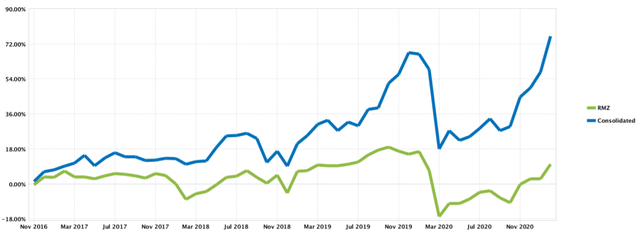

Over the past months, the REIT (VNQ) market has strongly recovered, and as a result, our portfolio is now hitting new-all-time-highs:

Source: Interactive Brokers

For this reason, we are now shifting from a phase of aggressive accumulation to a phase of portfolio recycling to make sure that our capital is invested in the most optimal way possible.

We generally avoid selling positions and take a long-term-oriented approach to investing, but market conditions have changed materially over the past months and we see some opportunities to consolidate capital towards our highest-conviction positions.

So far, we have locked gains in Urstadt Biddle Properties (UBA) and Hersha Hospitality (HT) and recently, we sold a third position in Spirit Realty Capital (SRC) to double down on another REIT that's called: VICI Properties (VICI).

Here is why:

Spirit Realty Capital vs. VICI Properties

We first invested in Spirit Realty in May of 2017.

Back then, it was hated by most analysts and offered at a 2x lower valuation multiple than its higher-quality net lease peers Realty Income (O) and National Retail Properties (NNN).

SRC deserved to trade at a discount because of its worst track record, but the discount was excessive, and therefore, SRC was the best value pick in the net lease sector.

We invested heavily in it and for a long time, it was our largest holding at High Yield Landlord.

But times have changed, and SRC is not as opportunistic as it used to be.

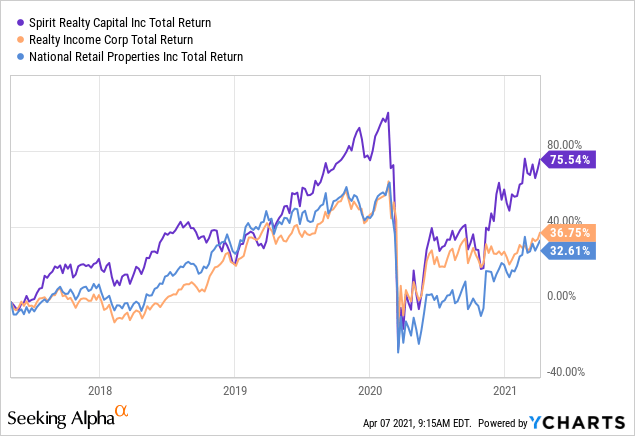

Since then, SRC has handily outperformed its close peers and returned closer to fair value:

After this surge, SRC is not offered at a 2x lower valuation multiple anymore.

The difference in pricing is now much smaller.

In fact, some of SRC's peers are priced at the same valuation multiple or only slightly higher, despite enjoying much better business

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,000 members on board and a perfect 5/5 rating from 394 reviews:

For a Limited-Time - You can join us at a deeply reduced rate!