iQoncept/iStock via Getty Images

Those who have been with me for the past 5 and a quarter years know I have been engaged in the perpetual pursuit of maximizing returns through actively positioning and repositioning the 2nd Market Capital High Yield Portfolio (2CHYP) which is the core portfolio of Portfolio Income Solutions.

Over the years, I have maintained focus on a primary guiding principle: a focus on value rather than price.

I cannot emphasize enough how much this helps in both peace of mind in the short term and generating superior returns in the long term.

On any given day, stocks will be up or down a percent and in any given week they will be up or down 5%, but rarely do underlying values change anywhere close to that much. The key to active portfolio management is to always know the actual value of your companies and buy when market volatility dips prices well below that value and sell when exuberance brings prices well above.

The market is seeing the waves of a stock bobbing up and down 5% and reading into that as if the company is suddenly thriving or failing. I am seeing the slow and steady value accumulation that comes from the cash flows of the business and its accretive reinvestment.

In Portfolio Income Solutions, we own good companies that accrue cash flows and grow earnings steadily throughout the year. It is a hybrid approach between value and growth that looks at something I call total value accumulation.

Total value accumulation over holding period

3 factors sum to total value accumulation:

- Retained cash flows

- Dividends paid

- Incremental net present value (NPV) of business less capital invested

The change in these 3 inputs should approximate the total return of a stock over one’s holding period.

Let me dig a bit into what each of these mean and follow with a full review of the 2CHYP portfolio, both at the portfolio level and each individual stock.

Retained cash flows and dividends paid

These tend to be a heavy focus of value investors as they are really just a breakdown of earnings. For any given level of earnings, some of it is paid out as dividends and the rest is retained. The more earnings a company has, the bigger each of these buckets can be

For clarity I am not referring to absolute amount of earnings. Generally, a bigger company will have more earnings than a smaller company, but from an investor's perspective, it is not absolute earnings that matter but rather earnings per dollar invested.

Thus, for an investor, it is the ratio of earnings to market price that really determines how much earnings power you can get from your investment. This ratio is simply the inverse of earnings multiples and why the S&P trading at such a lofty multiple is such a problem for investment returns going forward.

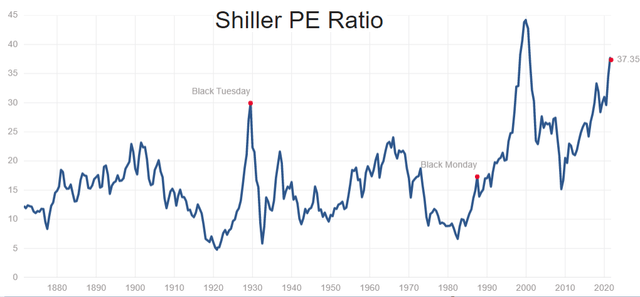

The Shiller PE ratio looks at average earnings over the past 10 years and compares it to current market pricing. It is a nice measure because it is less susceptible to outputting a wonky number based on unusually good or bad quarters. The trailing 10-year period has some good times and some bad times and so will the next 10 years so this is a good way of ascertaining a long run earnings run-rate.

The S&P is extremely expensive right now at a 37.3 multiple on Shiller earnings which means that for every $100 invested one can expect to get earnings of about $2.67. About $1.34 of this $2.67 is dividends leaving only $1.33 for reinvestment in the business.

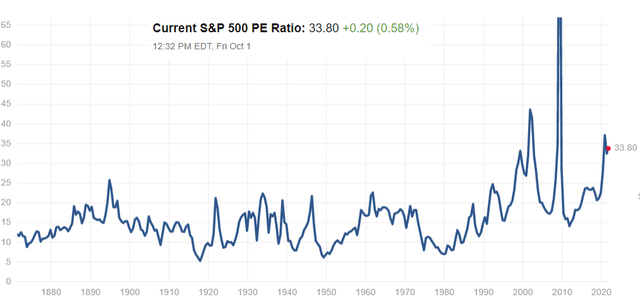

Perhaps one could argue that forward earnings will be much higher than the previous 10 years so they would use the current multiple rather than the Shiller multiple. Well, it still looks expensive with the S&P at 33.80X.

This leaves expected earnings of $2.95 for each $100 invested. At that rate it is going to be difficult to overcome inflation.

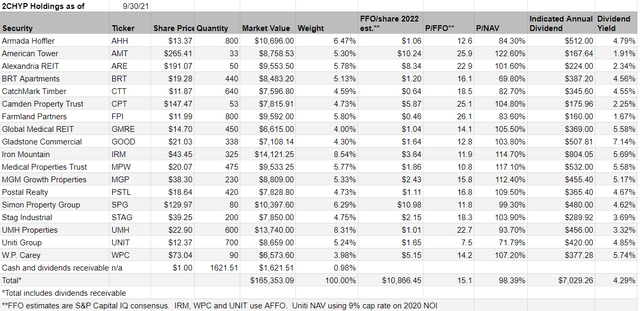

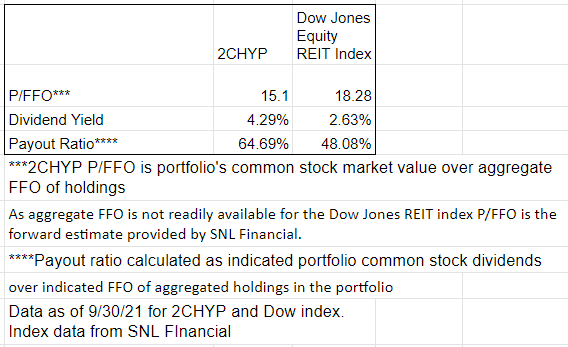

At Portfolio Income Solutions, we believe value matters. 2CHYP generates $10,866 of FFO annually on an investment of $165,353 equating to $6.57 for each $100 invested. This provides a 4.25% dividend yield while still leaving plenty at the companies for reinvestment in their businesses.

In this sort of comparison, one has to be very careful because focusing exclusively on valuation is where some value investors can get into trouble.

This is where the 3rd parameter of total value accumulation comes in.

Incremental Net Present Value of business less capital invested

The 3rd parameter is significantly more complicated than the first 2 so let us unpack this a bit.

In a nutshell, it refers to the overall change in value from organic and external sources. A company may produce phenomenal cash flows, but if the underlying business is degrading, the lost value needs to be deducted from those cash flows to get the overall return.

The most extreme example of this would be companies that deal in depleting resources such as an oil company working in a single basin. As that basin gets depleted, the forward value of the company amortizes to zero as the reservoir runs dry. As this is so common in the oil and gas space, there is proper accounting to handle it.

Among REITs, there is no proper accounting for either depletion or accrual of value to the underlying business so we have to do this manually for each company.

Hotel REITs are a great example of something that on the surface provides excellent value. Most trade at FFO yields around 10% which alone would be a market beating return. However, hotels require a substantial amount of capex relative to other property types, so just to maintain the forward value of the business, the REIT has to put a substantial portion of that 10% cash flow yield into capex.

On the other side of the coin, towers require almost no capex and can fairly consistently increase rental rates organically. As a result, the forward value of the business is increasing at a pace that is faster than the amount of incremental capital put into it.

Considering this parameter along with the value parameters forms a nice composite of quality and value. In the 2CHYP portfolio, we intentionally skew toward companies with organic growth while still maintaining a low overall FFO multiple of 15.1X which compares favorably to the REIT index at 18.3X.

Here are the holdings as of 9/30/21

The Portfolio Income Solutions portfolio known as 2CHYP (2nd Market Capital High Yield Portfolio) has been running for 5 years and a quarter having commenced trading on 7/1/16 with a balance of $100,000. For ease of comparison, no money has been added or removed.

Performance

As a REIT portfolio, our benchmark is the MSCI REIT index. The comparative performance is shown below.

Total Returns | 1 year | 3 year | 5 year | Since inception 7/1/16-9/30/21 |

2CHYP | 54.34% | 43.51% | 48.82% | 65.35% |

MSCI U.S REIT Index (MSCI) | 33.86% | 34.69% | 39.19% | 37.05% |

See accompanying disclosures about performance. Past performance is no guarantee of future returns.

While I am proud to have significantly beaten the index so far, my focus is on continuing to beat it going forward. With that in mind, here are stocks we have selected for the portfolio.

Individual stocks – reason behind each pick

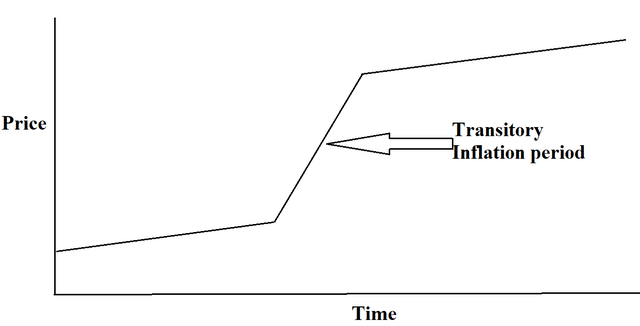

Inflation is here in a big way. Powell is perhaps right that inflation is transitory, but I don’t think many know what transitory means when it applies to a derivative.

The knee jerk interpretation of transitory would be that prices spike then eventually come back down but that would be if price increases are transitory.

Inflation is the first derivative of price and the derivative being transitory is a whole different thing mathematically.

It means the rate of increase of prices spikes then returns to normal. It also means the prices do not come back down. So even if Powell is right that inflation is transitory, it means prices do this.

Powell is seen by many on Wall Street as one of the least worried about inflation and even he says price increases are here to stay.

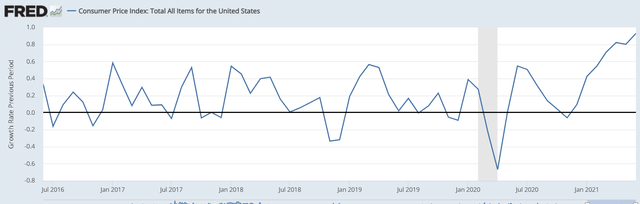

This isn’t a mere prediction. It is already happening as seen in the FRED data below.

Note the chart above is monthly, so it needs to be annualized to get the real number.

In the presence of all this inflation, the land based REITs are severely mispriced.

Farmland is appreciating at a rate of about 8% in 2021 and I would estimate another 8%-10% in 2022. Timberland is also appreciating as evinced by recent sales from each of the REITs at prices well north of where the land was purchased.

Despite the value accrual, the land REITs CatchMark Timber (CTT) and Farmland Partners (FPI) are trading at steep discounts to their acreage. Further, these REITs get amplified benefits from the inflation due to leverage.

Alico (ALCO) is a citrus grower that also stands to benefit from inflation not being priced into its stock for those who wish to dabble outside the REIT spectrum.

It seems there is a trend in which the market is not seeing value accrual if it does not flow through the earnings statement. The same has been true of UMH.

UMH Properties (UMH) is perhaps the best example of incremental net present value. Today, UMH is a popular stock because the growth is obvious as FFO/share is rising rapidly. A few years ago, we owned UMH when nobody liked it because we saw the incremental NPV creation that was going on.

See, UMH acquires properties at medium occupancy and often kicks out the bad tenants as part of their community improvement. In so doing, the cash flows of the property actually dip temporarily because occupancy drops as the evictions occur. In full cycle, UMH is buying the communities at around $30K per site and by the end they are worth $75K per site with only a moderate capital investment.

Essentially, the incremental value creation greatly outweighs the capital invested which means substantial value accretion for shareholders but the market was not seeing it because so many of the properties were in the early stages before cash flows truly hit.

Every CEO has a story to tell about how they are creating value, but some make more sense than others. We have known Sam Landy for the better part of a decade now and his story is consistent and proven time and time again. It is a clean repeatable process of value creation for all parties involved. The tenants get a cheap place to live in a clean and safe community and the REIT gets a growing stream of cash flows as rents are raised about 4% a year for the foreseeable future.

Presently, UMH’s rents are about 20% below market rate which gives a long runway to their strong same store NOI growth.

Unrecognized asset strength

Right around 2017-2018 industrial started to become the go-to asset class. REITs that were not previously involved in industrial began to pivot because they too wanted the market to give them a high multiple. Around that time, I met with Will Eglin of Lexington (LXP) and he discussed that LXP was moving to be an industrial pureplay after decades of being a diversified REIT.

He strongly believed that industrial was a better asset class than office and he was largely right, but here is the problem. If everyone wants industrial, the prices are going to reflect that so he was having to sell office at high cap rates to buy industrial at low cap rates.

Perhaps it was a good move despite the FFO dilution because of what happened to office in the pandemic, but it is not the kind of clear win we are looking for at Portfolio Income Solutions.

What we really want here is a strong asset class that is not yet recognized as such. There are 21 REIT subsectors but only a handful that have a decent weight in REIT indexes. We believe there is value in some of the smaller, more overlooked asset classes.

Now I don’t claim to have expertise in every property type, but what I can do is go to industry conferences and listen to those who do have expertise in the property types. A few years back I went to VICI’s (VICI) meeting at REITWEEK and Ed Pitoniak spent almost the entire conference discussing the mispricing of casinos. Casinos were trading at 9% cap rates but had the risk profiles and growth profiles of a 6%-7% cap rate asset class.

After the meeting I examined the historical volatility of casinos, their cash flow streams and the health of the tenants. It seemed he was right but I was still new to the casino space so I wanted further information.

A year or so later I was able to meet with Andy Chien of MGM Growth Properties (MGP) and sure enough he spent much of the meeting talking about the exact same thing. Casinos are eventually going to be a 6%-7% cap rate asset and the early players like MGP and VICI are getting these properties way below their eventual value.

Of the 3 casino REITs, MGP offered the best value. Gaming and Leisure Properties (GLPI) had a shaky primary tenant and VICI was a bit higher multiple than MGP so I bought MGP. I had absolutely no idea MGP was going to get bought out, but that is the benefit of owning value. Value companies tend to be the targets of M&A.

Post offices are in the early stages of what casinos are going through. As of today, the majority of post offices are owned by Mom and Pop and cap rates are high.

At the same time, FedEx locations are trading at low 4% cap rates as seen in the battle to buy Monmouth (MNR). A post office is basically a FedEx with slightly better credit as it is the U.S. government. Demand for package delivery has never been higher and the postal service has pricing power as it has delivery proximity in areas that competitors do not.

Eventually, I believe post offices will be a low cap rate asset considered part of the industrial sector and Postal Realty (PSTL) will have created a massive amount of value with their high cap rate acquisitions in the early days.

Triple net income convexity with respect to rising rates

Triple net is arguably the sector most susceptible to rising interest rates as the long lease terms make it harder to realize rental increases in the near term. Note that most of them have debt locked in for similar or longer term than the rental contracts so cash flows are not likely to suffer, it is just that the steady stream of cash flows will be worth slightly less relative to a higher “risk free” rate as Treasury yields increase.

As with all things there is nuance to this rule and the market doesn’t seem to be pricing in the convexity of this pricing relationship.

What does this mean?

Well, in brief it means higher yielding triple nets are much better positioned than lower yielding triple nets. A 20 basis point increase to Treasuries hurts a 2% yielding security significantly more than it hurts a 6% yielding security as the price adjustment to keep the same ratios is going to be smaller for the higher yielder.

Triple nets are just a great business model so I want some exposure even if they are slightly disadvantaged in a rising rate environment. My triple nets of choice are Gladstone Commercial (GOOD) and W. P. Carey (WPC). Both are discounted to peers and trade at a substantially higher yield at 7.14% and 5.74%, respectively. Both are also heavily industrial based for which their multiples are not giving them credit.

Over time the higher industrial concentration will likely lead to organic growth. GOOD has among the most favorable tax treatment of dividends (which I wrote about more extensively here) so not only does it give bigger yield, but you get to keep more of it.

Science requires real estate

Alexandria (ARE) is the leading life sciences REIT with an unmatched portfolio of high quality lab space. It is often the go-to for researchers because they know the caliber of real estate ARE can develop. In addition to its massive development pipeline that was already in place, ARE just got a new contract to develop the headquarters and core R&D facility for Moderna (MRNA).

Construction has begun with move-in for the 462,000 square foot property expected to begin in 2023. ARE is not cheap by traditional value metrics at 22.9X FFO, but once you factor in the high single digit same store net operating income growth on top of the accretion from the spreads on their developments, I think the value is there.

Apartments

Apartments have historically been a great property type with strong and steady total returns.

Much of their strength comes down to the business model which is high margin due to the direct transaction between landlord and tenant. Market rates are easily determined and demand tends to pull sales rather than REITs having to spend money pushing their inventory on the market.

The business model became significantly more complicated when COVID hit and eviction moratoriums went into place. Tenants could continue to occupy without paying rent which was partially responsible for 2020 being the first negative organic growth year in quite a while for the sector. There might be a legitimate humanitarian reason for the eviction moratoriums, but from the perspective of analyzing the business they were unequivocally bad for apartments.

Today, however, many of the moratoriums have ended and the rest are likely to finish soon which is causing pricing power to surge back in favor of the landlords. Rents are spiking as much as 10%-20% in an industry that has historically been 2%-5%.

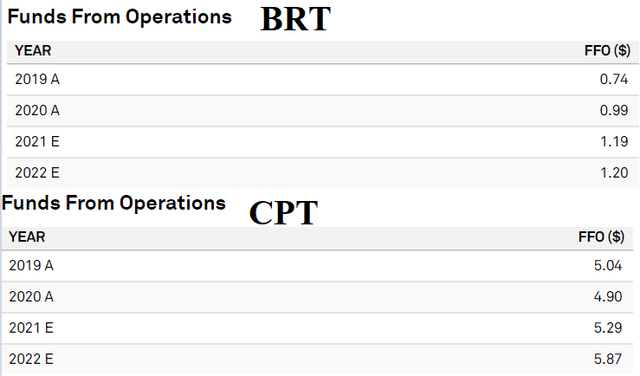

This in turn leads to impressive FFO growth. In 2CHYP the selected apartment REITs are BRT Apartments (BRT) and Camden (CPT) which have the following projected growth rates.

Since so much of this is just organic rental growth on the properties they already own, it comes with minimal capital requirements. That is a great industry to be in.

BRT is in my view the deepest value apartment REIT with a low P/FFO multiple. Camden is more middle of the pack on its valuation, but I see it as the best platform for growth. Management is stellar and its properties are in the top multifamily submarkets.

In addition to the pure-play multifamily REITs, there is a back-door way to invest in the sector at a cheaper price. Armada Hoffler (AHH) has some major apartment developments about to be delivered yet because it is a diversified REIT, it trades at just 12.6X FFO. I wrote more extensively about this pricing phenomenon here.

Beyond the cheapness, AHH is just a good solid REIT. Management runs the business with integrity and has a long track record of creating shareholder value.

Tech REITs

We have inadvertently taken a bit of a barbell approach to the tech REITs with owning American Tower (AMT) and Uniti Group (UNIT). AMT is the global leader in cell tower infrastructure and from this positioning has access to just about any deal across the globe. I prefer it to the other tower companies because of its international presence as that is where the majority of macro tower growth is going forward. The U.S. is close to built out, but South America still needs thousands of towers. AMT reliably provides that product and generates a healthy return.

Uniti is far less proven in its growth story. The theory is that fiber demand will spike as 5G rolls out causing significant lease-up of the fiber already in place. I think this will happen and if it does the upside is huge. UNIT’s last quarter did show some nice leasing activity which is a good sign.

There is of course the potential for 5G to use other networks or overbuild UNIT’s network which means the growth story is far from certain. That is where the valuation comes in. At 7.5X AFFO essentially 0 growth is priced in, so I view UNIT as a strong cashflow play with lease-up as icing on the cake if/when it manifests.

Our third tech REIT, Iron Mountain (IRM) is not often considered a tech REIT as its legacy storage business still produces the bulk of its revenues. Its growth is fully in the tech space, however, with a full pivot into data centers and lease up is going quite well. I have written about this angle plenty of times so instead I want to discuss certain capabilities that make IRM unique among REITs.

So most of IRM’s property is just standard run of the mill warehouses that would command fairly low rent per foot. Most of the value IRM provides to the customer is services rather than real estate. They pick up the boxes, deliver them to the storage and then later retrieve whatever items the customer needs from those boxes. So essentially, the customer is hiring IRM as a service provider but the deal is structured as renting the storage space at a rate per foot that is vastly above what one would rent that space for and here is the key point. Rental of storage space is a REITable source of income.

So IRM gets to be a service provider in a very tax advantaged way. This clever structuring gives IRM an edge that has allowed it to become the global leader in data storage solutions. This is a well run company and trades at just 12X AFFO.

Healthcare

I’m not sure how much longer healthcare will be considered a REIT subsector before it is broken up into its distinctly different parts. The fundamentals of the various property types are disparate yet the multiples of the healthcare REITs in different property types are about the same.

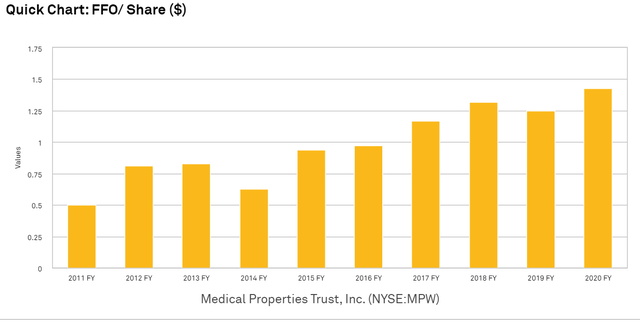

I believe this is mispricing in the stronger property sectors of hospitals and medical office. Why is MPW trading at 10.8X FFO when it has this as its track record?

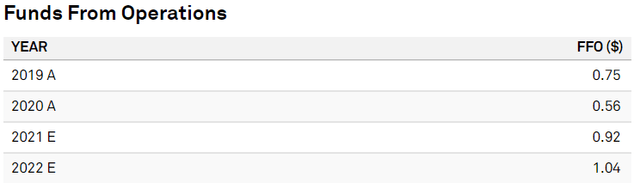

Why is GMRE trading at 14.1X FFO when it has this growth rate?

I think being in the healthcare REIT sector is causing a high level of apprehension about MPW and GMRE that is not warranted. There are reports just about every week about some sort of healthcare provider being in financial trouble.

That is true about senior housing and to some extent true about skilled nursing although the stronger SNFs are still doing fine. It is much less true about hospitals and MOBs which are generally quite profitable.

MPW and GMRE each have tenant EBITDAR coverage of rent that is more than double that of the healthcare REIT sector.

I’m not saying they are riskless, but rather that the market is pricing in an extreme level of risk which I don’t think is correct. As a result, we get to own high quality growth REITs at deep value REIT pricing.

REITs that know how to win

In a world where every company tries to have a set strategy that is easy for investors to understand, I really appreciate those that are willing to sacrifice simplicity for opportunism.

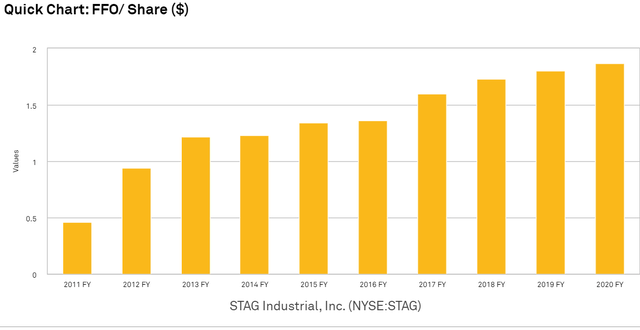

STAG Industrial (STAG) trades at a much lower multiple than peers because the market can’t figure out what it is. They started out as a B and C buyer in tier 2 and tier 3 areas. Then they bought class A in top locations and more recently have started doing developments.

I think the market has incorrectly perceived this as indecisive, but in reality it is opportunism. Ben Butcher knows industrial real estate and simply pivots to whatever is most opportunistically priced at a given time.

The pure play focused industrial REITs might acquire well in the snapshot in time where their property type is opportunistic, but they are only getting mediocre deals the rest of the time.

STAG’s strategy has allowed it to get great deals all the time.

Simon Property (SPG) has received a fair amount of flak for its diversions into retail operations. I think some perceived it as buying the troubled tenants so as to not lose occupancy. While that may have been some of the impetus, it was also a purchase at highly distressed pricing which has led to some crazy IRRs. In some cases, SPG has generated over 100% IRR on its retailer purchases.

This is not a huge part of SPG’s business. A few extra million of profit here and there barely moves the needle on the behemoth that is SPG. To me it is more about the demonstration of executional expertise. SPG knows retail at each level of the vertical and understands how to make it work. It is a superior company and I am happy to own it at 11.8X FFO.

Actively managed portfolio

While I feel confident in the positioning of the portfolio headed into October, I find it crucial to continued success to both admit when I am wrong and not fall in love with positions that do well. As such, I will continuously monitor each position for potential breaks to the investment thesis as well as valuation exiting the opportunistic range.

Dividends are scarce, we provide the solution

For everything you need to build a growing stream of dividend income, please consider joining Portfolio Income Solutions. As a member you will get:

- Access to a curated Real Money REIT Portfolio

- Continuous market and single stock analysis

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Portfolio Income Solutions, we don’t only share our ideas, we also discuss best trading practices and help you become a better investor.