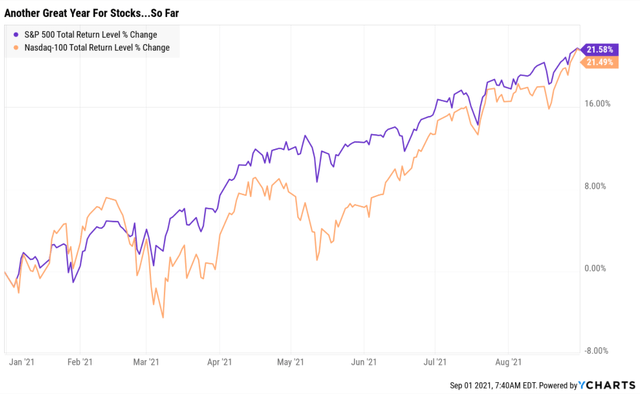

The S&P has posted 53 record highs so far this year, putting it potentially on track to surpass 1995's 77 record closes.

The market just had a 3% rally in August, the Nasdaq 4%. Stocks are now up

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Research Terminal, Phoenix Watchlist, Company Screener, and Daily Blue-Chip Deal Videos.

Membership also includes

- Access to our five model portfolios

- Daily Phoenix Portfolio Buys

- 50 exclusive articles per month

- Our weekly podcast

- 50% discount to iREIT (our REIT focused sister service)

- real-time chatroom support

- exclusive daily updates to all my retirement portfolio trades

- numerous valuable investing tools

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.