CatchMark Timber Trust (CTT) is a company that has both fantastic and challenging aspects which makes it worth examining in great detail because if we can figure out how these things are going to play out, the returns could be substantial. In particular there are 4 aspects of CTT that massively impact its fair value.

- Triple T Joint venture

- Amplified inflation hedge

- Adverse dynamic between timberlands and mills

- Carbon Sequestration opportunity

The first 2 I already addressed in previous articles so I will not duplicate that here.

- Discussion of both the risks and the upside of the triple T joint venture.

- CTT as a strong inflation hedge as detailed here. Since the value of the land greatly exceeds the market capitalization, it should appreciate at a multiple of inflation.

As indicated by the title, this article will primarily be about carbon sequestration, but the important aspect of carbon sequestration to CTTs business is that it has the potential to entirely fix the adverse strategic dynamic between mills and timberlands.

Mills are bullying timberlands

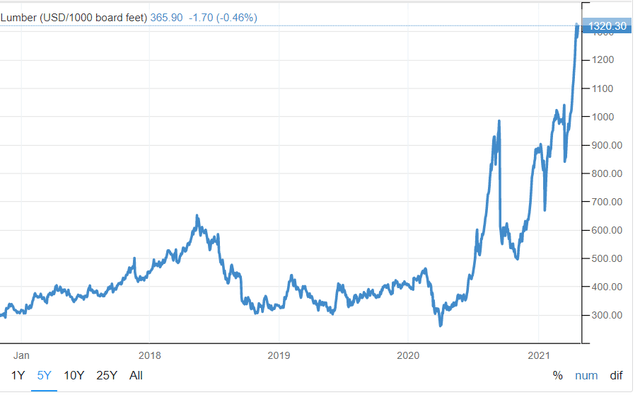

The numbers say it all. Lumber prices are up from mid $300s to over $1300.

Yet timber prices have not budged.

The mills are buying timber from the timberlands for very cheap prices, milling that timber into lumber and selling at astronomically high prices. The mills are capturing all of the value in the vertical.

The simple supply and demand fundamentals that are creating this imbalance are that there is a shortage of mills and an ample amount of timberland supplying those mills. Thus, the mills have all the power and are using it to capture the profits leaving timberlands operating at razor thin margins.

This dynamic is the only reason our timberland investments are very small at the present.

Other than the barebones pricing of sawtimber and pulp, timberland has phenomenal fundamentals. The inherent aspects of timberland are just straight up desirable investment characteristics.

- Land appreciates rather than depreciates

- Land requires minimal or no capex to appreciate

- Timber sales create carrying yield while we wait for appreciation

- Global supply of timberland is perpetually declining which portends increased value for what remains

These are the makings of a world class long term hold investment.

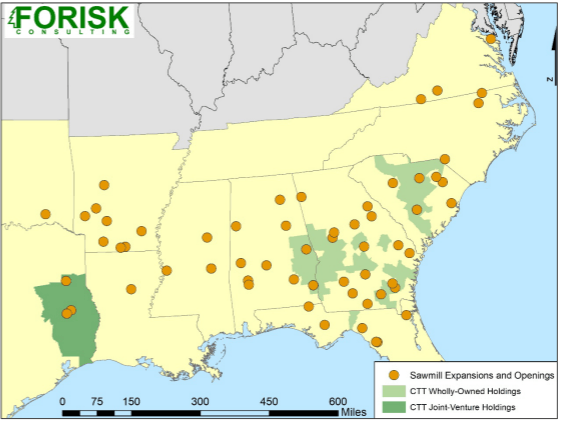

It is just a matter of getting past this situation in which the mills are able to bully the timberlands. Over a long period of time this will self-correct through free market equilibrium mechanisms. Mills are opening up and as mill supply increases, they lose their power over their supplier. There are quite a few mills opening or expanding in CTTs timberbasket.

Source: CTT

Source: CTT

However, it could be as long as a decade before enough mills open to correct the imbalance.

Carbon sequestration presents an opportunity to increase timberland profitability much sooner. If it takes off in scale, timberlands could be a huge winner and CTT is best positioned to take advantage of carbon sequestration.

Carbon Sequestration - what is it and how does it work financially?

Before I discuss the financial aspects of carbon sequestration as it relates to CTT, I want to note that this is adjacent to politically sensitive issues such as climate change and carbon's role in it. I am stating no opinions either way on this issue and the thesis is agnostic to one's stance on said issue. The thesis is grounded entirely on the financial merits of CTT as an investment and is agnostic to the morality of carbon sequestration.

The basic idea here is that trees are a natural means to pull carbon out of the air on massive scale. The carbon is then stored or sequestered in the physical bulk of the biomass.

With so many entities ranging from governments around the world to companies looking to improve their ESG scores, there is a massive push to reduce net carbon emissions. Both companies and governments are willing to pay to reduce carbon emissions and this forms the carbon market.

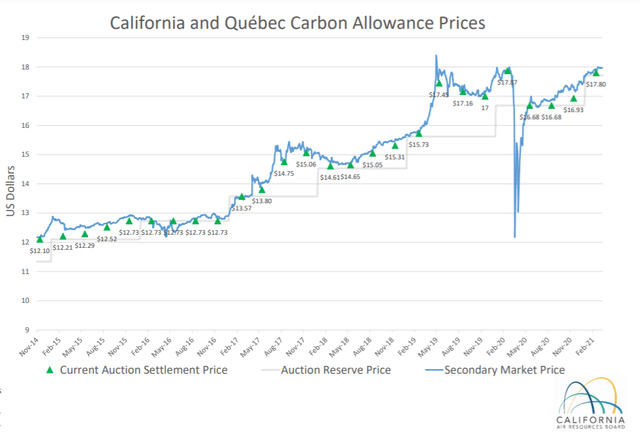

Carbon allowances are tradable units that each allow the buyer to emit an extra ton of CO2 beyond what they were allotted. A carbon offset works in the same way. Rather than not emitting 1 ton of CO2 a company can emit the ton of CO2 and then offset it by pulling 1 ton of C02 out of the atmosphere thereby undoing their emissions. This is quickly becoming a big market and there is a well established price for carbon allowances. Source: California Air Resources Board

Source: California Air Resources Board

Timberlands are now entering the game in a big way as they can very economically produce carbon offsets.

For a given tract of land the timberland owner can measure their trees and a year later they can remeasure their trees. The delta in biomass multiplied by a factor (on which I will show the math later) represents the amount of CO2 the timberland pulled out of the air. The timberland owner signs an agreement with the buyer of the carbon offset to not harvest their trees for a given period of time. In exchange the buyer pays the timberlands just over $17 for each ton of CO2 the growth offset.

The timberland gets money and gets to keep growing their standing inventory and the buyer gets to offset their carbon footprint.

These sorts of agreements are in their nascency, but are already limiting harvest on about 5 million acres of U.S. timberlands. According to the USDA Forest Service, there are 521 million acres of producing timberlands in the U.S., so these agreements, at the moment, cover about 1% of supply.

It is an established and real thing, but has not yet achieved a scale that impacts market dynamics.

I think it could get a lot bigger given the scale of the push for carbon neutrality. If it does, the implications for timber REITs are wonderful.

Unit economics of carbon sequestration for CTT

Since 2014, the price of 1 carbon offset credit has risen from about $12 to close to $18. This is the amount a timberland owner would get paid for sequestering 1 ton of CO2.

How much tree growth sequesters 1 ton?

Well we need a few piece of information to do the math.

- Carbon is only a portion of the weight of C02, so locking up 1 ton of carbon actually gets rid of 3.67 tons of CO2.

- A paper from the USDA estimates that dry weight is about 56% of green weight. The water does not contain carbon so it is the dry weight we should use.

- A different paper from Ecometrica shows that about 50% of the dry weight of a tree is carbon.

Thus, each ton of living tree contains about 0.28 tons of carbon. Multiplying that by the 3.67 tons of CO2 per ton of carbon, each ton of living tree locks up 1.0276 tons of CO2 (0.28 X 3.67).

It will of course vary by region, tree species and silvicultural practices, but it's going to be pretty close to 1 ton of tree getting rid of 1 ton of CO2.

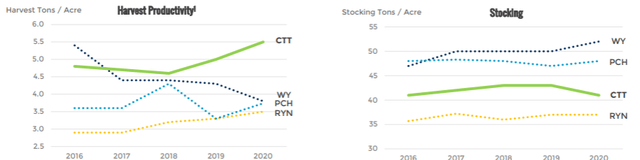

CTT's land is the most fertile among the timber REITs in terms of growth per acre as it grows about 5 tons per acre per year. Note in the slide below how when CTT harvests less than 5 tons/acre their stocking goes up and when CTT harvests more than 5 tons/acre stocking goes down.

So with 5 tons per acre of growth per year that would be 5 carbon offsets per acre per year.

How does the revenue of carbon offsets compare to the revenue of just selling the timber?

CTT's forests are overwhelmingly pine and their sales mix varies from period to period but is generally around half pulp and half sawtimber.

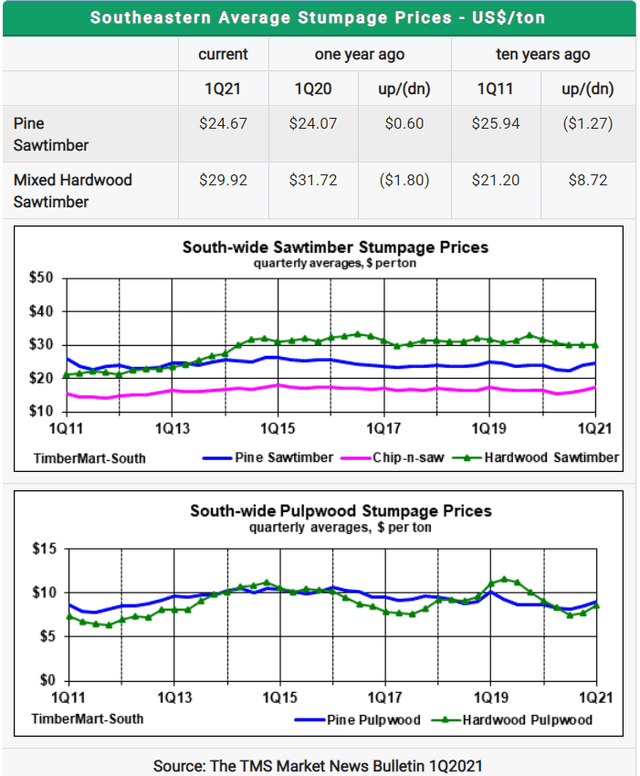

Here is the pricing for these products.

In the southeast where CTT primarily operates, pine sawtimber goes for $24.67 per ton (stumpage price not delivered price). Pulp sells for about $9 per ton. So using a 50/50 mix that would be a weighted average of just under $13 per ton.

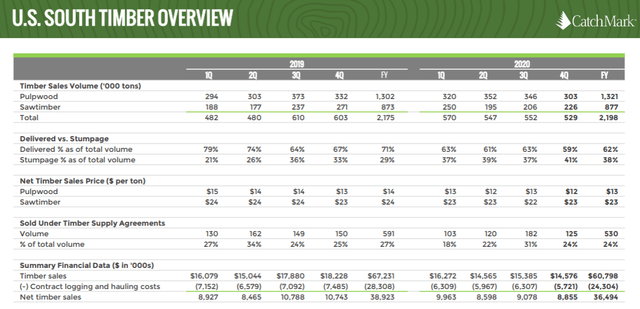

CTT has supply agreements with set pricing and has consistently gotten better sale prices than the Timbermart-south average. So for CTT it is a bit higher. CatchMark also does some of the harvesting and delivery themselves allowing them to get delivered priced rather than stumpage prices. The breakdown of CTT's timber sales can be seen below.

The net timber sales after logging and hauling costs were $36.5 million in 2020 against volume of 2198 tons or about $16.60 per ton.

It is quite clear that the almost $18 per ton that they could get for carbon sequestration is a better deal.

Prima facie it may appear better because $18 is greater than $16.60, but the advantages go so much further than that.

Having their cake and eating it too

In entering into a carbon sequestration agreement not only would CTT get the close to $18 per ton of growth, but they would get to expand their inventory. They would get paid to grow it and then still have the trees to eventually be sold at a later date when the sequestration contract ends.

Timber REITs frequently choose to defer harvest to wait for better pricing. While deferring their inventory grows. Timber REITs often do this for free, but now there might be an opportunity to get paid to defer harvest.

It is a no-brainer slam dunk win for the timber REIT. It all just relies on how many carbon offset contracts become available.

So far the 5 million acres of U.S. timberland under such contracts is just a drop in the bucket.

The real opportunity comes if/when the demand for carbon offsets increases to a more material number.

I think this is plausible given the direction the U.S. government and Europe are headed with regard to CO2 regulation.

Carbon offset sales becoming widespread would have 2 direct benefits for CTT and a significant competitive benefit.

Direct benefits

- Direct payments of roughly $18 per ton would increase revenue immediately

- Value of standing inventory would increase

Competitive benefit

As sequestration payments prevent harvest of trees, it reduces the supply of timber available to the mills. With less supply, the mills would have to start paying more to get their logs. Prices would eventually equilibrate to a level where the prices mills paid were competitive with the value accretion a timberland owner would get for sequestration contracts.

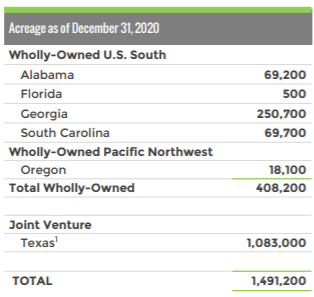

These benefits would accrue to all the timber REITs, but I think CTT is the best positioned to reap the rewards. Specifically, CTT offers the most land per invested dollar.

Source CTT.

Source CTT.

With 1.49mm acres and a market cap of $547mm each $367 invested in CTT gets exposure to an acre of timberland.

There is debt in there so buying CTT doesn't actually buy land that cheaply, but the leveraged exposure is that high.

Further, CTT's land is faster growing at about 5 tons per year of growth so each $367 invested could theoretically generate almost $90 of annual sequestration revenue ($18 X 5). Again there is debt and expenses in there so this is not an expected return figure.

The point is CatchMark would be a massive beneficiary of carbon offsets taking off and they are by far the most levered toward this opportunity.

If sequestration agreements expand from the current 1% of U.S. timberland to closer to 20%, I anticipate CTT materially outperforming the market.

For a full toolkit on building a growing stream of dividend income, please consider joining Portfolio Income Solutions. As a member you will get:

- Access to a curated Real Money REIT Portfolio

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Portfolio Income Solutions, we don’t only share our ideas, we also discuss best trading practices and help you become a better investor.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $33.25/month (paid annually) before it expires!