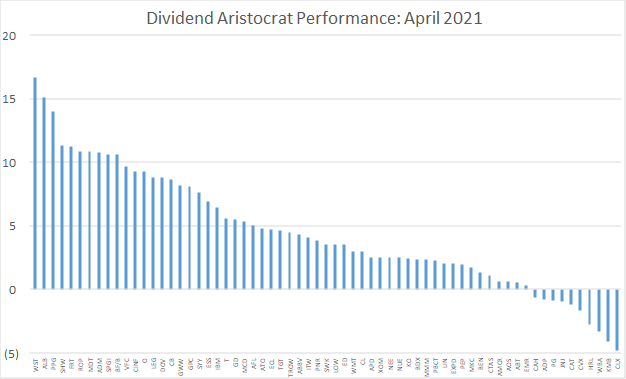

Gains for the Dividend Aristocrats were broad-based in the month of April with constituents with positive returns outnumbering constituents with negative returns by a factor of 5.5x to 1. Despite the skew towards positive monthly returns depicted in the graph below, the S&P 500 Dividend Aristocrat Index (BATS:NOBL) trailed the S&P 500 (SPY) by 94bp on the month, returning 4.4% versus the 5.34% gain for the broad index. Over the last year, the dividend growth strategy has kept pace with the broad market recovery, and over multiple business cycles stretching back 30 years, the dividend growth strategy has outperformed by nearly 2% per year.

Source: Bloomberg, S&P, Ploutos

Source: Bloomberg, S&P, Ploutos

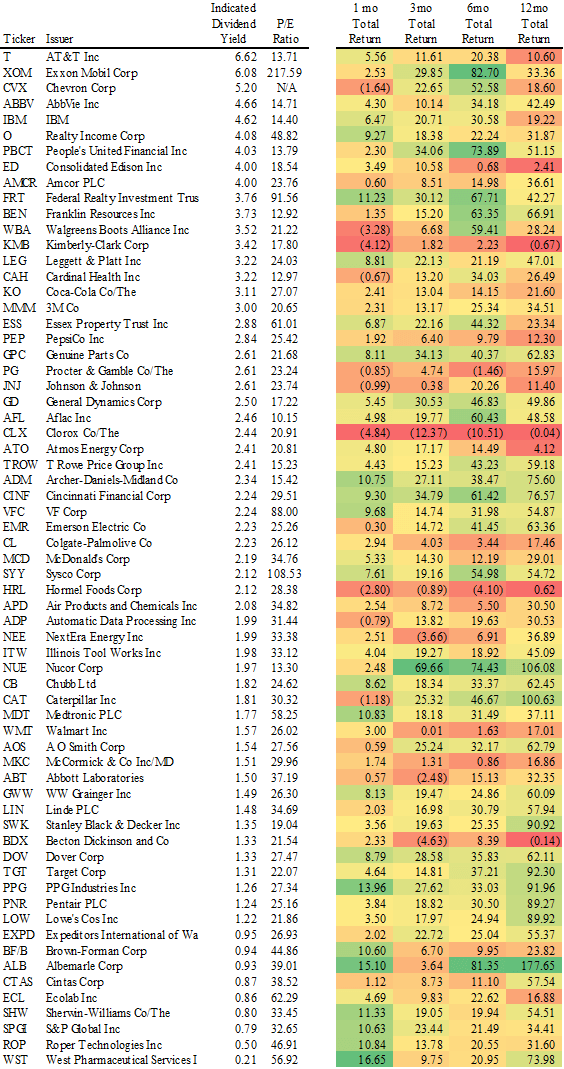

In the table below, the list of the current Dividend Aristocrat constituents is sorted descending by indicated dividend yield, and lists total returns, including reinvested dividends, over trailing 1-, 3-, 6-, and 12-month periods.

Source: Bloomberg, S&P, Ploutos

Source: Bloomberg, S&P, Ploutos

Here are a couple of notable observations from this list and the broader performance trends in April:

- Of the 94bp of underperformance for the Dividend Aristocrats, 47bp was attributable the Consumer Staples sector. The worst performing stock of the month was Clorox (CLX), the maker of disinfectant wipes. The second-worst performer of the month was Kimberly-Clark (KMB), a maker of toilet paper and other household goods. The fourth-worst performer was Hormel (HRL), the maker of Spam. When disinfectant wipes, toilet paper, and Spam are in less demand, it is a sign of an economy normalizing from the COVID slowdown.

- Related to the COVID crisis, Johnson & Johnson (JNJ), the maker of a one-shot COVID vaccine that came under recent scrutiny due to its potential ties to blood clots, was the seventh-worst performer down just less than 1%.

- While consumer staples lagged, retail REITs benefitted from the recent cyclical rebound. Federal Realty Investment Trust (FRT) and Realty Income (O) were both the top performers, returning 11.2% and 9.3% respectively on the month. With dislocation remaining with the brick-and-mortar retail sector, some may be betting that these companies can be consolidators of a space, using their investment grade balance sheets and higher equity multiples to purchase higher capitalization rate assets on the cheap.

- Despite the recent rally in their share prices, these REITs remain among the ten highest dividend payers in the dividend growth index. Interestingly, the four constituents with the lowest dividend yields - West Pharmaceuticals (WST), Roper Technologies (ROP), S&P Global (SPGI), and Sherwin-Williams (SHW) - were among the ten best performers in April, each returning double-digit gains on the month.

- For much of the last year, Tech has been the swing sector that drove under/overperformance for the Dividend Aristocrats versus the broad market. While the S&P 500 has a 27% weight to tech, the weight in the dividend growth index is just 3.3%, a number that increased in 2021 with IBM joining the index after its 25th straight year of dividend increases. In April, Tech had a limited impact on relative performance with a modest outperformance of tech stocks driving 7bp of the overall 94bp outperformance.

The Dividend Aristocrats generated a solid 4.4% return in April but lagged the broader S&P 500 on the month as the dividend growth strategy's consumer staples tilt overweight contributed to underperformance in the cyclical rebound. The dividend growth strategy has kept pace in the rebound over the last year, and the strategy still offers the traditional downside protection that has allowed it to outperform in each of the last six down years for the S&P 500 over the past 30 years.

Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties, and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon.