This article was previously published for members of The Dividend Kings.

Last week I added shares to my Lockheed Martin (NYSE:LMT) and Deere & Co. (DE) positions. In my real-time trade alert, I let Dividend Kings subscribers know that I would be working on a series of articles, highlighting the attractive value that I see in the industrial sector. This is the first part of that series...

FOMO, or the fear of missing out, can teach us valuable lessons. While I never believe that investors should give into the greed that inspires us to buy assets with irrationally high valuations attached and chase momentum higher because we’re afraid of being left behind, I do think that FOMO can play an important role when it comes to identifying target asset allocations.

Minimizing regret is an important part of risk management when it comes to asset allocations and maintaining a healthy psyche; which, in turn, allows investors to stay consistently calm and rational in the face of the market’s volatility.

Therefore, anytime I experience feelings of FOMO I make sure to bookmark those desires, making sure that I come back to them if/when the market’s sentiment shifts (which it always does because of its fickle nature), because while they may have not been rational when they first popped up, they did make a desire for increased exposure to a certain asset (sector, industry, or individual stock) clear.

Therefore, when opportunities arise which allow me to fix those allocation shortfalls in a prudent and disciplined fashion, I make sure that I do so to avoid such regret in the future.

As I’ve said before, I’m a big fan of taking what the market gives me in terms of the highest quality companies trading at the lowest valuation. While I try to maintain a well balanced and diversified portfolio with regard to sector/industry exposure, I don’t feel the need to force the issue in that regard at any given point in time.

The market tends to ebb and flow, with various industries coming into and out of favor and I’ve seen these sentiment driven cycles play out enough times to know that so long as I remain patient, I will eventually be provided the opportunity to buy equities from a certain area of the market with attractive discounts attached.

In other words, the market is just that: a market of stocks.

And therefore, when putting capital to work, I see no reason to bypass sales for the sake of meeting target allocation thresholds. Eventually, balance will occur. But, in the meantime, the most efficient way for me to compound my wealth (and more importantly, my passive income stream) is to buy the cheapest blue chips that I can find (remember, when we’re talking about dividend growth companies, so long as their growth theses remain intact and their fundamentals support sustainable dividend growth, a lower share price equates to a higher dividend yield and therefore, a higher yield on cost when averaging into them).

Historically, I’ve always been heavily invested in secular growth names because I like the defensive nature of their cash flows and their reliable dividend growth prospects over the long term.

One of my primary goals as an investor is to ensure that I sleep well at night with my holdings and knowing that I have strong secular tailwinds at my back certainly helps me to rest easy in the face of short-term market volatility.

On the flip side of this coin, I have largely avoided more cyclical stocks because of their volatile earnings which can make predicting dividend growth very difficult.

But, over the years, I’ve come to realize that blue chips - even the economically sensitive ones - still have the ability to reliably increase their dividends over long periods of time (even if they experience short-term freezes from time to time) and during the reflationary rally that we saw throughout late 2020/early 2021, when traditional value and cyclical equities roared and the secular growers which I have historically gravitated towards fell out of favor, I admit that I felt some FOMO with regard to my desire to increase my relatively low exposure to cyclical stocks.

I remained disciplined, unwilling to chase momentum; however, I knew that if I had the chance to build out positions in more cyclical areas of the market, given an opportunistic chance. Thankfully, I didn’t have to wait all that long.

The combination of extraordinarily fast earnings growth and stagnating share price growth (and in some cases, significant, share price weakness) has resulted in a handful of blue chip industrial names trading with attractive forward looking price-to-earnings multiples.

And yes, I realize that when investing in more cyclical stocks, sometimes paying attention to price-to-earnings multiples can be a bit backwards (because when using this valuation metric, these stocks tend to look cheap at the tops of their cyclical peaks when shares are best avoided and expensive during cyclical troughs, which is actually when they have the higher forward looking return potential); however, all of the companies that I have been buying in this space have not only cyclical upside, but also defensive cash flows and also secular tailwinds which lead me to believe that their bottom-line growth will not crater in the months/quarters/years.

I’m still not a fan of certain areas of the value trade which, in my view, face strong secular headwinds over the long term (such as energy). I also draw a fairly hard line in the sand when it comes to companies with a history of dividend cuts (such as many financial institutions and materials stocks, which have historically shown that they are very economically sensitive).

But, I have wanted to increase my exposure to the industrial sector, especially after having sold off my large Boeing (BA) position. For years, Boeing was the backbone of my industrial/manufacturing exposure and I was content with that because I believed strongly in the secular tailwinds behind the aerospace industry (driven largely by globalization and urbanization), but after having jettisoned those shares due to BA’s dividend cuts, when the re-opening rally occurred I realized that I was woefully underexposed to the types of stocks that outperform during times of economic expansion and have the potential to protect my portfolio from rising interest rates.

I’ve taken steps to do so in recent months as the cyclical/value rally lost its steam. And more recently, I’ve noticed that the industrial names have fallen even further out of favor and therefore, I wanted to write this article because outside of the healthcare sector, which faces legislative headwinds (which are notoriously difficult to predict and account for fundamentally), I believe that several large cap, blue chip industrial names offer some of the most compelling dividend growth bargains in the market today.

This article will be part one of a series highlighting my favorite industrial stocks right now and up first is one of my highest conviction DGI investments in today’s market: Lockheed Martin (LMT), which is a blue chip trading with a sub-market multiple, a 3% dividend yield which is more than twice as high as the S&P 500’s, and an 18-year dividend growth streak.

This is a company that I’ve been buying throughout 2021. It’s a company that I bought this week. And, due to its high quality and low valuation, it’s a stock that I plan to continue to accumulate, so long as its valuation remains depressed.

Lockheed Martin

Lockheed Martin is a well known defense contractor known for cutting edge technologies spanning a wide variety of industries, such as aerospace (both manned and unmanned), submersibles, advanced manufacturing and robotics, communications, radar, satellites and other space related technologies, missiles, cyber security, energy, and much, much more (the company’s “what we do” page offers a lot of interesting data on LMT’s various operating segments for those looking to learn more about its products/services).

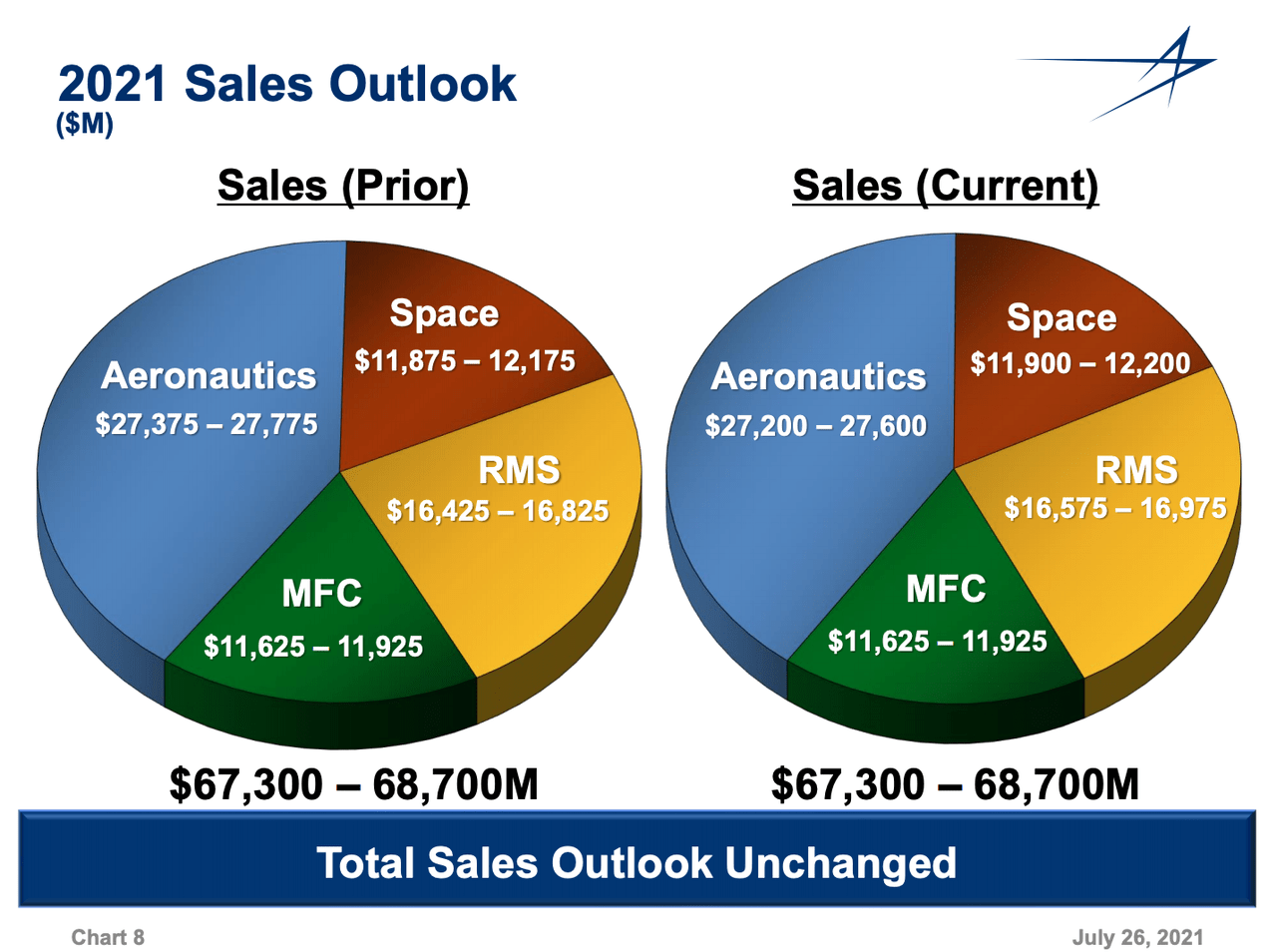

Below, you’ll see a sales breakdown of each operational segment, as well as management’s most recent full-year guidance.

Source: LMT Q2 ER Slides

In short, this company develops and manufactures a wide variety of advanced hardware and software products/services; however, Lockheed isn’t rewarded with a technology-like premium by investors.

Why? Because its wares are largely sold to clients within the public sector (namely, the U.S. government and its various armed forces, which accounted for 74% of LMT’s sales in 2020). This seems to imply to investors a limited total addressable market.

However, it also implies relatively steady cash flows - governments can literally print cash and while there have been fears about the blue wave during the 2020 election leading to less defense spending, President Biden’s budget proposals have included defense spending growth above levels seen during the previous administration. In April, Biden’s original budget proposal included a 2% defense spending increase relative to Trump’s record fiscal 2021 defense spend. Then, in July, the democrat controlled Senate Armed Services Committee voted to increase fiscal year 2022 defense spending by even more (approximately 5%). To me, the notion that democratic leadership equates to lower defense spending is flawed. Historical data doesn’t support this. And, for what it’s worth, during the last election cycle, defense companies allocated more money towards the Biden campaign (which received ~30% more donations from defense firms than former President Trump).

Furthermore, in today’s world, it’s clearly paramount that governments invest heavily in new-age technologies for national security purposes. The U.S. is battling for global supremacy in many respects (including military might) with China. And, while America just pulled out of the war in Afghanistan, the U.S. has no shortage of adversaries across the world (including Russia, which remains a strong nuclear power). While many individuals have issues with the dollars dedicated to the military industrial complex every year here in America, I believe that these investments not only increase security, but as ironic as it sounds, can help to preserve peace (getting back to the admittedly morbid cold-war era idea of mutually assured destruction).

Lastly, I’ll say that historically speaking, when cuts occur in the defense spending space, they tend to impact personnel and operational spending more so than R&D and technological investments. In short, demand for Lockheed’s products is quite high, which is clearly shown by the company's massive backlog (which, management noted, during the Q2 conference call, is expected to end the year at $143 billion in size) and I suspect it will stay that way. All in all, regardless of who controls the Oval Office and Congress in the coming years, I have it hard to believe that drastic defense cuts are on the horizon.

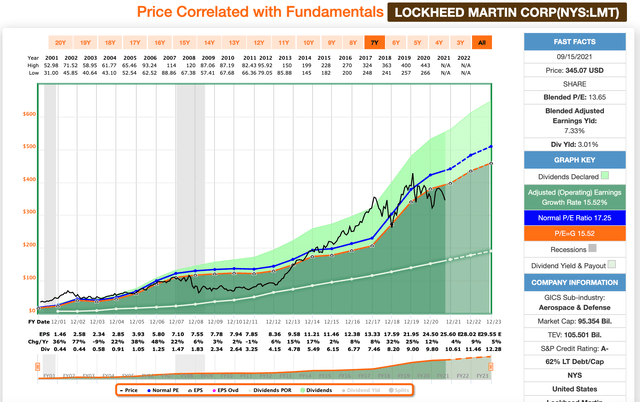

Even with that being said, it’s true that Lockheed doesn’t have the strong double digit forward growth prospects in place right now that many big-tech names have. Looking at the F.A.S.T. Graph below, you’ll see that while LMT has had many strong double digit EPS growth years in the past, looking ahead, the analyst community expects to see mid-to-high single digit growth from LMT during the next several years.

Source: F.A.S.T. Graphs

These pale in comparison to the reliable double digit growth figures that can be found in the big-tech space; however, I think investors in the defense space are trading high growth for reliable, defensive cash flows. And frankly, in an expensive market like this one, I don’t think this is a terrible sacrifice to make.

What’s more, after its recent sell-off (LMT shares are currently trading down some 14% from their 52-week highs), Lockheed yields 3%. This company has a 40.6% forward looking EPS dividend payout ratio (using consensus estimates for 2021 EPS) and an 18-year annual dividend increase streak. Therefore, I suspect that LMT will continue to provide mid-to-high single digit dividend growth to investors from here. In today’s yield starved market, a 3% yield growing at a rate well above inflation is very attractive, indeed.

To me, having the opportunity to buy shares of a company like Lockheed which has produced some of the most iconic aeronautic technologies that mankind has ever known at a sub-market multiple is an attractive proposition.

Right now, not only is LMT trading with a price-to-earnings premium that is below the S&P 500’s, but it is also trading with a steep discount to its historical, long-term average premiums. As you can see on the F.A.S.T. Graph above, LMT’s 20-year average P/E ratio is 17.25x. Shares trade with a blended P/E ratio of 13.65x and a forward P/E multiple of just 12.3x at the moment (using the current 2022 analyst consensus estimate for EPS of $28.02). This represents major discrepancies.

Looking at LMT’s average trailing 5 and 10-year P/E ratios, we see that the stock’s present valuation (and more so, its forward looking premium) are once again well below these historical data points as well. LMT’s 5-year average P/E ratio is 17.6x and its 10-year average P/E ratio is 16.25x.

Given that Lockheed’s forward looking growth prospects remain positive and not all that far below long-term averages I believe that the discrepancies between present valuation and historical averages point towards an irrational discount being applied by the market.

You have to go back nearly a decade to see such cheap valuations attached to LMT shares. More specifically, prior to early 2021, late 2013 is the last time that LMT traded with a sub-14x blended premium.

For much of the last decade LMT shares lacked an attractive margin of safety. However, the weakness that this defense contractor has experienced since the last election has created, what I believe to be, a great long-term opportunity.

I originally initiated my LMT exposure on January 29th, 2021, at $323.12. At that level, I saw a strong margin of safety which not only protected my downside risk, but also represented upside potential of roughly 20%.

Since then, the broader markets have rebounded nicely. LMT’s share price rallied as well, though not to a point that the stock’s valuation became unattractive.

I’ve continued to add to my LMT position throughout 2021, buying shares at $382.22 (on 5/2/21), $387.74 (on 5/24/21), $373.40 (on 6/29/21), and most recently, at $344.95 (on 9/15/21).

I was pleased to average up my share price from my original position because of the relatively strong yield that LMT offered, as well as the continued discount to fair value that I saw (my fair value estimate for LMT has sat in the $420 range for several months now).

Actually, given the passage of time and the ongoing fundamental growth that LMT has experienced since January, shares are essentially as cheap now as they were then.

My most recent purchase at $344.95 represents upside potential of 21.75% relative to that near-term price target.

In short, anytime I have a chance to buy shares of a blue chip dividend growth stock like LMT trading at a 15%+ discount to fair value, I’m pleased to do so.

And in today’s market, I’m ecstatic to lock in a 3% yield, due to the fact that the vast majority of names that I follow with safe and reliably growing dividends that yield 3%+ are trading with extraordinarily high valuation premiums because of record low interest rates and the broader T.I.N.A. (there is no alternative) market that all income oriented investors are contending with at the moment.

My most recent purchase pushed LMT’s weighting up to approximately 0.86% of my portfolio. This implies that my position is getting full. But, due to the high quality of this company, I’d be more than happy to push it up to the 1.5%-2% range, meaning that if LMT’s weakness persists, I’ll be more than happy to continue to accumulate shares.

Come Join Safe High Yield

Safe High Yield offers one actively managed portfolio, a weekly portfolio review, and real-time trade alerts/stock analysis of the companies included in the portfolio.

The portfolio yields roughly 6% right now (our yield on cost is even higher!) and has never experienced a dividend cut.

We're sticking with the K.I.S.S. (keep it simple, Stupid) mantra for this service, which allows us to offer it to subscribers at the lowest possible cost.

Click here to come join us and begin your free 2-week trial!