Thesis: Dividend Growth Play On Renewables

After a recent selloff, four renewable energy yieldcos that offer dividend yields between 3.4% and 5.6% as well as strong growth rates look attractive as long-term dividend growth plays.

In what follows, we'll review the current state of utility sector decarbonization and the growth of renewables, then we'll discuss yieldcos and finish with the case for the four highlighted below.

In short, these four stocks look like fantastic vehicles through which dividend-focused investors can play the mega-trend of a rapidly "greening" economy.

Renewable Energy Growth Picking Up Steam

Global renewable electricity sources grew at their fastest pace in 20 years in 2020.

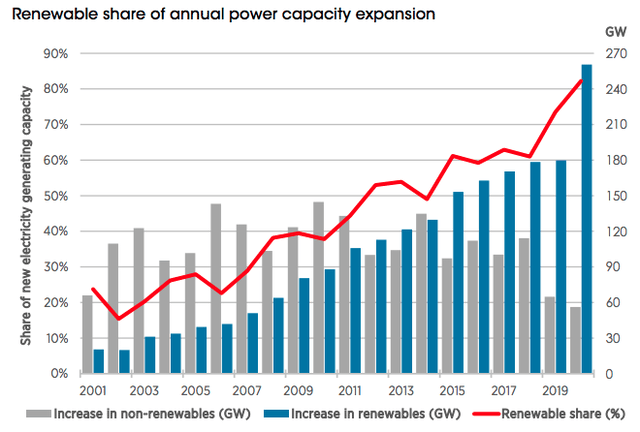

That is how a recently released report by S&P Global begins, citing data from the International Energy Agency. New renewable energy installations leaped significantly last year, as installations of non-renewable electricity generation sources continued their multi-year decline. Renewables' share of new generation additions topped 80%, which also was the continuation of a longstanding trend.

Source: International Renewable Energy Agency

Source: International Renewable Energy Agency

And last year's leap in wind, solar, and hydroelectric energy additions should prove to be more than a one-time event. Rather, the report indicates that this surge in renewables is set to become the new normal.

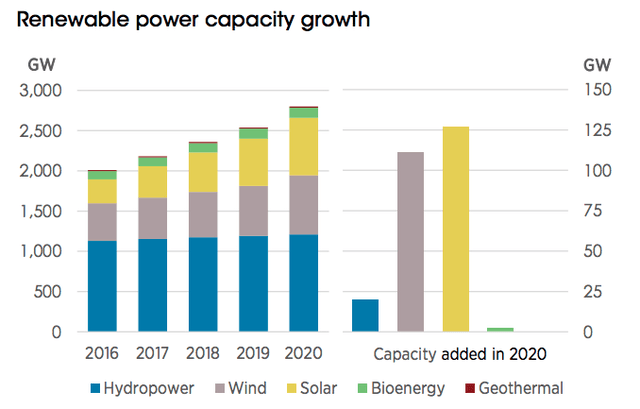

In 2020, for the first time, the capacity growth of solar (22% year-over-year) outpaced that of wind (18% YoY), reflecting the advancement and falling cost of production of photovoltaic technology. In the chart below, we find the total installed capacity on the left and the breakout of new additions in 2020 by type on the right.

Source: International Renewable Energy Agency

Source: International Renewable Energy Agency

Renewable generation capacity increased by 261 gigawatts (10.3%) across the globe in 2020. In 2021, the IEA expects another 270 GW of renewables capacity to be added, followed by 280 GW in 2022. And by 2022, solar PV installations should make up over

With Better Information, You Get Better Results…

At High Yield Landlord, We spend thousands of hours and well over $50,000 per year researching real assets like REITs, infrastructure, pipelines, and renewable energy for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

At High Yield Landlord, We spend thousands of hours and well over $50,000 per year researching real assets like REITs, infrastructure, pipelines, and renewable energy for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

We are the #1 rated service on Seeking Alpha with a perfect 5/5 rating.

We are the #1 ranked service for Real Estate Investors with 2000+ members.