Investment Thesis: Demand for irrigation services will continue to rise and I estimate that Lindsay Corporation is set to see a five-year target price range of $208-285.

When I last wrote about Lindsay Corporation (NYSE:LNN) back in 2018, I made the argument that downward pressure on international irrigation revenues as well as increased competition from domestic players in the Chinese market would mean that the stock could underperform going forward.

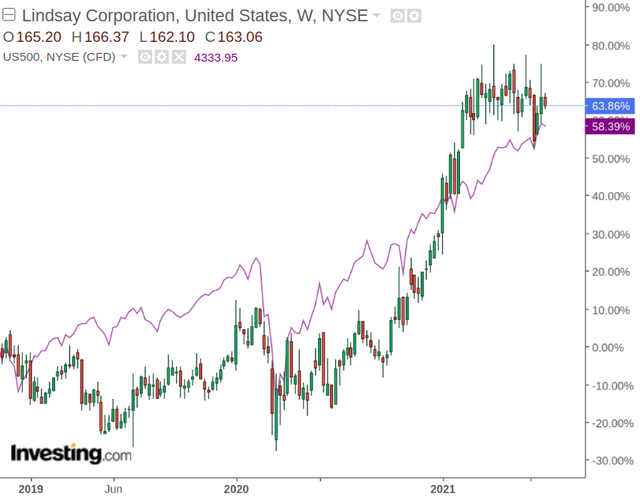

The stock continued to trade in a stationary manner up towards the latter half of 2020 - with returns rising substantially at that point and slightly exceeding that of the S&P 500 over the same time period:

Recent Performance

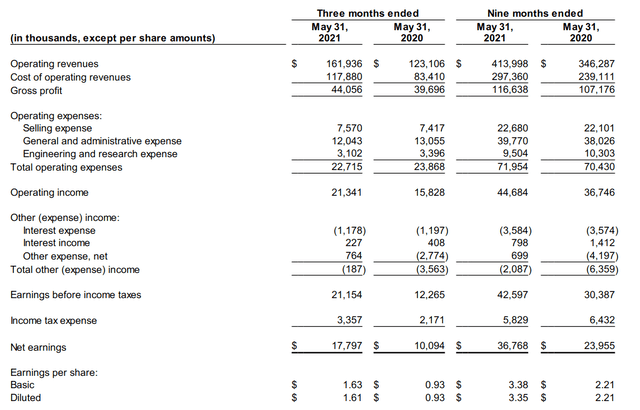

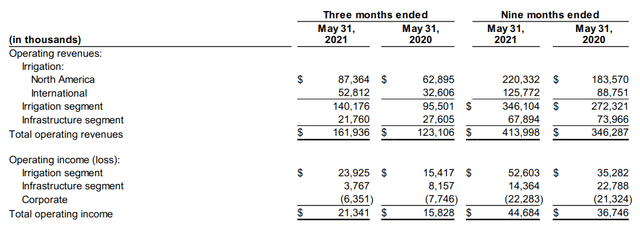

The most recent earnings quarter was quite encouraging for Lindsay Corporation. We can see that on a nine-months ended basis, net earnings are up by over 50% as compared to the same period last year.

Source: Lindsay Corporation Fiscal 2021 Third Quarter Results

Source: Lindsay Corporation Fiscal 2021 Third Quarter Results

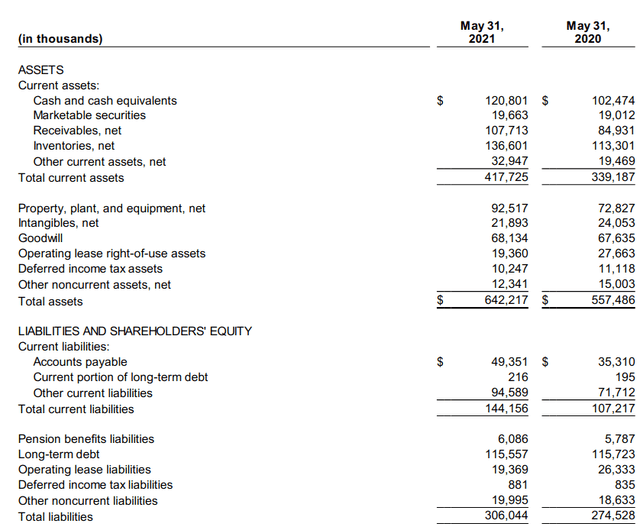

When looking at the company's balance sheet, we also see that while long-term debt has decreased slightly over the year, cash and cash equivalents are up by just under 18% from last year as well - meaning the company is in an increasingly better financial position to cover short-term expenses.

Source: Lindsay Corporation Fiscal 2021 Third Quarter Results

Source: Lindsay Corporation Fiscal 2021 Third Quarter Results

When looking at a revenue breakdown - we see that the Irrigation segment (which represents the majority of the company's revenues) - is up by just under 20%, with international irrigation revenues showing the biggest growth on a percentage basis at 41%.

Source: Lindsay Corporation Fiscal 2021 Third Quarter Results

Source: Lindsay Corporation Fiscal 2021 Third Quarter Results

Looking Forward

With the COVID-19 pandemic having placed significant strain on food production and associated supply chains, irrigation services are increasingly being prioritised to ensure irrigation-based food security - and this is particularly the case in developing countries.

While irrigation services had been seeing somewhat of a slowdown pre-pandemic, COVID-19 has exposed the fragility of global food supply chains. As a result, I anticipate that the strong growth in revenue that we are seeing as a result of higher irrigation demand is set to continue.

Using this assumption as a baseline, I attempt to forecast a 5-year forward target price for Lindsay Corporation. In doing so, I make the following assumptions:

- The EPS growth of 50% that we saw in the last year will moderate to 20% growth per annum for the next five years. While growth will continue to remain robust, I am making the assumption that market growth will slow somewhat as more supply chains start to reopen and competition intensifies from major competitors such as Valmont Industries (VMI), who has also been expanding internationally and secured a major irrigation contract in Africa last year.

- The discount rate is set to 7% (as a proxy for an assumed long-term rate of return on the S&P 500).

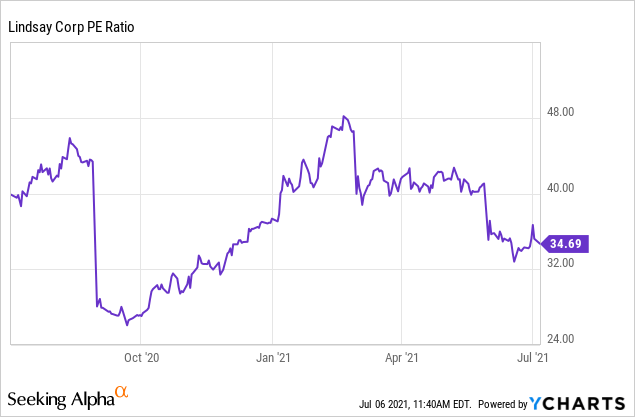

- The terminal P/E ratio is set to 35x, which is virtually equal to the current P/E ratio at the time of writing.

- The target price is calculated as the product of the terminal P/E ratio and the present value of diluted EPS in year 5.

Source: YCharts.com

Source: YCharts.com

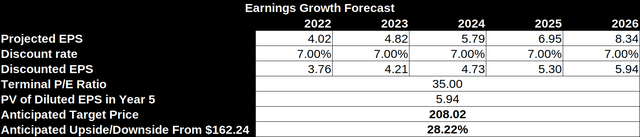

Based on the above assumptions, here are my calculations:

Assuming a 20% EPS growth per year, I am calculating a five-year target price of $208, which represents just over a 28% upside from the current price.

In this regard, while a significant portion of growth seems to have been baked in from the price rise that we have seen over the past year - there still seems to be significant upside potential.

Of course, should the forecasted yearly EPS growth of 20% turn out to be higher, then we can expect a higher target price accordingly.

Moreover, with demand for irrigation services rising, we could see a situation where the P/E ratio climbs higher as investors increasingly bet on future earnings - which would mean a higher target price under this scenario.

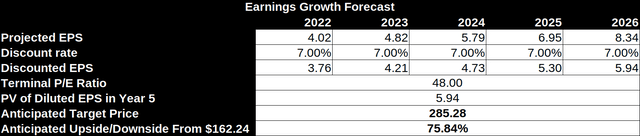

For instance, let us assume that the P/E ratio rises back to the peak of 48x as seen earlier this year:

Under this scenario, the target price rises to $285, which represents a 75% upside from the current price.

On a five-year basis, a target price range of $208-285 seems realistic.

Conclusion

While I was more bearish on the prospects for the irrigation industry back in 2018, the landscape has changed dramatically as a result of COVID-19.

The pandemic has highlighted weaknesses in global food supply chains, and demand for irrigation services to meet food demand are increasing.

Considering both this and Lindsay's recent earnings performance, I take a bullish view on the company and expect further upside from here.