Today, we'll discuss two ideas among the list: ViacomCBS (VIAC) and AbbVie (ABBV).

Growth Perspective: ViacomCBS

Business Model

ViacomCBS is the combination of CBS and Viacom that has created a media conglomerate operating around the world. CBS' television assets include the CBS television network, 28 local TV stations, and 50% of CW, a joint venture between CBS and Time Warner. The company also owns Showtime and Simon & Schuster. Viacom owns several leading cable network properties, including Nickelodeon, MTV, BET, Comedy Central, VH1, CMT, and Paramount. Viacom has also built several online properties on the strength of these brands. Viacom's Paramount Pictures produces original motion pictures and owns a library of 2,500 films.

What's the Story

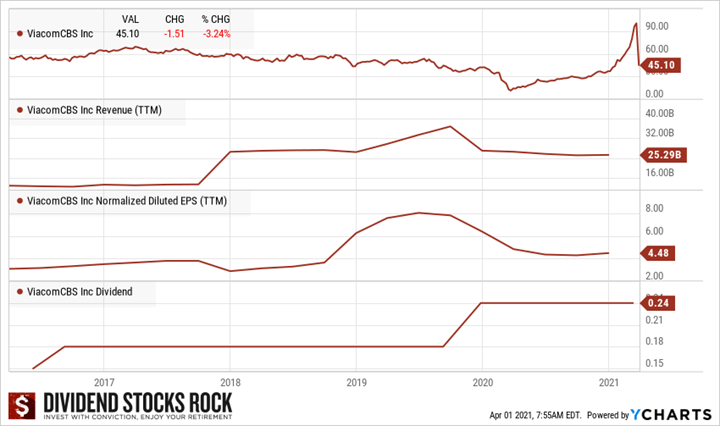

Not long ago, the stock lost 50% of its value in 5 days. That's crazy, right? It all started when VIAC announced an equity issue in new Class B common shares and mandatory convertible preferred shares. The arrival of 20 million new shares was the first spark to a significant sell-off. We think it was a smart way to cash in on a high valuation to support spending on its new streaming business. The company's future is tied to its ability to generate content and attract customers on its streaming platforms.

Then, the stock continued to drop as Archegos Capital (a hedge fund) was forced to sell more than $20B in stocks on Friday due to a margin call. VIAC lost 50% of its value in a single week. It's an interesting speculative play but proceed with caution. The company shows a dividend safety score of 2 since it increased its payout only once in the past 5 years. However, the dividend is safe with low payout ratios. Management prefers to focus on growth (the integration of the merger + massive CAPEX toward streaming), which is not necessarily bad. After this stock