighted average per share price excludes all dividends received/reinvested.

On 4/6/2020, I initiated a position in CHMI’s Series B preferred stock, (CHMI.PB) at a weighted average purchase price of $10.65 per share. This weighted average per share price excluded all dividends received/reinvested. On 6/19/2020-6/24/2020, I sold my entire CHMI-B position at a weighted average sales price of $22.045 per share. This calculates to a weighted average realized gain and total return of 107.0%. I held this position for approximately 2.5 months.

On 10/19/2020, I initiated a position in PMT at a weighted average purchase price of $16.275 per share. On 10/29/2020, I increased my position in PMT at a weighted average purchase price of $14.90 per common. When combined, my PMT position has a weighted average purchase price of $15.358 per share. This weighted average per share price excludes all dividends received/reinvested.

Final Note: All trades/investments I have performed over the past several years have been disclosed to readers in “real time” (that day at the latest) via either the StockTalk feature of Seeking Alpha or, more recently, the “live chat” feature of the Marketplace Service the REIT Forum (which cannot be changed/altered). Through these resources, readers can look up all my prior disclosures (buys/sells) regarding all companies I cover here at Seeking Alpha (see my profile page for a list of all stocks covered). Through StockTalk disclosures and/or the live chat feature of the REIT Forum, at the end of February 2021, I had an unrealized/realized gain “success rate” of 96.2% and a total return (includes dividends received) success rate of 96.2% out of 52 total past and present mREIT and BDC positions (updated monthly; multiple purchases/sales in one stock count as one overall position until fully closed out).Both percentages experienced a modest increase, when compared to April-May 2020, as a direct result of the recent partial market rally to counter previous fears/panic surrounding the COVID-19 pandemic. In addition, in early April 2020, I initiated several new positions and increased several existing positions at attractive-very attractive prices. Currently, I have only 2 realized “total losses” in any of my past/sold positions (the rest have generated a realized total return). I encourage other Seeking Alpha contributors to provide real time buy and sell updates for their readers which would ultimately lead to greater transparency/credibility. Starting in January 2020, I have transitioned all my real-time purchase and sale disclosures solely to members of the REIT Forum. All applicable public articles will still have my sector purchase and sale disclosures (just not in real time). Please disregard any minor “cosmetic” typos if/when applicable.

I am currently "teaming up" with Colorado Wealth Management to provide intra-quarter CURRENT BV and NAV per share projections on all 20 mREIT and 15 BDC stocks I currently cover. These very informative (and “premium”) projections are provided through Colorado's S.A. Marketplace service. In addition, this includes additional data/analytics, weekly sector recommendations (including ranges), and exclusive "rapid fire" mREIT and BDC articles after earnings. For a full list of benefits I provide to the REIT Forum subscribers, please see my profile page.