buzbuzzer/iStock via Getty Images

Getty Realty (NYSE:GTY) is a triple net REIT focused on convenience stores and it provides an interesting investment proposition on multiple fronts.

- High yield from an uncorrelated asset class

- Potential for substantial asset value appreciation with normalization of cap rates

- Relative value to other triple nets

Uncorrelated asset class

Most of the retail triple net REITs consist of free standing basic retail locations such as a Dollar General or a Starbucks.

Getty went for a different approach, focusing almost entirely on auto transportation via gas stations, car washes and other auto services.

Getty

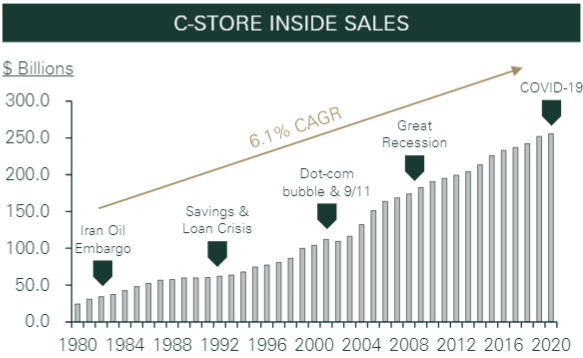

The bulk of a gas stations earnings come from retail sales inside the store that patrons tend to pick up while filling their tanks and of note, convenience stores don’t seem to respond to the broader economy.

Getty

Sales remained strong through just about every recession, even including COVID where road traffic dropped materially.

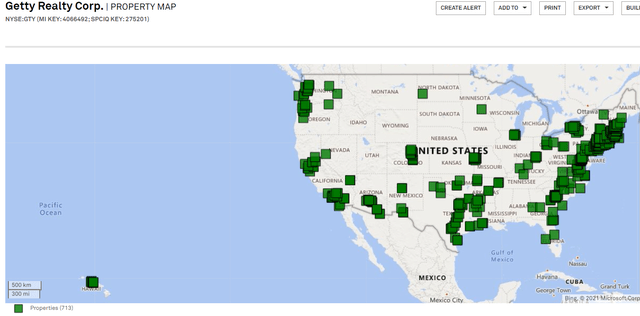

Getty’s portfolio of C-stores is spread across the U.S., roughly mirroring a heat map of economic activity.

SNL Financial

It is unclear to me as to whether convenience stores are better or worse than other forms of real estate, but there are 2 features that stand out:

- Resilience with high occupancy and minimal rent interruptions

- Uncorrelated to other real estate and other asset classes

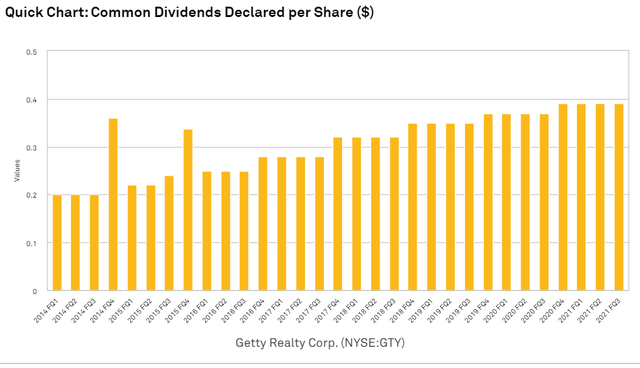

As such, Getty could arguably be a good portfolio position as a source of diversification that also provides high yield. Its 5.25% dividend yield is well covered by FFO/share and has been growing nicely.

Dividend chart

SNL Financial

Stable dividends alone aren’t enough for me at Portfolio Income Solutions as I seek capital appreciation in addition to income.

In this regard, Getty does have some potential via net asset value (NAV) accretion and trading at a more attractive valuation than peers.

NAV Accretion

Which should trade at a higher valuation?

- A gas station located on the corner of 2 high traffic streets

- a pharmacy/store/restaurant that is also fairly well located

The latter is the standard institutional triple net asset that is being chased by excessive amounts of capital. The standard triple net product is going for cap rates around 5%.

In contrast, gas stations are closer to 7% cap rates.

The market says the pharmacy/store/restaurant is massively more valuable.

I think there is some room here to challenge this notion. Is each dollar of rent from a gas station really worth 40% less than each dollar of rent from a Dollar General?

Getty’s assets are 99.5% occupied which is significantly above the triple net REIT average. 71% of their properties are corner locations with easy ingress and egress. Tenants are comfortably covering rent 2.6X coverage and Getty maintained a higher level of rent collection through the pandemic than most triple net peers.

I am less convinced that there should be a cap rate spread here and anticipate the gap to close over time.

It has been a continual source of opportunity when somewhat unusual real estate asset classes trade at a spread to the more normal assets just because they are less familiar.

We have watched spreads close between Class B and Class A industrial. Similarly, value-add multifamily has closed the gap on Class A stabilized and, in some instances, now trades at a premium.

Towers and data centers when new to the REIT space traded at extremely high cap rates and have since proven to be premier asset classes and have closed the gap on traditional real estate.

Manufactured housing was feared by institutional REIT investors until it became the biggest growth sector and now goes for cap rates under 4%.

In each case, those who invested in the unusual asset class when it was trading at a big spread to traditional assets got huge gains.

The above mentioned opportunities have largely played out at a broad level with some niche cases of specific companies still being opportunistic. There are, however, some asset classes that still have this opportunistic cap rate gap today.

- Post offices trade at a 200-300 basis point spread to traditional industrial/logistics

- Casinos trade at a 150-250 basis point spread to traditional triple net

- Hospitals trade at a 300-400 basis point spread to senior housing despite better fundamentals

- Development spreads in life sciences over stabilized cap rates remain excessive

Each of these asset classes is highly opportunistic today.

I think there is potential for gas stations to be on that list. Given the historic performance of gas stations in terms of lease reliability and the high customer traffic in their catchment radii I think a somewhat smaller spread is warranted.

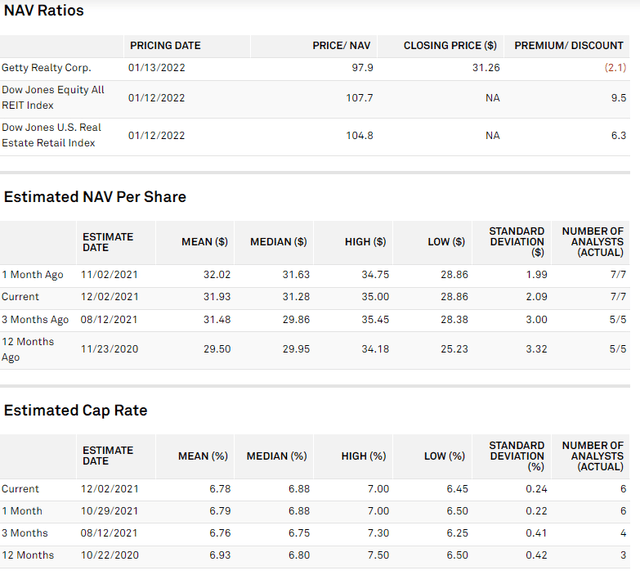

At current cap rates, Getty appears to be trading at just a slight discount to NAV.

NAV estimates

SNL Financial

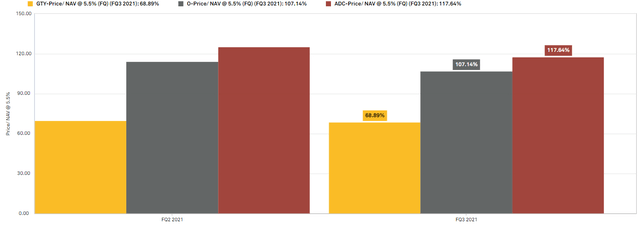

However, the potential for NAV accretion is clear when you plot GTY at a 5.5% cap rate alongside traditional triple nets at the same cap rate.

SNL Financial

If we believe gas stations should trade at comparable cap rates to other triple net assets, Getty is trading at a 30% discount to NAV while Agree Realty (ADC) and Realty Income (O) are trading at 17% and 7% premiums, respectively.

That gap represents the magnitude of outperformance GTY could experience if it does indeed prove to go the way of the other unusual asset classes trading at spreads to traditional assets.

Beyond the speculative upside of compressing spreads GTY seems like a generally solid investment.

Company quality

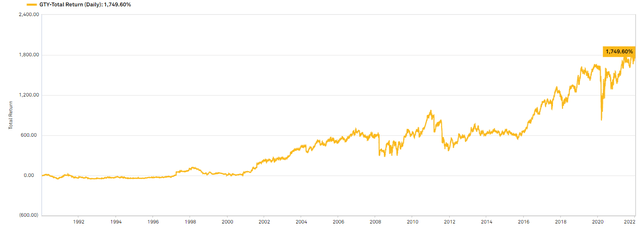

Getty has been around for a long time and has delivered a solid return to investors.

SNL Financial

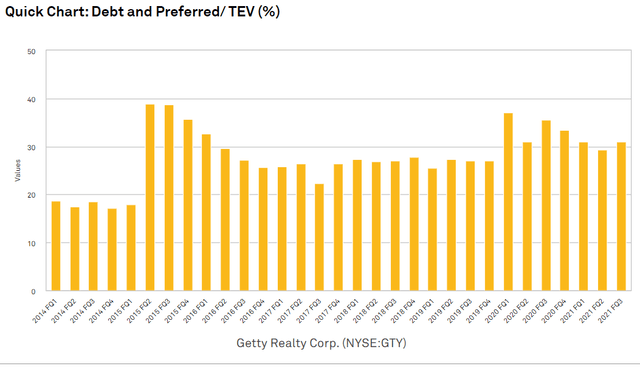

The company is conservatively run with a consistently low to moderate level of debt.

SNL Financial

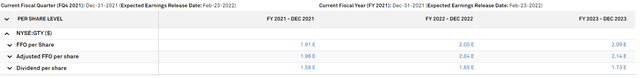

FFO per share is slated to grow at a moderate pace over the next few years based on consensus estimates.

FFO/share estimates

SNL Financial

The source of this growth is a combination of organic from lease escalators that average 1.7% and accretive acquisitions at cap rates that exceed cost of capital.

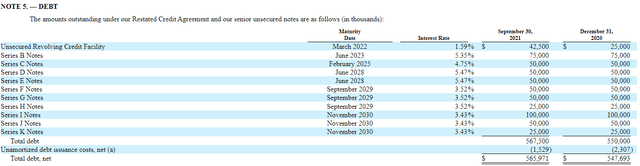

Since GTY has a long weighted average lease term remaining it does not stand to benefit from inflation in terms of rental revenues, but it is also rather resistant with interest expense locked in at fixed rates for the long term. Shown below is Getty’s debt schedule.

10-Q

There is a bit of upside as these senior notes come due since the 2023-2028 maturities are at rates significantly higher than what GTY would get today. I suspect these will be eventually refinanced in the 3s or 4s saving a decent chunk of interest expense.

I met with Getty’s management at REITWEEK last year and left with a generally favorable impression. They were straightforward and forthcoming and seem to have a good plan on how to manage the business.

The Bull thesis

The base case is that Getty will continue on a steady course. At current valuation, GTY is a bit cheaper than most of the triple nets and provides a well covered 5.25% dividend yield. With the growth from escalators and acquisitions it translates into a low double digit expected return.

Given the diversifying aspects of GTY that already makes it a solid investment but there is the upside case of the cap rate spreads tightening. If gas stations end up being valued similarly to other types of triple net assets, Getty could get as much as 40% asset value accretion. I see this as a nice speculative upside on what is already a solid base return.

Dividends are scarce, we provide the solution

For everything you need to build a growing stream of dividend income, please consider joining Portfolio Income Solutions. As a member you will get:

- Access to a curated Real Money REIT Portfolio

- Continuous market and single stock analysis

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Portfolio Income Solutions, we don’t only share our ideas, we also discuss best trading practices and help you become a better investor.