Introduction

Since last discussing Nordic American Tankers (NYSE:NAT), they have reduced their dividends once again and thus suppressed their yield down to a low 2.50%. Even though they seem superior to other oil tanker companies they could not defy the worst industry-wide downturn in over two decades, as my previous article discussed. A follow-up analysis is provided within this article that now includes their subsequently released financial results for the fourth quarter of 2020, which provide insights into their medium to long-term future.

Executive Summary & Ratings

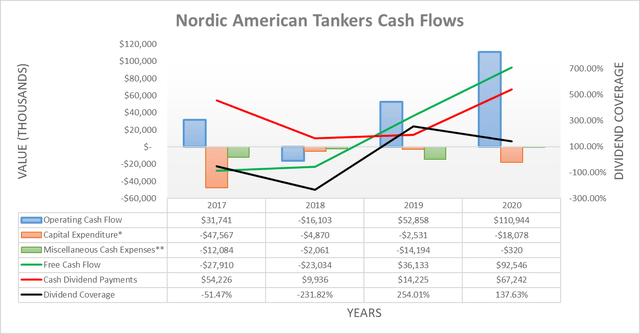

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that was assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Image Source: Author.

*There are significant short and medium-term uncertainties for the broader oil and gas industry, however, in the long-term they will certainly face a decline as the world moves away from fossil fuels.

Detailed Analysis

![]()

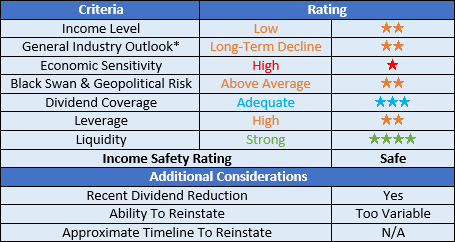

Image Source: Author.

Instead of simply assessing dividend coverage through earnings per share, I prefer to utilize free cash flow since it provides the toughest criteria and best captures the true impact on their financial position. The extent that these two results differ will depend upon the company in question and often comes down to the spread between their depreciation and amortization to capital expenditure.

On the surface 2020 appears to have been a blockbuster year with operating cash flow of $111m surging well above the $53m generated during 2019, but alas this only tells half the story. Their time during 2020 saw two extremes, earlier in the year they generated boatloads of cash as the