eyegelb/iStock via Getty Images

The Q4 earnings season for the Gold Miners Index (GDX) is set to begin next month, and one of the first companies to report its preliminary results is B2Gold (NYSE:BTG). Unlike most miners, B2Gold trounced its guidance, reporting record production of ~1.05 million ounces vs. its mid-point of ~1.0 million ounces. This was helped by record production at Masbate and another strong year at Fekola, with the asset producing ~567,800 ounces. With a base dividend yield above 4.0% and B2Gold trading at 10x earnings, the stock remains reasonably valued for income investors. Given B2Gold's continued operational excellence, I would view any pullbacks below $3.60 as low-risk buying opportunities.

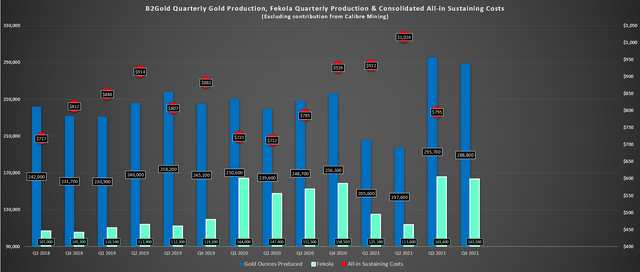

B2Gold released its preliminary Q4 and FY2021 results this week, reporting record Q4 production of ~304,900 ounces, a 12% increase on a year over year. This strong finish to the year pushed annual production to a new record of ~1.05 million ounces, up 0.7% year over year vs. tough comps, and representing a 5% beat vs. its initial guide of ~1.0 million ounces. As shown below, the main driver of this outperformance was its Fekola Mine in Mali, where the company produced ~567,800 ounces, helped by record throughput due to mill outperformance. Let's take a closer look at the results below:

B2Gold Quarterly Production & Costs Company Filings, Author's Chart

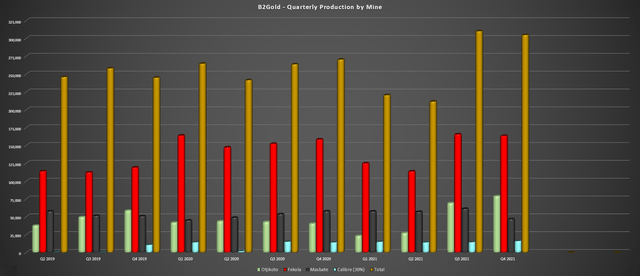

Looking at B2Gold's mine-by-mine production below, we can see that the company had another solid quarter in Q4, with production increasing year-over-year at Fekola and Otjikoto, with the latter reporting record production of ~78,700 ounces. The company also saw a much higher attributable production from its equity interest in Calibre, with the production of ~16,100 ounces, a 13% increase from the year-ago period. The only underperformed in the quarter was its Masbate Mine in the Philippines, which produced just ~46,600 ounces. However, this asset was up against difficult year-over-year comps, and despite the decline relative to Q4 2020, the asset had a record year, with ~222,200 ounces produced.

B2Gold Quarterly Production by Mine Company Filings, Author's Chart

Looking ahead to FY2022, B2Gold has guided for production of ~1.02 million ounces at the mid-point, which would represent a small decline from FY2021 levels, and the first year in more than a decade that production will not increase. However, this outlook assumes just 45,000 ounces from Calibre, which could be conservative. It also assumes zero contribution from the Anaconda area north of Fekola, where the company may see some contribution later this year by trucking material south to its Fekola Mill. Given B2Gold's track record of underpromising and overdelivering, I would not be surprised by a beat relative to this guidance mid-point, with production coming in closer to ~1.03 million ounces, representing a ~1.5% decline year over year.

However, while the company continues to grow production and is firing on all cylinders, costs are creeping up due to inflationary pressures. As noted in the preliminary Q4 update, despite the production beat, costs are likely to come in at the upper portion of its cost guidance range ($870/oz to $910/oz). This would represent a 3% increase in costs from pre-COVID-19 levels, which is not that unreasonable at all, and costs would still be well below the industry average. However, while my estimates of $895/oz still make B2Gold a very low-cost producer relative to the industry average, its FY2022 cost guidance came in a little higher than I expected.

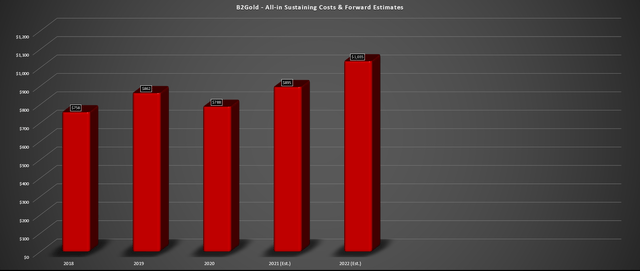

B2Gold Estimated All-in Sustaining Costs Company Filings, Author's Estimates

As shown above, all-in sustaining costs have been guided for $1,000 to $1,040/oz, or a $1,020/oz mid-point. These increases in costs are not company-specific and are related to inflationary pressures sector-wide, with fuel, labor, and consumables seeing sharp cost increases. In B2Gold's case, the company is also seeing slightly higher sustaining capex and is budgeting for a stronger Namibian Dollar this year. Based on my estimates of $1,030/oz to $1,035/oz, this would represent a 15% increase in costs year over year, which would strip B2Gold of its title of enjoying costs more than 10% below its peer group.

While this trend higher in costs was the one negative in the report, B2Gold is still a very profitable company, enjoying AISC margins near 43% at a $1,825/oz gold price based on FY2022 estimates. Hence, I don't see any reason that this affects the long-term investment thesis. Besides, unlike some peers, B2Gold is sitting on a massive cash hoard, which could allow it to acquire a lower-cost operation or development project with minimal share dilution, helping to improve its costs in 2023/2024. Of course, the other opportunity is Gramalote which B2Gold shares with AngloGold (AU), which is expected to be a sub $900/oz per year operation but is unlikely to begin commercial production until at least 2025.

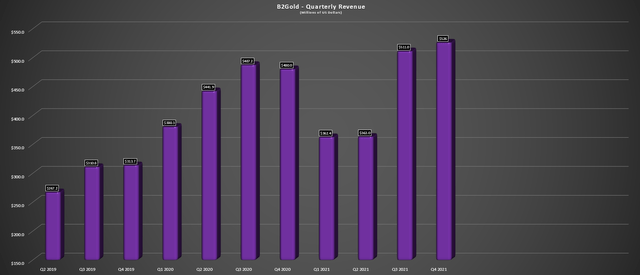

B2Gold Quarterly Revenue Company Filings, Author's Chart

Moving over to B2Gold's financial results, we can see that the company reported record revenue of ~$526 million in Q4 and managed to generate nearly $2.0 billion in revenue despite a softer year for the gold price. This was based on selling ~292,400 ounces of gold at $1,800/oz in Q4 and nearly 1 million ounces for the year at similar prices. However, while the company did higher production on a year-over-year basis, revenue and earnings were down due to the weaker gold price. So, even though B2Goldd had an incredible year operationally, annual EPS is set to decline more than 20% based on current estimates of $0.38 (FY2020: $0.50).

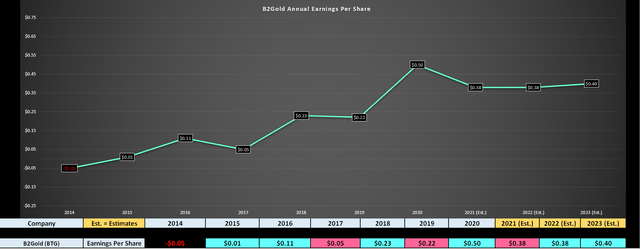

B2Gold Earnings Trend FactSet, Author's Chart

If inflationary pressures were not an issue, we would have seen a meaningful recovery in annual EPS this year, given that I would expect a higher average realized gold price this year after a year of consolidation in 2021. However, even if the average realized gold price improves to $1,900/oz, it will likely be difficult for B2Gold to report earnings of more than $0.40, given that higher costs are offsetting what should be a better year for gold. So, while production continues to trend in the right direction, I don't expect to see much earnings growth on a year-over-year basis unless the gold price can spend a chunk of the year above $1,950/oz.

Having said that, while B2Gold may be seeing a dip in its earnings trend, it's important to note that earnings are still expected to remain 75% higher than FY2019 levels. In addition, though earnings are expected to decline year over year and remain below their FY2020 peak, B2Gold was one name that was up against insurmountable comps, benefiting from an extremely high-grade year in 2020 at Fekola and a record gold price, making it difficult to comp against in 2021/2022. Overall, B2Gold's earnings trend is much better than many of its peers in the intermediate/senior producer space, growing annual EPS at a compound annual growth rate of ~22.9% since FY2016 ($0.38 vs. $0.11). Let's take a look at the valuation below.

Valuation and Technical Picture

Based on ~1.06 billion shares outstanding, B2Gold trades at a market cap of ~$4.0 billion at $3.80, and the company has more than $500 million in net cash or $0.50 per share. This leaves B2Gold trading at a forward cash flow multiple of less than 6, with the company likely to generate operating cash flow of at least $600 million in 2022. This figure compares very favorably to its historical cash flow multiple north of 8. Meanwhile, from an earnings standpoint, B2Gold trades at ~10x earnings, or 9x earnings after subtracting out net cash. Finally, from a P/NAV standpoint, B2Gold trades close to 0.90x P/NAV. So, across every valuation multiple, the company remains very reasonably valued, even if earnings are down from their peak.

Meanwhile, investors shouldn't have anything to worry about from a dividend standpoint, with the $0.04 quarterly dividend ($0.16 annualized) representing a base dividend that the company should be able to maintain, even if the gold price were to dip to $1,650/oz. At a share price of $3.80, this represents a ~4.20% yield, well above the average dividend yield of ~2.50% for million-ounce gold producers. In summary, B2Gold offers an attractive dividend yield, a very reasonable valuation, and the possibility for some near-term growth if the company makes an acquisition in the next 18 months.

So, Is the Stock a Buy?

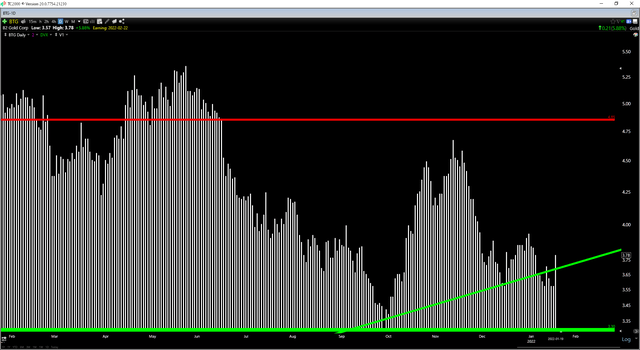

BTG Technical Chart TC2000.com

Looking at B2Gold's technical picture, the stock has strong support at $3.30 and no meaningful resistance until the $4.85 level. This represents a reward/risk ratio of 2.1 to 1, with $1.05 in upside to potential resistance and $0.50 in downside to support. Generally, I prefer at least a 4 to 1 reward/risk ratio when buying mid-cap producers, and B2Gold doesn't quite meet this criterion after this week's rally. So, while the stock's valuation is quite attractive, the low-risk buy zone for the stock comes in at $3.60 or lower, where the reward/risk ratio would improve to 4 to 1.

B2Gold Operations Company Presentation

B2Gold had an exceptional year, marking its 13th year of growing production, and another year where it managed to over-deliver for investors. Combined with an attractive dividend yield with significant coverage, B2Gold offers one way for income investors to scoop up an attractive yield while diversifying their portfolio, with the security that the stock likely has a floor near $3.30 per share from a valuation standpoint. In summary, if the stock were to dip below $3.60, I would view this as a low-risk buying opportunity.