CinemaHopeDesign/iStock via Getty Images

The Q4 Earnings Season for the Gold Miners Index (GDX) is set to begin next month, and one of the first companies to report its preliminary results is Equinox Gold (NYSE:EQX). Despite a slower start to 2021 due to a blockade at Los Filos, Equinox finished strong, producing ~210,400 ounces, a record quarter for the company. This solid performance helped the company grow production 26% year-over-year. Looking ahead to FY2022, production should increase at least 20%, but I would expect another very high-cost year. With a few high-margin Tier-1 jurisdiction producers paying dividends and trading at close to 1.0x P/NAV, I see more attractive opportunities elsewhere in the sector.

Equinox Gold Operations

Company Website

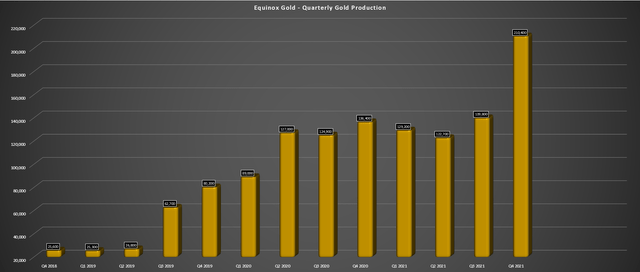

Last week, Equinox Gold released its Q4 and FY2021 results, reporting quarterly gold production of ~210,400 ounces, a new record, and a 50% increase sequentially (Q3 2021: ~139,800 ounces). This was helped by a blow-out quarter from Mesquite, which produced ~66,900 ounces, a more than 130% increase from Q3 2021 levels, and well above my estimates. Given the solid performance, Equinox beat its guidance midpoint of ~593,000 ounces by nearly 2% and should have no issue coming in within its cost guidance of $1,300/oz to $1,375/oz.

Equinox Gold Quarterly Production

Company Filings, Author's Chart

Given the impressive Q4 performance with high double-digit production growth, the company also reported record annual production, with gold production increasing 26% year-over-year. This was despite a much softer year at Los Filos, which was impacted by a nearly 2-month disruption due to an illegal blockade at the mine. With what should be a full year of contribution from this asset in 2022 and the start of production at Santa Luz in Q1, Equinox has more growth coming down the pike and a very solid year ahead in 2022.

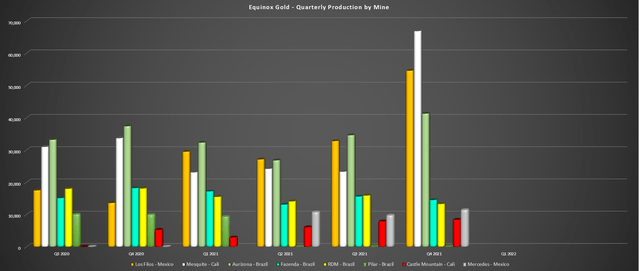

Equinox Production by Mine

Company Filings, Author's Chart

Digging into the results a little closer, we can see that all of the company's operations had a strong performance in Q4, with the two highlights being Mesquite and Aurizona. At Aurizona, Equinox produced ~41,300 ounces, an ~11% increase year-over-year, which helped the mine to meet its guidance of 135,000 ounces. Finally, at Los Filos, while guidance was revised sharply lower due to the blockade (180,000 ounces to 130,000 ounces), it did at least beat revised guidance with a strong finish to the year (54,600 ounces). Among the portfolio, the only real misses were RDM and Mercedes, with the former being a small contributor and the latter divested.

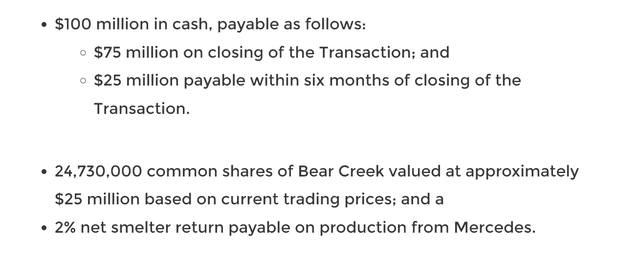

Mercedes Transaction

Company News Release

Given the sluggish performance from Mercedes in 2019/2020 before Equinox acquired the company, I'm not surprised that it divested the Mexican asset, and it actually got a solid price. This is because Equinox will receive total consideration of $100 million in cash from Bear Creek Mining (OTCQX:BCEKF), ~$25 million in shares, as well as a 2% net smelter return royalty on production from the asset. Given that this was a higher-cost asset, this was a solid move from Equinox, allowing it to clean up the portfolio and improve its jurisdictional profile, all while providing a small boost to its cash balance and investment portfolio.

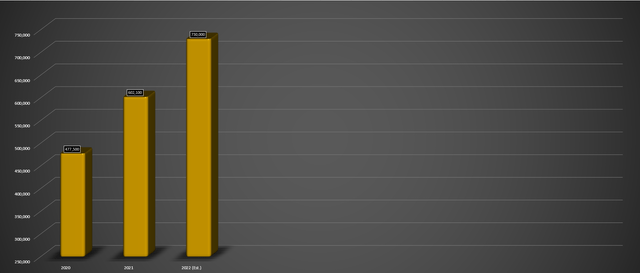

It's also worth noting that despite the divestment of this asset, production will still increase meaningfully next year, with a full year of contribution from Los Filos, higher production from Castle Mountain, and commercial production from Santa Luz (~111,000 ounces) picking up the slack. This should set up the company to produce over 725,000 ounces in FY2022, translating to another year of 20% plus production growth. In a sector where even a mid-single-digit increase in production is respectable, this certainly makes Equinox stand out among its peers.

Equinox Annual Gold Production

Company Filings, Author's Chart

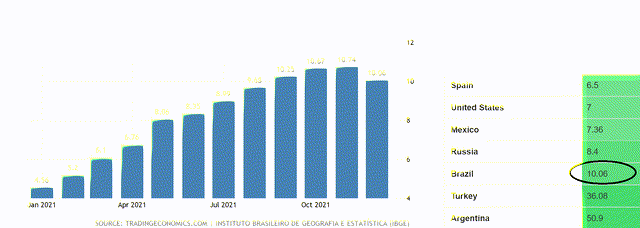

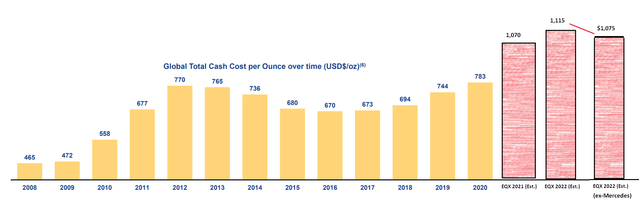

However, while production is rising at a much quicker rate than peers, costs are also rising rapidly and are sitting well above the industry average. This is evidenced by guidance for all-in sustaining costs of $1,338/oz at the midpoint in FY2021, a nearly 30% increase from FY2020 levels. Looking ahead to FY2022, I expect to see similar costs, with inflation rates in Brazil well above the industry average (Equinox has four operations in Brazil with Santa Luz) and inflationary pressures related to fuel and consumables, and labor across all jurisdictions. So, even after the divestment of Mercedes and bringing on a lower-cost mine with Santa Luz, I would expect to see FY2022 cash costs of $1,075/oz and all-in sustaining costs near $1,325/oz.

Brazil Inflation Rate

TradingEconomics.Com, Instituto De Geografia E Estatistica

Industry-Wide Cash Costs vs. EQX Estimated Cash Costs

Gold Royalty Corp Presentation, Author's Drawing/Notes

Looking at the chart above, this would represent only a slight decrease from my previous estimates ($1,115/oz) and a slight increase from estimated FY2021 cash costs of $1,070/oz (guidance: $1,050/oz midpoint). If we compare this to other gold producers across the sector, these costs are well above the peer group. In fact, even if we assume that inflationary pressures push industry-wide costs to $855/oz in FY2022 (7% above 2020 levels), Equinox's cash costs would be more than 25% above the peer average, making it a much lower-margin producer for the time being.

With inferior margins and a mediocre jurisdictional profile, I don't see any reason that the stock should command a valuation of 1.0x P/NAV. Some investors will argue that its growth profile and a trend towards improving costs should justify a premium multiple. However, we are still years away from a meaningful improvement in costs, with the most significant improvement set to occur when the Greenstone Gold Project starts commercial production in H2 2024 (~240,000 ounces at sub $750/oz costs). So, while a re-rating will be in order if Greenstone doesn't see a capex blowout like Magino and Cote, and once it's in production, I think a more fair multiple based on the current portfolio is 0.80-0.85x P/NAV.

The good news is that with an investment portfolio valued at ~$450 million, Equinox opportunistically taking some profits on its Solaris shares into strength, and additional cash from the Mercedes deal, Equinox can easily fund its growth projects. Having said that, I would be surprised if we don't see a slight increase in capex vs. estimates at Greenstone, given that both Magino and Cote, which are other larger projects being built in Ontario, both saw high double-digit increases to their initial capex estimates. This could weigh on the asset's NPV (5%) slightly, depending on whether inflationary pressures continue to worsen, given that Equinox started construction much later than IAMGOLD (IAG) did at Cote (Q4 2021 vs. Q3 2020) when inflation was more muted.

Valuation & Technical Picture

Equinox currently has ~301 million outstanding shares and ~350 million fully diluted, translating to a fully diluted market cap of ~$2.62 billion. If we compare this figure with its estimated net asset value of ~$3.55 billion, the stock trades at approximately ~0.74x net asset value, which is a reasonable valuation for one of the better growth stories sector-wide. Based on what I believe to be a conservative fair value of 0.85x P/NAV (pre-Greenstone production), I see a fair value closer to $9.00 per share.

While this fair value points to a 20% upside from current levels, I generally prefer to buy at a minimum 30% discount to fair value for small-cap or mid-cap producers. This is required to bake in a meaningful margin of safety to protect against downside volatility in metals prices. After applying this discount, the low-risk buy zone for the stock comes in closer to $6.30; hence I do not see the stock at a low-risk buy point currently.

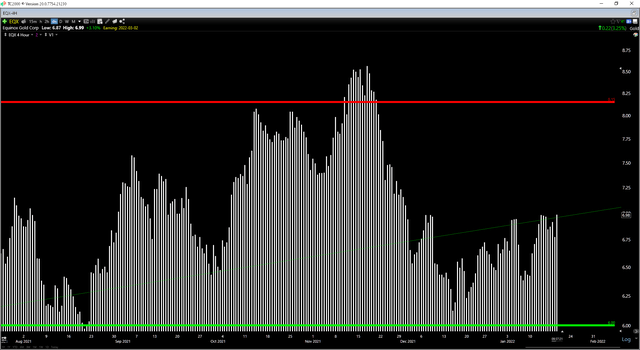

EQX Technical Chart

TC2000.com

Moving over to EQX's technical picture, we can see that the stock has a strong support area at $6.00, which I highlighted in my previous article, and a short-term resistance zone at $8.15. With the stock now trading at $7.50, it is trading in the upper portion of this trading range, confirming that this is not an ideal buy-point. This doesn't mean that the stock can't go higher, but I prefer to buy at or below support when it comes to stocks that I see as sector performers. While Equinox benefits from an enviable growth profile, it is a higher-cost name, so I am more neutral on the stock short-term.

Gold dore bars

Company Website

Equinox had a solid finish to FY2021, and looking ahead to FY2022, we are likely to see at least 20% production growth, even after accounting for the sale of Mercedes. However, while the production growth is impressive, this is partially overshadowed by cost increases, with Equinox being one of the highest-cost producers in the intermediate producer space. This will change dramatically once Greenstone is online, but this is three years away. Hence, with high-margin producers with growth profiles trading near 1.0x P/NAV, I think there are currently more attractive bets elsewhere in the sector.