Kent Raney/iStock via Getty Images

It's been a rough year thus far for the Gold Juniors Index (GDXJ), but fortunately, for McEwen Mining (NYSE:MUX) investors, the stock has been a surprising sanctuary amid the sector-wide carnage. This is evidenced by its 12% gain vs. a 24% decline in the GDXJ. With a growth plan set to be unveiled at Fox by year-end, some investors are understandably excited about the stock's future. However, I continue to see the stock as uninvestable given the track record of shareholder dilution. So, while a bounce is certainly possible, I think there are much better ways to buy the dip.

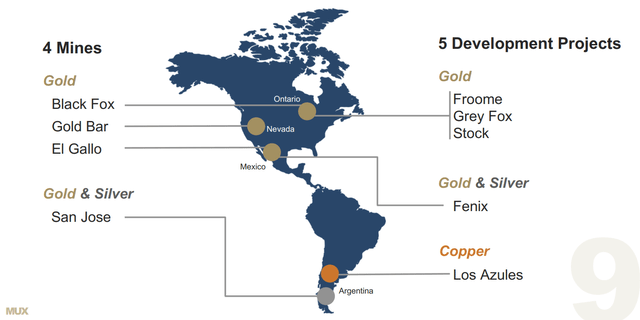

(Source: Company Video)

As noted above, McEwen Mining has been one of the only stocks with a positive year-to-date performing in the mining sector in 2021, up 12%, and easily outperforming its benchmark. I would argue that a bounce in the stock was more than overdue after four consecutive annual declines against a rising gold (GLD) price, with MUX sliding 88% from its 2016 highs to its 2020 lows. Regardless of my views, the performance is a welcome surprise for investors, and the rally could continue with a major catalyst coming up at year-end, with McEwen Mining set to release its Fox Complex Preliminary Economic Assessment [PEA]. However, while this could provide a boost to the share price, I don't see any way to justify investing in the stock. Let's take a closer look below:

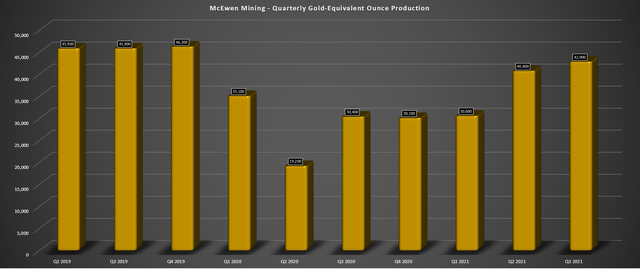

(Source: Company Filings, Author's Chart)

Last week, McEwen Mining released its Q3 production results, reporting a 40% increase in production on a year-over-year basis to ~42,900 gold-equivalent ounces [GEOs]. On a sequential basis, production was also up 5%, with Q3 2021 marking the best quarter for the company in 18 months. While investors might have been excited by this news and year-over-year gains, it's important to take a look at the bigger picture, which points to much less impressive results. On a two-year basis, McEwen Mining has seen production decline by nearly 7% vs. Q3 2019 levels. Worse, if we look at the results on a non-equivalent basis vs. the GEO basis that continues to adjust each quarter, gold production is down over 8% from Q3 2019 levels (~32,100 vs. ~35,000), and silver production is down more than 16%. This is the antithesis of growth, which the year-over-year results would otherwise imply.

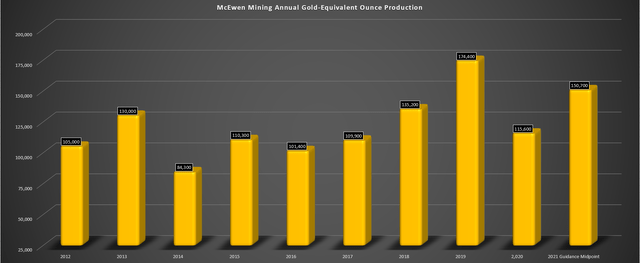

(Source: Company Filings, Author's Chart)

If we look longer-term, production growth may appear impressive, with gold production coming in at 79,200 ounces in 2013 and expected to rise to ~119,200 ounces in 2021 at the midpoint. This would translate to a compound annual growth rate of 5.2%, assuming McEwen Mining hits this year's estimates. Still, in the same period, silver production has dived from ~3.13 million ounces to estimates of ~2.38 million ounces in FY2021. This translates to a (-) 3.4% compound annual production growth rate, mostly offsetting the growth from gold production. These results may not appear that bad, with investors concluding that there has been at least some growth in the period. However, on a production per-share basis and a margin basis, which are much more important metrics, the results are quite different from the marginal growth shown on a purely metal basis.

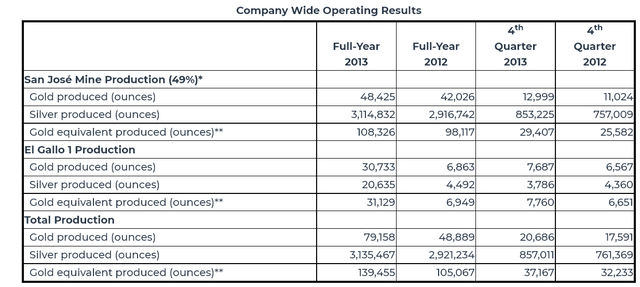

(Source: Company News Release)

As of year-end 2013, McEwen Mining had 298 million shares on a fully diluted basis and produced 79,200 ounces of gold and ~3.14 million ounces of silver, translating to ~124,100 GEOs at a 70 to 1 silver/gold ratio (in my estimate). This translates to 0.0004 ounces of gold produced per share held. Looking to FY2021 guidance and estimated year-end 2022 shares fully diluted at the same ratio (153,100 / 495 million shares), this ratio sinks to 0.0003. If we compare this to a company like Agnico Eagle (AEM) that has grown through smart acquisitions and with limited share dilution, the ratio comes in at a much more impressive 0.008. Even worse, if we compare margins in the period, McEwen Mining was producing gold at $1,178/oz in FY2013, and AISC should come in above $1,400/oz this year. So, not only has production per share slid considerably on a trailing-7-year basis, but the quality of the production has also sunk, given that it's costing an extra $200/oz plus to get each GEO processed.

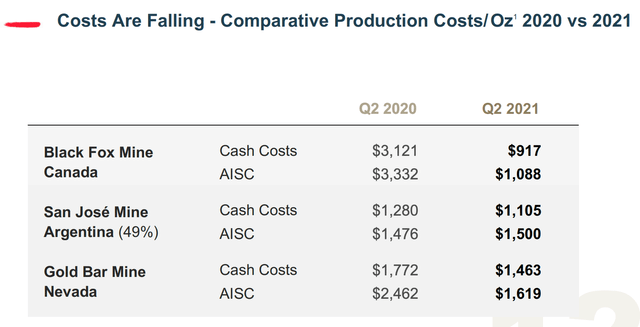

(Source: Company Presentation)

The increase in costs is attributed to two projects which have massively underperformed expectations to date: Black Fox and Gold Bar. McEwen Mining points out in its recent presentation that costs are falling, with all-in sustaining costs down sharply from year-ago levels in the most recent quarter (Q2 2021). However, while the company was correctly pointed out that costs are declining, they are declining from abnormally high levels that more than double the industry average at Black Fox and Gold Bar. So, while the progress is great, it would have been very difficult for costs not to fall vs. these year-ago comparisons. This is akin to an investor pointing out that his year-to-date returns are improving, given that he is only down 40% for the year in 2021 vs. losing 80% of his capital in 2020. A step in the right direction, yes. Impressive? Not so much.

(Source: Company Presentation)

So, where do we go from here?

As McEwen Mining has pointed out, growth is on the horizon, and the Fox Complex is the source of this major growth. The hope is that the company can finally make its ~$35 million investment payoff, and with substantial resources on the property and 2,400 tonnes per day of capacity, there is meaningful growth here if the company can execute. McEwen Mining stated last year that the objective of the PEA is to develop a plan to grow annual production to 100,000 to 150,000 ounces per annum at all-in sustaining costs of $1,050/oz for a 10-year mine life. If we compare this to Fox's current production profile of fewer than 40,000 ounces per annum, this should provide a massive boost to McEwen Mining's annual revenue, production, and earnings per share. However, it's important to take these projections with a grain of salt.

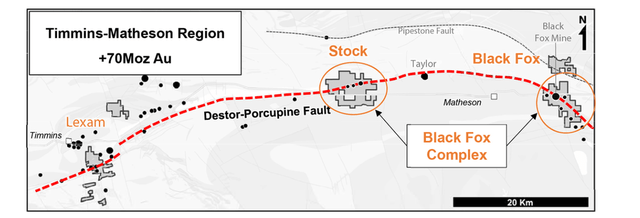

As it stands currently, McEwen Mining has a mere 14,000 ounces of gold reserves at Black Fox at an average grade of 4.05 grams per tonne gold, so there are no reserves today to back up the 150,000 ounces per annum over 10 years vision. Moving to measured & indicated resources which are next up in the pecking order for resource confidence, resources sit at ~1.16 million ounces of gold above 3.50 grams per tonne gold (Grey Fox, Black Fox & Froome Underground), and ~167,000 ounces below 3.50 grams per tonne gold. If we look at strictly the high-grade resources (3.5+ grams per tonne gold), there are ~5.5 million tonnes of material at an average grade of 6.50 grams per tonne gold. Applying a 70% conversion rate (resources --> reserves) to be conservative on the tonnage and moderate grade dilution would translate to a reserve base of ~3.85 million tonnes at 5.50 grams per tonne gold.

(Source: Company Website)

If we assume the mill is filled to capacity (2,400 tonnes per day), and a 92% recovery rate, this would support a production rate of approximately ~137,000 ounces per annum. So, while 150,000 ounces per annum is possible based on high-grading and focusing solely on Grey Fox, 150,000 ounces over ten years does not look doable at all. In fact, unless there's material growth in resources or a very high conversion rate, it would be difficult to support even a 130,000-ounce production profile over more than six years. Having said that, 100,000 ounces per year does look quite doable, which would require a much lower average feed grade. The other option, of course, is trucking re from Lexam Underground to beef up tonnage at the Fox Complex where McEwen Mining holds a historical resource of ~690,000 ounces at 4.9 grams per tonne gold. However, this would translate to slightly higher costs, with Lexam lying more than 60 kilometers west of infrastructure.

In summary, while there's no doubt the Fox Complex offers growth, I think it's difficult to rely on the high end of the stated goal (150,000 ounces) and also on the 10-year figure. It is certainly possible that production could peak at 150,000 ounces for a year or two, but with this plan based on resources, and requiring a very high conversion rate, I think it's safer to assume an average production profile of closer to 100,000 ounces per annum over seven years than 100,000 - 150,000 ounces per annum over 10 years. This would still provide a major boost to production and an improved cost profile, but I still don't see this making McEwen Mining a must-own producer in the space.

This is because while Fox would pull down consolidated costs, San Jose and Gold Bar are relatively high-cost assets, so McEwen Mining would still be a high-cost producer with an inferior track record of building shareholder value. There is no shortage of these companies in the sector, and the best returns from an investment standpoint are generated owning those companies with track records of minimal share dilution, accretive growth, and long-term annual EPS growth, with Agnico Eagle Mines being a rare example that meets these criteria. Therefore, while McEwen Mining may be a trading vehicle for a swing trade back to the $1.35 - $1.45 level, I do not see the stock as an investment vehicle.

(Source: Company Video)

McEwen Mining has had a brutal 3-year stretch, and Gold Bar has been a disaster with a significant write-down, while Black Fox has also been a major disappointment. However, if McEwen Mining can finally turn things around and begin producing 100,000+ ounces per annum, this will present a major turnaround. The issue, unfortunately, is that the last four years of high costs and disappointing results led to a more than 50% increase in the share structure, which will now weigh on future earnings per share, production per share, and reserves per share. Meanwhile, it doesn't inspire a lot of confidence in future growth when past results massively underperformed expectations. If McEwen Mining were the only name to buy in the sector, one could make an argument for owning the stock. However, with dozens of producers on sale, many offering growth, and with most having much better track records, I continue to see McEwen Mining as an inferior way to play the sector.