RealPeopleGroup/E+ via Getty Images

Most investors love net-lease REITs. They offer solid dividend yields, include three dividend champions (O, NNN, and WPC), and use a fairly simple business model that turns a large portion of revenue into dividends. Who can blame investors for gazing longly at the sector?

We covered the sector in our net lease update for subscribers. For those without a membership, we recently shared a large section:

Dividend Champions Duel: Realty Income vs. National Retail Properties

We're going to build on that article by including updates on several other REITs in the sector.

Quick Recap About Net Lease REITs

These REITs tend to have high dividend yields because they are able to turn the majority of revenue into dividends.

In 2020, Realty Income (O) had rental revenues of $1,639,533.

Note: All values in thousands.

That resulted in REIT/BASE AFFO of $1,148,977.

The 84.1% dividend payout ratio on REIT/BASE AFFO gives us a total dividend payout of about $966,289. That's about 59% of revenue turning into dividends. So when the net lease REIT gets a rental check, the majority of that cash is headed to the shareholder's account. When people say they like rentals but don't like REITs, I have to wonder how much they enjoy fixing toilets.

It's not like the rest of the rent is wasted. While the REIT does have some overhead costs, their biggest cash expense was interest at $309,336. By itself, interest expense counts substantially more than all other cash expenses combined. Remember that REITs record depreciation on the value of their real estate, even when the buildings are appreciating in value. Consequently, the income statement will always list a huge "expense" for depreciation.

To be clear, if you owned a rental and had a mortgage on it, the bank wouldn't give you better borrowing terms than Realty Income can achieve.

Besides paying interest, general and administrative expenses came to $69,752. To put that in perspective, it's about 4.25% of revenue. How much do ineffective property managers cost? Right, significantly more. So if investors in REITs get less overhead and do less work, it should be clear why these investments belong in most portfolios.

So what else does a net-lease REIT do with its cash flows?

The 15.9% of REIT/BASE AFFO they retrained gives them about $182,687 towards additional acquisitions which are fueling their growth rate in AFFO per share.

The numbers will vary some for each REIT, but it's the same general business model. Collect rent, handle overhead and interest expense, then send a huge portion of the total revenue on to shareholders.

In this article, we're going to cover the other net lease REITs.

We wouldn't be surprised to see some of these other REITs become dividend champions like O, NNN, and WPC. Two that clearly have that potential are STOR and ADC. Long leases, solid business strategies, and careful use of leverage put them in a great position.

STORE Capital

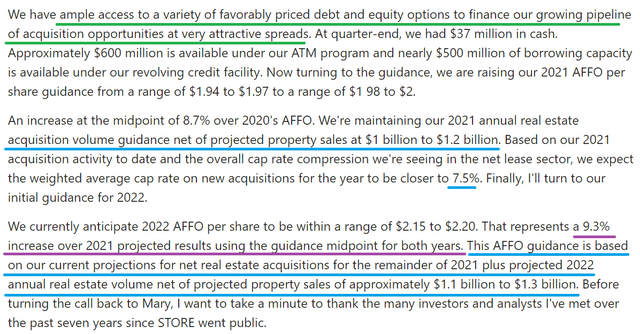

STORE Capital (STOR) confirmed the same strategy Realty Income is using. On the Q3 2021 STOR earnings call, CFO Cathy Long said:

That’s the same plan. Remember that we said Realty Income would need to clear a hurdle rate of about 4.6%? STOR’s hurdle rate should be slightly higher. However, a 7.5% cap rate on acquisitions would easily give them a favorable spread that would allow them to be very active on acquisitions. This is how net lease REITs generate value for shareholders. The underlying business model comes down to being able to finance the real estate more effectively than the tenant could. That’s the reason tenants choose to do business with net-lease REITs. Higher acquisitions at attractive spreads indicate that tenants still find STOR’s value proposition extremely attractive.

Their ability to hit such aggressive growth targets for AFFO per share depends on being able to continue issuing equity and debt to finance acquisitions.

Agree Realty

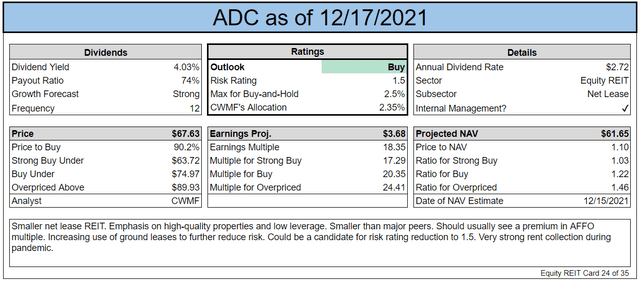

A week ago we provided a report on Agree Realty (ADC). Our work on the other net lease REITs reaffirms that research. With our expectations reinforced, ADC earns a modest bump to the target. Expect debt and equity issuance over the next year. However, ADC has already used some forward equity offerings to handle their issuance. That puts them in a position to be aggressive going after deals.

Looking at their debt profile with the increase in shares already lined up, we're dropping ADC's risk rating from 2.0 to 1.5. The balance sheet is excellent.

W.P. Carey

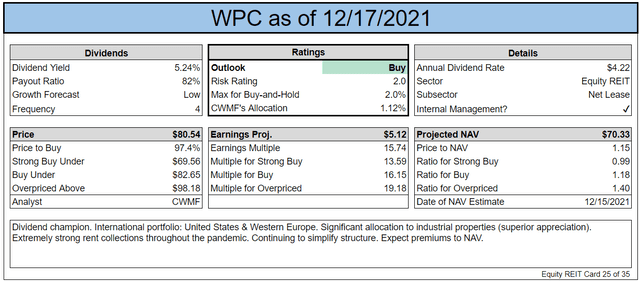

W.P. Carey (WPC) has a higher multiple of AFFO per share than it averaged over the last few years. The appearance of a premium would make some investors think WPC is expensive. However, WPC’s prior AFFO per share was inflated by including investment management contributions to AFFO. Since that AFFO portion of AFFO is essentially non-recurring (rapidly running toward $0), it didn’t deserve much weight in analysis. All we care about is the real estate portfolio and the AFFO per share produced by the real estate. If you hear WPC’s growth rate in AFFO per share is weak, you’re hearing from someone who doesn’t want to recognize the difference in where the AFFO originated. The growth rate in AFFO per share reported in several tools should improve materially over the next few years as investment management AFFO is almost gone (eliminating the accounting headwind).

If you’d like to know more about WPC, many subscribers enjoyed WPC: A Quick Rebuttal.

Four Corners Property Trust

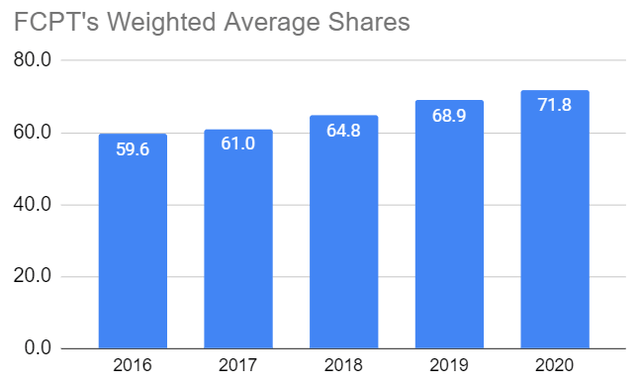

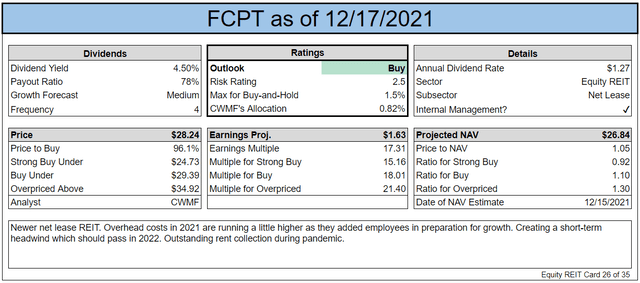

Four Corners Property Trust (FCPT) isn’t driving new equity issuance fast enough for our taste. From 2017 to 2019 they were issuing shares at a reasonable speed, but it slowed down a bit during 2020:

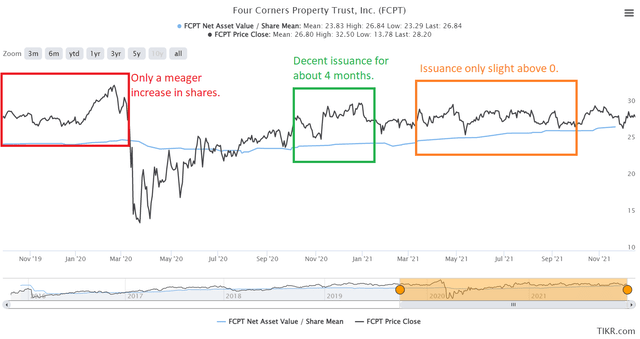

For most of 2020, they were barely issuing new equity. They picked up in Q4 2020, which makes sense since the price recovered to reach a healthy premium to net asset value per share. However, they had a fairly similar price through most of 2021 and hardly issued any new shares. We charted the price to NAV and highlighted segments to reflect issuance activity:

Source: TIKR.com

See the issue? FCPT still had a respectable premium to NAV and growth benefits shareholders due to improved economies of scale on overhead costs and new cheap debt bringing down the weighted-average rate on debts.

Spirit Realty Capital

Spirit Realty Capital (SRC) trades quite a bit above their five-year average multiple of AFFO per share (13.7x today vs 12.4x average). However, SRC has been improving the REIT during that period and they’ve been a monster on external growth. Shares outstanding have been increasing rapidly to fuel a large acquisition pipeline. To the extent SRC can maintain a high enough share price to fund that acquisition, it benefits existing shareholders. Yet there is also some risk of SRC’s multiple coming down, which would make issuance more difficult. During the pandemic, SRC was one of the net lease REITs with weaker collections. However, they have been working to reduce risk.

Management is targeting a BBB+ credit rating, which would be great. They recently reached a BBB credit rating and are running about a year behind schedule. Getting to that BBB+ rating may require using more equity and less debt in acquisitions, which makes the acquisitions less accretive to AFFO per share since debt is “cheaper.” However, they deserve credit for actively pushing for growth. Historical results get a bit messy because they spun off a large chunk of properties a few years ago. That transaction distorts the historical results since getting rid of the properties reduced AFFO per share. On the other hand, they were getting rid of their weakest assets, so the remaining portfolio deserves a higher multiple.

While SRC has been very active in issuing shares, they previously were not successful in driving outsized growth in AFFO per share. Remaining aggressive with today’s low-interest rates could help, but if they want to reduce leverage they won’t be getting to issue as much debt at the low rates available today unless they issue an enormous volume of shares. This matters for comparisons because some peers are able to achieve substantial spreads between their WACC (weighted-average cost of capital) and the cap rate on acquisitions.

We determined the target for SRC was a bit too low and gave it a larger than average bump, but it is still the net lease REIT furthest from entering our target “buy under” range.

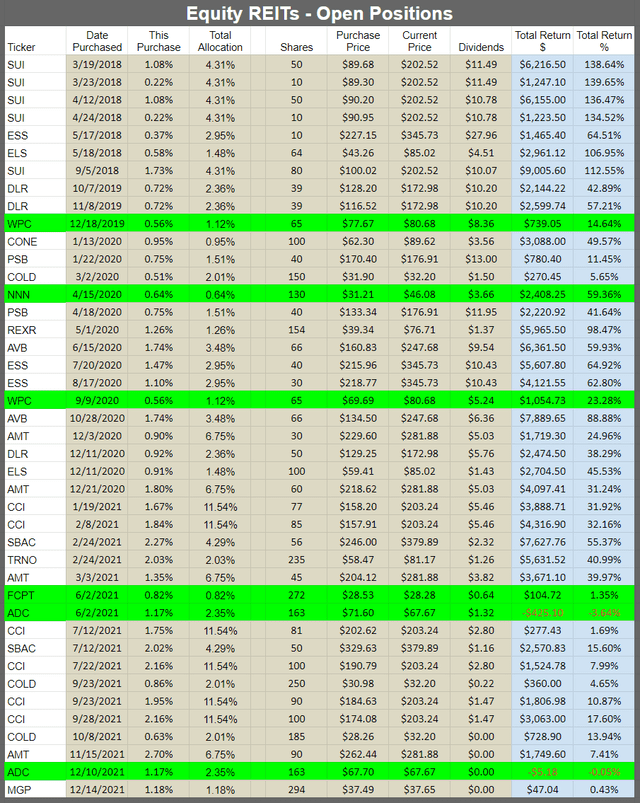

Open Positions

All our open equity REIT positions are shown below with the Net Lease REIT positions highlighted in green:

Source: The REIT Forum

The last position, in MGM Growth Properties (MGP), could be considered a net-lease REIT, but the emphasis on gaming in their portfolio puts them in a “gaming” subcategory.

Conclusion

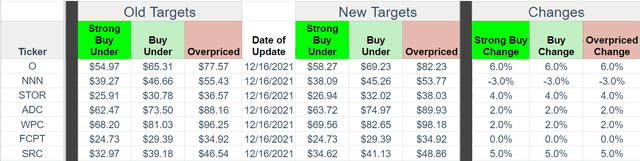

The following changes were applied to our targets in the Net Lease sector update.

The main points of the first net lease article were:

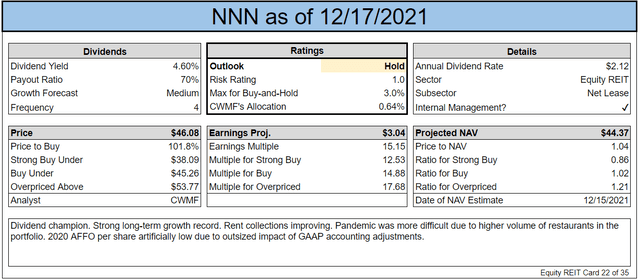

- NNN: Investors and analysts didn’t understand National Retail Properties’ AFFO per share calculation. It seems they still don’t. That made NNN too cheap in 2020, but they’ve recovered despite slower underlying growth in the power of their portfolio. 2020 AFFO was artificially low. 2021 and 2022 are artificially high. The calculations should produce headwinds to “AFFO” per share going into 2023. -3%

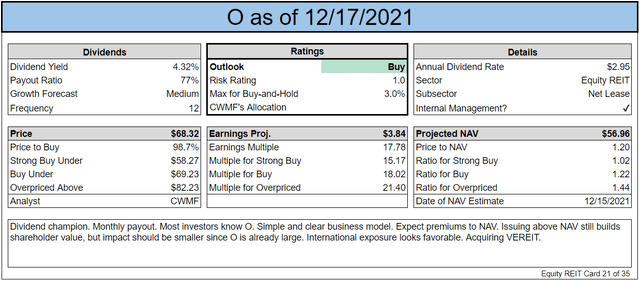

- O: Realty Income surprised with strong AFFO per share guidance despite spinning off ONL. We looked into several potential reasons, but the biggest factor is extremely aggressive acquisition plans. With clear plans for strong growth, they get the biggest boost. +6%

The main points of this article are:

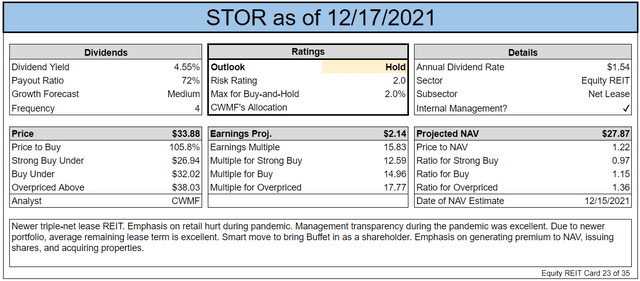

- STOR: STORE Capital is also planning to deliver outstanding growth through heavy acquisition activity. That’s executing on the model that works so well. +4%

- ADC: Agree Realty has foreshadowed another year of aggressive acquisitions, which should drive strong growth. Risk rating down to 1.5 (was 2.0) on low leverage. Modest boost as the guidance from O and STOR reaffirms our expectations for ADC. +2%.

- WPC: W.P. Carey still looks good. They trade above historical multiples for AFFO per share because WPC’s AFFO quality keeps improving. +2%

- FCPT: Four Corners Property Trust hasn’t been active enough on acquisitions for our taste. +0%

- SRC: Spirit Realty Capital targets were a bit on the low side. They’re still the furthest from our targets though. Actively seeking growth, but less accretive impacts. +5%

Index Cards

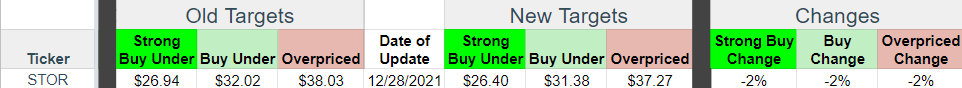

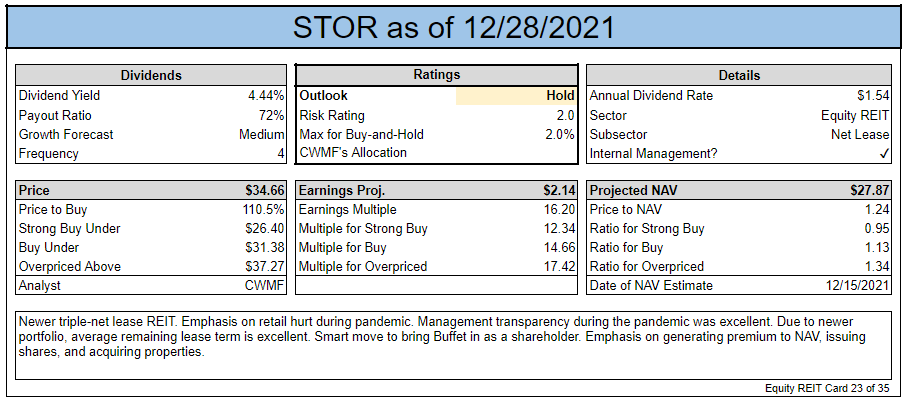

However, following the abrupt departure of Christopher Volk from STOR, we reduced the STOR targets by 2% from those listed above:

That leads to the following updated card:

Thinking about trying The REIT Forum? Take advantage of our Post-Christmas Sale to get 20% off on your first year and 33% off our annual membership. Click the banner below to start a two-week free trial!

We're already down from 30 spots to only 8 remaining spots, so there's no time to waste. Prices shown on the checkout page include the discounts.