Arthit_Longwilai/iStock via Getty Images

Dividend investors often make the mistake of thinking the highest yield wins. However, that is often a harbinger of business and share price weakness. In those cases, your risk is often higher than the stock market or S&P 500's (

Take a free trial to see what high quality stocks we are targeting on a correlated market correction or continued rolling corrections.

Find out what our members already know. Our analysts and institutional AI platform give us an edge that 99% don't offer.

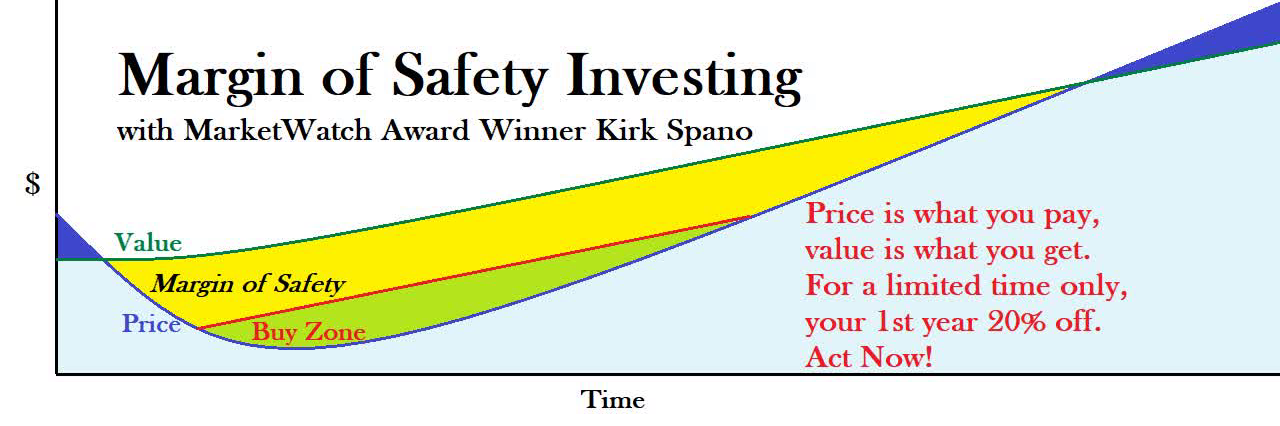

Join us today to invest in a changing world with a Margin of Safety. Now 20% off your 1st year.

ETF Asset Allocation, Growth Stocks, Dividend Growth, Low Volatility Retiree Dividend Stocks, REITs, Option Selling For Income & Alternative Income.