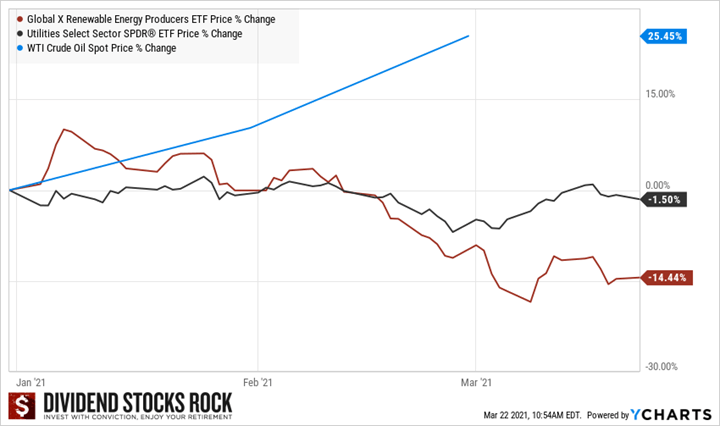

Between January 6th and March 22nd, renewable energy stocks have fallen over 20%.

Many ask me what is happening. After all, while renewable energy companies have a hard time on the market, both the TSX (+9.4%) and S&P 500 (+4.5%) are doing well. The utility sector is lagging in general, but it hurts if you moved your money towards "the future" at the end of 2020.

Is this a classic case of "buy the rumor, sell the news" where investors who waited for Biden to be officially certified were late to the party? After all, Biden and his team have a climate change plan including around $2 trillion (we now hear about a $3T deal!) in investments, subsidies, or tax breaks for clean energy. This should be enough to stimulate this industry for a while. Well, as is often the case, it's more complicated than this. Let's dig deeper, shall we?

It's Time to Take Things in Perspective

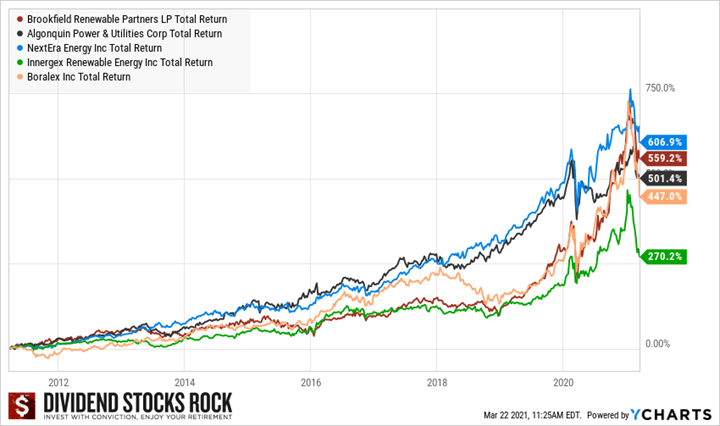

First things first, when you send me an email asking why company XYZ is down 20%, I always hit the pause button. First, please note that I cannot (legally) answer this type of question in a one-on-one email because I am not your Financial Advisor. I usually gather such questions and write a newsletter about the topic or discuss the subject in one of our monthly webinars. Second, I always look at the overall stock history before digging deeper as to why a stock is down 20% at any given moment in time. When you take a close look at the renewable energy sector, you realize those companies have been on a solid bull trend for about ten years.

With many stocks showing more than 400% growth over the past decade, it's only normal to see a "small correction" from time to time. Some investors that have