Dilok Klaisataporn/iStock via Getty Images

Main Thesis / Background

The purpose of this article is to evaluate the Vanguard Long-Term Bond ETF (NYSEARCA:BLV) as an investment option. This ETF has a primary objective "to track the performance of the Bloomberg Barclays U.S. Long Government/Credit Float Adjusted Index". I often review BLV as an option for long-term bond exposure, and have generally shied away from this type of allocation over the past few years. Simply, the yield was too low and the interest rate risk too high for me to justify. Of course, this fund has performed well during specific time-frames throughout the past year, especially in Q2-Q3 when yields ticked down. However, over time, BLV has faced pressure. In fact, over the past year since my October 2020 review, BLV has seen a negative return, while the broader equity market has rallied strongly:

Source: Seeking Alpha

With this performance in mind, I wanted to take another look at BLV to gauge if I should change my outlook going forward. After review, I still think a neutral rating makes the most sense. Long-term bonds face a lot of interest rate risk, and most signs tell us yields and rates will rise going forward, not decline. Of course, credit risk is minimal, and buying in now does present a potential contrarian play. These two factors make me reluctant to be "bearish" on this fund, because the market could surprise us. If growth stalls and inflation metrics turn out to be "transitory" (we have been waiting a while for that to come to pass), then BLV will hold up reasonably well. This balancing act suggests to me that a neutral rating makes sense.

Many Signals Of Higher Prices

To begin, I want to take a look at the broader macro-market, and how inflation metrics are driving my overall outlook for BLV. It seems in almost every article I write I am able to dig up one or two different inflation metrics to showcase how prices are rising, and that has been consistent for most of the second half of the year. While the Fed pushed a "transitory" message early in 2021, I never bought it, and they are starting to finally come around to the fact that inflation pressure is simply too great. In my view, we have reached a point of no return in some regards. What I mean is, prices have risen so much, so quickly, that even if the gains slow down or reverse a little bit, we will be stuck in a range much higher than where we were prior to this year. Simply, much of these price moves will be permanent, and consumers and businesses are going to have to adjust to this reality.

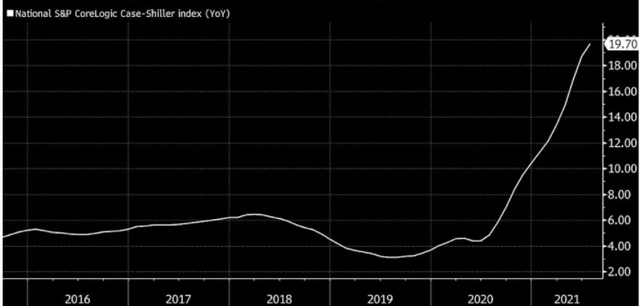

This begs the question - why do I feel this way? To understand why, let us look at a few key numbers. One, home prices, which readers are surely aware have been rising at a brisk pace. In fact, home prices have risen almost 20% this year alone, after climbing most of the past decade as well:

Source: Yahoo Finance

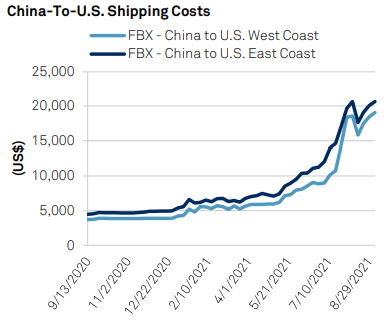

Another area to take a look at is shipping costs, which are very important to global businesses. While consumers may not feel the direct impact, they feel it indirectly, as those costs get passed on to importers/exporters, distributors and, ultimately, the retail buyer. Here again is a sign that inflation is not slowing down, as many hope. Despite costs leveling off towards the middle of summer, they continue to push higher in the short term. This is likely driven by the rising price of oil and general supply-chain issues, as well recovering consumer demand:

Source: S&P Global

My point here is these are just two more signs that price pressures are not abating. These are two very different categories (U.S. home prices and U.S. - China shipping rates), but they both paint the same story. Costs are rising, and things are getting more expensive. In this climate, bonds tend to struggle, and longer-term bonds get disproportionately hit. This makes me skeptical that BLV is a smart place to park cash for the time being.

BLV's High Duration A Major Headwind

In the prior paragraph, I discussed how inflation continues to rear its head. Now, I want to explain quickly why this is bad for BLV. Simply, this fund has a higher level of interest rate sensitivity, as measured by its duration. The higher the duration, the more sensitive a bond or fund is to interest rate movements. In the case of BLV, we see the fund has a duration over 16 years:

Source: Vanguard

This means BLV is very susceptible to changes in interest rates, as well as inflation expectations. When we see prices and costs rising, it is wise to limit duration risk. A fund like BLV does not offer this strategy, which is a key reason for its weakness over the past year.

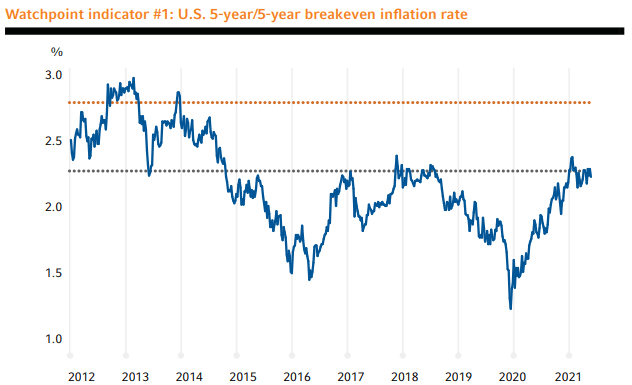

Of course, what is past is past, what matters now is how the fund will perform in the coming year. On this note, however, there is not a lot to be wildly optimistic about either. To understand why, let us look at the breakeven inflation rate, which offers insight into market expectations for inflation and yields. Clearly, breakeven rates have soared since 2020, and we see they are sitting near the Fed's longer-term target. The good news is (for BLV investors) the breakeven rate has flattened out a bit after that sharp rise:

Source: Russell Investments

Again, this helps to explain BLV's weakness. Inflation has been rising, taking the breakeven rate up with it. This means investors demand more yield to compensate for the forward inflation risk, dragging down bond prices.

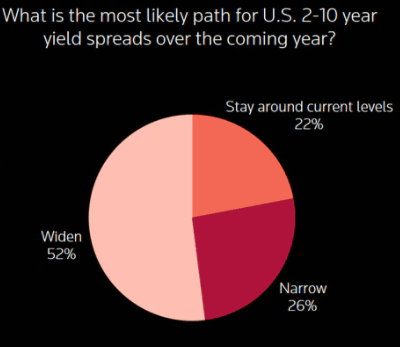

With this backdrop, is there any opportunity? Importantly, I do think there is, which is why I reiterate I am not bearish on this fund, but neutral. While I personally see inflation remaining strong in the early stages of 2022, I could very well be wrong. Further, the majority of the market shares my view. In a recent survey reported by Reuters, over half of investors expect spreads to widen, why only a quarter expect them to narrow, as shown below:

Source: Reuters

This is not meant to confuse readers, as this provides support to the belief that inflation is going to be persistent, and yields will rise (hurting BLV). However, I am indeed saying that one could take the opposite approach here, as the market seems overwhelmingly in one corner. This means being a contrarian, which often works out over time. While I find myself in the "widen" camp, the majority of the market is in that camp, so perhaps expectations are getting too one-sided. If that is the case, the market will overreact on contradictory news.

For example, if prices subside more than expected or growth in the U.S./developed world regressed, there is plenty of room for downside. In this case, investors with the strategy of betting on BLV now will do quite well. Personally, this is not a strategy I am advocating, but I am saying I see the merit in doing so, if one has a viewpoint different than my own on inflation.

Risk Of Fed Tapering

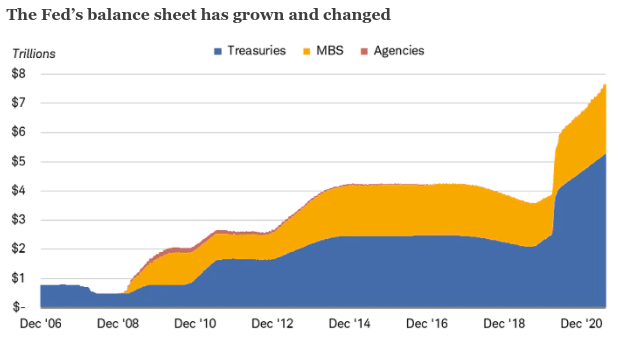

Another important risk to emphasize for BLV has to do with Fed tapering. This is the slowing of asset purchases by the Fed, or perhaps even the selling of existing assets. As readers are probably aware, the Fed steps in to buy assets to drive down yields and support underlying values of these assets. When it comes to Fed buying, they branched into corporate bond, both investment grade, and high yield, as well as municipal securities to combat the Covid-19 pandemic. Despite getting more creative this time around, we should recognize the Fed still predominately buys Treasuries and MBS, with its balance sheet growing substantially due to this buying:

Source: Charles Schwab

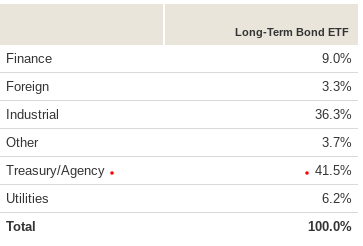

This is an important strategy that is relevant to BLV because this fund holds a substantial amount of Treasury and agency MBS assets, as seen below:

Source: Vanguard

My takeaway here is this is a fund that is susceptible to price declines when and if the Fed tapers. As a fund that has a high duration with a lot of the assets the Fed is buying, seeing yields tick up and asset prices decline will be a double whammy.

This, again, begs a question - how likely is the Fed to taper? While the Fed has often delayed taking action on asset purchases or rates, they had is starting to get pushed by market forces. Based on their own guidance, tapering may indeed be coming sooner than later. To understand why, consider that last December the Fed said it would continue to increase its holdings of Treasury securities by at least $80 billion/month and of agency MBS by at least $40 billion/month “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.” Now, most recently in its September FOMC statement, the Fed stated that:

The economy has made progress toward these goals. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted”

Source: Federal Reserve

The conclusion is that the Fed, in its own words, sees an economy where tapering is justifiable. Whether or not they will act, or simply move the goalposts, is a subjective outlook right now. Personally, I do think tapering will occur at some point this year, and will continue uninterrupted in early 2022. As a result, this removes a tailwind for BLV, as some demand will ease. Fortunately, this means the Fed feels the economic backdrop is strong enough for these assets to stand on their own, which is an overall positive. But it should, at the very least, limit upside.

Bottom Line

With inflation metrics and expectations rising, long-term bonds were not the place to be over the past year. While they have provided a nice hedge during some times of market turmoil, and in early 2021 when yields dropped substantially, the broader trend has been modest. For investors who expect the Fed to hold off on tapering and/or who expect some further equity volatility, a fund like BLV could very well make sense. However, for those, like myself, who believe inflation pressures and positive economic outlooks for next year will force the Fed to act, BLV is not the best move. Ultimately, I see the merit to storing some cash in equity hedges, but given the fund's high duration, this is not the one I would personally pick. That said, I do not believe we have seen the last of market volatility this year. This means downside losses for BLV will probably be modest, as the fund will inevitably perform well on the risk-off days to come. However, I see those days as being few and short-lived, and reiterate my cautious stance on BLV at this time.

Please consider the CEF/ETF Income Lab