Leland Bobbe/DigitalVision via Getty Images

The Buy thesis

VICI Properties (NYSE:VICI) has become the dominant casino REIT with a scale and market concentration advantage. At current pricing, its growth trajectory greatly exceeds that which is implied by its modest earnings multiple. There are numerous catalysts in play or soon to be in play which I believe will propel market price up toward fair value. MGM Growth Properties (MGP) is an advantaged way to buy VICI as there remains a roughly 150 basis point arbitrage spread.

Let me begin by discussing the growth opportunities and follow with catalysts, risks, and the MGP arbitrage.

Growth avenues

The growth at VICI is well known. The following are not my numbers, but rather the analyst consensus estimates.

A REIT growing this fast would usually trade at around 25X. However, at a multiple of 14.8X 2022 estimated FFO, it would seem the market does not believe VICI’s growth can continue.

I see growth coming from the following sources:

- Merger with MGP

- Venetian

- ROFRs

- Escalators amplified

The first two are the most broadly known with each being massive transactions that made headlines.

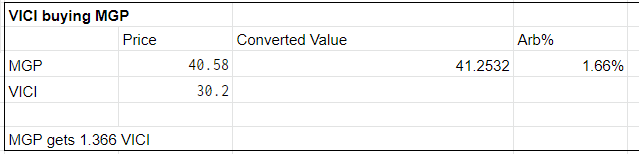

VICI is acquiring MGM Growth Properties at a fixed ratio of 1.366 shares of VICI for each share of MGP with the merger expected to close in the first half of 2022.

With Incremental annual rent of $1.009B the cap rate is rather low for casinos at 5.68% given the price tag of $17.2B, but that is still above VICI’s cost of capital and should be accretive to FFO/share. The rent alone would make this an acceptable transaction, and the strategic benefits are substantial.

Post-transaction, VICI will have a dominant share of the Las Vegas Strip as well as controlling a high percentage of the regional casinos.

VICI’s Strip concentration is further enhanced with its purchase of the Venetian for $4B scheduled to complete this quarter. Annual contracted rent of $250 million spots this at a 6.25% going in cap rate.

These big ticket lumpier deals are accretive and really move the needle due to their size, but there is a portfolio premium built into the cap rates. It is actually the smaller individual casinos in VICI’s pipeline that I am more excited about because without that portfolio premium the cap rates are impressive.

VICI currently holds Rights of First Refusal or ROFRs on half a dozen mid-sized casinos and put/call options on the Indiana Grand as well as Harrah’s Hoosier Park

The going rate for these mid-sized casinos seems to be cap rates of 7%-9%. Massive casinos tend to go for somewhere around 6%. In both cases, I view it as significant mispricing.

In recent years, big ticket office real estate has gone for cap rates ranging from 3.7% to 5.5% and I would consider office to be both lower growth and higher risk than casinos.

There are two main cultural shifts going on that I think will cause casinos to eventually be at parity or even lower cap rate than office.

- Some percentage of work from home is permanent. I tend to think a low percent while others are more favoring of work from home, but in either case, it is a headwind for office. It is just a matter of how big of a headwind.

- Gambling is increasingly popular, especially among millennials.

As a fundamental analyst I try to stick to the objective realm, but occasionally cultural/social factors have real fundamental impact so I have to look at these as well.

I do not claim to have any expertise in analyzing culture, but I have come to a conclusion in which I have fairly high confidence:

My generation loves gambling.

It is evident in factual data whether it be trips to Vegas or the popularity of FanDuel and other sports betting platforms. I also think it is evident in the popularity among this demographic of investments that are akin to gambling such as meme stocks and other speculations.

Incidentally, this generation is also starting to have massive earnings power.

These are the key ingredients that fuel sustainable success of casinos; desire to gamble and the disposable income to fuel this desire.

The casino REITs have triple net contracts with the gaming operators and thus do not necessarily directly participate in the increasing gaming revenues, but it does have important implications for the risk profile of the triple net cashflows.

Lower risk than previously anticipated

VICI and MGP went through the COVID shutdown with virtually no impact. In fact, revenues for each company went up slightly as a result of contractual rent escalators.

This was in spite of casinos being forcibly shut down followed by a prolonged period of restricted attendance. With such an underlying desire to gamble and so much disposable income, demand for casinos is resilient.

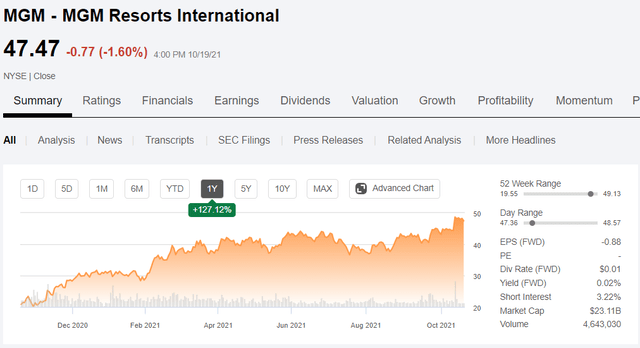

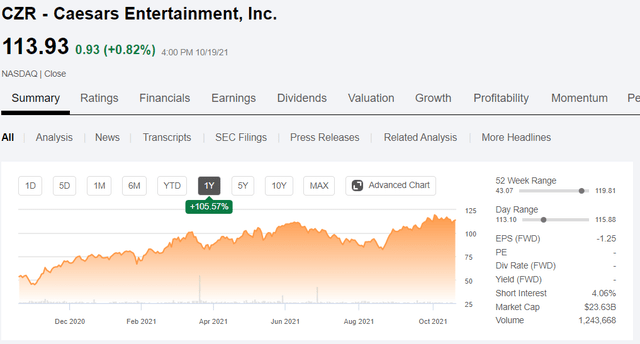

Following the merger with MGP, VICI’s two largest tenants will be MGM Resorts International (MGM) and Caesars (CZR) which are both succeeding.

MGM is up 127% over the past 52 weeks bringing it to a market cap of $23B.

Caesars is up 105% and also at $23B

Those are tenants that are very capable of paying rent. Tenant EBITDAR coverage ratios of rent are healthy which means not only that the tenants can pay, but they want to stay in these locations which bodes well for renewal.

I’m not as convinced one could say the same about office tenants in an environment where they are weighing their options and potentially moving to partial work from home.

As all of this data flows through the market, prices will correct themselves. I believe cap rates will even out. Office will move up from 3.7%-5.5% to 5%-6% and casinos will move down to 5%-6%.

If and when this happens the big winners will be those who assembled massive portfolios of casinos while they were cheap. VICI’s acquisition spree at cap rates ranging from 6% to 9% will increase in value by as much as 50%.

Rent Escalators

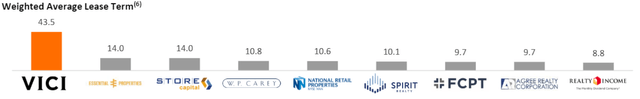

The final piece contributing to VICI’s growth is rent escalators. VICI’s triple net contracts are extremely long term with a weighted average remaining lease term of 43.5 years.

This is of course not strictly a positive. The stability is nice, but there are two potential downsides.

- Inflation tends to hurt more the longer the lease term

- In the extreme upside scenario of casino profitability going through the roof, VICI may not be able to fully participate as they would not be able to mark leases up to market.

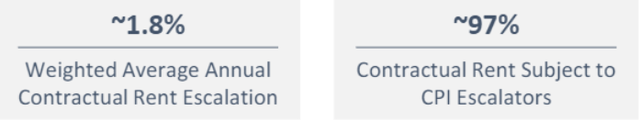

The first risk factor is largely mitigated through the terms of their leases. The leases on average have 1.8% annual escalators and 97% have CPI-based escalators.

Therefore, I would consider VICI well hedged against inflation, but I do still see a lack of participation in the extreme upside scenario.

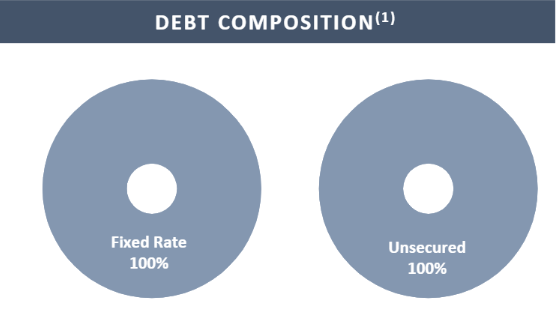

Given where inflation is reading today, I anticipate overall rent escalation to be somewhere around 3% a year. With interest rates coming up along with inflation, one might expect interest expense to largely wash out the rent gains, but that is the great thing about VICI’s positioning; 100% of debt is fixed rate.

Source: VICI

Source: VICI

As such, the rent escalators will accrue directly to the bottom line. Pro forma for the Venetian and MGP, VICI has $2.543B annual rent. At a 3% growth rate that would be $76.29 million incremental FFO each year.

Between the big M&A, ROFRs, individual casino acquisitions, and the built-in rent escalators I see significant growth ahead for VICI.

Valuation

At just under 15X forward FFO, VICI is significantly cheaper than triple net peers and the REIT index as a whole. I think much of this discount is related to the legacy view of casinos as risky.

We have all heard the stories of the boom and bust of Atlantic City and so in the back of everyone’s mind is the idea that casinos can go bust overnight. What happened there, however, was just an extreme use of leverage. All types of real estate or businesses in general have some inherent volatility and when such extreme leverage is applied things break.

Today’s casino environment is entirely different. The operators are huge and have strong margins, and the casino owning REITs have only modest leverage. VICI is well on its way to getting an investment grade rating. With this more stable backdrop, there are mechanisms in place to handle volatility.

I think the resilience of the sector was demonstrated during COVID which was the biggest disruption in decades and yet the operators survived and the REITs didn’t even miss a rent check.

Based on a forward-looking analysis, the fundamental risk to casinos looks very much in line with that of more traditional real estate so I see no reason for it to trade at a such a discount. With normal risk and faster growth, I think VICI will stabilize at a multiple at least as high as the REIT index at around 18X.

This puts fair value at about $37.

Catalysts

I see two significant catalysts in the near term

- Index inclusion (S&P 500)

- Credit rating upgrade to investment grade

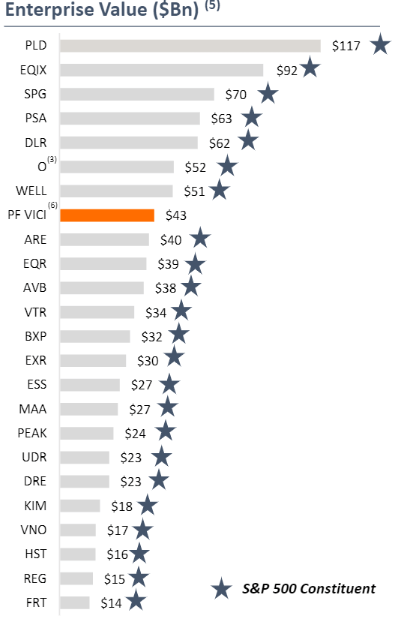

Once the MGP merger completes, VICI will be a shoo-in for inclusion in the S&P 500 index which would lead to substantial buying of VICI through the ETFs that follow the S&P such as SPDR S&P 500 Trust ETF (SPY).

VICI meets all the inclusion criteria so it is eligible, just not yet quite big enough to drive its inclusion. Once the merger completes, however, it will have an EV of $43B putting it in a range of size where every other REIT of that size is already in the S&P

Source: VICI

So assuming the merger goes through in early 2022, it is just a matter of time before VICI has a new wave of passive indiscriminate buyers.

Also pending the merger, VICI is well positioned to get an investment grade rating from each of the major ratings agencies. I suspect the agencies are waiting until the merger closes because the pending status creates some level of uncertainty and presumably the ratings agencies do not want to upgrade during the uncertainty.

From a Debt to EBITDA standpoint and other balance sheet metrics, VICI is a solid candidate for investment grade.

REITs with investment grade ratings tend to trade at premiums so this should help increase its trading multiple.

Risks to thesis

In any M&A there is a chance of things falling through. I don’t see that as likely here as VICI paid a healthy premium to MGP shareholders and the synergies make the merger viable for all parties involved. That said, things can happen so it is never certain until fully closed.

Historically, the risk to casinos was crackdown on gambling, but recently the government has been going in the clear direction of looser regulation on gambling. This presents its own set of risks with online gambling threatening to take market share which in theory threatens casinos in the same way that Amazon threatens malls.

However, online gambling also has clear upside for casinos making it unclear if it is a tailwind or headwind.

Online sports betting, threat or synergy?

The clear difference between online gambling and casinos as compared to Amazon/malls is that online gambling is tied to brick and mortar.

In order to get an online gambling license, one has to have a brick and mortar legal casino. As a result, the primary beneficiaries of online gambling are the casino owners and operators themselves.

One of the most profitable online gambling providers is MGM, so this is a clear benefit to MGP and soon to be a clear benefit to VICI.

The risk side comes in if the rules change. If online gambling becomes the wild west and anyone can create their own venue without the prerequisite of a legal physical casino that is when it might be more of an Amazon/mall situation.

I have no idea if the rules would ever change in this direction, but it is certainly something to watch for as an early warning sign.

Buy VICI through MGP

As of this writing, I view MGP as just a better way to buy VICI. Each MGP share will be converted into 1.366 shares of VICI. So, with VICI at $30.20, each MGP share will convert into $41.25 at current pricing. Yet MGP can be bought for $40.58 which provides an arbitrage spread of 1.66%.

Source: Portfolio Income Solutions Arbitrage Tracker

Source: Portfolio Income Solutions Arbitrage Tracker

The spread will fluctuate over time, but while it's open, I see no reason to buy VICI directly when one can buy VICI for 1.66% cheaper through MGP. There is a tiny additional spread for MGP in that while we wait for the merger to close MGP is paying a slightly higher yield at 5.14% compared to 4.78% for VICI. So perhaps in addition to the arbitrage spread, one gets a few extra pennies of dividends.

Make your money work for you

At Portfolio Income Solutions we do the rigorous analysis to determine which stocks will work and which won’t. We then curate a portfolio of the most opportunistic individual stocks and provide members with continuous analysis to help keep their investments in shape. We constantly watch the market in order to buy and sell the right stocks at the right times.

Start investing with the aid of dedicated research by joining Portfolio Income Solutions.

Not sure yet? Grab a free trial. Canceling is easy and there are no obligations.