Dividend Yield Basics

The dividend yield is a financial ratio that measures how much companies pay out in dividends compared to their stock prices. The ratio is given as a percentage that shows how much money a company pays out for each share of the stock price, divided by the current stock price.

Investors can use the dividend yield as a factor when determining whether they want to invest in a particular stock. It might seem like a higher dividend yield is always the best option, but that isn't always the case. Some stocks with high dividend yields are seen as less attractive than those with lower yields.

It's important to understand the relationship between the dividend yield and the stock price because a higher yield can sometimes result from a plunging stock price, suggesting that investors may be worried about the future prospects of the company/stock. In some cases, this might present an opportunity to pick up a stock at a low price, while in other cases, the stock might continue falling despite a higher dividend.

Note: Not all companies pay dividends, and mature companies are more likely than younger companies to pay a dividend.

Dividend Yield Formula

The dividend yield formula is annual dividend per share divided by price per share of the company's stock.

Dividend Yield = Amount of Money Paid Out Per Share (over four quarters) / Current Stock Price

How To Calculate Dividend Yield

It's not difficult to learn how to calculate the dividend yield. Investors generally use the last full-year financial report in calculating the dividend yield. However, if it's been more than a few months since the last annual report was released, investors often add the last four quarters of dividends (trailing twelve months or TTM) and use that to calculate the yield instead.

Here's how to use the dividend yield formula in a concise, step-by-step process:

Step 1: Find Company's Past Dividend Payments

First, look up the last four quarters of dividend payments on the company's website, annual report, press releases, or filings with the Securities and Exchange Commission.

Step 2: Find Company's Current Price Per Share

Check the current price per share of the company's stock.

Step 3: Calculate Dividend Yield

Divide the dividend paid over the last four quarters by the company's current stock price. The result is the dividend yield, which you can then use as one factor in determining whether to buy the stock.

Tip: A high dividend yield isn't always a good thing. It can indicate that the stock price is plunging. However, there can be many reasons for a rising or falling dividend yield, so it's important to research those reasons when deciding whether to buy a stock.

Forward Dividend Yield

Another important thing to know about dividend yield is the forward dividend yield, which differs from the historical dividend yield. The forward dividend yield is an estimation of how much a company will pay in dividends over the next year, given as a percentage of the current stock price. On the other hand, the historical dividend yield uses the last four dividend payments to calculate the yield.

Calculating Forward Dividend Yield

To calculate the forward dividend yield, take the next expected dividend and annualize it. Then divide the full year of estimated dividend payments by the stock's current share price.

Forward Dividend Yield = annualized estimated dividend payments divided by the stock's current share price

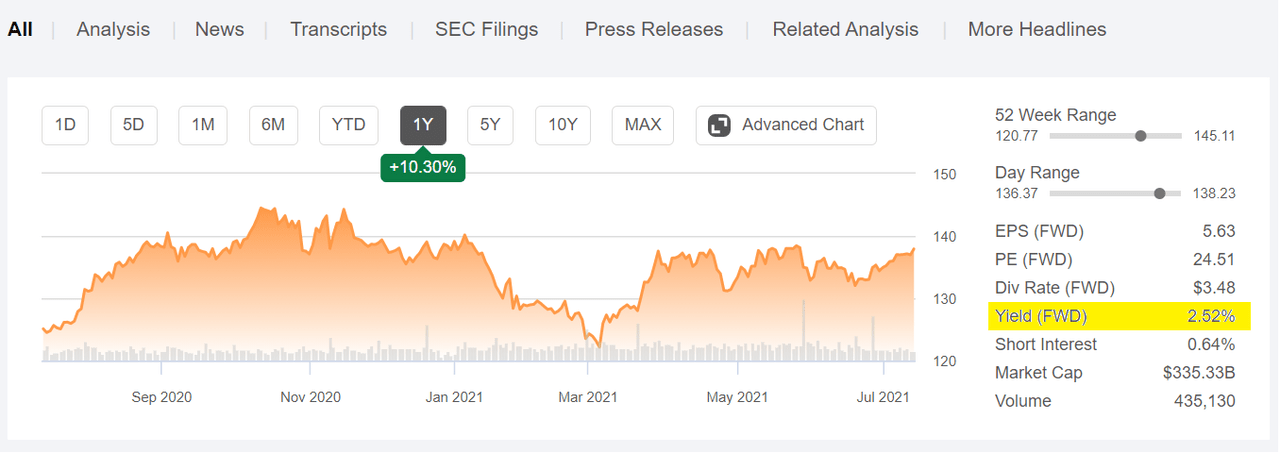

Investors will find forward dividend yields on Seeking Alpha's quote pages for each stock, like this:

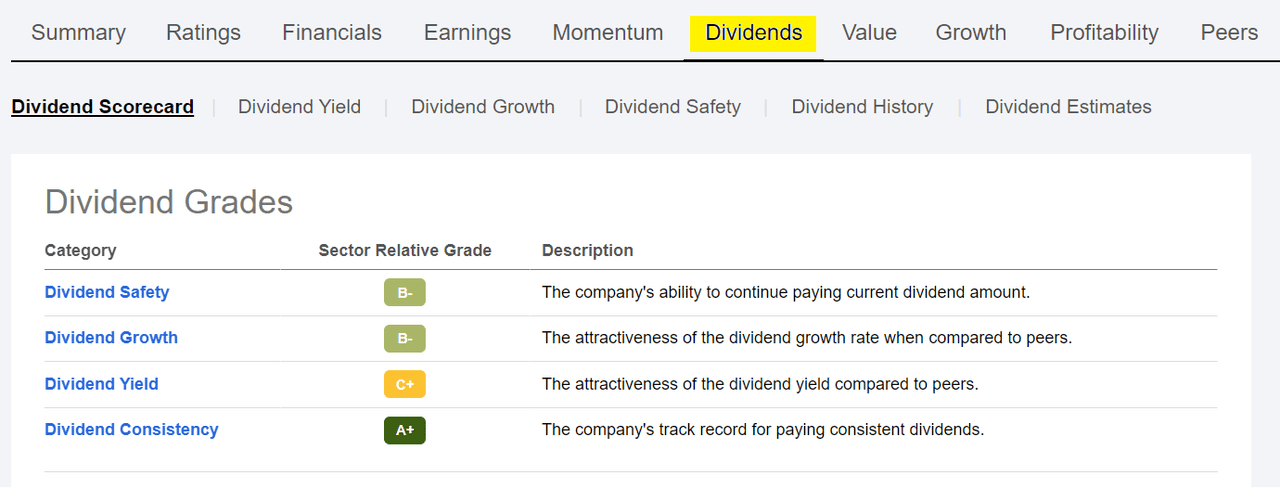

Each symbol page also includes a Dividends tab alongside tabs for Scorecard, Yield, Growth, Safety, History, and Estimates:

Dividend Yield Examples

Let's say one company's stock is trading at $100, and it paid $5 in dividends over the last four quarters, the historical dividend yield is 5%. That's a pretty high dividend yield compared to what most companies pay. Some types pay higher dividends, like real estate investment trusts, which are required to pay 90% of their profits out to shareholders through dividends. Stocks that usually pay lower dividend yields often include industrial companies.

Suppose another company's stock trades at $40, and it paid out $1 in dividends over the last four quarters, the historical dividend yield is 2.5%.

What does it mean if a stock's dividend yield rises from 2% to 2.5%?

It could mean that either the company increased its dividend or its stock price declined, or a combination of the two. If a dividend yield has increased as a result of stock price decline, it's worth assessing the reason why the stock is declining before making an investment decision simply based on the higher yield.