This article was written by

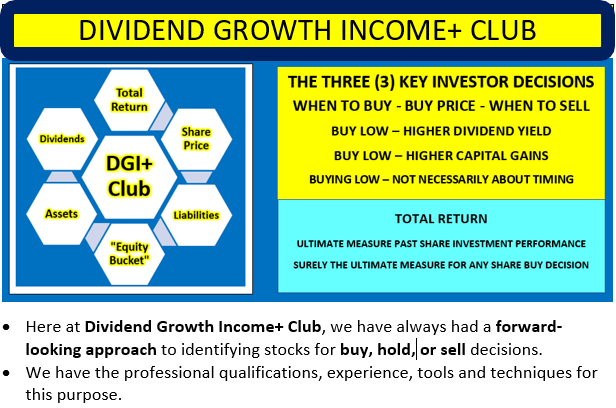

I am a retired accountant with a background in large mining projects, from feasibility to full-scale operation, large scale primary industry and food processing, commercialisation of university intellectual property, and consulting to small businesses, government departments and insolvency practitioners. I have gained a wealth of experience from having the extreme good fortune to work, in a cooperative environment, with so many people far more intelligent and smarter than me; from scientists and engineers with MBA qualifications, to University professors across a range of disciplines. Through the accident of mergers, acquisitions and dispositions, I held, at various times, financial controller positions within Utah International Inc, General Electric Inc, and BHP Billiton organizations. If I have a special skill, it is in methods of assessment of projects with long lives, where costs are front loaded and/or future revenues are subject to considerable degrees of uncertainty. In relation to stocks, I have a theory, using projections to calculate a present value per share is far less useful for a share buying decision, than using those same projections for calculating future value per share for determining potential exit value and rate of return.

Analyst’s Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first consulting an investment advisor and/or a tax advisor as to the suitability of such investments for their specific situation. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer, or a recommendation to buy, sell, or dispose of any investment, or to provide any investment advice or service. An opinion in this article can change at any time without notice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.