EXTREME-PHOTOGRAPHER/E+ via Getty Images

Main Thesis/Background

The purpose of this article is to evaluate the Invesco KBW Bank ETF (NASDAQ:KBWB) as an investment option at its current market price. This is a sector-specific fund, with a focus on bank stocks exclusively. Importantly, it is heavily weighted towards the biggest banking names, and it is managed by Invesco. KBWB is my preferred way to own the banking sector, and I have had a bullish view on it over time. However, I turned to a more cautious tone when I last covered it almost four months ago. In hindsight, this was a reasonable take, as the fund's return since then has been modest, as shown below:

Source: Seeking Alpha

As we approach 2022, I was considering adding to my banking position ahead of the new year. But after some thought, I am going to wait and see if a better entry position present itself. This caution is due to a few reasons. One, the market is starting to come under pressure, and that makes me generally less bullish on the big U.S. banks. While a correction to the upside is possible, I don't want to overextend myself in case we see more volatility due to the newly emerged COVID-variant. Further, bank earnings had been getting a boost from a release of credit loss provisions, and the benefit from that action is not sustainable now that the reserves are mostly gone. Finally, yields have recently been on the decline, as investors weigh emerging global risks, such as variants, supply-chain issues, and other geo-political concerns. Banks had been rising on hopes of action by central banks, but the recent developments I just mentioned are now putting rate hikes in doubt.

General Market Concern Weighing On Earnings Estimates and Yields

To begin, I want to look at the broader market picture. This impacts general outlook for stocks as a whole, and is absolutely relevant to my outlook on large U.S. banks, and KBWB by extension. When considering a play on the banks, one has to be generally optimistic about the economy and the markets, as all are entwined. Yes, KBWB could rise even if the broader market falls. Given that the S&P 500 is very over-weight Tech stocks and that is a sector at risk when yields rise, there is plenty of opportunity for banks to out-perform (as they tend to do well when yields rise).

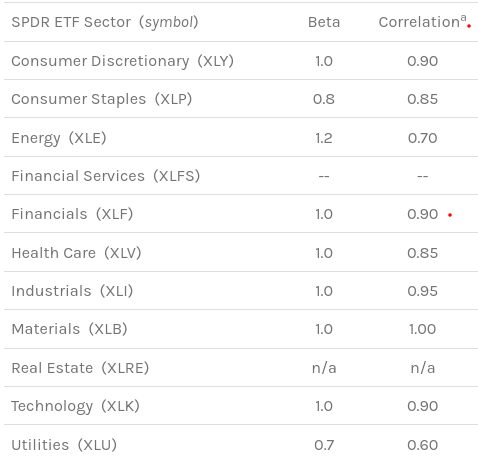

Yet, we have to consider the Financials sector is one of the most correlated to the S&P 500 over long stretches of time:

Source: Institute of Business and Finance

My general point here is that when one considers buying in to Financials, they want to be expecting a general market rise. With this backdrop, it should make sense why I am getting a bit cautious. The major indices are down between 5-8% since hitting new highs not too long ago, and there are multiple headwinds on the horizon.

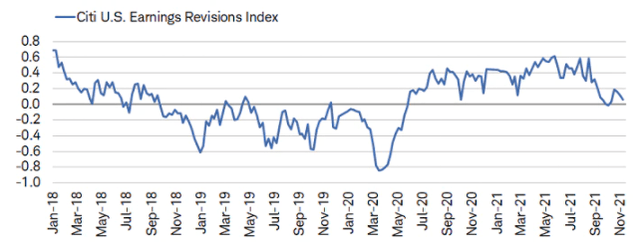

One headwind that is quite important is the sharp change in earnings revisions from analysts. For most of 2021, earnings have impressed and, as the year has gone on, we saw a consistent level of earnings upgrades along the way. This helped boost investor confidence, sending P/E ratios higher, as investors were willing to pay more for earnings they expected to materialize later.

When we take an assessment of the current environment, we see a change has begun to occur. While upward revisions were indeed the story for most of the year, those upward revisions have evaporated of late:

Source: Charles Schwab

The implication here is investors are going to start needing other reasons for bidding up equities. With a challenging global backdrop, there are plenty of reasons for hesitation. The emergence of the omicron variant is one, along with renewed travel restrictions and continued supply-chain issues. All of these factors are weighing on sentiment, which is a key reason why the rise in yields has cooled off recently. This has hurt the Financials sector in particular, which had been out-performing as yields ticked higher and central banks were expected to be more hawkish in 2022. Across the developed world, the outlook on rate hikes has softened:

Source: Yahoo Finance

My overall takeaway is not to be alarmist, but to approach investing in December with a grain of salt. We have seen a reasonable pullback, but there are plenty of reasons now for investors to get jittery before the new year begins. I think it is a bit too early to start taking on more risk, supporting my neutral view on KBWB.

Earnings Are Strong, But Boost From Loss Provisions Subsiding

I now want to shift in to a micro-look at KBWB, which a focus on the fund's largest holdings. While the fund has over two dozen banks in its portfolio, it is dominated by the performance of some of the largest in the country. The top five holding actually make up just under 40% of total fund assets, and include Wells Fargo (WFC), Bank of America (BAC), JPMorgan Chase (JPM), U.S. Bancorp (USB), and Citigroup (C).

The good news here is that there has been strong earnings reports out of these names, and the sector at large. It is hard to argue against billions of profits, and the banks are indeed flush with cash. However, we should note that profit did drop across the big five in KBWB's portfolio, down slightly in Q3 when compared to Q2:

| Company | Q2 2021 Profit (billions) | Q3 2021 Profit (billions) |

| WFC | $6.0 | $5.1 |

| BAC | $8.9 | $7.7 |

| JPM | $11.9 | $11.7 |

| USB | $1.9 | $1.9 |

| C | $6.2 | $4.6 |

Source: Seeking Alpha Earnings Reports

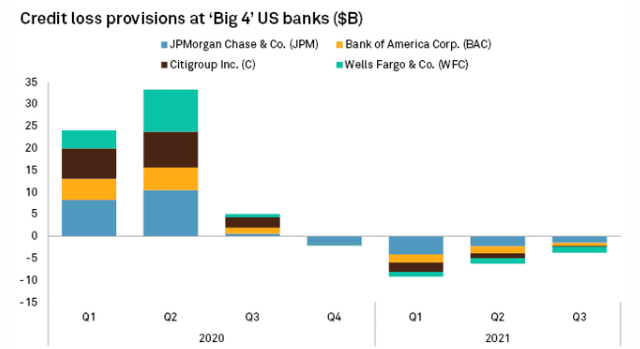

Again, this is not too alarming, considering the vast amounts of profit these institutions are making. However, we should consider the way behind this trend. Part of the reason has been that earnings, especially at the largest banks, have been padded by the release of credit loss provisions that were set aside on the onset of the COVID-19 pandemic. Those losses did not materialize, due to tremendous federal support and a quicker than expected economic recovery. As a result, the banks have been gradually releasing these loss provisions each quarter in 2021, which is adding to their "net profit".

However, as the graphic below shows, those releases are dwindling, and most of them have known already found their way to quarterly earnings reports:

Source: S&P Global

The conclusion I draw here is that the major banks have artificially showed earnings growth due to some accounting moves. The credit loss provisions was indeed money the bank's expected to lose. So removing that title for the funds is certainly positive. Yet, it clouds the actual sustainable earnings power of KBWB's top holdings over the course of 2021. Now that this tailwind is gone, we are starting to see the impact - in the form of lower profits in Q3 than Q2.

I am not saying the banks will not continue to churn out profits in the quarters ahead. In fact, my outlook on the banks remains very positive. Yet, the stocks are not cheap, and earnings in the next few quarters are not likely to beat the last few quarters now that the benefits of shifting the credit loss provisions have come to a conclusion. As profits become more normalized, it will limit the premium investors will put on these stocks.

Cost Savings From Branch Closures Continues

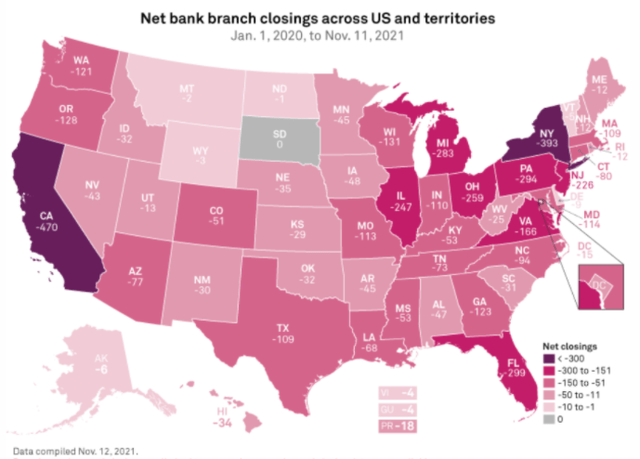

While I have noted some concerns, I do want to balance out this review with some positives on the banking sector. After all, I do own KBWB, and I plan on continuing to do so. Just because I am not looking to add more now does not mean I would advocate outright selling here. One reason I continue to like the banks, big and small alike, is that there has been an aggressive focus on cost cutting over the past decade.

One fundamental trend we have seen in this sector has been the consistent closure of bank branches. This has resulted in plenty of cost savings, and more streamlined operations. While this started years ago, the good news is the trend continues to this day. In fact, 2021 saw a substantial decline in bank branches across much of the country, as shown below:

Source: S&P Global

I continue to view this positively, and see no reason not to expect it to continue in 2022. In general, this is an easy way to see cost savings for a major bank, and I am glad to see it is being taken advantage of so consistently.

Merger Activity Will Probably Slow Next Year

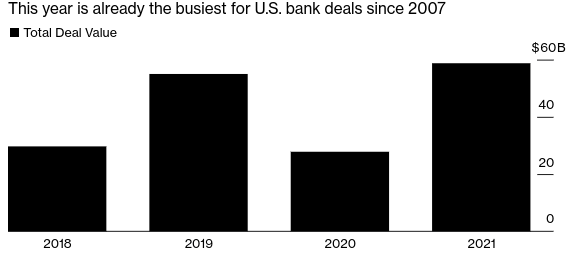

My final point is another reason why I see some validation for a modest outlook for the banking sector as a whole. KBWB has seen a boost this year from a surge in M&A activity within the sector. This consolidation is generally a positive for equities, as investors like the cost savings and synergies that result. However, I expect this M&A activity to slow next year, as 2021 saw an extremely number of deals, both in number and value. For perspective, the graphic below shows the volume for the past four years:

Source: Bloomberg

The takeaway here is simple - after such an aggressive year of M&A, we will probably see a bit of a breather next year. This will be because of more scrutiny from regulators before approving proposed mergers, and also because demand will wane as the attractiveness of new deals is sure to be more limited given how much activity took place this year.

Bottom line

KBWB keeps giving me gains, but the gains are slowing. With an uptick in market swings over the past month or so, I have been considering making some portfolio adjustments. Given the winning streak I have had with KBWB, I considered adding more cash to this fund. Yet, after review, I believe I should be patient, and only add if I can get a better price at some point over the next few months. I see some headwinds, such as general equity weakness, a reduction in rake hike expectations, and a release of credit loss provisions throughout 2021 which has made earnings appear better than they really are. As it stands now, I think maintaining a neutral outlook on KBWB makes sense, but I will keep a close eye on it going forward. As a result, I suggest readers approach any new positions in this fund selectively at this time.

Please consider the CEF/ETF Income Lab