J2R/iStock Editorial via Getty Images

Investment Thesis

So far this quarter I have written articles on two banks I own and consider worthwhile over the medium term, namely Deutsche Bank (DB) with its restructuring efforts winding down in 2022, article here, as well as Societe Generale (OTCPK:SCGLF) which still offers rerating potential again largest peer BNP Paribas (OTCQX:BNPQF) based on a slightly better capital position and a sum-of-the-parts valuation approach, article here.

Today I am looking at my third bank holding, Commerzbank (OTCPK:CRZBF), which despite being vulnerable over the short term from a technical perspective (the stock is up around 27% over the past 3 months) still offers decent return potential over the medium term, albeit with the pace of gains moderating substantially. I think the main strength of Commerzbank is its robust capital position coupled with very low tangible book valuation:

| Commerzbank | Deutsche Bank | |

| CET1 Capital | 13.5% | 13% |

| MDA Buffer | 411 bps | 258 bps |

| Price/Tangible Book | 0.36 | 0.46 |

Compared to other more profitable banks, the difference is even greater:

| Societe Generale | BNP Paribas | |

| CET1 Capital | 13.4% | 13% |

| MDA Buffer | 440 bps | 375 bps |

| Price/Tangible Book | 0.51 | 0.77 |

| Underlying RoTE in 2021, YTD | 10.4% | 10.4% |

What is missing in the comparison is obviously what RoTE can German banks deliver over the medium term. I think that due to business mix (lack of sizable asset management and investment banking exposure) Commerzbank will likely lag Deutsche Bank by around 1% RoTE over the cycle, with the caveat that should the ECB sometime decide to normalize policy this gap may shrink somewhat. However, this lower return is compensated by a lower CET1 capital requirement, as evident from the comparison above.

Operational Overview

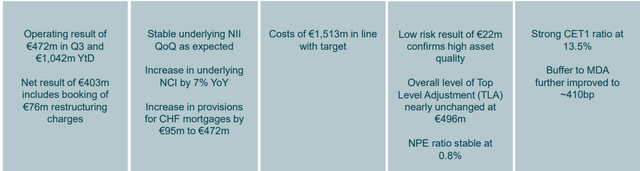

Commerzbank's Q3 results benefitted from a very lost cost of risk (7bps) and a tax rate around 1% (based on 9-month 2021 pre-tax loss), offset by 76M EUR of restructuring charges, overall resulting in a RoTE of 5.8%:

Source: Commerzbank Q3 2021 Analyst Presentation

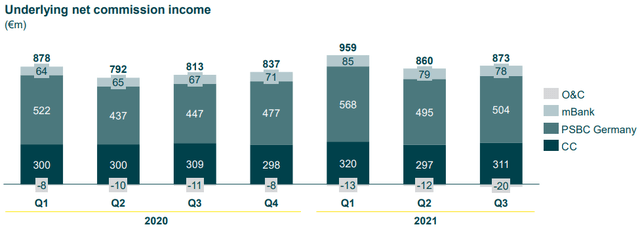

Commissions remain a bright spot, with Q3 2021 net commission up 7.4% Y/Y (please note that in the graph below PSBC refers to Private & Small Business Customers; CC refers to Corporate Clients, mBank is the Polish subsidiary and O&C is Other & Consolidation):

Source: Commerzbank Q3 2021 Analyst Presentation

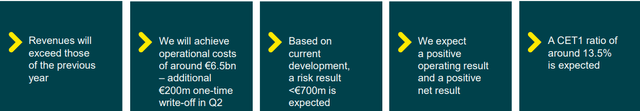

CET1 Capital was at 13.5%, with earnings offsetting regulatory headwinds. All in all, observed performance prompted management to boost guidance:

Source: Commerzbank Q3 2021 Analyst Presentation

With regards to restructuring progress, CEO Manfred Knof made the following comments on the Q3 conference call:

Core of our strategic transformation is a leaner setup with 20% lower costs. This requires 10,000 job cuts that had to be negotiated with the employee representatives. And we achieved very good results in a short timeframe.

In May, we already agreed on the framework for the redundancy program. In July, we kicked off the voluntary redundancy program. And as of now, we are very close to the finalization of all detailed redundancy agreements for all departments of the bank.

In parallel, and also due to the voluntary program, we already have insured and contracted more than half of the gross FTE reduction. 1,500 FTEs are already off payroll. A further 2,100 are contracted for exits in the time period until 2024. And the voluntary program has added another 1,600 FTEs that are going to leave the bank at January 1, 2022. Looking into 2022, and with concluded detailed redundancy agreements, I'm very confident that we will make further significant progress in the restructuring.

Source: Commerzbank Q3 2021 Conference Call

To sum up, some 5200 of the 10.000 full-time equivalents are already off payroll or contracted.

Capital Return Potential

With only 90M EUR remaining to be booked as restructuring charges until year-end 2022, I think it is appropriate to start thinking about levers management has to pull in terms of shareholder returns. While I expect no dividend will be paid in respect of 2021, some sort of interim buyback from 2022 earnings looks possible. A key date to watch will be the capital markets day on March 1 2022 when updated projections for 2024 will be released. Management will likely want to see how credit quality performs once business support measures expire this year, as well as seek further clarity on Swiss mortgages which affect mBank.

Going back to our earlier comparison of the capital position of Commerzbank and Deutsche Bank:

| Commerzbank | Deutsche Bank | |

| CET1 Capital | 13.5% | 13% |

| MDA Buffer | 411 bps | 258 bps |

We see that Commerzbank is sitting on a quite substantial MDA buffer, which in absolute terms and per share looks like this:

| Commerzbank capital buffer vs DB | EUR Billion | EUR, per share |

| CET1 Capital | 0.88 | 0.7 |

| MDA Buffer | 2.68 | 2.14 |

While bringing the MDA buffer down to Deutsche Bank's 258 bps level looks unlikely in the near term, given ongoing uncertainties and restructuring still in progress, it is certainly something to keep an eye on. At a 258 bps MDA buffer Commerzbank would be running at a CET1 ratio of around 12%, which, while on the low side as far as European banks are concerned, is not something unheard of. For example, as of the time of writing, Banco Santander (SAN) has a fully-loaded CET1 of 11.85% and is operating at a payout ratio of around 40%, split between a mix of buybacks and dividends.

Given the current share price of around 6.95 EUR the 2.14 EUR/share capital buffer distribution could represent a 30% payout, albeit spanning the medium to long term. Key risk to this scenario is an impact on CET1 ratio from Basel IV beyond what can be absorbed by organic earnings.

Another source of capital could be a potential sale of mBank down the road, however this seems unlikely before the Swiss mortgages issue is resolved.

Investor Takeaway

While a number of near term uncertainties remain, ranging from wage negotiations given hot inflation reading in Germany (+4.5% Y/Y in October), ongoing restructuring, the Swiss mortgages issue at mBank (which resulted in an incremental provision of 95M EUR in Q3, bringing total provisions to 472M EUR) and the uncertain future of the 15% government stake, I think Commerzbank's valuation and capital buffer make for a decent medium term investment. Even assuming a modest through-the-cycle RoTE of 5%, I think investors will likely enjoy double-digit returns via dividends and buybacks, with Commerzbank likely to wind down its substantial MDA buffer once Basel IV is implemented in 2025. A pullback over the short term cannot be excluded given strong price momentum over the past 3 months. However I would view it as a buying opportunity.

Thank you for reading.