marrio31/iStock via Getty Images

Lately, the market has been very volatile. As an example, stocks dropped by nearly 10% in September, just to recover and even surpass previous highs a month later.

This high volatility reflects the enormous uncertainty that we are currently facing:

- The pandemic is still raging with more cases than ever in many countries of the world.

- The Fed has made it clear that interest rates will begin to rise sooner rather than later.

- Inflation is running the hottest in 30 years after printing up to 40% of all US dollars into existence during the pandemic.

- The US national debt is now approaching the $30 trillion mark and government spending isn't slowing down.

- American households also are carrying more debt than ever at $15 trillion.

- American companies have also amassed another $11 trillion in debt. Some call this a "debt bubble" and others call it the "pandemic hangover."

- Meanwhile, Russia also is building troops near the Ukrainian border, and China is increasingly hostile toward Taiwan.

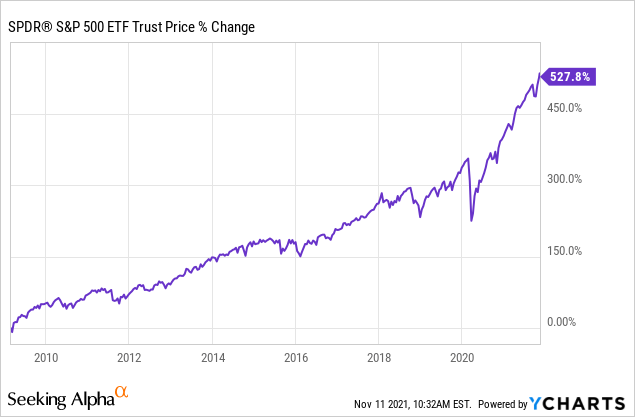

Despite all of that, the market has resumed its upward trend, now returning more than 40% since the beginning of the pandemic, and 500%-plus since the last "real" recession:

That's truly spectacular and it begs the question:

How much longer will these returns continue?

Valuations increased significantly even as the world became a lot more uncertain, and now, we haven't had a proper bear market in more than 12 years and are long overdue for one to occur.

With that in mind, increasingly many investors are looking for a refuge to protect their hard-earned capital. This has led many of you to ask me:

Which is safer: REITs or stocks?

Of course, there's no simple answer here as it depends entirely on which stock and which REIT you are referring to.

However, on average, I consider the REIT sector to be a lot safer than regular stocks, and that's especially true today. In what follows, I present five reasons why that is:

Reason #1: REITs Are Priced at Reasonable Valuations. Stocks Are Priced at Historically Expensive Valuations.

Risk is very much a function of what you pay. If you get a great deal on a somewhat risky company, you may still be in a safer position than if you bought a safe company at an extreme price. That's simply because you have margin of safety and market sentiment can change drastically over time.

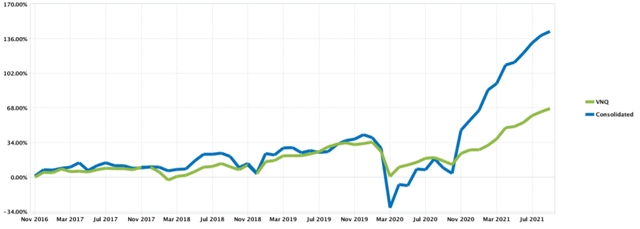

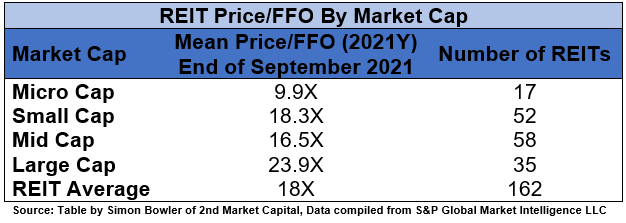

Today, REITs (VNQ) are barely recovering from the pandemic, and their valuations remain very reasonable at 18x FFO on average (FFO is the equivalent of earnings in the REIT sector):

In comparison, regular stocks already have repriced at large premiums to pre-COVID levels, and as a result, their valuations are today way above historic averages. As an example, the S&P 500 (SPY) is currently priced at 29x earnings, which is twice its historic average:

Historically, such high multiples don't last and eventually we see some reversion to the mean. That explains why some legendary investors, including Ray Dalio, are concerned about stock market valuations and fear that we could be facing a "lost decade."

REITs, on the other hand, still have upside as many of them still haven't even recovered to pre-pandemic levels, despite rising rents and property values. It provides margin of safety in an uncertain world.

Reason #2: REITs Are Great Inflation Hedges. Stocks May or May Not Be.

Today, one of the biggest risks is inflation. Just the other day, it was reported that the consumer price index was up 6.2%, the highest in more than 30 years.

Fortunately for REITs, they own real estate investments, which have historically been some of the very best inflation hedges. That's because real estate is "real" and essential to our society. As replacement costs go up, so do rents and property values. Moreover, because REITs finance properties with debt, they also benefit from inflation in that their debt is slowly inflated away even as their properties become more valuable. It explains why REITs have historically done so well during times of rising inflation:

Stocks, on the other hand, may or may not react well to inflation. Some businesses will manage to pass it down to consumers, while others will experience declining profitability as their costs rise, and there is not enough new revenue to make up for it.

Overall, regular businesses are less protected from inflation than real estate.

Reason #3: REITs Have Historically Outperformed During Times of Rising Rates. Stocks Offer No Margin of Safety in The Event of Rising Rates.

It appears that interest rates may be hiked as early as 2022. A common misconception of the market is that REITs do poorly during times of rising interest rates, but it is actually the opposite.

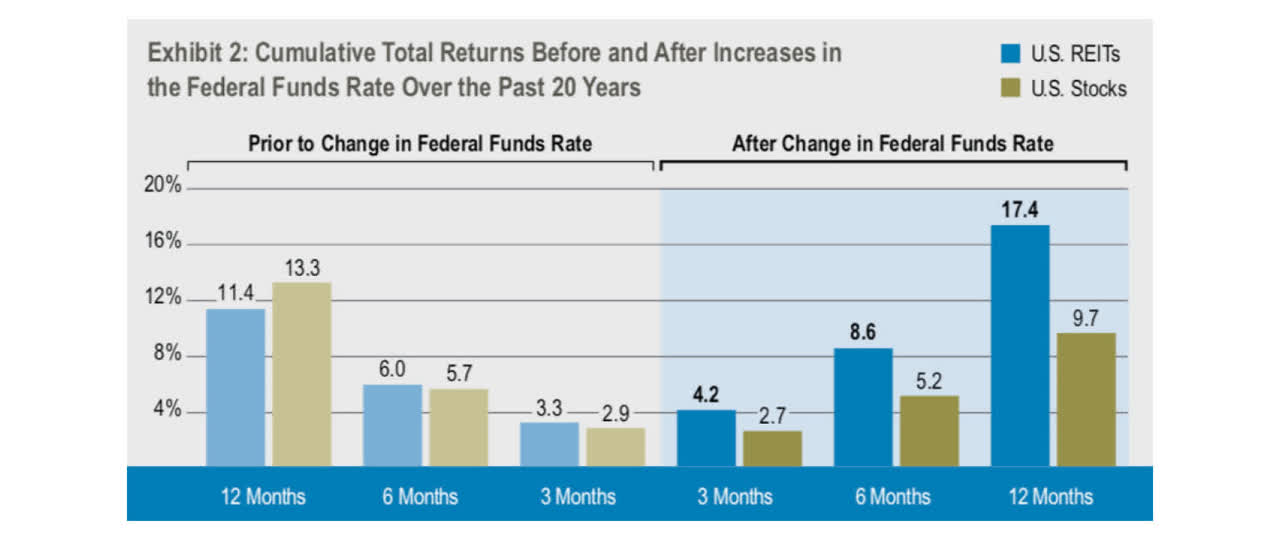

Over the past 20 years, REITs have produced nearly 2x higher total returns than regular stocks in the 12 months following rate hikes on average:

That's because rate hikes often signal a strong economy and inflation, both of which are very beneficial to property owners. Moreover, since real estate is typically financed with long-term fixed-rate debt, it may take years before it shows any impact on interest costs.

Today especially, we think that REITs are likely to do better than regular stocks when interest rates start to rise because: (1) Stocks are priced expensively and offer no margin of safety, (2) inflation is surging, and (3) stocks (businesses) have expanded leverage, even as REITs cut down on debt over the past decade. More on that point below:

Reason #4: REITs Have The Lowest Debt in Decades. Stocks (Businesses) Have Greatly Expanded Debt During the Pandemic.

REITs learned their lesson from the great financial crisis and deleveraged their balance sheet over the past decade. Thanks to that, they entered the pandemic with the strongest balance sheets in their history:

Stocks (businesses), on the other hand, greatly expanded leverage to take advantage of the low interest rates and boost profits. That works well during times of economic expansion, but it also increases risks when we finally go into a recession or suffer another black swan.

Reason #5: REITs Are Resilient And Have More Staying Power. Stocks (Businesses) Not So Much.

Today, a lot of investors wrongfully perceive REITs as riskier than regular stocks because REITs suffered a lot from the last two crises, which were the great financial crisis and the pandemic.

However, it's important to remember that these two crises were very unusual and affected real estate a lot more than your regular recession.

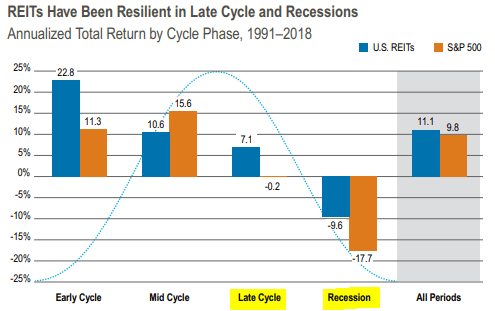

In fact, during most recessions, REITs have actually done a lot better than regular stocks. In a study from Cohen & Steers (CNS), it was found that REITs have historically provided nearly 2x better downside protection during recessions:

That's simply because the business model of REITs is a lot safer. If you own a well-diversified portfolio of rental properties, it's hard to mess it up. But if you operate a regular business, a lot of things can go wrong, and that explains why REIT bankruptcies are extremely rare, whereas companies come and go all the time.

Recently, a reader sent me a message that nicely illustrates this point:

Allow me to share a story, in three parts. We had leases with Sears/Kmart. If one had bought stock in Sears/Kmart and held it today, it was almost 100% loss of investment:1) We leased a warehouse to Sears. In 2018 we sold it to a REIT for a huge profit.2) We leased space in a mall to K-Mart. When that lease came up, K-Mart did not extend (they had options) and closed the store. Efforts to re-lease the space did not pan out, however the supermarket in the mall wanted to expand into the former K-Mart space, so the supermarket bought the entire mall from us.3) We leased a standalone building in a mall we still own to Sears. After Sears closed the store, we released the space at ~30% higher rent. In all three cases being a landlord to Sear/K-Mart turned out much better than being a stockholder. Username: nsolot"

We often forget this, but the business of owning and renting high-quality real estate is really one of the safest businesses out there. This is especially true if the real estate is well managed, conservatively financed, and bought at a reasonable price.

Bonus Reason #6: Individual REIT Opportunities Remain Abundant. Stocks, Not So Much.

Finally, and perhaps most importantly, there are still a lot of REITs that are priced at 20%, 30%, or even up to 50% discounts to their fair value. They dropped early into the pandemic and never really fully recovered despite posting strong results and even hiking dividends in some cases.

We think that these REITs are very attractive because they offer great margin of safety and upside potential as we move slowly move past the pandemic. A good example would be National Retail Properties (NNN), which is still priced at a 25% discount to pre-covid levels, despite doing better than ever and even hiking its dividend in 2020 and 2021. Similarly, W. P. Carey (WPC) also is priced at a 20% discount, despite owning mainly industrial properties, which have significantly grown in value over the past year.

Best of all, while you wait for the upside, you get paid 4%-6% dividend yields to wait. These high yields should mitigate downside risks even further.

On the other hand, we find it much harder to find such opportunities with margin of safety, upside, and yield in the regular stock market.

Bottom Line

We believe that REITs are today a lot safer than regular stocks because:

- Their valuations are more reasonable.

- They provide better inflation protection.

- They generally outperform during times of rising rates.

- Their balance sheets are the strongest ever.

- Their businesses are more resilient and stable.

But don't just buy any REIT. This is a sector in which you want to be selective because your investment results can greatly improve if you can sort out the worthwhile from the wobbly. At this time, my REIT portfolio is mostly invested in net lease, residential, and healthcare REITs because that's where we find the best risk-to-reward in today's market:

(Source: Interactive Brokers. See disclosure at the end of this article)

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,000 members on board and a perfect 5/5 rating from 400+ reviews:

For a Limited Time - You can join us at a deeply reduced rate!