Recent Weakness In Precious Metals Prices Signals Beginning Of A Major Short Opportunity

Summary

- Gold prices are down over 10% YTD and flash crashed over $60/oz. on Asian market open Sunday night.

- Gold will continue to trade as a "risk-on" asset and will not provide a hedge against a financial market downturn as the Fed has no further policy accommodation space.

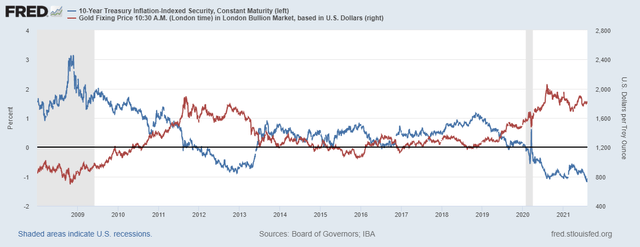

- Gold prices are inversely driven by the expected real UST yield as well as a currency component where a stronger USD is gold price negative.

- High US-centric inflation is not good for gold prices either as it fuels rising UST yields relative to global counterparts and a stronger USD.

- Real (inflation-expectation-adjusted) UST yields are likely to rise due to larger than normal US government supply issuance coinciding with a Federal Reserve taper (demand pullback).

Analyst’s Disclosure:I/we have a beneficial long position in the shares of GLL, ZSL, JDST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Short: RGLD through put options

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.