This article was written by

JD Henning is a Finance PhD, MBA, investment adviser, fraud examiner and certified anti-money laundering specialist with more than 30 years trading and investing stocks and other securities. JD runs Value & Momentum Breakouts where he identifies identify breakout signals and breakdown warnings using technical and fundamental analysis.

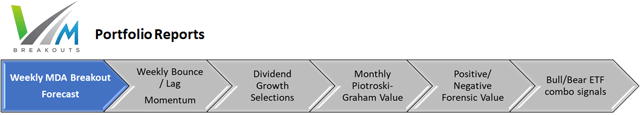

Signals from his proprietary Momentum Gauges® not only alert subscribers of market changes, but the strength of markets for short term breakouts or breakdown warnings across 11 different sectors. Top stock and ETF selections use technical and fundamental systems in proven financial studies. Value & Momentum Breakouts is the place to build your own optimal portfolio mix with a community of like-minded investors and traders. Features include a Premium Portfolio, bull/bear ETF strategy, morning updates and an active chat room.

Learn more.

Analyst’s Disclosure:I am/we are long NRGU, NAIL, BNKU, COPX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long several funds following the Market Momentum Gauge® and Sector Momentum Gauge® signals. I adjust my exposure ahead of weekends and holidays to minimize the risk from these high volatility 3x funds that may not be appropriate investments for your portfolio. Readers are highly encouraged to consider your own optimal asset allocation strategies to diversify risks and enhance returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.