Justin Sullivan/Getty Images News

AT&T (NYSE:T) stock has seen a steep decline in the last six months. During this time the stock's value has been eroded by a quarter. During an update in May, CEO John Stankey mentioned that the dividend payout will be 40% to 43% of the free cash flow for the main telecom business. This would be in the range of $8 billion to $8.6 billion on free cash flow projection of $20 billion. However, due to the massive erosion in stock value since the announcement, there is a high chance that the management will have to backtrack on this figure.

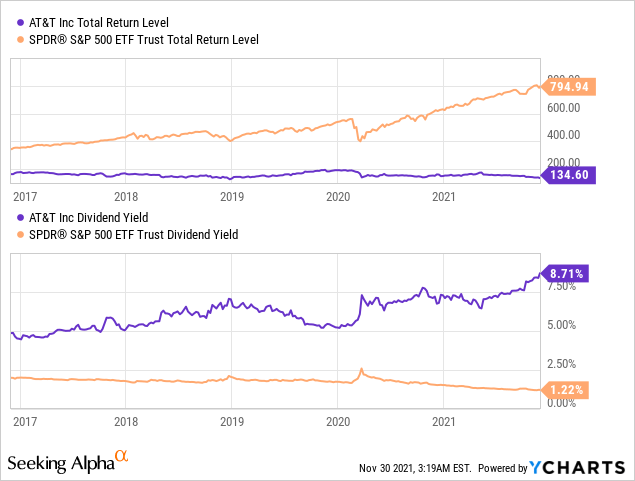

If the management goes ahead with the payout mentioned earlier, then the remaining AT&T stock could start with a dividend yield of over 7.5%. This would show Wall Street's lack of belief in the main telecom business of the company. Hence, the management would need to dial down on the dividend payout to get the yield in a reasonable range.

We have already seen a signal of this in the recent quarterly earnings when the management did not clearly mention the dividend payout they would give. Investors betting on future dividend yield should look at the current math and gauge the probable dividend payout after the spinoff.

Can management keep its word?

In a shareholder update in May, AT&T's management was very clear that they would like to have a dividend payout in the range of 40% to 43% of the FCF for the main telecom investors. This would be equal to $8 billion at the lower end or $1.12 per share. That would have effectively chopped the dividends paid by about half. In the last twelve months, AT&T has paid dividends of about $15 billion.

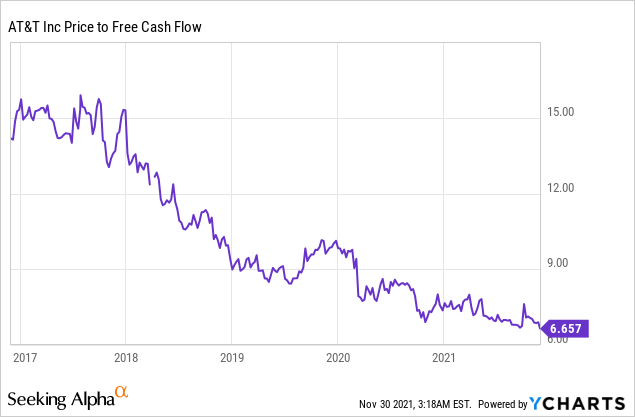

However, the recent massive drop in the stock value could make it untenable for the management to deliver $8 billion of dividends. Currently, the stock price is just over $24 with a dividend yield that is close to 9%. The valuation for Warner Bros. Discovery is close to $59 billion (700 million diluted shares of Discovery*24.73/0.29). AT&T investors will get 71% of this or $42 billion which is equal to $6 per share. Hence, the remaining AT&T stock after spinoff is valued at $18 per share.

When looking at the dividend yield, this would be equal to $1.12/$18 or 6.5%. The decline in stock does not seem to be over. If the current bearish momentum continues, we could see the stock price fall to a range of $21 to $23. At this point, the remaining AT&T stock after spinoff would be worth $15 to $17 per share. If the management goes ahead with the dividend promised, the dividend yield would be in the range of 6.8% to 7.5%. This level of dividend yield does not show much faith in the stock by Wall Street.

Prior to the merger with WarnerMedia, AT&T stock had only once given a dividend yield of close to 7% which was at the height of the Great Recession. To start again with a yield of close to 7% could be a bad signal for Wall Street and the management might try to dial it down a bit.

Dividends or Buybacks

The management is already looking to move away from a set goal in terms of dividends. In the recent quarterly earnings, CEO Stankey gave an ambiguous answer saying further information could only be given when they were "a little further along in the process..." and "have some degree of visibility". No concrete numbers were given during the earnings which would show how the management would go about giving dividends.

Figure 1: AT&T has a massive debt load which might prevent aggressive buybacks. However, at the current low price level, management could end up favoring buybacks to provide a floor to stock decline after the spinoff.

As mentioned above, it is highly unlikely that we would see dividend yields of over 7% once the spinoff is completed. The management can cut the dividend further and allocate some resources to buybacks which would provide a floor to the stock price. Alternatively, they could end up trying to reduce the debt load which would make the stock more attractive to Wall Street. Either way, investors betting on a high dividend yield after the spinoff could get a big surprise.

How low can the stock fall?

The recent decline in stock value from early 2020 to late 2021 has been equal to 40%. This is a similar decline in the stock seen during the Great Recession. The core issue with the stock price is the lack of clarity on the spinoff and future 5G service roadmap. The management cannot give a definitive answer about the dividends, buybacks, etc. until the stock price stabilizes. If the management sticks to its word of giving $8 billion to $9 billion in dividends, it could end up with a yield of over 7% which is a red flag for a low-growth telecom business.

Figure 2: The gap in dividend yield between T and S&P 500 has increased over the last few years. At the same time, the total returns of T have massively lagged behind the broader market.

The 5G service is also showing several challenges in increasing the coverage. AT&T recently received a warning from FAA to limit its 5G service in the C-Band spectrum because it could interfere with airplane electronics. On the other hand, T-Mobile (TMUS) is ramping up its coverage and has already reached 200 million people which is earlier than the previous deadline set by the company. This coverage would provide 5G service to over 80% of its customer base. The big worry now is that T-Mobile could start eating into the market share of AT&T. If we see even a minor increase in churn rate, Wall Street could end up a major bearish momentum of T stock.

While the stock seems cheap at the current valuation level, there are a number of headwinds that can pull the stock down and also limit future growth potential.

Investor Takeaway

AT&T's management has not clarified the dividend level they would like to give in the recent quarterly earnings. Future stock price decline in AT&T could lead to lower dividends as the management would like to prevent a very high dividend yield for AT&T after the spinoff. Instead of dividends, the management could focus on share buybacks to provide a floor to the stock price or it could divert resources to aggressively reduce the debt load.

T stock has seen close to a quarter of its market cap eroded since the spinoff announcement in May. Investors looking for value in T stock should consider the 5G roadmap of the company and the rapid expansion of T-Mobile's 5G services and coverage. There seem to be a lot of downsides for the stock at the current moment with very few upsides. Waiting for the stock price to stabilize would be ideal till more clarity is available from the management.