High-beta, highly speculative stocks took a swoon in early April, but the major market indexes barely retreated, except for a tax-fear-frenzy one-day nosedive mid-week. The market indexes relative immunity to stock specific drawdowns is impressive, but cracks under the surface could make it wise to use strength into month end as an opportunity to make some changes to your portfolio's sector allocation.

Notably, the percentage of stocks in our 1,600-stock universe trading 5% or more above the 200-day moving average remains at an extreme level, while bullish sentiment and seasonal headwinds suggest playing some defense could be smart.

Currently, 71.5% of stocks in our universe are 5% or more above the 200 DMA and only 10.6% of stocks are trading 5% or more below it. Extreme readings like these can last for months, but historically, they don't last forever.

Source: Top Stocks for Tomorrow.

Adding to the concern are the results from the most recent American Association of Individual Investors (AAII) Investor Sentiment Survey. Overall, 52.7% of respondents expect markets to run higher in the next six months and only 20.5% expect a retreat. Historically, optimism has clocked in at an average 38%, while pessimism has averaged 30.5%; and according to the AAII, above average optimism and below-average pessimism have been followed by below-average S&P 500 returns in the following six to 12 months.

The frothy expectations suggested by the survey are particularly intriguing because they coincide with a period of historical market weakness. April is the final month of its “Best Six Months” period of seasonal strength, according to the Stock Trader’s Almanac. Typically, the Dow Jones Industrials and S&P 500 become more hit-or-miss from May through October. For example, the Dow has gained 20,353 points in the six months November through April over the past 70 years, but only 3,778 points in May through October.

Nasdaq's seasonality is better, though, with its strength typically extending an additional two months through June.

Nevertheless, mid-to-late cycle stocks and defensive baskets are beginning to rebound in our sector rankings. For instance, technology is the worst scoring sector in our large cap sector ranking, while utilities – a notoriously defensive basket – scores highest. Similarly, healthcare, another defensive sector, has seen its score improve to neutral from below average. We may see volatility in sector scores, but the current ranking suggests diversifying sector exposure to include defensive groups could be smart.

The best sectors to buy

Weekly, we aggregate individual scores across our entire universe to determine the best and worst sectors to focus on for new ideas.

Our scoring system is explained more in the following YouTube video, but in short, each stock is scored based on seven key factors associated with future price action: earnings per share beat history, earnings per share future growth, insider buying activity, short-term and long-term money flow, relative valuation, and historical seasonal trends.

This week, the resulting large cap sector ranking has utilities, financials, REITs, and industrials scoring above average. Consumer goods, healthcare, energy, and services rank neutral, while basic materials and technology score below average and thus, should be approached as stock specific.

The best mid-cap sectors are consumer goods, financials, energy, services, and REITs. Industrials and utilities are neutral, while basics, technology, and healthcare score below average. In small cap, REITs, financials, consumer goods, energy, and services are best. Industrials score average, while utilities, technology, healthcare, and basic materials rank below average.

Source: Top Stocks for Tomorrow.

The current ranking suggests:

- The strongest tailwinds for finding winning stocks exist in financials, REITs, and consumer goods.

- Tilting toward large cap stocks in healthcare and utilities is smart.

- Focusing on mid-cap and small-cap stocks in energy is wise.

- Staying stock-by-stock in technology, rather than buying the broader basket.

The next chart shows sector scores by market cap. For example, mid-cap consumer goods is stronger than large-cap or small-cap consumer goods; and large-cap utilities is stronger than small-cap utilities. For perspective, the average score across our entire universe is 71.6 this week.

Source: Top Stocks For Tomorrow.

The strongest-scoring stocks today

Our stock scoring system can be a great tool for finding stocks worthy of your attention because stocks follow earnings over time, insiders buy for one reason, money flow reflects institutional sentiment, and seasonal patterns can rhyme.

This week, we shared over 200 high-scoring stock ideas with our members across all sectors, including these top 10 scoring stocks by sector across all market caps. For convenience, I’ve highlighted stocks with current scores that are most significantly above the trailing 4-week average score.

| Best Scoring by Sector | 4/22/2021 | 4 Week MA | |||

| Company Name | Symbol | Sector | INDUSTRY | SCORE | SCORE |

| BASIC MATERIALS | |||||

| W. R. Grace & Co. | (GRA) | BASIC MATERIALS | SPECIALTY CHEMICALS | 110 | 108.8 |

| Corteva Inc. | (CTVA) | BASIC MATERIALS | AGRICULTURAL INPUTS | 105 | 88.8 |

| Element Solutions | (ESI) | BASIC MATERIALS | SPECIALTY CHEMICALS | 105 | 103.8 |

| Eastman Chemical Company | (EMN) | BASIC MATERIALS | CHEMICALS | 100 | 102.5 |

| PPG Industries, Inc. | (PPG) | BASIC MATERIALS | SPECIALTY CHEMICALS | 100 | 90.0 |

| Ashland Global Holdings Inc. | (ASH) | BASIC MATERIALS | CHEMICALS | 100 | 95.0 |

| The Sherwin-Williams Company | (SHW) | BASIC MATERIALS | SPECIALTY CHEMICALS | 100 | 98.8 |

| Martin Marietta Materials, Inc. | (MLM) | BASIC MATERIALS | BUILDING MATERIALS | 100 | 87.5 |

| Compass Minerals International, Inc. | (CMP) | BASIC MATERIALS | OTHER INDUSTRIAL METALS & MINING | 95 | 70.0 |

| Avient Corporation | (AVNT) | BASIC MATERIALS | SPECIALTY CHEMICALS | 95 | 86.3 |

| CONSUMER GOODS | |||||

| Polaris Inc. | (PII) | CONSUMER GOODS | RECREATIONAL VEHICLES | 110 | 101.3 |

| Fox Factory Holding Corp. | (FOXF) | CONSUMER GOODS | RECREATIONAL VEHICLES | 110 | 98.8 |

| Leggett & Platt, Incorporated | (LEG) | CONSUMER GOODS | FURNISHINGS, FIXTURES & APPLIANCES | 105 | 97.5 |

| Wolverine World Wide, Inc. | (WWW) | CONSUMER GOODS | FOOTWEAR & ACCESSORIES | 105 | 107.5 |

| Levi Strauss & Co. | (LEVI) | CONSUMER GOODS | APPAREL MANUFACTURING | 105 | 88.8 |

| The Hain Celestial Group, Inc. | (HAIN) | CONSUMER GOODS | PACKAGED FOODS | 105 | 106.3 |

| Newell Brands Inc. | (NWL) | CONSUMER GOODS | HOUSEHOLD & PERSONAL PRODUCTS | 100 | 96.3 |

| The Coca-Cola Company | (KO) | CONSUMER GOODS | BEVERAGES | 100 | 76.3 |

| Constellation Brands, Inc. | (STZ) | CONSUMER GOODS | BEVERAGES | 100 | 97.5 |

| Monster Beverage Corporation | (MNST) | CONSUMER GOODS | BEVERAGES | 100 | 92.5 |

| ENERGY | |||||

| PBF Logistics LP | (PBFX) | ENERGY | OIL & GAS MIDSTREAM | 110 | 90.0 |

| Global Partners LP | (GLP) | ENERGY | OIL & GAS MIDSTREAM | 100 | 88.8 |

| Western Midstream Partners, LP | (WES) | ENERGY | OIL & GAS MIDSTREAM | 100 | 98.8 |

| Diamondback Energy, Inc. | (FANG) | ENERGY | OIL & GAS E&P | 100 | 97.5 |

| Occidental Petroleum Corporation | (OXY) | ENERGY | OIL & GAS E&P | 100 | 88.8 |

| Delek Logistics Partners, LP | (DKL) | ENERGY | OIL & GAS MIDSTREAM | 95 | 90.0 |

| Magellan Midstream Partners, L.P. | (MMP) | ENERGY | OIL & GAS MIDSTREAM | 95 | 95.0 |

| Enterprise Products Partners L.P. | (EPD) | ENERGY | OIL & GAS MIDSTREAM | 95 | 88.8 |

| Cheniere Energy Partners, L.P. | (CQP) | ENERGY | OIL & GAS MIDSTREAM | 95 | 91.3 |

| Oil States International, Inc. | (OIS) | ENERGY | OIL & GAS EQUIPMENT & SERVICES | 95 | 86.3 |

| FINANCIALS | |||||

| Prudential Financial, Inc. | (PRU) | FINANCIALS | INSURANCE-LIFE | 110 | 98.8 |

| Principal Financial Group, Inc. | (PFG) | FINANCIALS | INSURANCE-DIVERSIFIED | 110 | 95.0 |

| Wintrust Financial Corporation | (WTFC) | FINANCIALS | BANKS-REGIONAL | 110 | 102.5 |

| Ellington Financial Inc. | (EFC) | FINANCIALS | MORTGAGE FINANCE | 105 | 107.5 |

| Brown & Brown, Inc. | (BRO) | FINANCIALS | INSURANCE BROKERS | 105 | 81.3 |

| Banner Corporation | (BANR) | FINANCIALS | BANKS-REGIONAL | 100 | 93.8 |

| BancorpSouth Bank | (BXS) | FINANCIALS | BANKS-REGIONAL | 100 | 87.5 |

| Chubb Limited | (CB) | FINANCIALS | INSURANCE-PROPERTY & CASUALTY | 100 | 91.3 |

| CNO Financial Group, Inc. | (CNO) | FINANCIALS | INSURANCE-LIFE | 100 | 98.8 |

| Assurant, Inc. | (AIZ) | FINANCIALS | INSURANCE-SPECIALTY | 100 | 83.8 |

| HEALTHCARE | |||||

| Bristol-Myers Squibb Company | (BMY) | HEALTHCARE | DRUG MANUFACTURERS | 110 | 73.8 |

| Acadia Healthcare Company, Inc. | (ACHC) | HEALTHCARE | SPECIALIZED HEALTH SERVICES | 110 | 108.8 |

| Evolent Health | (EVH) | HEALTHCARE | HEALTH INFORMATION SERVICES | 105 | 86.3 |

| Evelo Bio | (OTCPK:EVLO) | HEALTHCARE | BIOTECHNOLOGY | 105 | 91.3 |

| Integra LifeSciences Holdings Corporation | (IART) | HEALTHCARE | MEDICAL DEVICES | 105 | 97.5 |

| Medpace Holdings, Inc. | (MEDP) | HEALTHCARE | DIAGNOSTICS & RESEARCH | 105 | 88.8 |

| OptimizeRx Corp | (OPRX) | HEALTHCARE | HEALTH INFORMATION SERVICES | 105 | 92.5 |

| AbbVie Inc. | (ABBV) | HEALTHCARE | DRUG MANUFACTURERS | 100 | 83.8 |

| CVS Health Corporation | (CVS) | HEALTHCARE | HEALTHCARE PLANS | 100 | 90.0 |

| Eli Lilly and Company | (LLY) | HEALTHCARE | DRUG MANUFACTURERS | 100 | 97.5 |

| INDUSTRIALS | |||||

| Carlisle Companies Incorporated | (CSL) | INDUSTRIALS | BUILDING PRODUCTS & EQUIPMENT | 105 | 105.0 |

| Compass Diversified Holdings LLC | (CODI) | INDUSTRIALS | CONGLOMERATES | 100 | 92.5 |

| 3M Company | (MMM) | INDUSTRIALS | CONGLOMERATES | 100 | 98.8 |

| Automatic Data Processing, Inc. | (ADP) | INDUSTRIALS | STAFFING & EMPLOYMENT SERVICES | 100 | 98.8 |

| Northrop Grumman Corporation | (NOC) | INDUSTRIALS | AEROSPACE & DEFENSE | 100 | 100.0 |

| Republic Services, Inc. | (RSG) | INDUSTRIALS | WASTE MANAGEMENT | 100 | 98.8 |

| KB Home | (KBH) | INDUSTRIALS | ENGINEERING & CONSTRUCTION | 100 | 88.8 |

| Expeditors International of Washington, Inc. | (EXPD) | INDUSTRIALS | INTEGRATED FREIGHT & LOGISTICS | 100 | 88.8 |

| Simpson Manufacturing Co., Inc. | (SSD) | INDUSTRIALS | BUILDING PRODUCTS & EQUIPMENT | 100 | 98.8 |

| Global Payments Inc. | (GPN) | INDUSTRIALS | SPECIALTY BUSINESS SERVICES | 100 | 100.0 |

| REITS | |||||

| Annaly Capital Management, Inc. | (NLY) | REITS | REIT-MORTGAGE | 110 | 107.5 |

| iStar Inc. | (STAR) | REITS | REIT-DIVERSIFIED | 110 | 107.5 |

| CorePoint Lodging Inc. | (CPLG) | REITS | REIT-HOTEL & MOTEL | 105 | 88.8 |

| Mack-Cali Realty Corporation | (CLI) | REITS | REIT-OFFICE | 105 | 96.3 |

| American Finance Trust, Inc. | (AFIN) | REITS | REIT-DIVERSIFIED | 100 | 87.5 |

| RPT Realty | (RPT) | REITS | REIT-RETAIL | 100 | 98.8 |

| Capstead Mortgage Corporation | (CMO) | REITS | REIT-MORTGAGE | 95 | 101.3 |

| MGM Growth Properties LLC | (MGP) | REITS | REIT-DIVERSIFIED | 95 | 83.8 |

| SL Green Realty Corp. | (SLG) | REITS | REIT-OFFICE | 95 | 96.3 |

| The Macerich Company | (MAC) | REITS | REIT-RETAIL | 95 | 93.8 |

| SERVICES | |||||

| Genuine Parts Company | (GPC) | SERVICES | SPECIALTY RETAIL | 110 | 102.5 |

| Equifax Inc. | (EFX) | SERVICES | CONSULTING SERVICES | 105 | 105.0 |

| At Home Group | (HOME) | SERVICES | SPECIALTY RETAIL | 105 | 93.8 |

| Red Rock Resorts | (RRR) | SERVICES | RESORTS & CASINOS | 100 | 101.3 |

| The Interpublic Group of Companies, Inc. | (IPG) | SERVICES | ADVERTISING AGENCIES | 100 | 98.8 |

| The Home Depot, Inc. | (HD) | SERVICES | HOME IMPROVEMENT RETAIL | 100 | 100.0 |

| Comcast Corporation | (CMCSA) | SERVICES | ENTERTAINMENT | 100 | 88.8 |

| YUM! Brands, Inc. | (YUM) | SERVICES | RESTAURANTS | 100 | 95.0 |

| Tractor Supply Company | (TSCO) | SERVICES | SPECIALTY RETAIL | 100 | 95.0 |

| Exponent Inc. | (EXPO) | SERVICES | CONSULTING SERVICES | 100 | 103.8 |

| TECHNOLOGY | |||||

| AstroNova, Inc. | (ALOT) | TECHNOLOGY | COMPUTER HARDWARE | 105 | 88.8 |

| J2 Global, Inc. | (JCOM) | TECHNOLOGY | SOFTWARE-INFRASTRUCTURE | 105 | 103.8 |

| OSI Systems, Inc. | (OSIS) | TECHNOLOGY | ELECTRONIC COMPONENTS | 105 | 95.0 |

| Open Text Corporation | (OTEX) | TECHNOLOGY | SOFTWARE-APPLICATION | 100 | 102.5 |

| Fidelity National Information Services, Inc. | (FIS) | TECHNOLOGY | INFORMATION TECHNOLOGY SERVICES | 100 | 87.5 |

| Alarm.com Holdings, Inc. | (ALRM) | TECHNOLOGY | SOFTWARE-APPLICATION | 100 | 92.5 |

| Dropbox Inc. | (DBX) | TECHNOLOGY | SOFTWARE-INFRASTRUCTURE | 100 | 97.5 |

| Ichor Holdings | (ICHR) | TECHNOLOGY | SEMICONDUCTOR EQUIPMENT & MATERIALS | 100 | 87.5 |

| Gartner, Inc. | (IT) | TECHNOLOGY | INFORMATION TECHNOLOGY SERVICES | 100 | 87.5 |

| Proofpoint, Inc. | (PFPT) | TECHNOLOGY | SOFTWARE-INFRASTRUCTURE | 100 | 98.8 |

| UTILITIES | |||||

| CenterPoint Energy, Inc. | (CNP) | UTILITIES | UTILITIES-REGULATED GAS | 110 | 102.5 |

| Sempra Energy | (SRE) | UTILITIES | UTILITIES-DIVERSIFIED | 105 | 103.8 |

| Consolidated Edison, Inc. | (ED) | UTILITIES | UTILITIES-REGULATED ELECTRIC | 100 | 70.0 |

| ALLETE, Inc. | (ALE) | UTILITIES | UTILITIES-DIVERSIFIED | 100 | 91.3 |

| NiSource Inc. | (NI) | UTILITIES | UTILITIES-REGULATED GAS | 100 | 100.0 |

| DTE Energy Company | (DTE) | UTILITIES | UTILITIES-REGULATED ELECTRIC | 100 | 100.0 |

| Essential Utilities, Inc. | (WTRG) | UTILITIES | UTILITIES-REGULATED WATER | 95 | 81.3 |

| Brookfield Infrastructure Partners L.P. | (BIP) | UTILITIES | UTILITIES-DIVERSIFIED | 90 | 88.8 |

| Entergy Corporation | (ETR) | UTILITIES | UTILITIES-DIVERSIFIED | 90 | 61.3 |

| American Electric Power Company, Inc. | (AEP) | UTILITIES | UTILITIES-REGULATED ELECTRIC | 90 | 60.0 |

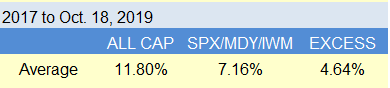

Never miss a report. Weekly large cap, mid cap, small cap and ADR rankings. Know what sectors, industries, and stocks to buy and when to buy them. Over 400 bps of excess return in the following 52 weeks since 2017. Free trial, special introductory pricing, and you can cancel anytime. Join the conversation. Sign up for Tomorrow's Top Stocks Today.