There is no doubt that the securities markets are a mess. The SEC’s attempt to have it both ways – competition between multiple exchanges on one hand, and assurance that customers will get the best bid and offer prices market-wide on the other – never stood a chance. The SEC has unwittingly created another natural monopoly, the outcome RegNMS was designed to prevent when promulgated in 2005.

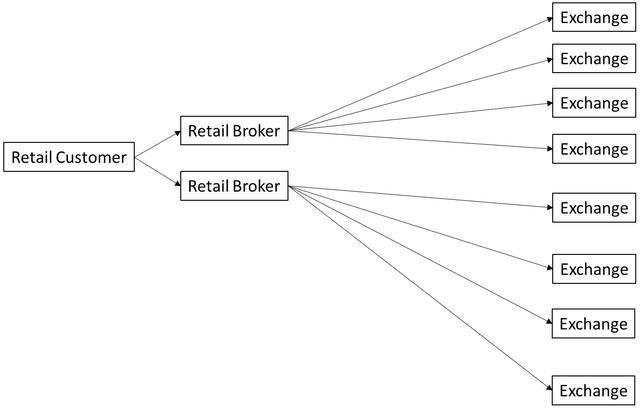

Here is a graphic that displays the market structure intended by the SEC’s RegNMS.

Source: Author

The graphic displays the problem created by multiple exchanges. Retail brokers, whose business it is to aggregate and fill many disparate relatively small retail orders, are asked in this model to choose the best among multiple bid/offer prices. The SEC perceived the problem and provided a solution, the National Best Bid and Offer price (NBBO). But NBBO opened the door to a multitude of evils.

The NBBO is produced using older technology and based on prices collected from exchanges by exchanges. NBBO prices take a long time (as speed is measured in this age of light-speed computation and telecommunication) to reach the user. The retail user, in turn, is rarely equipped to react at lightspeed.

The many exchanges now spread haphazardly across northern New Jersey and beyond – dispersed in space and therefore (due to Relativity, explained here) not capable of providing prices anywhere at a single time – were open to arbitrage from marauding broker-dealers who jumped at the opportunity.

At first, these firms, known as high-frequency traders (HFTs), colocated their computers next to exchange computers, using algorithms to race less tech-savvy institutional and retail orders across New Jersey collecting the arbitrage gains produced by a speed advantage. This gave birth to the third of the three market sectors: retail, institutional, and HFTs. The market structure then looked like this.