Introduction and Background

Caterpillar (CAT) is one of my longest-term, individual equity investments. I love the company, and through the highs and lows, it has treated me very well. My primary investment strategy with CAT to this point has been to utilize consistent dollar-cost-averaging and DRIPing. This has resulted in CAT occupying an outsized position from a market cap perspective in my dividend growth portfolio, but also, more importantly to me, an outsized position from a dividend income perspective as well.

The inevitable conundrum encountered by every investor is what to do when a position becomes over-weighted in your portfolio. One option is to allow the winners to run, which is what I typically like to do, and which has led to this result. Another option is to increase other positions in order to decrease the overall weight of that position in the portfolio. I also utilize this strategy. Additionally, a popular approach might be to sell at least part of the position and invest the proceeds into another holding, which, in theory, should have the added benefit of further portfolio diversification.

This final strategy is one I would like to explore given that CAT has reached too large of a position for me to be comfortable continuing to let it run, as well as being too large for it to be brought back into balance in a reasonable period of time with my projected future investment inputs. Unfortunately, this is easier said than done, in many ways. How do you confidently replace a core, winning, holding with another holding that will be as good or better? In other words, how do you diversify without de-worsifying?

High Quality Dividend Growth Financial Health Filter

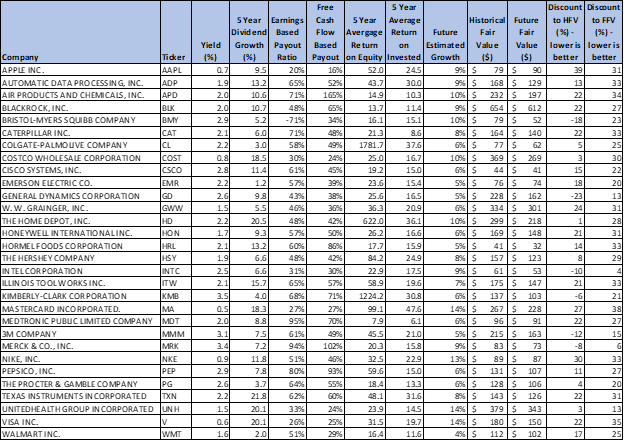

I routinely track around 100 of what I believe are the highest quality dividend growth stocks currently available. Tracking them consistently allows me to efficiently and confidently allocate capital when these high-quality instruments go on sale. Since I want to replace CAT with a company that is as good or better, for first pass filtering, I turn to the crude indicators of quality captured by the Standard & Poor's and Moody’s credit ratings, as well as the Value Line Financial Strength indicator.

CAT is rated A by Standard & Poor's, A3 by Moody’s and has an A+ Financial Strength rating from Value Line. Filtering my tracking list to include companies that have these ratings or better may be a crude first pass but coming from the perspective of erring on the side of quality when partially replacing a favorite investment, this is where I start. After this filtering, I am left with the following list of 30 potential stocks from my list.

Source: Finbox.com, Seeking Alpha, Author’s Analysis

Fair Value Estimation

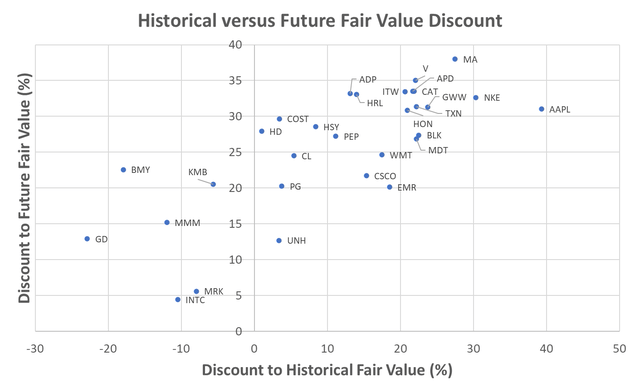

As the next step in the analysis to find a suitable diversification candidate, I like to look at the fair values of each of the stocks. I calculate two separate fair value estimates. The Historical Fair Value is simply based on historical valuations. I compare 5-year average: dividend yield, P/E ratio, Schiller P/E ratio, EV/EBITDA, and P/FCF to the current values and calculate a composite value based on the historical averages. This gives an estimate of the value assuming the stock continues to perform as it has historically. I also want to understand how the stock is likely to perform in the future so utilize the Finbox.com fair value calculated from their modeling, analyst estimates, a Cap10 valuation model, FCF Payback Time valuation model, and 10-year earnings rate of return valuation model to determine a composite Future Fair Value estimate. Plotting the Historical Fair Value versus the Future Fair Value allows for easy visualization of potentially attractively valued candidates for further due diligence.

Source: Author calculation of Historical and Future Fair Value

Normally, I would be looking for stocks that fall in the lower left quadrant (negative X and Y values), which would indicate that the company’s stock is trading at a discount to both Historical and Future Fair Value – none of these are at this time. However, in this case, where I am trying to diversify from one high quality holding into another of equal or better quality, I am less concerned about absolute valuation, and more interested in relative valuation.

Diversification Quality Down-selection Process

Given my goals for this exercise, and the number of candidates that we are now evaluating, in addition to relative valuation, I would now like to further down-select the list based on additional criteria to satisfy the diversification goal, without significant compromise in other key investment metrics.

For the next steps, I will compare various performance metrics that are important to my investment strategy between Caterpillar and the potential diversification candidates.

Dividend – I first start by evaluating key criteria related to the dividend. For this step, I am looking for candidates that have the same or better yield, so that I am not sacrificing income, the same or better 5-year dividend growth, so that I hopefully preserve future income growth potential, and that have similar or better payout ratios based on both earnings and free cash flow.

Financial Performance – I next look at historical financial performance based on the 5-year Return on Equity, and 5-year Return on Invested Capital. I like using ROIC in addition to ROE to ensure that companies are not manipulating their results through excessive leverage.

Estimated Growth – the final, most difficult factor that I will be looking at is Future Estimated Growth. You may ask what I mean by this. Ultimately, I am trying to determine how well the stock is likely to perform, and be able to continue to grow, so that it can sustain a growing stream of income for me. I use a broad set of inputs to estimate a growth rate. These include: 5-year historical EBITDA growth, EBITDA growth forecast from analysts, 5-year historical dividend growth, 5-year change in shares outstanding, net income to shareholders growth rate, analysts’ estimates for long-term growth and total return, and the Yacktman forward rate of return model. Using these inputs, I determine an estimated composite future growth rate.

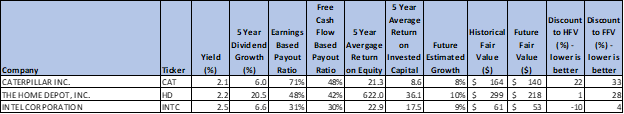

These steps leave me with a much shorter list of candidates to consider in trade for Caterpillar.

Source: Finbox.com, Seeking Alpha, Author’s Analysis

From a valuation perspective, Intel Corporation (INTC) looks very promising. However, I already have a full position in INTC. This leaves me, conveniently, with a single company to evaluate, The Home Depot (NYSE:HD). The question I now need to answer is whether it is worth trading some of my beloved CAT shares, which currently look moderately over-valued, for shares in HD, which show promise from a quality comparison perspective, but which also look like they might be somewhat overvalued?

The Home Depot Analysis

Let us first start with some of the obvious comparisons of HD to CAT based on the filtering we have done. First, we can see that HD has a similar yield, which means we won’t sacrifice any income as part of this trade, and it actually has had a much higher dividend growth rate. Coupled with the better payout ratios, HD looks like it could be a promising contender to help diversify our income stream. Furthermore, HD has very impressive ROIC and projected growth rates. Finally, though it looks somewhat overvalued on a Future Fair Value basis, it is in line with CAT, and from a historical basis looks to be better valued than CAT.

Is Home Depot’s Growth Sustainable?

One of the big questions to answer with HD (ignoring that there are plenty of questions with a cyclical stock like CAT as well) is whether HD’s recent success is at least partially a temporary phenomenon associated with the COVID pandemic, or whether it might be more sustainable.

HD’s CEO, while participating in the recent Alliance Bernstein 37th Annual Strategic Decisions Conference (transcript here), listed four reasons why he feels like there is future sustainable growth opportunity for HD, and why the results that have been seen during COVID will likely continue.

- Historical underinvestment in new housing creates scarcity and increases home values, creating incentives for investment in maintenance and home improvement for existing housing.

- COVID has accelerated eCommerce initiatives and adoption significantly. HD is utilizing stores to fulfill orders and aims to provide same day or next day delivery on 90% of orders. The format and penetration of HD stores is a key enabler of this, and difficult to replicate.

- Private branding and vertical integration investments will continue, which provide differentiation to competitors, and improved margins.

- The North American market is far from saturation, so organic stores growth, coupled with strategic M&A in the right areas, will continue to support growth moving forward.

This strategy makes a lot of sense to me, and I can see how it can lead to sustainable growth beyond COVID. Effectively, you have scarcity in the housing market justifying ongoing investment in existing properties. HD has significant economies of scale, coupled with a difficult-to-replicate macro-footprint, and is investing in being a leader in eCommerce for project-focused work with the ability to provide same/next day delivery convenience, plus local, under-one-roof convenience while in the middle of the project. Vertical integration and private branding remove the middleman, which helps increase margins and customer value, while also allowing better control over the supply chain. Plus, there is still room for growth in a market that has already proven the business model. In a vacuum, each of these seems to hold a lot of promise to help HD sustain the accelerated growth that has occurred during COVID, which provides confidence that they will be able to sustain future dividend growth as well.

Having said all of that it is worthwhile to acknowledge some of the risks that should also be highlighted. The CEO also acknowledged that, at least near term, commodities are pressuring input costs, which will pressure margins if pricing cannot be passed along to the consumer. Though HD has many supplier agreements in place to support cost control, he estimates that around 18% of the business is directly susceptible to commodity pricing. Additionally, though HD has many stores with under-one-roof capabilities, it is not alone in the market. Obviously, companies like Lowe's (LOW) and privately owned Menards are respectable competitors, who also share many of the same strategic objectives as HD. Finally, as the economy reopens, and travel and recreation hungry consumers have the opportunity to reemerge into the world, will they continue their spending on home projects, or will some of that discretionary income be re-allocated to those missed travel and leisure opportunities?

Home Depot Strategic Investments

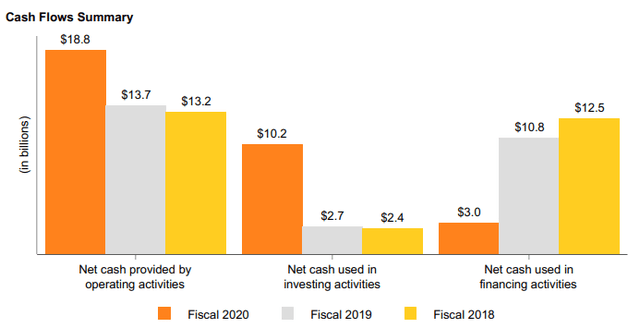

An important part of the strategy for maintaining a competitive advantage in a very competitive industry is disciplined capital allocation and reinvestment in the right initiatives. In the annual report, three priorities are given for the allocation of capital: first, reinvestment in the business to drive growth faster than the market; second, to grow the dividend with earnings; third, to return excess capital to shareholders through share repurchases. I really liked this chart that shows the allocation of cash flows from the past three years.

Source: Fiscal 2020 HD Annual Report

Obviously, cash flow from operations is up significantly in 2020, which could be a temporary benefit of the COVID lockdown. What is interesting to me though is how that money was used. The net investment into the business increased significantly and less cash was used in financing activities. To me, this shows the dedication to ongoing investment, and to look for opportunities for future growth, as outlined in the strategy. It should be noted that net Financing Activities benefited from the issuance of more long-term debt, and the suspension of share repurchases during the year. The increase in Investing Activities included the acquisition of HD Supply. For $18.8B in cash generated some of the big buckets included $2.5B in capital expenditures to support strategic imperatives, $8B in M&A with the HD Supply acquisition, and the payment of $6.5B in dividends.

Home Depot Historical Analysis

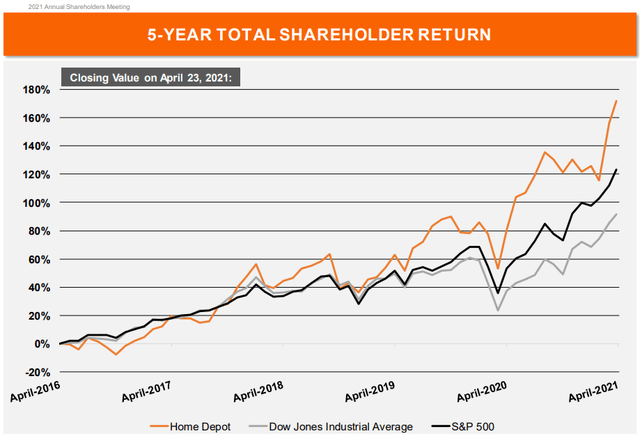

HD has been a consistent performer over time, producing good returns for shareholders. From the annual shareholder’s meeting, we see Total Shareholder Return for the past several years, compared to key benchmarks.

Source: 2021 Annual Meeting of Shareholders

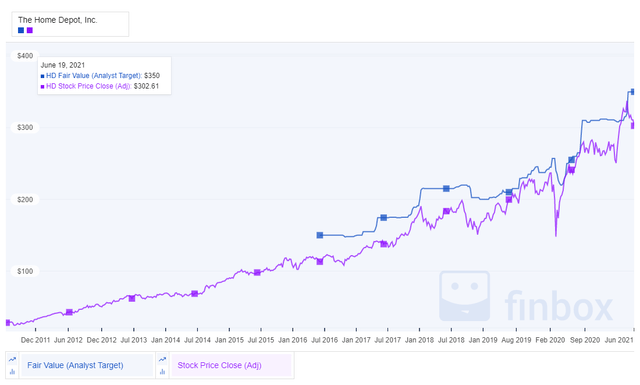

A 10-year price chart, overlaid with 5 years of analysts' targets also shows the consistency of performance that the HD stock price has exhibited over an extended period of time.

Source: Finbox.com

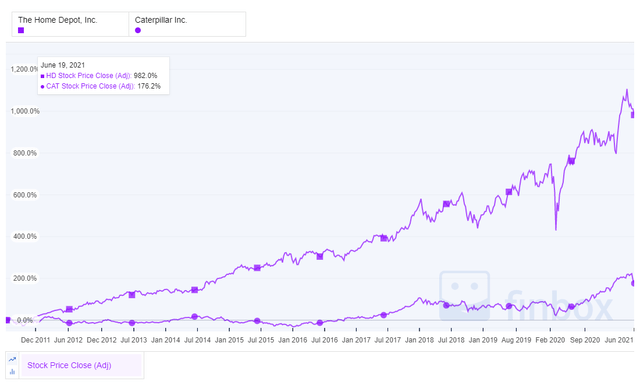

Since I am interested in HD compared to CAT for this particular exercise, here is a 10-year comparison of HD to CAT. Note that HD has rather significantly out-performed CAT over this period of time. HD also seems to avoid much of the cyclicality that is seen with CAT.

Source: Finbox.com

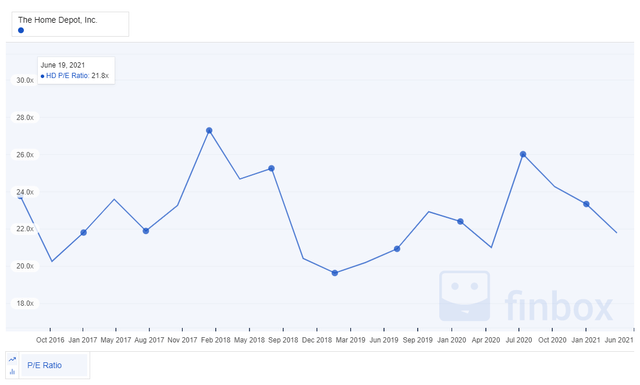

Is this outperformance real, or could it just be due to multiples expansion? Let’s look at this question in two ways, first with earnings, and then with dividend yield. From the charts below, if anything, HD’s PE ratio is on the lower end of the normal range currently, and its dividend yield appears to be within the normal range, though also on the lower end.

Source: Finbox.com

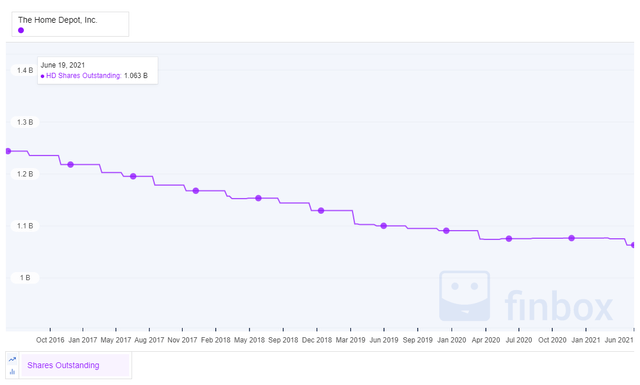

A key part of the Total Shareholder Return includes stock buybacks, which are also important to dividend growth sustainability. Notice, except for the pause in 2020, a consistent decrease in shares outstanding.

Source: Finbox.com

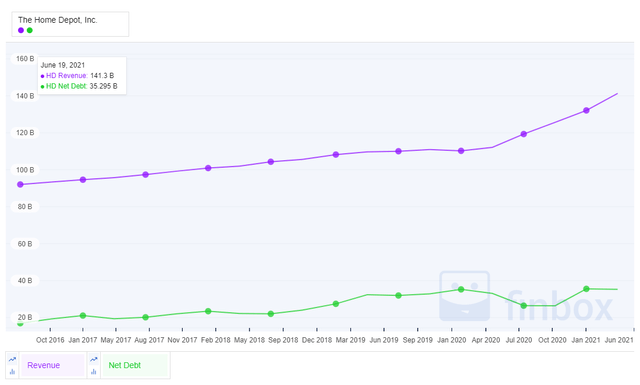

Obviously, sustainability of growth is also highly influenced by revenue growth and debt over time. HD appears to be doing a nice job of managing debt to a reasonable level, while also experiencing consistent revenue growth. One thing I appreciate is that even if the recent increase in revenue growth is somewhat temporary, and moderates in the future, they did not take on proportionate debt during this time of increasing revenue.

Source: Finbox.com

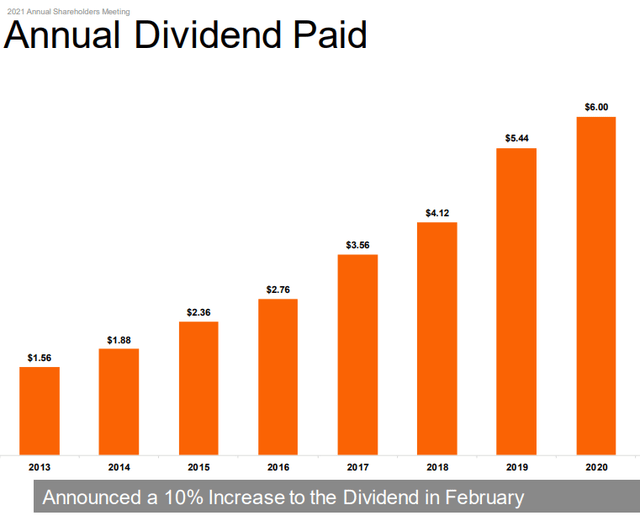

Finally, for a dividend growth investor, the consistency of the dividend growth is impressive.

Source: 2021 Annual Meeting of Shareholders

Home Depot Future Analysis

The past is a wonderful thing to study and learn from, but it is not a guarantor of future results. Though HD has performed admirably in the past, the question we still have is will it continue to perform admirably in the future. Before we dive a little deeper, let’s summarize what we’ve already discovered. First, HD is a very high-quality dividend growth stock, with excellent credit ratings. These give us some confidence that it should continue to be a good quality investment moving forward, and given the high ratings, those provide margin to react should be business start to degrade. HD has also shown good discipline in managing debt with respect to revenue. Next, HD has laid out a multi-dimensional strategy involving excellence, eCommerce, customer focus, strategic M&A, incremental expansion, private branding, and strategic vertical integration, for sustained future growth. HD has also stated that its top priority for capital allocation is to invest for future growth, pay a growing dividend supported by growing earnings, and return excess capital through share repurchases, which they have shown a history of achieving. All of these give us some indication that HD should be a solid long-term investment, and that there is margin in many dimensions to see degradation in the business before it becomes a significant issue. This is not a turn-around story.

Let’s now dig a little deeper, and see what the future might hold for HD, and try to answer the question of whether its results are going to be sustainable, and ultimately, if it makes sense to diversify some CAT shares into HD.

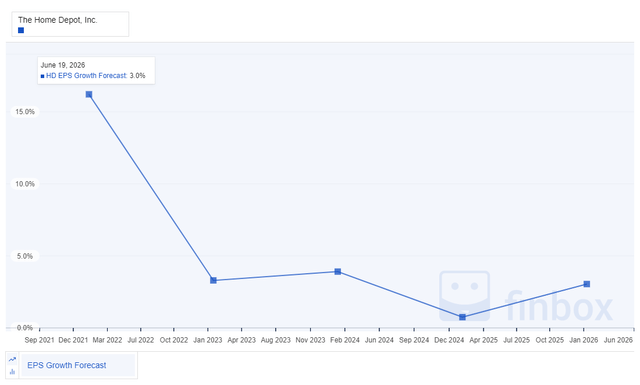

From an EPS perspective, the growth forecast for the next several years shows that the rate of growth seen during COVID and the near-term recovery we are coming out of will likely decrease, however, even with the decrease in growth projected, there will still be growth.

Source: Finbox.com

Looking at analyst’s estimates for long-term growth, the expectation is for HD to be able to continue to sustain close to double-digit levels of growth longer term. Though their expectations have come down over the past few years, the levels that are expected are still respectable.

Source: Finbox.com

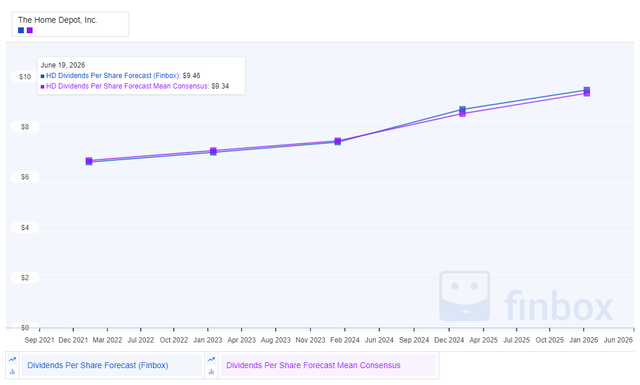

For a dividend growth investor, understanding future dividend growth potential is also important, especially in as much as it is sustainable. Here are the long-term dividend growth projections for HD, showing that growth should continue to compound nicely from today’s levels.

Source: Finbox.com

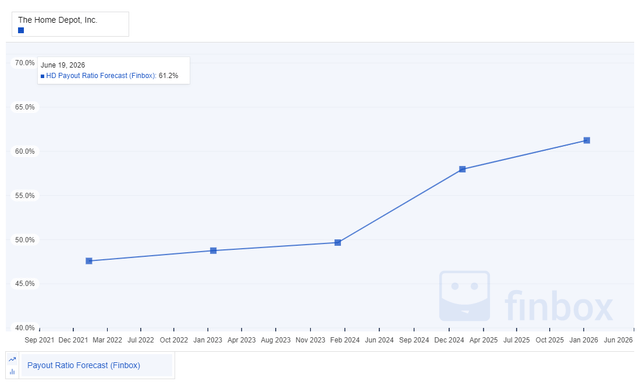

One thing that will need to be watched closely is that these dividend growth projections do also assume an increase in payout ratio. HD has stated that they intend to grow the dividend in line with earnings. Obviously, payout ratio expansion is not desirable, since at some point growth will be limited, and ultimately, other investments in the company will potentially be sacrificed. This could also mean that the growth estimates are overly optimistic, so is something to watch.

Source: Finbox.com

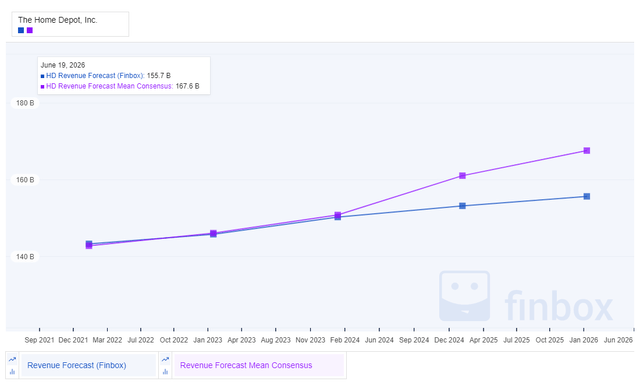

However, payout ratio does not necessarily have to expand if revenue and earnings can expand. Currently, forecasts for future revenue still look attractive, even off of today’s levels, which could be influenced by COVID dynamics.

Source: Finbox.com

Summary

What to do? We started with the question of whether it made sense to trade out a partial position in a high-quality stock like CAT when the position has become overweight in our portfolio. Through a direct comparison and filtering process we identified two potential candidates, INTC and HD that look like, based on previous, current, and high-level future anticipated performance, offered the potential to provide diversification without sacrificing quality, income, or future growth potential. We then took a deeper look into HD based on INTC already being a full position in the portfolio. After examining HD’s strategy, past performance, and anticipated future performance, it does look like divesting a portion of the current CAT holdings to diversify into HD makes sense, even at today’s relative valuations.

Obviously, with any investment there is risk. Some of the risks with an investment today in HD are that its future results will not meet estimates or continue the success of the past. This is especially relevant given inflationary pressure that could be coming in the commodities areas. There is also a real risk that the recent acceleration in revenue, earnings, and cash flow is not going to be sustainable due to changing dynamics associated with the COVID recovery. Finally, HD operates in an area of significant competition, and those competitors have similar strategies. This is not a new segment of the industry, and it is not ripe for disruption, but it is competitive.

Taking the risks and potential rewards into account, for me, the answer to the question first posed in the article is, yes, it does make sense for me to diversify part of my current position in CAT into a high-quality stock like HD. I will be continuing my due diligence, however, expect to be making changes to my portfolio, and welcoming HD into the family soon.