JamesBrey/E+ via Getty Images

REIT Rankings: Manufactured Housing

(Hoya Capital Real Estate, Co-Produced with Colorado WMF)

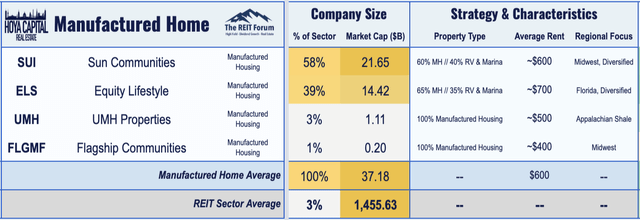

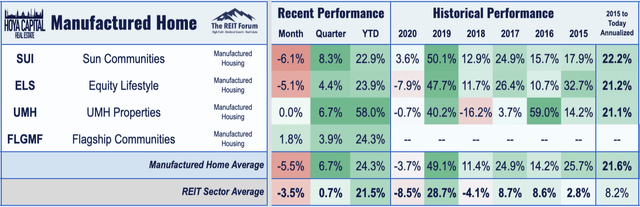

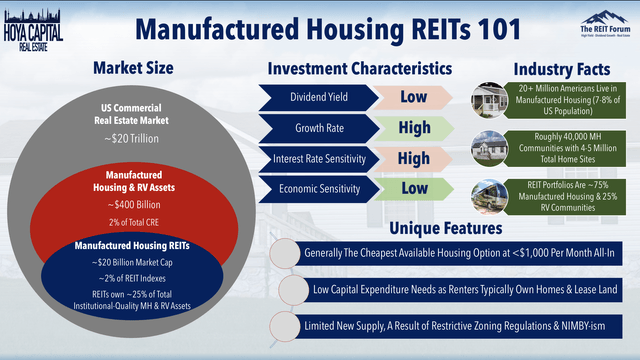

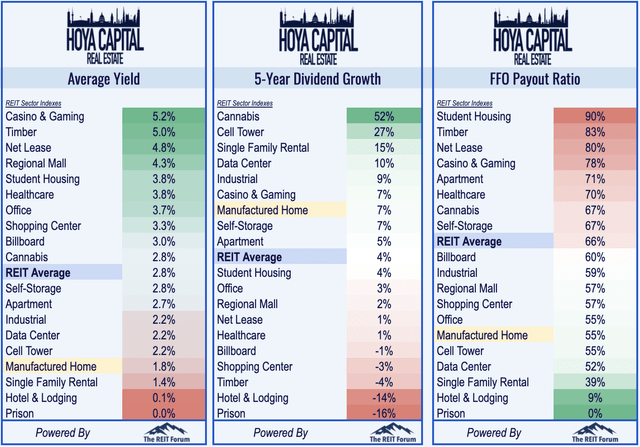

Despite reporting stellar results throughout the year, manufactured housing REITs' remarkable streak of eight straight years of outperformance over the REIT Index is suddenly in doubt. Pressured by concerns over rising interest rates, inflation, and the broader rotation from growth into value, MH REITs have pulled back into "correction territory" - a 10% decline from recent highs - for just the third-time over the past decade. Within the Hoya Capital Manufactured Housing Index, we track the four MH REITs, which account for roughly $35B in market value: Equity LifeStyle (ELS), Sun Communities (SUI), UMH Properties (UMH), and Flagship Communities (FLGMF).

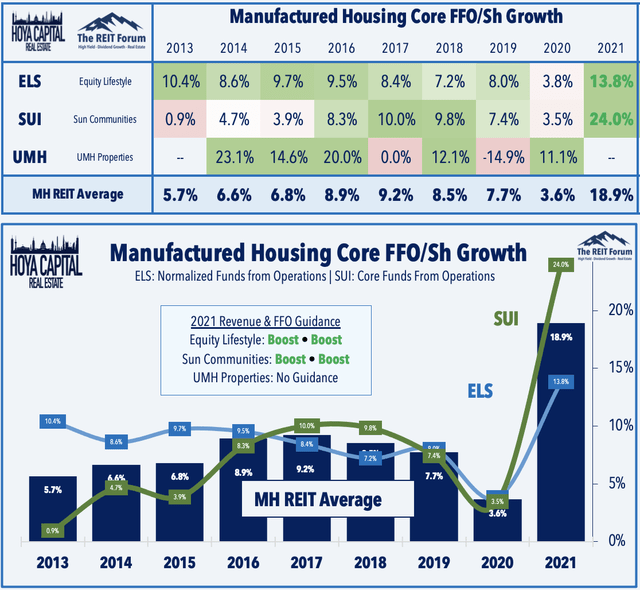

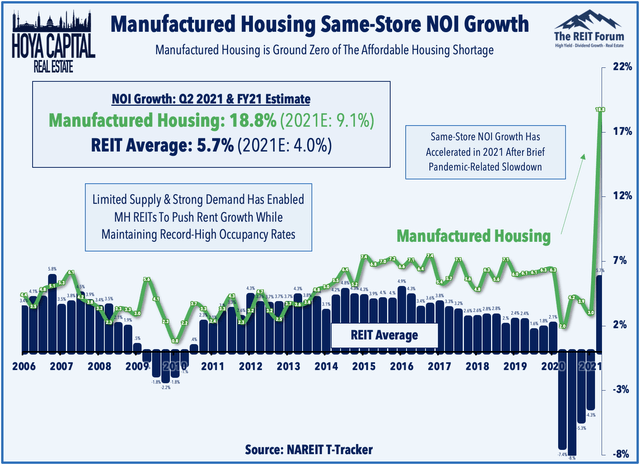

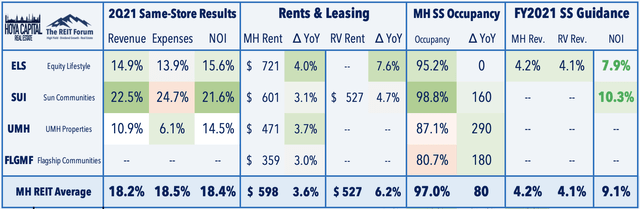

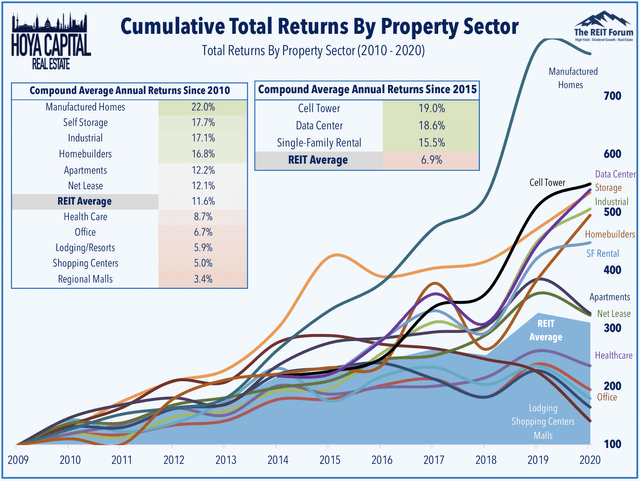

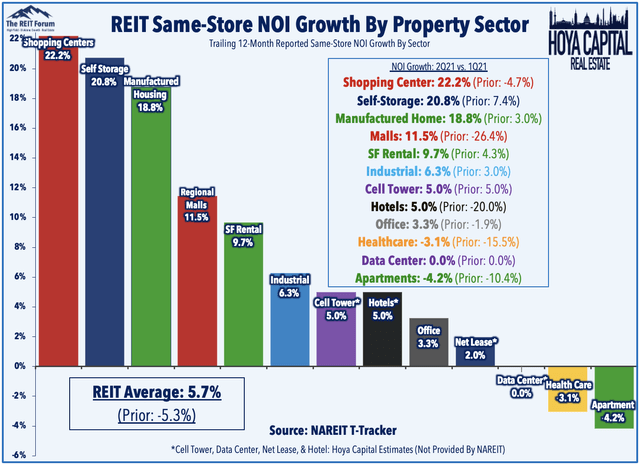

Beneficiaries of the intensifying affordable housing shortage, manufactured housing REITs have been the top-performing property sector over the past decade. As discussed in our Real Estate Earnings Recap, consistent with the trends across the residential REIT industry, MH REITs significantly boosted their growth outlook last quarter, citing strong rental housing demand and substantial upwards rent pressures. Equity LifeStyle raised its full-year FFO outlook by 410 bps to 13.8% while also boosting its same-store NOI growth outlook to 7.9% at the midpoint. Sun Communities somehow managed to top those impressive results by raising its full-year growth outlook by 610 bps to 24.0% and now sees double-digit NOI growth this year.

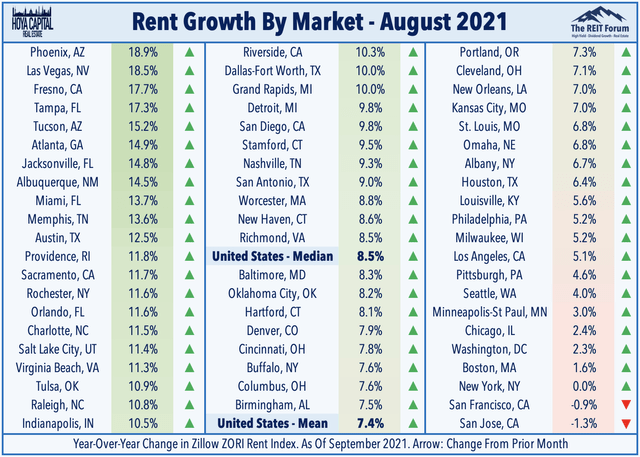

Driven by robust demand and limited supply of housing units, rental operators have benefited from a substantial increase in market rents across the country and throughout essentially all segments of the sector including MH units, apartments, and single-family rentals. Zillow (Z) reported last week that the pace of rent increases continues to accelerate across the U.S. with median rents rising 8.5% in August from last year. Realtor.com reported that rents rose to record-highs in August with national rental rates growing by 11.5% from the prior year, the first month of double-digit rent growth on record. Apartment List released their October Rent Report, which showed that rents have risen by a "staggering" 16.4% through the first nine months of 2021.

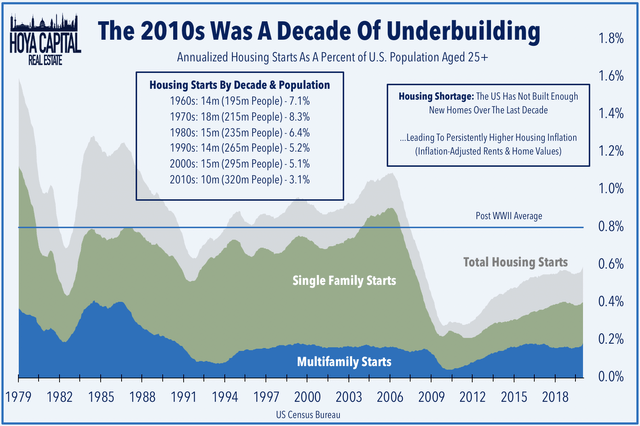

Earlier this year, Harvard University’s JCHS published its annual "State of the Nation's Housing." Researchers noted that "the supply of existing homes for sale has never been tighter," as soaring home prices and rents have been fueled by "the combination of robust demand and limited supply." JCHS concluded that "the pandemic is partially to blame for such tight conditions, but the biggest reason behind the constraints on supply is the underproduction of new homes since the mid-2000s." The report noted that "supply constraints are nearly universal," but particularly in the affordable housing segments. A separate report by the NAR estimated that the underproduction of new housing units relative to household formation totals 6.8 million units.

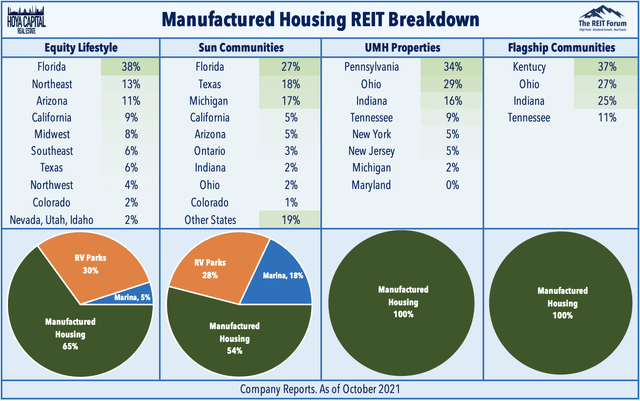

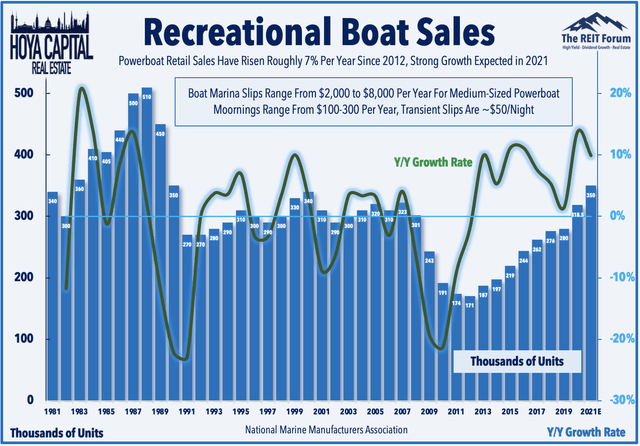

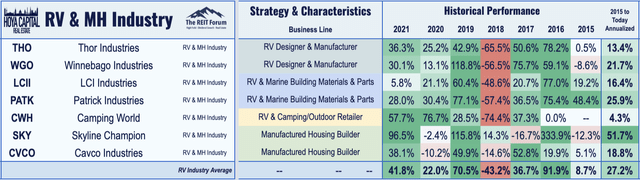

As noted in the JCHS report, "Work-From-Anywhere" has led to an uptick in not only traditional exurban housing demand like MH communities, but perhaps more significantly, it has powered a surge in demand for recreational vehicles ("RV") and boat sales. MH REITs' amplified focus on these analogous asset classes - RV parks and marinas - was perfectly-timed ahead of the coronavirus pandemic, providing an added external growth tailwind. RV parks now comprise roughly a third of assets for ELS and SUI, while marinas comprise 5% and 18%, respectively. UMH and newly-listed Flagship focus exclusively on traditional manufactured housing communities.

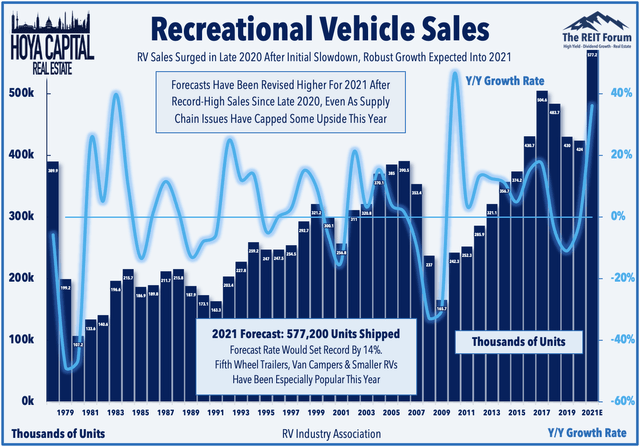

MH REITs have historically been one of the most interest-rate-sensitive REIT sectors - a function of their historically counter-cyclical fundamentals and the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. The diversification into RV parks and boat marinas - which have a more economically sensitive demand and cash flow profile - have provided a pro-cyclical counterbalance that should neutralize some of the potential headwinds from rising rates and inflation. The RV Industry Association expects RV sales to climb to their highest historical total ever this year despite facing similar supply chain issues as traditional homebuilders, demand that helped power a 6% rise in RV rents last quarter.

Recreational boat sales are also poised to set record-highs this year despite inventory levels that are "the leanest they’ve ever been." The recreational boating industry - which includes MarineMax (HZO), Malibu Boats (MBUU), MasterCraft Boat (MCFT), and Brunswick Corporation (BC) - have significantly outpaced the broader equity market since the start of 2020. With SUI's major investment in Safe Harbor Marinas, these MH REITs are now the two largest owners of marinas in the country. Institutional-quality marinas - of which there are roughly 500 across the U.S. - offer substantial operating parallels to the company's RV business. ELS now owns 23 marinas comprising 6,800 slips while SUI owns 41,275 slips across 114 marinas.

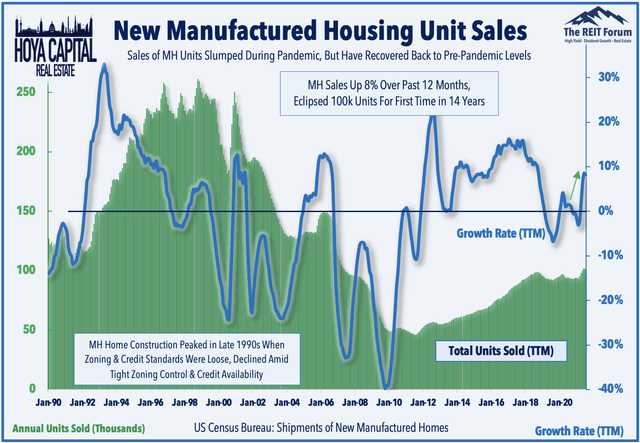

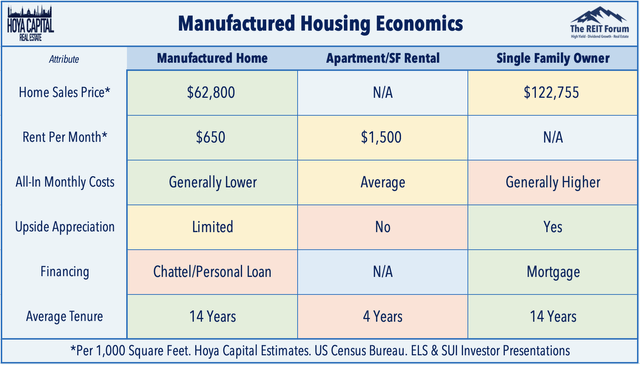

Sales of new manufactured housing units have also exhibited a strong acceleration over the last year, eclipsing 100k units in a twelve-month period for the first time in 14 years, driven largely by site expansions of existing MH REIT parks. MH sales peaked in the late 1990s when zoning and credit standards were loose, but declined sharply beginning in the early 2000s during the pre-GFC housing boom as demand shifted to site-built homes. MH units are typically the most affordable non-subsidized housing option in most markets and the manufactured housing resident base is incredibly "sticky", as the average MH owner stays in a community for 14 years, far higher than the 3-5 year average for other rental units.

MH REITs have been the "canary in the coal mine" of the intensifying housing shortage for the past decade, continuing to produce sector-leading NOI and FFO growth and, as a result, have outperformed the Equity REIT Index in each of the past eight years - the longest streak of consecutive outperformance ever within the REIT sector. Beneficiaries of this intensifying housing shortage - which creates a compelling backdrop for companies across the housing industry - we believe that the recent stock price correction could be the long-awaited buying opportunity for these dividend growth champions.

MH REIT Stock Price Performance

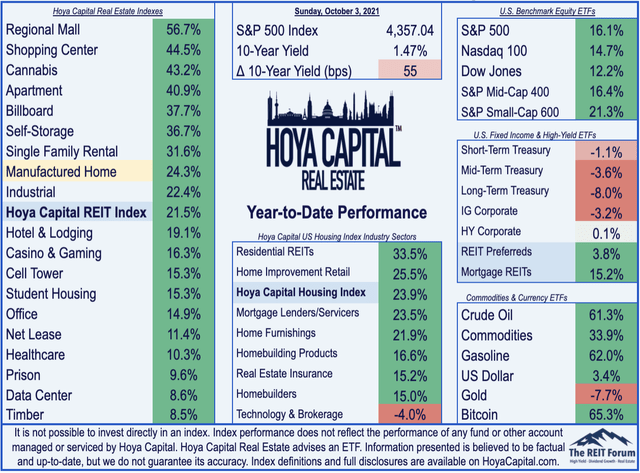

MH REITs gained nearly 15% in the weeks following their stellar second-quarter earnings reports - and were briefly the second-best-performing REIT sector on the year - but have given up these gains in recent weeks given the recent concerns over rising rates and inflation. Despite the roughly 10% correction from recent highs set in early September, MH REITs are still higher by 24.3% this year, still outpacing the 21.5% gains from the market-cap-weighted Vanguard Real Estate ETF (VNQ), and beating the 16.1% returns from the S&P 500 (SPY) and 16.4% gains from the Mid-Cap 400 (MDY).

Interestingly, while extending their streak of outperformance last year, 2020 was the first year since 2009 that MH REITs produced negative total returns. Consistent with the "reopening theme" across the REIT sector, small-cap UMH - which had lagged its two larger peers over the last decade - has led the way this year after boosting its dividend for the first time since 2008. With the strong gains this year, UMH has "caught-up" with the performance of ELS and SUI since the start of 2015, each of which have delivered returns between 21.1% and 22.2% over this time, among the best in the REIT sector.

The non-REIT players in the manufactured housing and RV industry have also put together another strong year. Leading the way this year has been MH builder Skyline Champion (SKY) and retailer Camping World (CWH), which have each surged more than 50% this year, followed by Cavco Industries (CVCO), which has gained nearly 25%. RV manufacturers including Thor Industries (THO) and Winnebago Industries (WGO) have given back some of their gains over the last quarter, however, as have Patrick Industries (PATK) and LCI Industries (NYSE:LCII) on concerns over supply chain constraints and pressured by the broader reopening rotation.

Deeper Dive: Inside Manufactured Housing

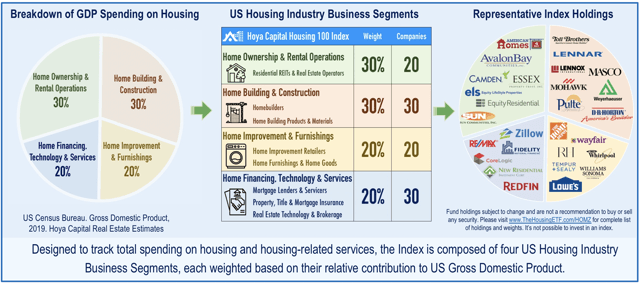

Roughly one-in-twelve Americans live in a factory-built manufactured home, and shipments of these units represent roughly 10% of housing starts in a typical year. MH REITs comprise 2% of the "Core" REIT ETFs and also represent 4% of the Hoya Capital US Housing Index, the benchmark that tracks the performance of the US housing industry.

The quality and appearance of MH parks can vary significantly from communities that are nearly indistinguishable from a typical single-family master-planned community to the stereotypical "trailer parks." Often misunderstood by investors, manufactured homes are generally not "mobile" (except for recreational vehicles "RVs") as about 80% of MH units remain where they were initially installed, and while units are generally built to higher-quality standards than commonly believed, the JCHS report noted the MH homes were among those most "in need of repair."

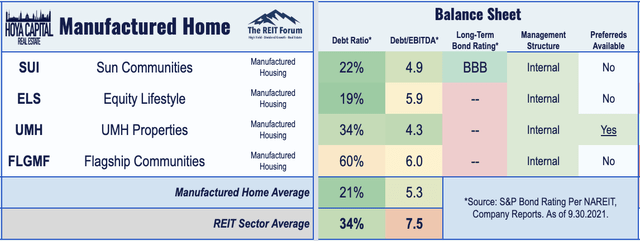

These REITs generally own communities in the higher tiers of the quality spectrum and are more "retiree-oriented" than the average MH community. MH REITs operate with some of the most well-capitalized balance sheets across the real estate sector. ELS and SUI operate with debt levels well below the REIT sector average of 34%, while UMH operates with higher leverage levels. Capital is cheap when balance sheets are well-managed, underscored by ELS's issuance of 10-year notes with a fixed interest rate of just 2.4% while SUI issued 10-year notes for 2.7%.

For residents, the economics of MH takes on the qualities of both renter and homeowner. Residents generally own their home but lease the land underneath it, paying an average of $70k for a new 1,500-square foot prefabricated home. The average monthly lease to set their home on a site and hook up to utilities in MH or RV community can range from $300 to $1,000 per month. By foregoing the investment in the land, however, property appreciation is generally minimal, and as a result, MH homeowners in land-lease communities generally cannot finance MH or RV purchases with traditional mortgages, and as with RVs, owners must finance the acquisition with a personal property (chattel) loan at a higher interest rate.

Manufactured Housing REIT Earnings

The headwinds observed during the peak of the pandemic in mid-2020 - the shutdown of RV parks and the slowdown in RV and manufactured housing sales - have swiftly become tailwinds amid a broader revival across the U.S. housing industry and other WFH-related industries. As noted above, MH REITs reported incredible same-store NOI growth of nearly 20% in Q2 driven by resurgent demand in its transient RV facilities - many of which were temporarily closed during the comparable Q2 of 2020. Occupancy rates ticked higher by another 80 basis points in Q2 while "core" manufactured housing rents increased by 3.6%.

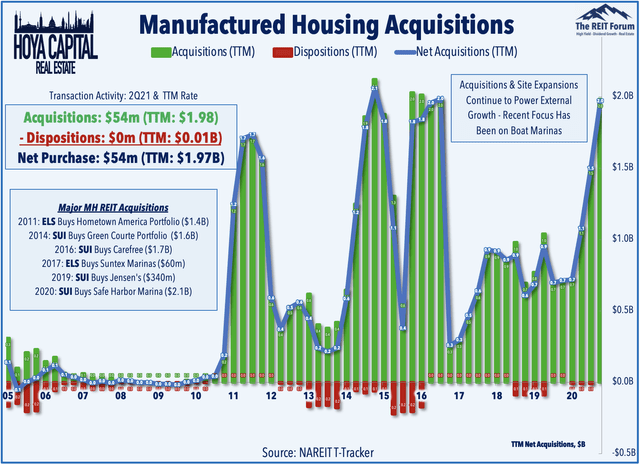

Utilizing a strong cost of equity capital, these REITs have continued to grow externally by adding units to existing sites and by growing via acquisitions and site expansions. MH REITs acquired nearly $2 billion in assets over the last year, largely in one-off acquisitions while disposing of just $10 million. On its earnings call, SUI CEO Gary Shiffman did note that while the acquisition pipeline remains robust, there is "lots of competition out there in the MH, the RV side, and a little bit on the marina side." SUI sees cap rates "similar to where they've been" with MH and RV "in the 4% to 5% cap rate range, and we're seeing them dip even sub-3% in some cases."

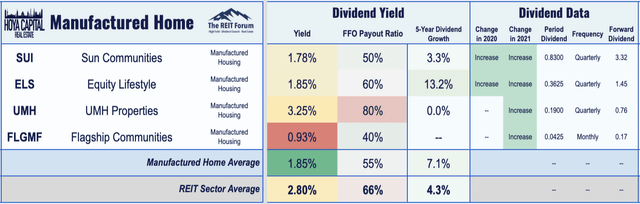

Manufactured Housing REIT Dividend Yields

One of the more growth-oriented real estate sectors, Manufactured Housing REITs pay an average dividend yield of 1.8%, ranking towards the bottom of the REIT sector and below the market-cap-weighted average of 2.8%. MH REITs, however, have delivered one of the strongest rates of dividend growth over the last five years. ELS and SUI were two of 52 equity REITs to raise their dividend in 2020 and all four REITs have boosted their payouts in 2021, part of a wave of more than 110 REIT dividend boosts this year. MH REITs pay out less than 60% of their available cash flow, implying greater potential for future dividend growth and more free cash flow to fund external growth.

UMH Properties pays the highest dividend yield in the sector at 3.25%, but went nearly two decades with zero dividend growth before finally raising its distribution for the first time since 2008 earlier this year. Equity LifeStyle pays a dividend yield of 1.85%, while Sun Communities pays a dividend yield of 1.78%. ELS has delivered average annual dividend growth of 13.2% over the last five years, among the best in the REIT sector, while SUI has chosen to retain as much capital as possible - and issue new equity - to fuel further accretive growth. Despite their differing capital raising strategies, both REITs have delivered nearly identical total returns over the past decade.

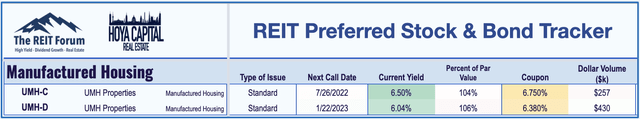

For investors looking to take the "preferred route," UMH Properties has a suite of two preferred issues - UMH.PC and UMH.PD - that have initial call dates in July 2022 and January 2023, respectively. The two preferred issues - which are standard cumulative redeemable preferred stock - have delivered steady performance over the last several years and pay an average current yield of 6.25%, while trading at a slight premium to par value. These two issues delivered slightly negative price returns last year, but including the dividends, produced total returns of roughly 4% in 2020.

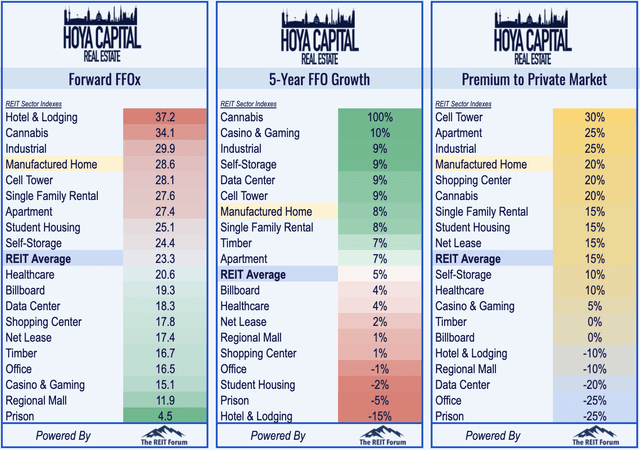

Manufactured Housing REIT Valuations

MH REITs haven't appeared "cheap" based on traditional static FFO-based metrics at any point during this historic eight-year stretch of relentless outperformance, but following the 10% correction - combined with the upward revision in FFO estimates - has resulted in the "cheapest" relative valuations in since the pandemic began. MH REITs currently trade with a Forward Price/FFO multiple of around 28x, a premium to the 23x multiple on the broad-based REIT index. MH REITs are one of the few REIT sectors that have consistently enjoyed a NAV premium over the past decade, which has helped to fuel accretive external growth.

Takeaways: Rare Opportunity In Pullback

Despite reporting stellar results throughout the year, manufactured housing REITs' remarkable streak of eight straight years of outperformance over the REIT Index is suddenly in doubt entering the fourth quarter. Pressured by concerns over rising rates, inflation, and the broader rotation from growth into value, MH REITs have pulled back into "correction territory" for just the third time over the past decade. Heightened rate sensitivity is the result of MH REITs' historically counter-cyclical fundamentals and the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment.

No REIT sector has benefited more from the affordable housing shortage than MH REITs, which produced an incredible 22% annual compound total returns from 2010 through 2020. Consistent with the trends across the residential REIT industry, MH REITs significantly boosted their growth outlook last quarter, citing strong rental housing demand and substantial upwards rent pressures. Beneficiaries of the intensifying housing shortage - creating a compelling backdrop for companies across the housing industry - the correction could be the long-awaited buying opportunity for these dividend growth champions.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Storage, Timber, Prisons, Cannabis, High-Yield ETFs & CEFs, REIT Preferreds.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

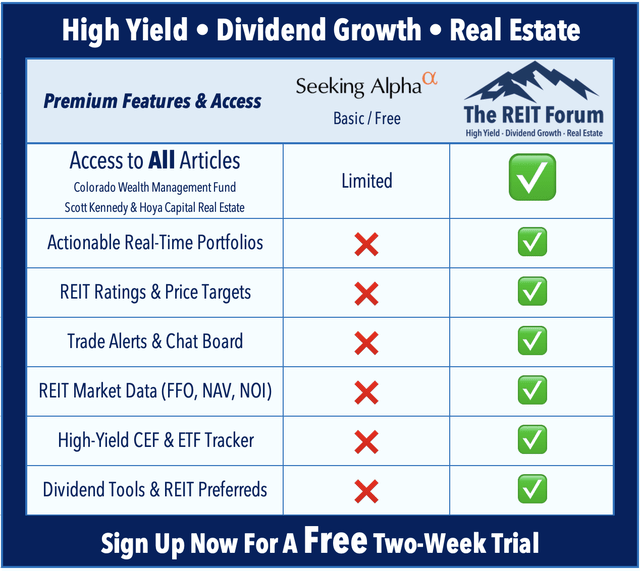

Subscribe to The REIT Forum For the Full Analysis

Hoya Capital has teamed up with The REIT Forum to bring the premier research service on Seeking Alpha to the next level. Exclusive articles contain 2-3x more research content including access to The REIT Forum's exclusive ratings and live trackers and valuation tools. Sign up for the 2-week free trial today! The REIT Forum offers unmatched coverage and top-quality model portfolios for Equity and Mortgage REITs, Real Estate ETFs and CEFs, High-Yield BDCs, and REIT Preferred Stocks & Bonds.