Investment Thesis

Over the past year, Artisan Partners' (NYSE:APAM) shares are up 56%. However, in our opinion, the growth potential has not yet been exhausted. Artisan Partners Asset Management is an asset management firm whose AUM has been growing in recent years. This is not surprising because the company's management teams consistently beat their index competitors. APAM is a growth company that pays good dividends. If the AUM volume remains at a comparable level until the end of 2021, we will see revenue growth of 40% YoY. Despite the dynamics of financial indicators, Artisan Partners is trading cheaper than peers on multiples. According to our estimate, the upside potential to the fair price is 37%. We have a bullish view of the company.

Today, we identify two key risks for investors, the impact of which is difficult to avoid or anticipate:

- The interest rate hike will likely lead to a significant revaluation of the stock market and Artisan Partners as well. However, we have applied a high discount rate in the business valuation to ensure a reasonable margin of safety.

- Deteriorating market conditions can significantly affect the return that a company generates for its clients. As a result, we can see an outflow of AUM and a decrease in revenue.

Company Profile

Artisan Partners Asset Management is an American investment company founded in 1994 by Andrew and Carlene Zieglers. The company provides asset management services to pension funds, trusts, endowments, charitable organizations, private funds and mutual funds, and also manages equity and fixed income portfolios of its clients. The company specializes in high value-added investment strategies. The structure of the company is conditionally divided into teams of managers specializing in different investment strategies: Growth Team, Global Equity Team, US Value Team, International Value Team, Global Value Team, Sustainable Emerging Markets Team, Credit Team, Developing World Team, Antero Peak Group. Each team manages investment funds, separate accounts, or provides advisory services. The company receives Management and Performance fees. The revenue structure is presented below:

(Source: 10-K filing)

According to the latest press release, on May 31, 2021, the volume of assets under management was $172.916 million. Most of the assets are owned by institutional investors.

(Source: 10-K filing)

Approximately 86.8% of APAM shares are held by institutional investors. The shareholder structure is presented below:

(Source: CNN.Business)

The management is headed by:

- Eric R Colson (Chairman/CEO)

- Jason A Gottlieb (President)

- Charles J Daley Jr (Exec VP/CFO/Treasurer)

Growth Contrary To Industry Trends

It is always easier to work in a growing market. Working in an industry that is growing is like going with the flow. A consolidating market, in turn, punishes for any mistake by taking market share.

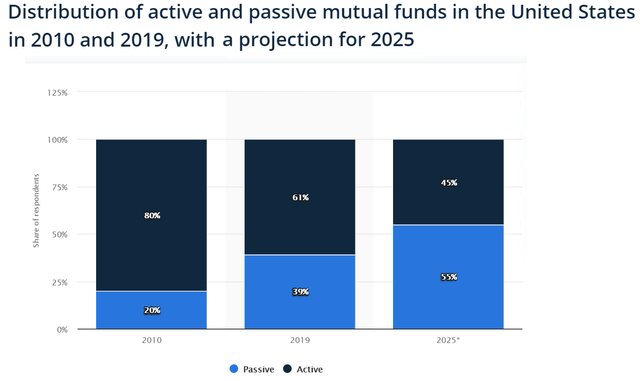

The stagnation of mutual funds is a natural phenomenon. According to Standard & Poor's, only 36% of actively managed funds beat the S&P 500 at a distance of 1 year, at a distance of 10 years, the index surpasses only 14.9% of managers, and at a distance of 15 years, 8.4%. Comparatively lower results and higher commissions have led to a significant shift in the industry. Despite the fact that the total number of mutual funds has remained practically unchanged for 20 years, the structure of assets under management has changed significantly in favor of passive funds:

(Source: Statista)

(Source: Statista)

As a result, many companies cannot withstand the winds of change and are losing their market. We have already analyzed one of these companies. However, Artisan Partners does not lose its positions and also increases the volume of assets under management. It is noteworthy that AUM is growing organically and not through acquisitions.

Assets Under Management and Investment Performance

Management always emphasizes that the company's philosophy is to attract and retain talented investment professionals. In asset management, this approach is justified because people are the cornerstone of business. The more talented the managers, the higher the quality of services. As a result, the performance of almost all teams of the company outstrips the dynamics of the index competitors.

(Source: 10-K filing)

Management is able to provide clients with high returns. Due to this, the volume of assets under management also grows.

(Source: Created by the author)

Financial Performance

Since 2017, the company's revenue has grown by an average of 5.88% per year. The dynamics of revenue is presented below:

(Source: Created by the author)

According to the APAM release from 06/09/2021, the volume of AUM of the company in May increased to $172.9 billion. If the volume of assets remains at a comparable level by the end of the year (we expect that the volume of AUM will increase), the company's revenue could grow by 40% YoY to $1.259 million at the end of 2021. Forecasted 0.73% is the average for revenue as a percentage of assets under management since 2014.

(Source: Created by the author)

As assets under management grew, the share of COGS and SG&A expenses in revenue declined. As a result, the company demonstrates a high net profit margin.

(Source: Created by the author)

The asset-to-equity ratio has been steadily declining in recent years, but is still very high.

(Source: Created by the author)

The reason for the high share of liabilities in the balance sheet is that half of all the company's liabilities are amounts payable under tax receivable agreements. While TRA is a controversial way to squeeze money out of companies (you can read more about this in this article), it does not threaten APAM's solvency. Interest Coverage Ratio is equal to 37.

Due to the high net profit margin and the asset-to-equity ratio, the company demonstrates an extremely high ROE. APAM earns $154 for shareholders on $1 of equity.

(Source: Seeking Alpha)

In addition to its impressive financial performance, Artisan Partners has consistently paid dividends to its shareholders. The history of dividend payments is presented below:

(Source: Seeking Alpha)

The current dividend yield is 6.5%, the payout ratio is 68.4%. It is noteworthy that the average annual growth of dividends over the past 5 years is 2.19% with an average annual growth of levered free cash flow of 11.3% per year. Therefore, we expect the company to continue to be a dividend and growth company at the same time in the coming years.

Valuation

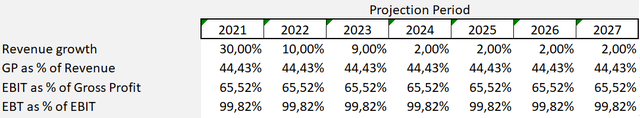

We made several assumptions within the discounted cash flow model. Taking into account the current volume of assets under management, as well as the historical dynamics of revenue as a percentage of AUM, we expect that by the end of 2021 revenue will grow by 30% YoY and will continue to grow by an average of 2% (Fed's inflation target) from 2024. Relative indicators such as gross margin, EBIT in Margin, EBT in EBIT were determined based on their historical dynamics. Our assumptions are presented below:

(Source: Created by the author)

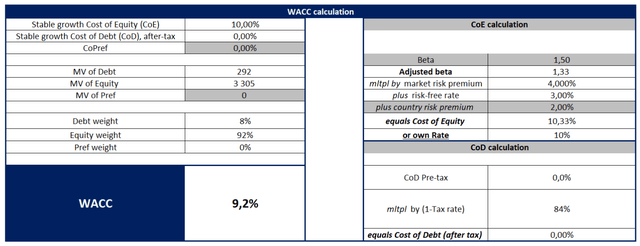

With a Stable growth Cost of Equity equal to 10, the Weighted Average Cost of Capital (WACC) is 9.2%.

(Source: Created by the author)

Thus, we have determined that the fair capitalization of the company is $4.561 million, or $70.3 per share. Thus, the company is trading at a discount to the fair price. The upside potential is about 37%.

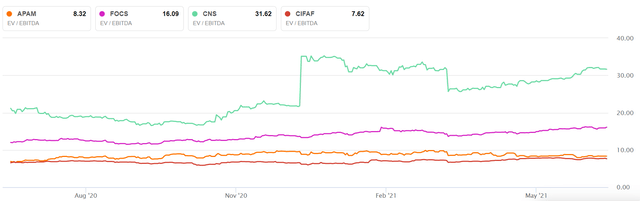

In terms of EV/EBITDA multiple, the company also looks undervalued relative to peers.

(Source: Seeking Alpha)

The PEG ratio is 0.25. The P/B multiple is 18.2, the high premium to book value is offset by a high return on equity.

Conclusion

Despite market trends playing against the company, Artisan Partners remains a growth company that also provides investors with solid dividend yields. Management always emphasizes that the company's philosophy is to attract and retain talented investment professionals. As a result, the performance of almost all management teams outpaces the performance of index competitors, and the volume of assets under management of Artisan Partners is growing. If the volume of AUM remains at a comparable level by the end of the year, the company's revenue could grow by 40% YoY to $1.259 million by the end of 2021. According to our valuation, APAM is trading at a discount to its fair value. We are bullish on the company.