Turning Point Brands (NYSE:TPB) is one cannabis support company, which investors do not want to overlook. Rolling papers, blunt wraps, and cones make a up a large part of their revenues. The company is benefiting from state cannabis legalization and growing CBD markets. They operate with positive net income, a positive EBITDA, and have increasing revenues. Their Q2-2021 quarterly report comes out this month, July 27th, pre-market, and they are expected to report between $103 and $107 million in revenues.

Their stock performance is bullish and reflects the company's current valuation and potential for growth. The company already profits as a cannabis support company in the US and Canada. Zig-Zag rolling papers is an iconic brand, available everywhere and most gas stations. The company manufactures and sells cannabis support products, smokeless tobacco products, and CBD products. They are manufacturers, distributors, and have e-commerce sites.

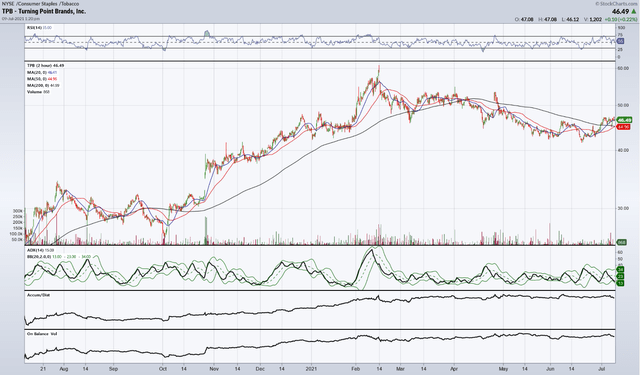

Their stock price has been on a twelve-month uptrend, although it, like all cannabis companies' stock price performance, is still recovering from the February rallies. The next price channel for the stock will be around $52. I recommend that cannabis minded investors begin a long-hold strategy around the company to benefit from their winning business strategy and far market reach.

There are risks, discussed below, which are particular to their business, including government regulations on tobacco products. Previous coverage on Seeking Alpha has rated the company as a buy and their stock as bullish. I agree with the analysis and find their breakdown of the company's valuation helpful, as well as their risk assessment.

Turning Point Brands has different operating segments, proprietary brands, and e-commerce sites

Turning Point Brands is a manufacturer, marketer, and distributor of branded consumer products, including active ingredient products, cannabis support products, and CBD products. They operate in the alternative smoking accessories and Other Tobacco Products (OTP) markets. These markets are driven by cannabinoid legalization in various states and countries. These markets are also driven by nicotine smoking cessation.

They have three operating segments, each with a core proprietary brand. Under the Zig-Zag brand segment, the company markets and distributes rolling papers, cones or tubes, and other products associated with consuming cannabis. They also supply finished cigars and make-your-own cigar wraps (blunt wraps).

The Zig-Zag segment has low operating costs because the products are made by third party manufacturers. The rolling papers are made in France and the cigars in the Dominican Republic. The company distributes the finished products to wholesalers, from where they are sent to retail outlets. The company also operates an online e-commerce site for the brand.

Their rolling papers and other brands are available in 190K US retail stores and 20K Canadian shops. They ship to over 800 distributors and 200 wholesalers. Through their partnership with ReCreation Marketing, the company has expanded their Canadian market reach to more than 280 cannabis dispensaries, with plans for national reach.

The next segment is NewGen, which distributes CBD products, liquid vapor products, and other tobacco products. Within this segment, Nu-X Ventures operates as a recent subsidiary, which is dedicated to the development, production, and sale of alternate smoking products. They sell CBD products, including dried flower / pre-rolls, vapes, gummies, tinctures, and pet supplements. The segment also includes Solace, which provides a line of nicotine e-liquids and vaping devices.

The NewGen segment primarily operates online. It contains three e-commerce sites: Vapor Beast, VaporFi, and Direct Vapor. Vapor Beast is a business to business wholesaler of e-liquid and vape products. VaporFi and Direct Vapor sell e-liquids and vape products to consumers. The e-commerce sites sell a large variety of vaping brands and products. Nu-X has its own e-commerce site as well.

The Stoker's Products segment manufactures, distributes, and markets moist snuff tobacco. They also contract for and market loose leaf chewing tobacco products, which is outsourced from Sweden. Their moist snuff tobacco is grown in-house at facilities in Dresden, TN and Louisville, KY. This segment contains several different brands of chewing tobacco.

Through their Docklight Brands investment, the company received the right to distribute Marley brand CBD topical cream in the US, including after sun care, lip balm, and skin cream. The product is currently sold in over 12K retail locations in the US. The investment will also support the development of other Marley CBD and THC products, which are already available in different international markets.

Tobacco and vape products are regulated by the US government. The company files Premarket Tobacco Applications (PMTAs) for 250 of their products and there is no guarantee that all of their PMTAs will be approved. These regulations not only concern tobacco products, but also vaping products, vaping devices, vaping parts, e-liquids, closed e-vape systems. Their cost of filing PMTAs for Q1 2021 was $5.9 million. They have an advantage over smaller vaping companies, who cannot afford nor have the correct resources to file the PMTAs. The regulation is one of many risks to the company.

Turning Point Brands' quarterly reports show net income and growing revenues

In Millions of $USD | Q4 Dec 2020 | Q3 Sep 2020 | Q2 Jun 2020 | Q1 Mar 2020 | ||

Revenues | 107.6 | 105.3 | 104.2 | 105 | 90.7 | |

Cost Of Revenues | 54.4 | 53.5 | 55.9 | 56.9 | 49.3 | |

Gross Profit | 53.3 | 51.8 | 48.3 | 48.1 | 41.4 | |

Total Operating Expenses | 28.3 | 42.9 | 27.6 | 30.7 | 31.3 | |

Operating Income | 25 | 8.9 | 20.7 | 17.4 | 10.2 | |

Earnings From Continuing Operations | 11.5 | 12.7 | 7.8 | 9.2 | 4.5 | |

Net Income to Company | 11.5 | 12.7 | 7.8 | 9.2 | 4.5 | |

Basic EPS | $0.62 | $0.67 | $0.41 | $0.47 | $0.23 | |

Diluted EPS | $0.57 | $0.65 | $0.40 | $0.47 | $0.22 | |

EBITDA | 26.2 | 10.2 | 22 | 18.7 | 11.4 | |

Total Cash & ST Investments | 167.4 | 41.8 | 67.4 | 64.2 | 99.4 | |

Total Receivables | 6.6 | 9.3 | 8.8 | 5.1 | 4.3 | |

Total Current Assets | 297.2 | 157.3 | 170.5 | 161.6 | 191.8 | |

Total Assets | 627.3 | 489.3 | 479.2 | 467.2 | 449.3 | |

Accounts Payable | 24.2 | 9.2 | 11 | 14.4 | 17.3 | |

Total Current Liabilities | 61.2 | 56.6 | 55 | 52 | 58.1 | |

Long-Term Debt | 424.8 | 281.7 | 288 | 289.3 | 272.7 | |

Total Liabilities | 502.3 | 358.5 | 361.9 | 355.5 | 344 | |

Price** | 46.29 | 52.17 | 44.56 | 27.90 | 24.91 | 21.11 |

Total Enterprise Value (MM) | 1,167.50 | 1,270.66 | 1,106.83 | 787.83 | 686.68 | 620.67 |

Market Cap (MM) | 882.26 | 995.37 | 853.95 | 536.29 | 487.14 | 415.92 |

*Quarterly report table from Seeking Alpha

**Valuations from www.TIKR.com

For Q1-2021, the Zig-Zag Products segment drove revenue making up 38% of net sales ($41 million). New legal cannabis states are accelerating its growth. The products are also available in non-legal states. In their Q1-2021 investor presentation, the company predicts the US legal cannabis market to be valued at $34 billion by 2025. As a cannabis support company, they will continue to gain a portion of the growing cannabis market.

The NewGen Products segment made up 35% of net sales ($37.4 million). The company estimates the CBD market in the US to be valued at $6.3 billion by 2025. Stroker's Products segment made up 27% of net sales at $29.3 million. The smokeless tobacco and roll-your-own markets are also expected to increase.

According to the company, Q2-2021 sales are expected to be between $103 and $109 million. They expect 2021 fiscal year sales to be between $422 and $440 million The expected EBITDA for 2021 is $103 to $108 million. The expected quarterly EPS for Q2 is $.55 and estimated EBITDA is $27.26 million.

Selling, general, and administrative (SG&A) has decreased for the company to $28.9 million compared to $32.4 million last quarter. The reduction occurred because of reduced spending on filing PMTAs. The company received proceeds of $250 million ($102.081 million net) from Senior Secured Notes and they have a current credit line (not being used) of $24 million.

The company operates with gross profit and net income. Their revenues increase while operating costs decrease. They have more than enough cash on hand to fulfill their business strategy and expand operations. Their assets are about on par with their liabilities. They consistently report positive EPS and EBITDA.

Stock price has been up 81% over the last 12 months

Twelve-month price performance chart from www.StockCharts.com

The company's stock price hit an all-time high of $61 last February. Since then, the stock has found lower price channels. It is currently on an uptrend and is trading above its 20/50/200 moving day averages. Momentum for the stock has been increasing, although trading volume remains low at 180K average 50-day volume. A large amount of the stock, up to 90%, is owned by large institutions. It could use more attention from retail investors.

The company's stock trades at about 2.65x value (NTM Total EV / revenues) and thus is rather undervalued when compared to large cannabis companies. Today the stock price sits around $46.50 per share and will soon be tempting the $50-52 price channel. The stock price has rallied on the last four earnings calls, causing movements between 5% and 13%.

Investment Strategy: Take a long-hold position with Turning Point Brands

Turning Point Brands should be some part of one's cannabis holdings. As a support company, it will grow with the greater cannabis market. Because of the large market reach of their products, available in most gas stations and head shops, their revenues will continue to grow and as will their operating segments. One should enact a long-hold position in proportion to their other cannabis holdings.

If the stock price soon hits a target of $52, then the increase would be 13-14%. The investment should be held long-term to profit from increasing valuations of the company. Although I am not recommending a call strategy at the moment. It is good to know that Aug 20 calls at $55 are trading for around $35 per contract. One might watch this tier over the next few weeks in case it becomes tenable.

Risks: Moderate to High

The company has sound financials and a winning business strategy, but there are risks to consider. Because the company's different product lines are regulated by the US government, any of them may be disrupted for a myriad of reasons. The PMTAs have threatened disruption to their whole industry, but the company has the finances to meet the issue. Recently, the US government passed the PACT Act, which regulates the shipping of nicotine and vaping products through the mail. This new regulation again threatens disruption to all companies in their markets. Turning Point Brands ensures investors that they will be able to overcome this new disruption. At the same time, their third-party manufacturers and distributors may also experience disruptions for the same reasons. The ongoing regulations are the most important risks to consider in valuing the company. New regulations adversely affect their revenues, operating segments, and third parties.

Conclusion

Turning Point Brands will announce its Q2-2021 earnings later this month. They expect a consistent increase in revenue, net income, and EBITDA. It is likely that their results will continue to impress investors because the company succeeds with a large market reach and a myriad of products and brands. As a cannabis support company, there is huge potential for growth and expansion. Besides good financials, the company's stock price has performed well over the last twelve months. The company is not overvalued and has room to grow, which is good news for a long-hold strategy. Either way, it is important for the cannabis minded investor to watch the company and their news.