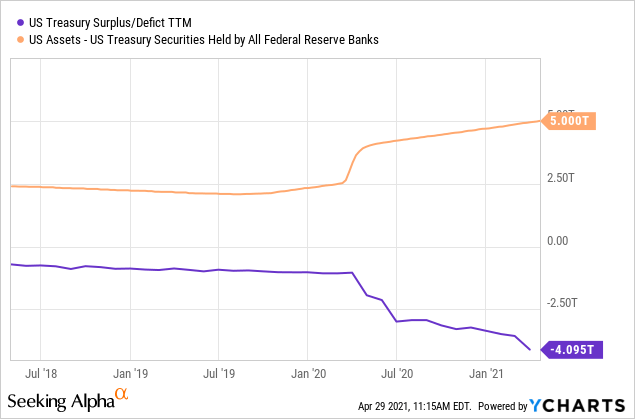

One of the dominant macroeconomic trends of the "COVID era" has been the extreme increase in the U.S. Federal deficit and the Federal Reserve's balance sheet. The U.S. government is spending exorbitant amounts, with much of that money being funded not through tax revenues but debt growth. Importantly, very little of that debt is funded by private investors (including banks) as the Federal Reserve has effectively become the primary lender. This is illustrated quite clearly below:

The tremendous expansion of the Fed's balance sheet is from effectively created money. In fact, since last January, the monetary base (which is the amount of effective extant currency) has increased by a staggering 70% from $3.4T to $5.95T today. To put that in perspective, the amount of effective currency has increased by the same degree over the past eighteen months as it did from the creation of the U.S. government (roughly 1792) until 2011. This will likely accelerate over the coming years with the recent infrastructure bill and another potential stimulus bill.

With the multi-trillion dollar deficit likely to last, the monetary base will almost certainly continue to climb. Today's economy sees sustained demand due to these spending programs, but production is severely constrained as unemployment remains generally high. Trade issues and shipping shortages have also exacerbated the issue, creating growing shortages. These shortages are due not only to domestic labor issues but also to general production declines and commodity shortages worldwide.

This is extremely problematic in certain commodities like lumber, which currently trades at over 3X normal levels, while most food commodity prices are around 50% above normal. While the CPI inflation rate is only slightly above the trend, the extreme spike in commodities and high wage inflation (due to a labor shortage) implies consumer prices may accelerate over the coming year.

Since the Federal Reserve is not planning to hike interest rates, I firmly believe this sets the scene for a large drop in the U.S. dollar. The U.S. dollar declined considerably last year but has built support around its current price. That said, with new aggressive spending programs expected to be announced and the U.S. trade deficit skyrocketing, I believe the catalyst for a larger wave lower has arrived. This may make for an attractive short opportunity for popular U.S. dollar ETFs such as Invesco's (NYSEARCA:UUP).

A Perfect Storm is Facing the Dollar

The U.S. dollar has taken an interesting course over the past seven years. The dollar was weak coming out of the 2008 recession's subsequent aggressive Q.E programs. However, the extreme decline in commodity prices and the related collapse of numerous emerging market currencies around 2014-2015 saw the U.S. dollar rise to extreme levels. Around the world, demand for the U.S. dollar rose to extreme levels due to its popularity as a trade and external debt currency.

The lasting effect of this demand has been the primary factor that has allowed the Federal Reserve to create such a large amount of money without creating rapid high inflation. In general, currencies decline in value when their real return is too low and/or the trade deficit is too extreme. Considering the U.S. has meager real interest rates, a very high (and growing) trade deficit, and a rapidly growing money supply, it would seem the U.S. dollar should be much lower than it is. This has been called the "exorbitant privilege" of currency hegemony which stems from being the center of geopolitical and economic power.

China is now working to replace or at least impair the U.S. dollar's hegemonic status. The country has lower inflation than the U.S. (and possible long-term deflation due to demographics), an enormous trade surplus, and much higher interest rates. The Chinese government may not want its currency to appreciate too aggressively against the U.S. dollar. Still, if the "exorbitant privilege" were to become less prominent, then the Yuan would likely surge, and the dollar would decline tremendously.

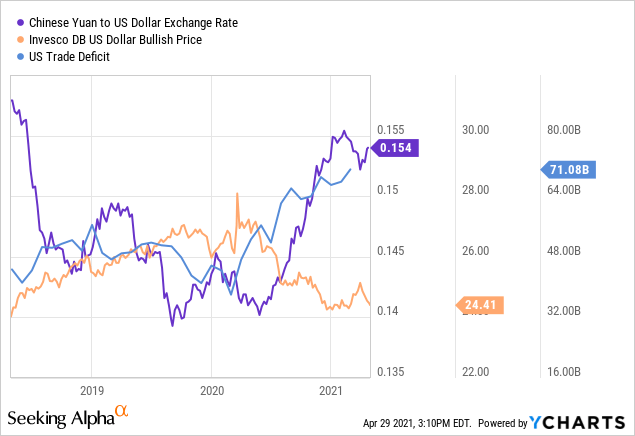

We can already see that the overall U.S. dollar exchange rate is becoming more correlated to the CNY/USD rate. Of course, the CNY/USD rate is closely tied to the U.S. trade deficit. See below:

Demand for goods from China has become so voracious over the past year that there is now a massive global shipping container shortage, causing shipping prices to rise considerably. As the U.S. dollar depreciates against the Yuan, Chinese manufacturers earn less Yuan unless they raise prices. This usually takes time, but goods from China should become about 7% more expensive and likely more after accounting for heightened global commodity prices and shipping costs.

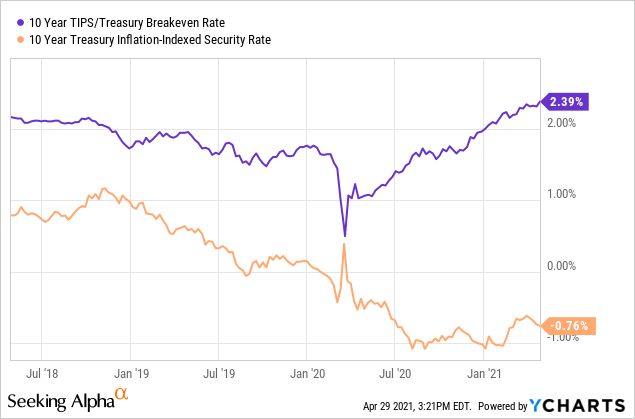

No doubt, this situation will lead to an increase in the U.S. CPI inflation rate. This can be measured through the forward 10-year Treasury breakeven index, which is the difference between inflation-indexed and "normal" 10-year Treasury bond yields. The inflation-indexed bond yield is also key for the U.S. dollar since it tracks the post-inflation return of U.S. currency. The 10-year inflation breakeven rate is on a clear up-trend while the inflation-indexed rate may be reversing back down. See below:

As the inflation-indexed rate declines further into negative territory, many investors (including banks and governments) will likely consider moving money into countries with superior real yields. This includes not only China but also Japan and Europe due to lower inflation in those areas. Importantly, Europe and Japan are not pursuing such aggressive spending programs as did the U.S. As such, they will experience lower inflation for some time.

A Short Opportunity in UUP

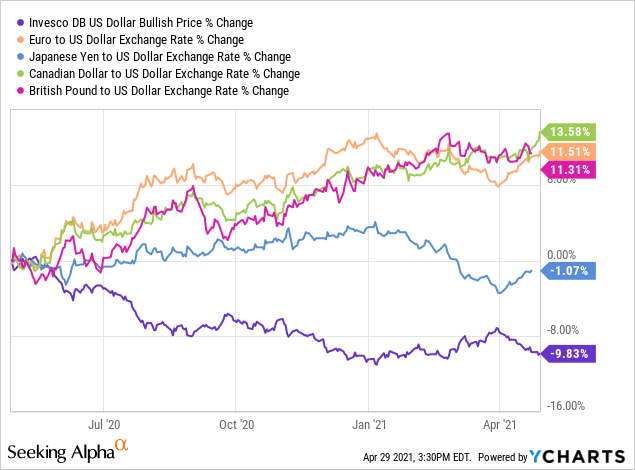

Overall, the scene is set for a significant decline in the U.S. dollar. Based on real interest rate differentials between the U.S. and other countries, I believe the DXY U.S. dollar index should be around 80 or at least 11-12% lower. This equates to a price of $21-$22 for the U.S. dollar ETF (UUP). The situation varies slightly between each currency. The Canadian dollar is on an apparent appreciation trend, while the British pound is more lackluster. However, the Euro looks like it is on the verge of breaking resistance, and the Japanese Yen has reversed its decline. Combined, this has pushed the U.S. dollar back to its January support level. See below:

Considering the fundamental trends are overwhelmingly bearish for the U.S. dollar, I believe UUP is likely to break below support over the coming weeks. Importantly, UUP is around the same support level it hit in 2018, which means a lot of money may quickly flee as this money is broken. If so, I expect to see a reversal of the rapid rise in the U.S. dollar, which occurred during late 2014 which saw UUP rise from $21.5 to $24 in roughly six months. Thus, my target for UUP is $22 by October-December of this year, though it could fall further.

For those who do not trade on the FX market, this bet could be made by short-selling UUP or buying the inverse fund (UDN). Those looking to make a more speculative bet with a smaller amount of capital could also buy put options on UUP. One interesting option is the December $24 put option contract which currently has a payoff schedule as shown below:

As you can see, if my base-case proves correct, then such an option may have a 300-500%+ payoff. Obviously, such a bet should only use a tiny portion of capital as there would be a 100% loss if the dollar fails to decline. Additionally, liquidity constraints probably limit this trade to a smaller amount of money for those not looking to wait until expiration.

While I have conviction regarding my bearish U.S. dollar view, no trade is risk-free. The Federal Reserve may shock the market and suggest raising rates much earlier than originally anticipated. General economic pressure worldwide may also create a run on U.S. dollars if it results in another wave in losses for emerging market currencies. I believe both are unlikely, but they still could upend the short bet. Personally, I believe the new pressure to create yet another stimulus bill may catalyze the drop, but the answer remains in the future's hands.