Diy13/iStock via Getty Images

Teradyne, Inc. (NASDAQ:TER) expects double-digit sales growth. Most analysts are extremely optimistic about the company's future performance. In my view, if innovation continues, and the company continues to invest in robotic solutions for the automation industry, revenue will most likely grow substantially. The market does not seem to be taking into account the FCF to be generated in the future. With conservative forecasts and assuming that acquisitions will continue, I obtained a valuation close to $201-$400. With the shares currently trading at their minimum level of 2022, I am a buyer.

Teradyne, Inc.

Incorporated in Massachusetts, Teradyne, Inc. supplies automation equipment for test and industrial applications.

I cannot go through all the products offered by Teradyne, but keep in mind that the company operates in a sector in which innovation is critical. In my view, the most interesting features are the company's collaborative robotic arms, autonomous mobile robots, and advanced robotic control software. The company's systems are offered by manufacturers to decrease manufacturing and logistics costs:

IR

If you are a growth investor, you will most likely appreciate Teradyne. Many growth industries need Teradyne's products, including consumer electronics, wireless, automotive, industrial, computing, and communications among others.

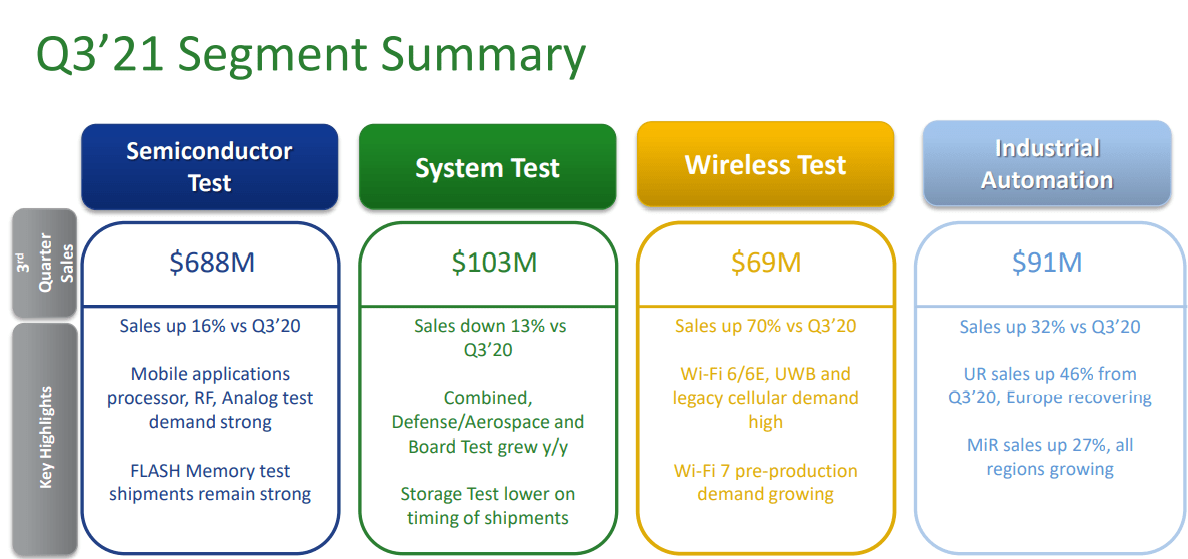

Serving industries that grow at double digits, Teradyne obviously reports double digit sales figures. In the last presentation given to investors, quarterly sales of semiconductor tests, system tests, wireless tests, and industrial automation grew at 13%-32% q/q:

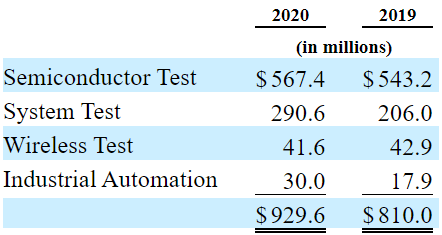

The company's revenue growth in the past was also positive. In 2020, the company reported more than 14% sales growth y/y. Besides, most investors out there believe that the company's sales growth will also be significant in 2022 and 2023.

Annual Report

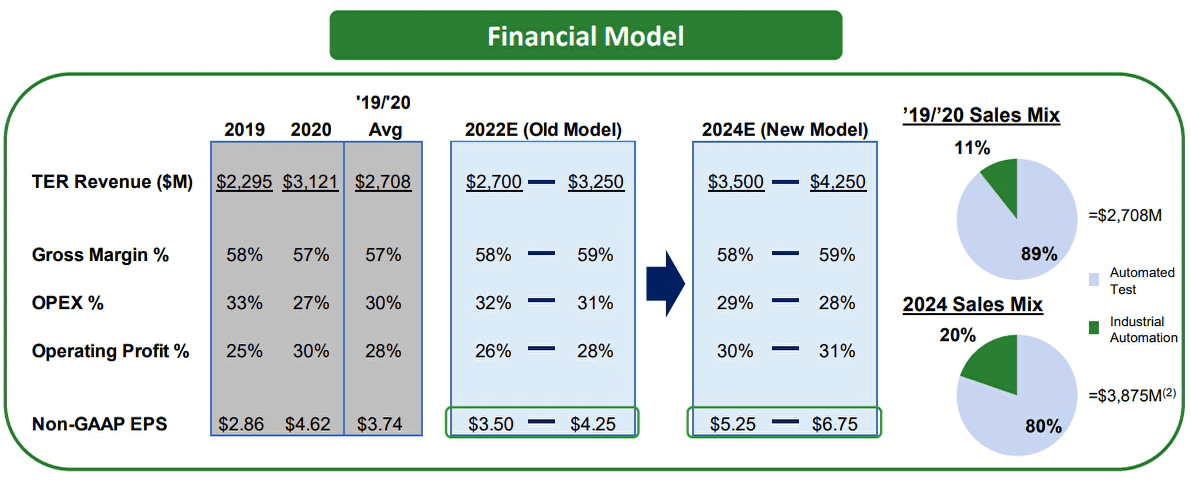

I could find the company's sales expectations for the years 2022-2024. Management believes that revenue could reach 4.25 billion in 2024. Besides, it is expecting to report 2024 operating profit of more than 30%. Take a look at the figures below because my financial models are somewhat based on the assumptions made by the management:

Presentation

My Base Case Scenario Implies A Valuation Of $216

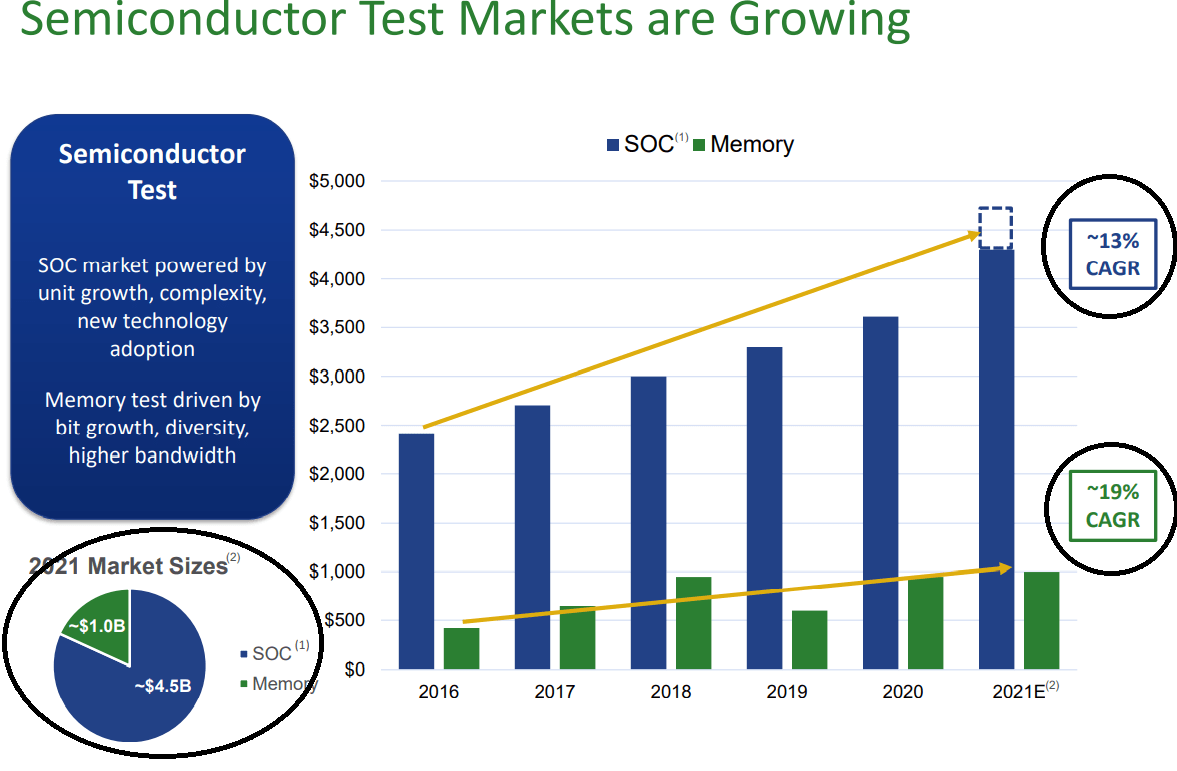

Under this scenario, I took a look at the expected growth of the global chiplets market, which is close to 40%. I also studied the global automatic test equipment market, which is expected to grow at a CAGR of 4.2%. In my view, sales growth would be between these two figures.

The global chiplets market is projected to advance at a CAGR of 40.9% from 2021 to 2031, and is estimated to reach US$ 47.19 Bn by 2031. Microprocessor (MPU) chiplets will pave the way for advanced circuitry for electronics in various end-use industries. Source: Bloomberg

The global automatic test equipment market size was valued at $6.44 billion in 2020, and is projected to reach $9.52 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030. Source: Allied Market Research

Under my base case scenario, management will be moderately successful in growing its market share in the test businesses. In the presentation, the company noted that its target market is expected to grow at a CAGR of 19%-13%, so I used conservative sales growth of 18%-9%:

Presentation

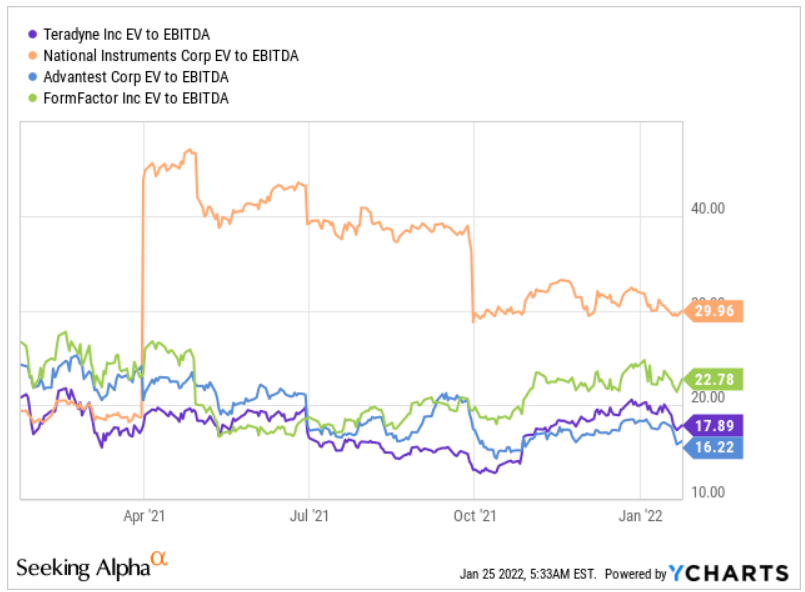

If Teradyne also continues to introduce new productions, and invests in Industrial Automation businesses, in 2032, the exit multiple will most likely be larger than 11x-13x. Notice that other competitors trade at 16x-29x:

YCharts

Finally, if Teradyne acquires further competitors and continues to balance capital allocations, I would expect cost of equity to be moderate. In my model, I used a cost of equity of 8.9%, which is close to that of other investment advisors.

We plan to execute on our strategy while balancing capital allocations between returning capital to our shareholders through dividends and stock repurchases and using capital for opportunistic acquisitions. Source: Quarterly Report

Under this case scenario, I also assumed that the company will benefit largely from its 5G test investments. Besides, I also believe that the promises of management about 2021 will also materialise in 2022:

We expect strong momentum in our test businesses and a return to growth for Industrial Automation. Source: Annual Report

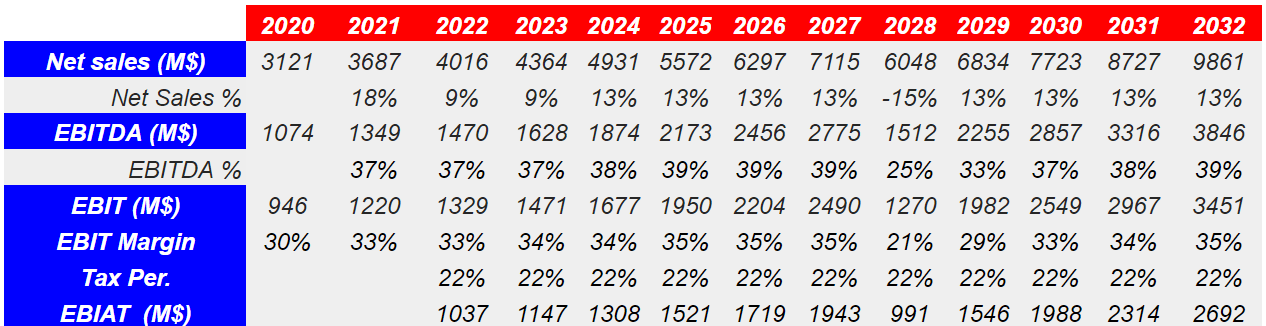

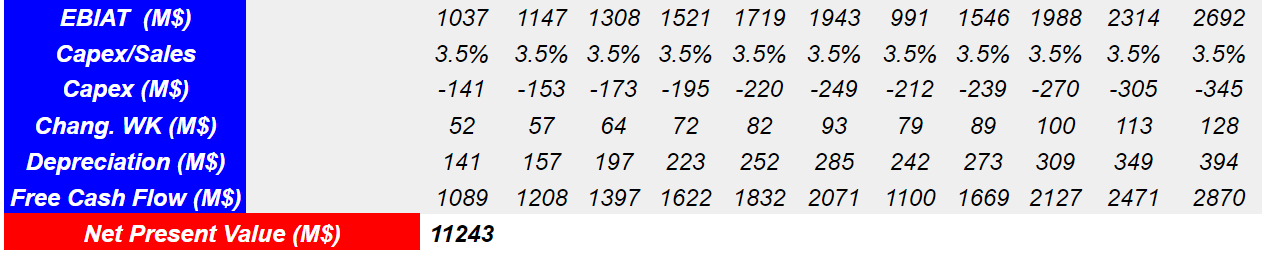

My results include 2032 sales of $9.8 billion and an EBITDA margin of 37%, which implies 2032 EBITDA of $3.8 billion. If we also assume tax of 22%, the 2032 EBIAT would be equal to $2.6 billion:

My Figures

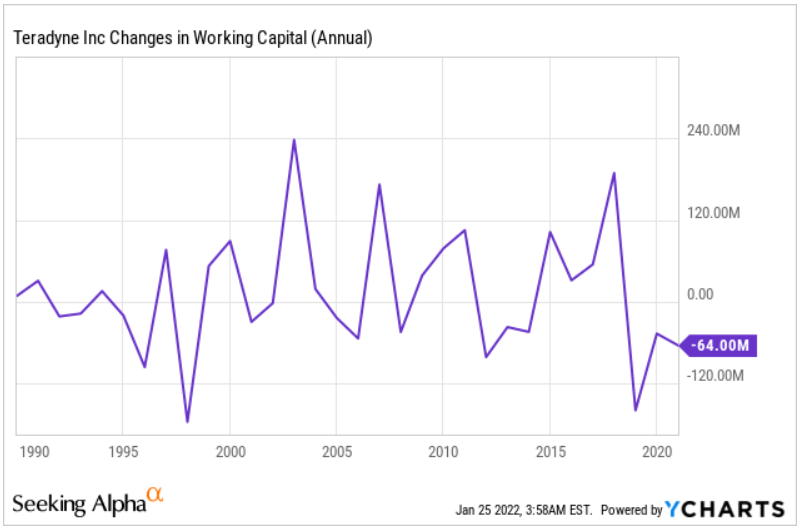

With a capex/sales ratio of 3.5%, conservative changes in working capital of $52-$128 million, and depreciation of $141-$394 million, future FCF would be $1.2-$2.8 billion. Finally, I obtained a net present value of $11 billion:

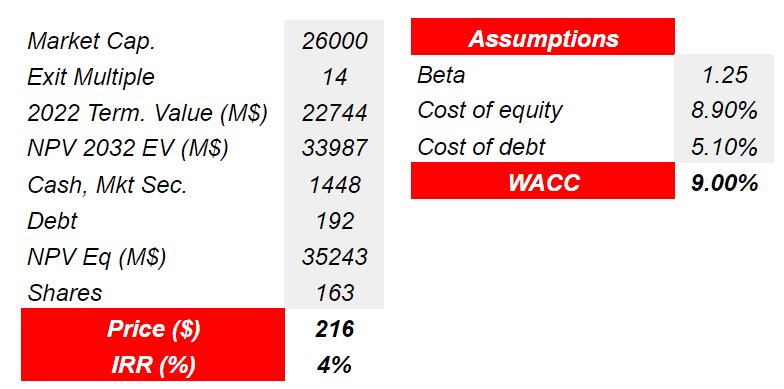

My Figures YCharts

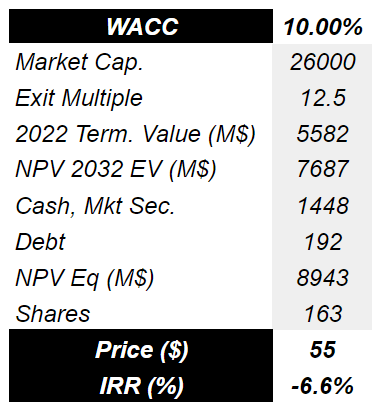

If we assume an exit multiple of 14x, beta of 1.25x, and a WACC of 9%, the 2022 terminal value equals $22 billion. The implied price would stay close to $216, and the internal rate of return stands at 4%:

My Figures

A Decline In The Number Of Customers And Lack Of Innovation Could Lead To A Valuation Of $55

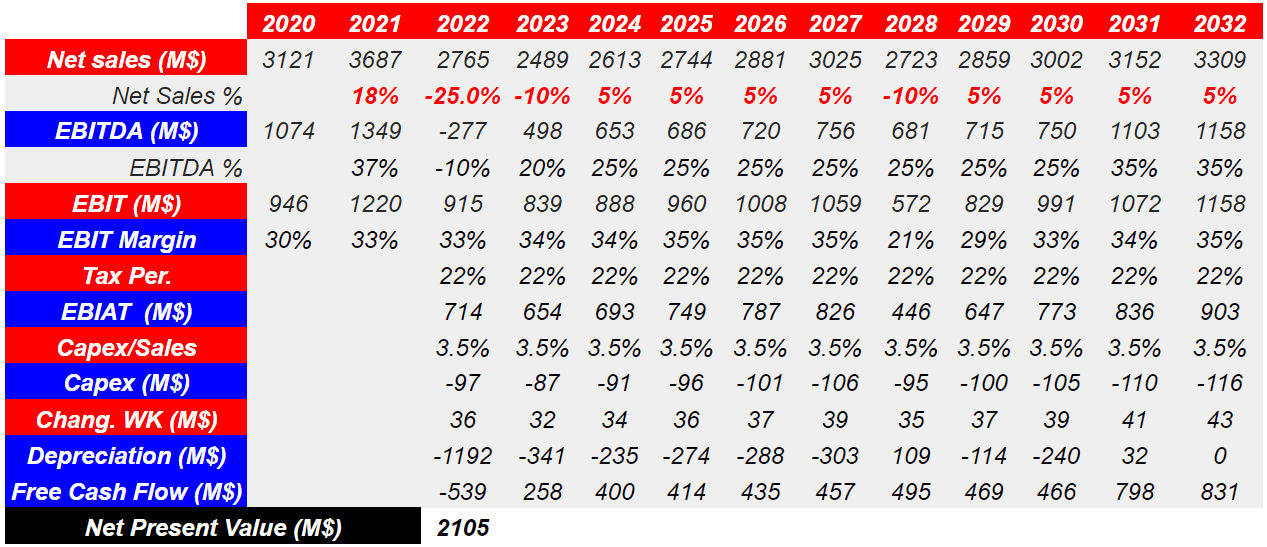

Under this particular case scenario, I expect that the company will have some trouble with one or several of its customers. Given the fact that Teradyne does not have a lot of clients, the collapse in the sales growth could be substantial. Under my financial model, I will be expecting sales growth to be close to -25% and 5%:

A few customers drive significant demand for our test products both through direct sales and sales to the customers' supply partners. We expect that sales of our test products will continue to be concentrated with a limited number of significant customers for the foreseeable future. Source: Quarterly Report

In each of the years, 2020, 2019 and 2018, our five largest direct customers in aggregate accounted for 36%, 27% and 27% of consolidated revenues, respectively. Source: Annual Report

Teradyne's technological position depends primarily on the creative ability of the company's engineers. Teradyne operates in a competitive market, in which innovation is critical. If customers don't acquire the company's products due to availability of superior offers in the market, revenue would decline significantly. As a result, traders may sell their shares, which would lead to an increase in the cost of equity. Take into account that I will be using a WACC larger than that in the previous case scenario:

In a rapidly evolving market, such as ours, the development or acquisition of new technologies, commercialization of those technologies into products and market acceptance and customer demand for those products are critical to our success. Source: Annual Report

The company obtains a lot of products from China, Malaysia, Taiwan, and Korea. If management has any issue with subcontractors, there are supply chain risks, or suppliers wish to renegotiate prices, Teradyne's EBITDA margin would decline substantially. Under this case, I would be using an EBITDA margin of 20%-35%, which is lower than that in the base case scenario:

In addition, an increasing portion of our products and the products we purchase from our suppliers are sourced or manufactured in foreign locations, including China and Malaysia, and a large portion of the devices our products test are fabricated and tested by foundries and subcontractors in Taiwan, China, Korea and other parts of Asia. Source: Annual Report

Putting everything together, I obtained net sales between $2.765 billion and $3.5 billion, and FCF close to $255-$850 million. Finally, the net present value would stand at $2.105 billion:

My Figures

Under the previous dramatic assumptions, the WACC would increase to 10%. I also assumed an exit multiple of 12.5x, which is obviously lower than that in the base case scenario. The implied price would be equal to $55, and the internal rate of return would be equal to 6.6%:

My Figures

Best Case Scenario Would Include Aggressive Acquisition Of Competitors

Under the best case scenario, management will use its total amount of cash to acquire other businesses. As a result, the company's sales growth would be larger than that of the target market. Note that Teradyne knows the M&A markets well. In the past, management has acquired a significant number of competitors. It is likely that shareholders will enjoy more acquisitions in the future:

On January 30, 2019, Teradyne acquired all of the issued and outstanding shares of Lemsys SA ("Lemsys") for a total purchase price of approximately $9.1 million.

On November 13, 2019, Teradyne acquired 100% of the membership interests of AutoGuide, LLC. The total purchase price was approximately $81.6 million.

On April 25, 2018, Teradyne acquired MiR, a Danish limited liability company located in Odense, Denmark.

On February 26, 2018, Teradyne acquired all of the issued and outstanding shares of Energid for a total purchase price of approximately $27.6 million. Source: Annual Report

That's not all. If the company successfully manages to integrate the new teams acquired from previous acquisitions, operating synergies would be very beneficial. I also need to highlight that in the last two years, management has not executed any impairment of goodwill. It appears that the company knows well how to assess the valuation of targets.

No goodwill impairment was identified in 2020, 2019 and 2018. Source: Annual Report

In this case, I assumed 15% sales growth almost every year from 2022 to 2032, and an EBITDA margin of 35%-40%. Also, with conservative capital expenditures, D&A, and working capital changes, the FCF would grow from close to $1.05 billion to close to $3.35 billion. The net present value would stay between $17.5 billion and $18.5 billion.

Finally, if we also assume a WACC of 5% and an increase in shares outstanding to $200 million, the implied price would equal $400. Note that I expect some of the acquisitions to be made in equity:

My Figures

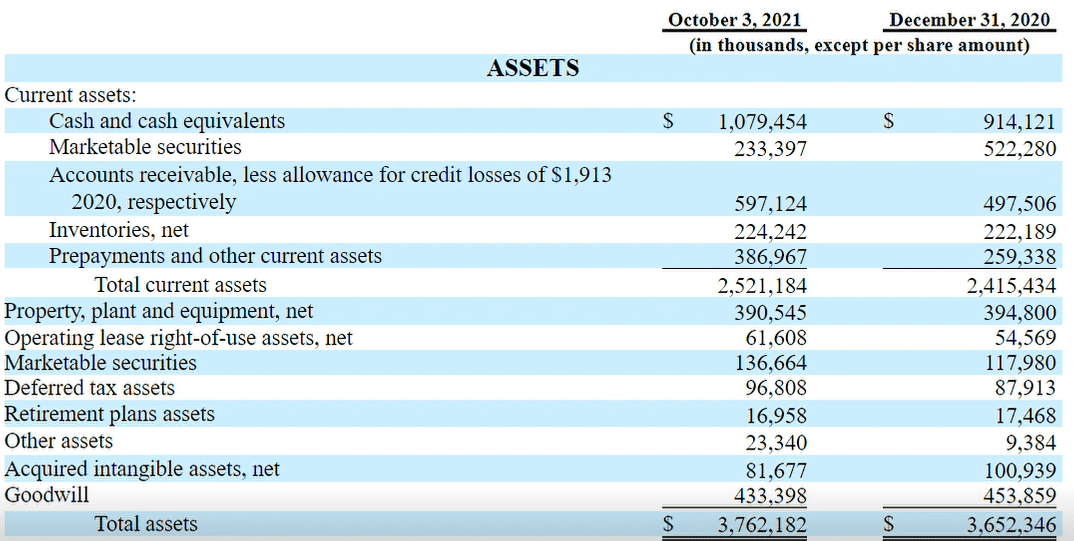

In my view, Teradyne has sufficient cash in hand to acquire new targets. Also, the financial health of the company is very good. As of October 3, 2021, the company reported $1.07 billion in cash, and $369 million in marketable securities:

Quarterly Report

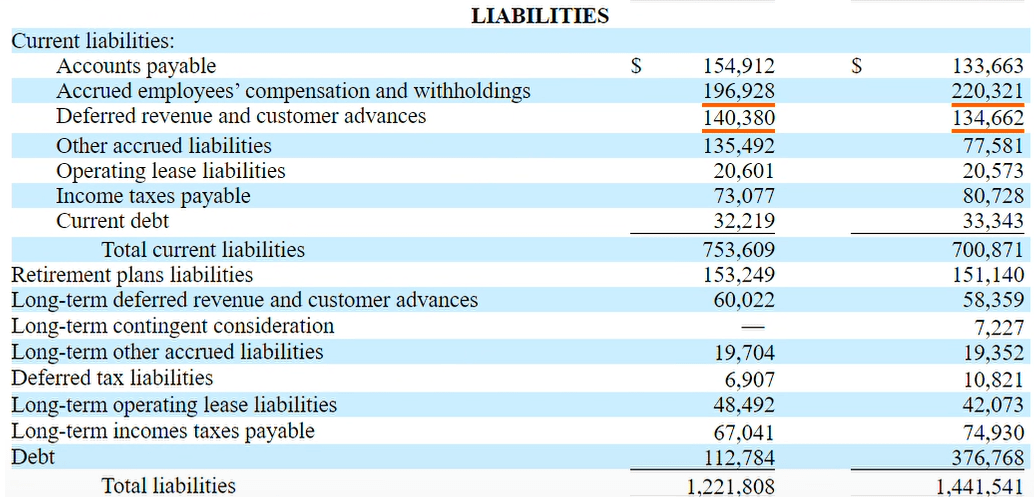

The company's total amount of debt is also not worrying. Take into account that including operating lease liabilities, the contractual obligations stand at $192 million. In my view, if management requires additional financing from banks, they will be most likely offering good conditions:

Quarterly Report

Conclusion

Currently trading at its minimum level of the year 2022, Teradyne, Inc. will most likely trend higher in the coming months. I don't think market participants are taking into account that Teradyne works for industries that grow at a double-digit. Besides, management expects strong momentum in the company's test businesses and its Industrial Automation business segment. In my view, with more products in the market and some acquisitions, Teradyne could easily trade at much more than $100-$150. Under my financial models, I believe that the fair value stands at somewhere between $201 and $400. I am a buyer.