kemaltaner/iStock via Getty Images

This article was coproduced with Nicholas Ward.

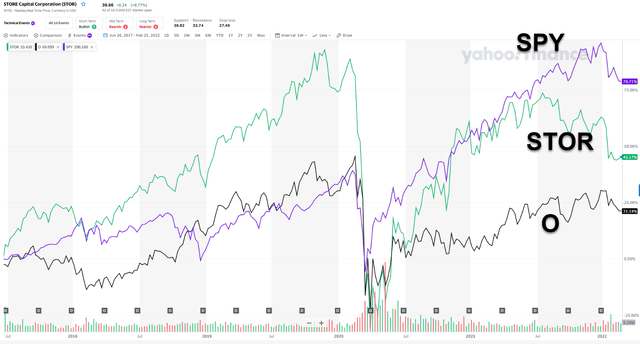

For years, STORE Capital (STOR) has been producing top notch results relative to its peers in the triple net lease REIT space.

However, during the 12-18 months, we've seen things take a turn for the worse.

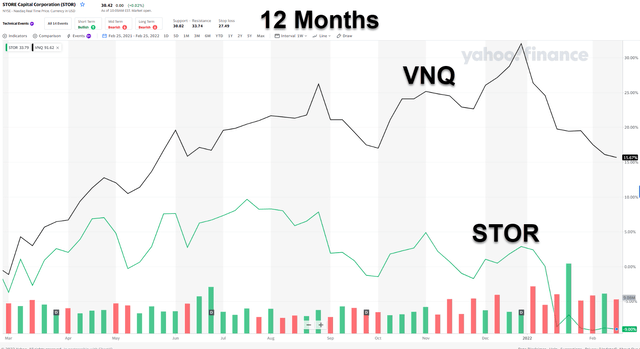

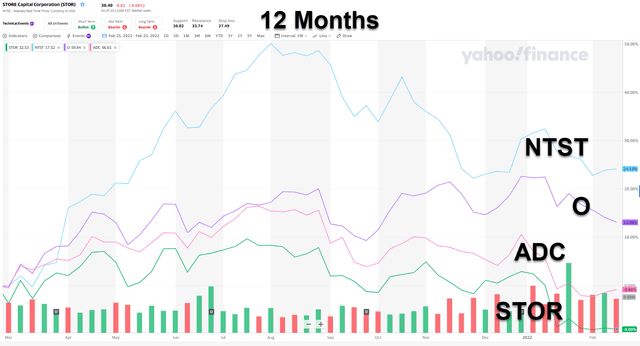

Looking back, we see that STOR's trailing twelve month share price performance sits at -13.28%.

This performance comes during a period of time where the S&P 500 is up 9.25%. The Vanguard Real Estate ETF (VNQ) has posted even better performance than the broader market over the last year, up 11.80%. And, when looking at the net lease space specifically, we see that STOR's performance lags all of its blue chip peers.

For instance, Netstreit (NTST) is up 16.75% during the trailing twelve months. Realty Income (O) shares have risen by 8.84%. W.P. Carey (WPC) shares are up by 5.51%. Agree Realty (ADC) shares are down, but by just 1.78%. And, National Retail Properties (NNN), which is probably the closest comparison to STOR, operationally speaking (due to its shared focus on the middle market), are down by 7.92%.

As you can see, STOR's performance is the worst of the bunch.

Part of the bearish sentiment surrounding this stock comes from the fact that STOR has seen a leadership transition during this period, with acclaimed CEO, Christopher Volk being removed from the company (as Chairman) and is now being run by the current CEO, Mary Fedewa.

Oftentimes, when talking about equities, we say that a long-term investment is a partnership with management. They're the individuals who are making decisions and pulling the strings that ultimately lead to success or failure, in terms of fundamental growth. And, while we acknowledge Fedewa's talents as a portfolio aggregator (formerly CIO), we have questioned her ability to lead.

The fact is, Fedewa is unproven and with Volk having been forced out of the company, we've wanted clarity about STOR's new direction.

Looking at STOR's Q4 results, it appears that G&A savings from the management transition contributed to STOR's recent AFFO beat; however, while we love seeing AFFO rise a few cents per share because of lower costs, we also believe that it's difficult to put a price or valuation on the knowledge and experience that someone like Volk brought to the table.

Only time will tell how well the company performs without him.

It takes time to gain experience; it takes time to gain investor trust. And therefore, wanted to give her time to show us where she planned to take this company now that she's at the reins.

This week, STOR posted its Q4 and full-year 2021 results. This data should provide insight into the company's performance, management's outlook, and potentially even, whether or not the weakness that has plagued STOR shares recently has been irrational or justified.

So, let's dive into the results and see whether or not it's time for us to take STOR out of the penalty box and upgrade our rating from "Hold" to "Buy".

STORE Capital Dividend

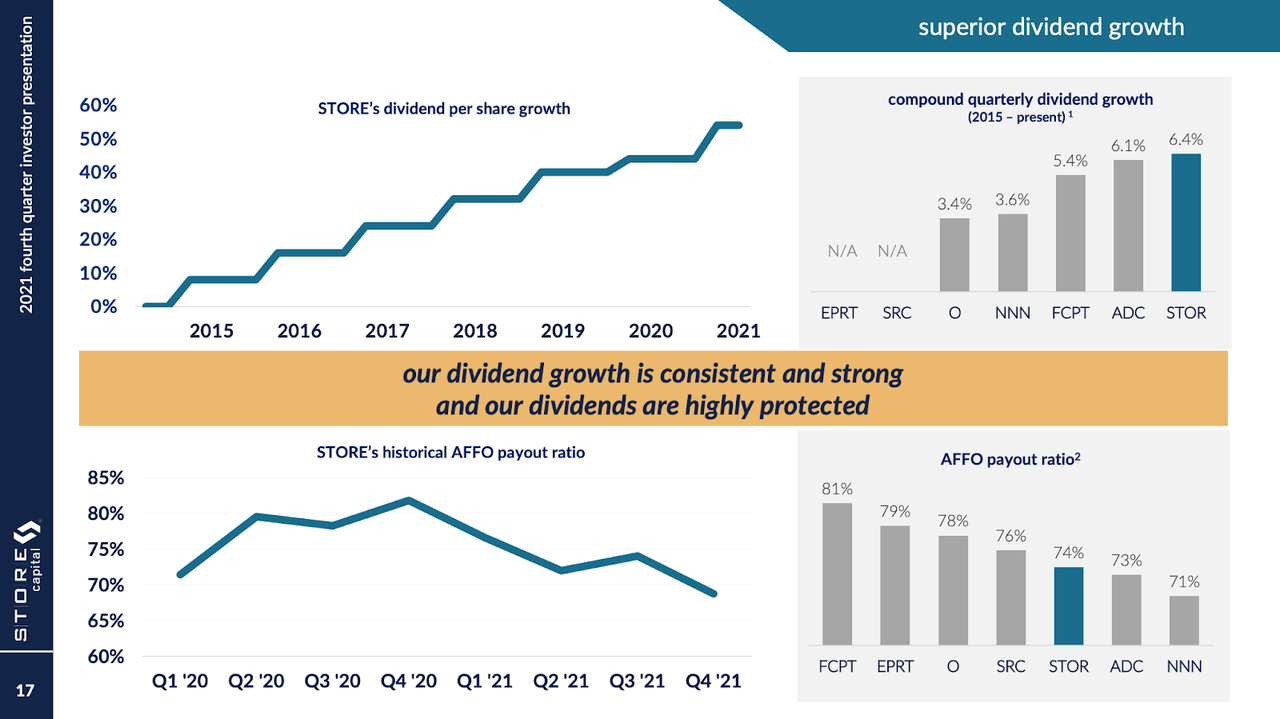

First and foremost, let's highlight STOR's dividend safety and growth metrics because frankly, this is where this company has historically set itself apart.

STOR's Q4-21 Investor Presentation

No, STOR doesn't have the longest dividend increase streak in the REIT space. It's not a dividend aristocrat. STORE Capital's annual dividend increase streak is just 7 years.

However, that's due to the relatively young age of this company.

STOR has increased its dividend every year since it was established, and, as you can see on the chart above, STOR has posted some of the best dividend growth in the net lease space in recent years.

Furthermore, even after all of this, the stock's AFFO payout ratio remains amongst the lowest in the class, pointing towards high degrees of dividend safety and ongoing forward looking growth prospects.

However, has STOR managed to generate best-in-class dividend growth while maintaining such a low payout ratio?

Well, the answer is clear: rising fundamentals.

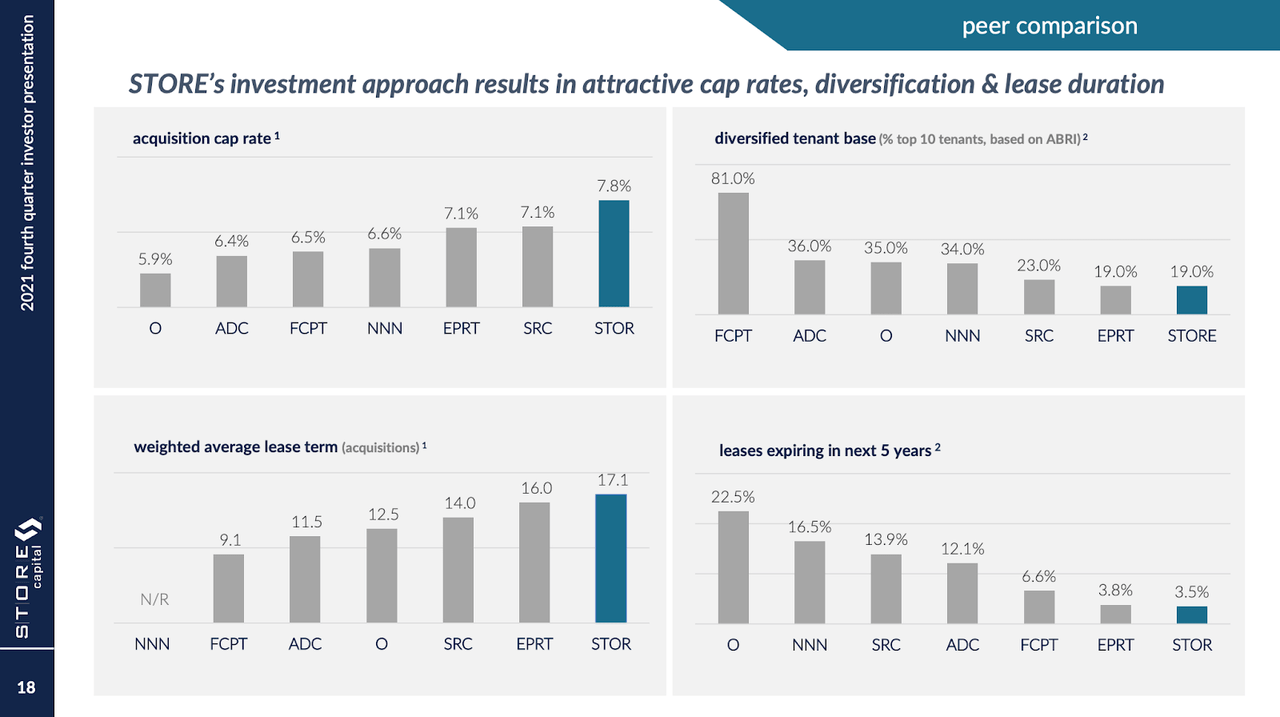

Because of its middle market focus, STOR has always generated some of the most attractive cap rates and therefore, generated some of the strongest cash flows in the industry.

And, looking at the chart below from the company's Q4 report, you'll see that this company's operations and portfolio construction remain very appealing.

STOR's Q4-21 Investor Presentation

However, we do want to point out that for all of the pros to this strategy, there are cons in place as well.

While STOR's middle market and experiential retail have allowed the company to post solid returns during bull markets, this company struggled during the pandemic - relative to many of its peers - posting -8% AFFO growth during 2020. STOR's rent collection suffered, and we saw the company experience some tenant related issues regarding bankruptcies from within its portfolio.

Investors can avoid such risks by focusing their attention (and investment dollars) on stocks with a stricter focus on investment grade tenants and more defensive industry allocations.

However, as we've seen in the past, when the skies are sunny, STOR's strategy works quite well. And so long as the company's new management team can continue the momentum that its old leadership produced, we wouldn't be surprised to see STOR bounce back from its recent lackluster performance.

STORE Capital's Portfolio

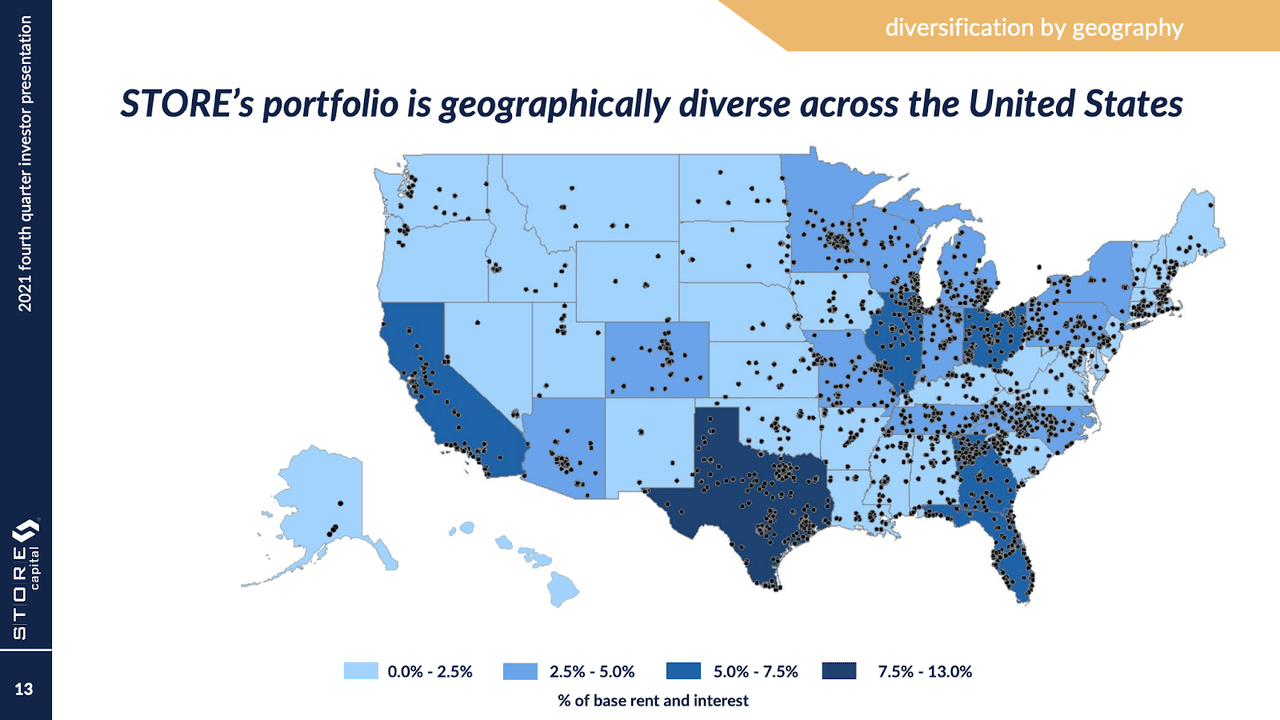

As of 12/31/2021, STOR's portfolio was made up of 2866 properties, spanning 556 tenants located in 49 different states. The value of the portfolio was $10.7 billion at the end of 2021.

STOR's occupancy ratio totaled 99.5% at the end of 2021 and management noted that the portfolio's base rent totaled $851 million, and the average non-cancelable remaining lease term on these properties was 13.4 years, with only 4.9% of STOR's leases scheduled to expire during the next 5 years.

STOR's Q4-21 Investor Presentation

When discussing 2022 projections, STOR's management maintained previously provided 2022 acquisition guidance, calling for $1.1 billion to $1.3 billion of acquisitions (net of property sales).

In other words, like so many other REITs that we track, it appears that STOR is looking to stay very aggressive as it emerges from the pandemic (and while interest rates remain low) when it comes to capital investments.

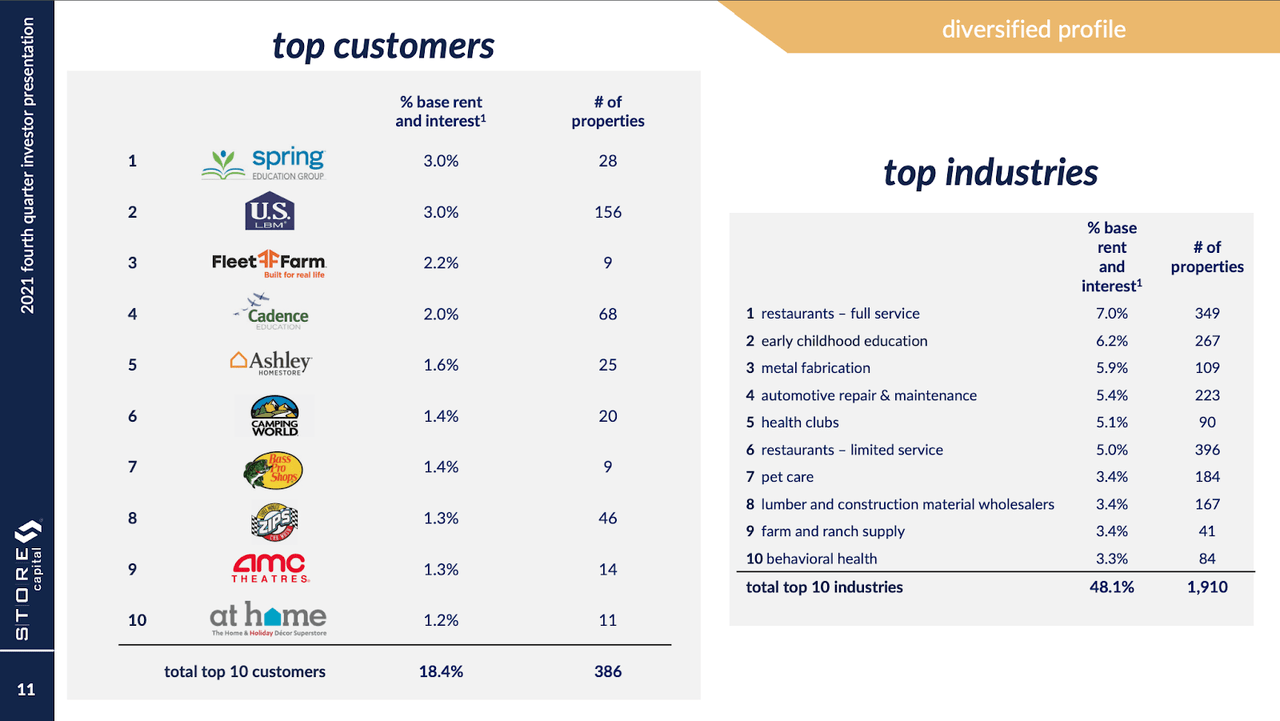

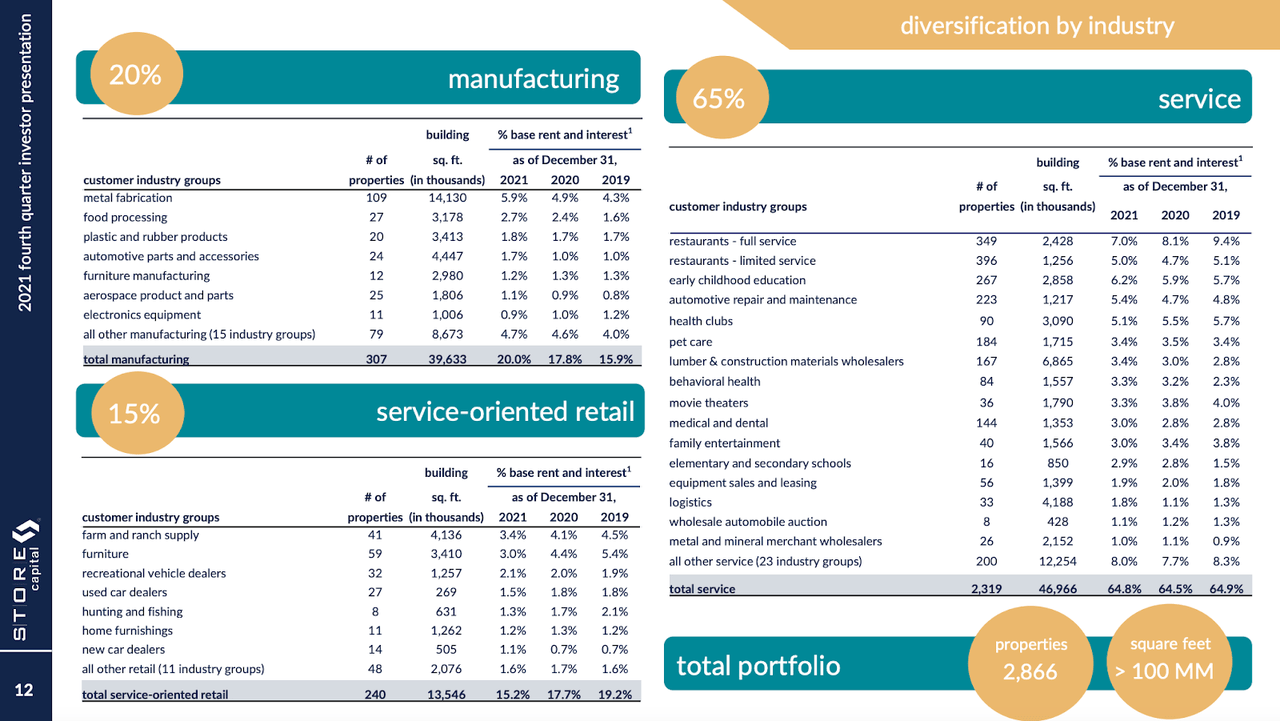

STOR has a fairly unique asset allocation strategy, with regard to the types of tenants that it focuses on. Looking at its top tenant base, you'll see that STOR's allocation towards things like full-service restaurants and early childhood education differs from many of its net lease peers who prefer to focus on things like convenience stores and drug stores.

STOR Q4-21 Investor Presentation

This strategy of focusing on higher risk tenants also provides STOR with bargaining power resulting in the higher cap rates.

Investors must be aware of the potential risks that come from more experiential retail, especially during the pandemic period (while it appears that we're in the later innings of the COVID-19 pandemic, we're not totally out of the woods yet; and, consumer habits have changed during COVID and there's no telling as to whether or not we'll see things like theaters and gyms return to their former glory).

STOR Q4-21 Investor Presentation

STOR Q4 Earnings Results

While we acknowledge the risks associated with STOR's strategy, the fact is, they're paying off nicely now for the company which just posted Q4 results which beat analyst estimates on both the top and bottom lines.

The company posted revenue of $209.2 million, up 21% on a y/y basis.

STOR's AFFO came in at $0.56/share, up 27.3% on a y/y basis compared to last year's Q4 AFFO total of $0.44/share.

During Q4, STOR put $486.2 million to work, investing in 100 properties. Management stated that the weighted initial cap rate attached to these investments was 7.2%. In its Q4 report, the company said,

AFFO for the three months and year ended December 31, 2021 rose primarily as a result of net additional rental revenues and interest income generated by growth in the Company's real estate investment portfolio.

For the full-year in 2021, STOR's revenue came in at $782.7 million, up 12.7% compared to 2020's sales total of $694.3 million.

STOR's AFFO/share totaled $2.05/share, up 12% on a y/y basis compared to 2020's full-year AFFO/share total of $1.83.

During 2021, STOR invested approximately $1.5 billion into 336 properties with a weighted initial cap rate of 7.5%. During the Q4 report, STOR's CEO, Mary Fedewa, said,

Momentum in our business continued to build throughout 2021 and we closed the year with a very strong fourth quarter, delivering AFFO per share of $0.56, the highest in our history.

For the full year, we achieved 12% growth in AFFO per share, which exceeded our guidance, raised our dividend by 6.9%, and acquired $1.5 billion in profit center real estate at an average cap rate of 7.5%.

All in all, these were solid results. And, looking forward, it appears that STOR remains quite bullish on its prospects, with Fedewa highlighting raised 2022 AFFO guidance saying:

Our customers are increasingly optimistic about the outlook for growth and are turning to STORE for our customized financing solutions to help them pursue new opportunities.

With a robust and diverse pipeline of more than $13 billion, a differentiated platform, and a well-capitalized balance sheet with flexible financing options, we are well positioned to deliver attractive spreads and strong AFFO growth in 2022. Reflecting our confidence, we are raising our 2022 AFFO per share guidance to a range of $2.18 to $2.22.

With regard to this AFFO guidance, STOR said:

This AFFO per share guidance equates to anticipated net income, excluding gains or losses on sales of property, of $1.02 to $1.05 per share, plus $1.06 to $1.07 per share of expected real estate depreciation and amortization, plus approximately $0.10 per share related to noncash items. AFFO per share is sensitive to the timing and amount of real estate acquisitions, property dispositions and capital markets activities during the year, as well as to the spread achieved between the lease rates on new acquisitions and the interest rates on borrowings used to finance those acquisitions.

In Q4-21 STOR issued 4.8mm shares ($146mm/$31.10 per share) on its ATM in the quarter (25.7mm shares or $686mm in 2020) and currently has $166 million of cash with $600 million available on its undrawn LOC, while net debt-to-adjusted EBITDA sits at 5.6x (5.4x in 3Q).

STOR Stock Valuation

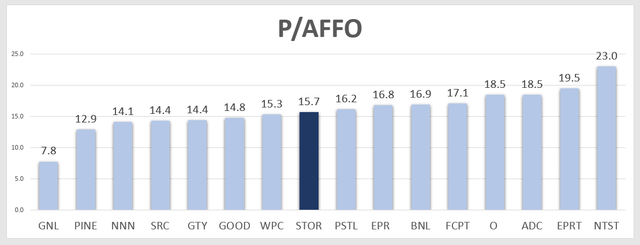

The combination of STOR's solid 2021 growth, its positive guidance for 2022, and the stock's share price woes as of late, STOR's valuation has fallen down to levels that are well below the company's longer-term historical averages.

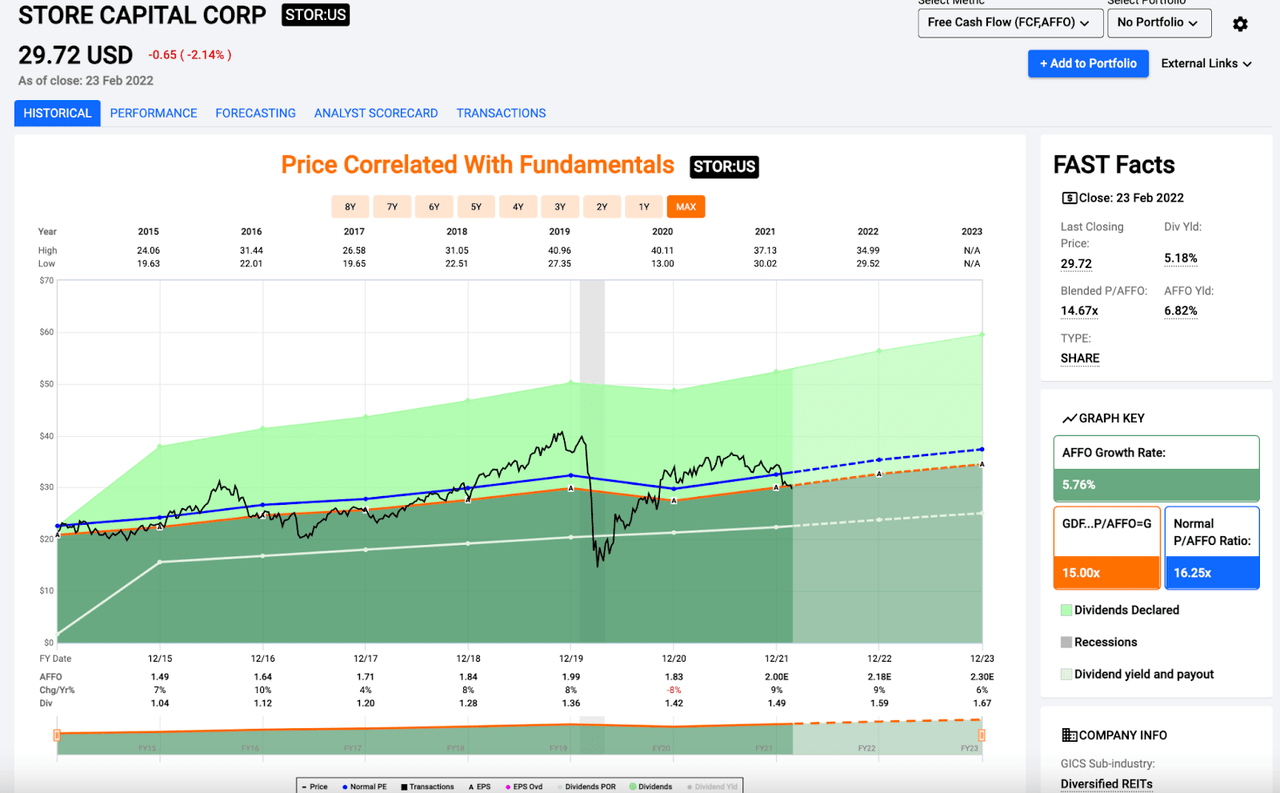

FAST Graphs

STOR's current blended P/AFFO multiple is 14.67x. And, on a forward basis, shares are much cheaper, trading for just 13.5x the mid-point of management's recent 2022 AFFO guidance.

In mid-2021, STOR shares were trading with a 19x multiple, which shows how quickly sentiment has shifted in recent months. But, when looking at STOR's forward looking growth prospects, it appears that this negative outlook by the market is irrational.

STOR's forward looking AFFO growth prospects are much higher than National Retail Properties, which has a similar operational structure and portfolio development priorities.

NNN is only expected to post AFFO growth of 1% in 2022, 3% in 2023, and 3% in 2024. And yet, STOR trades with an almost exact 2022 forward P/AFFO multiple of 13.5x.

STOR's AFFO growth prospects are essentially in-line with the consensus 2022 and 2023 growth rates currently being applied to names like Realty Income or Agree Realty (in 2022, O is expected to grow its bottom-line by 9-10% and ADC is expected to post AFFO growth of approximately 8%).

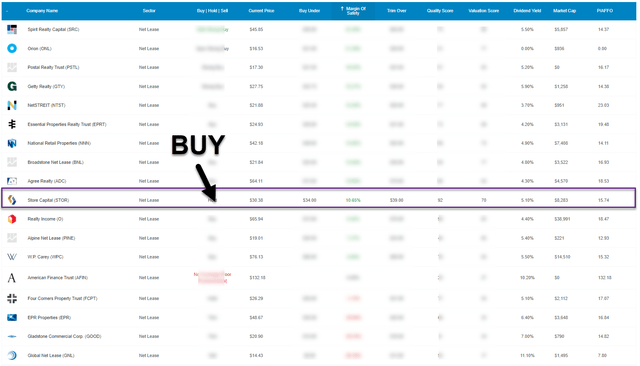

Yes, all of these companies have higher quality scores than STOR…STOR's iREIT IQ score is 92/100, compared to ADC's 96, NNN's 96, and O's 98…however, when looking at the relative comparison between valuation and growth, STOR appears to be more appealing.

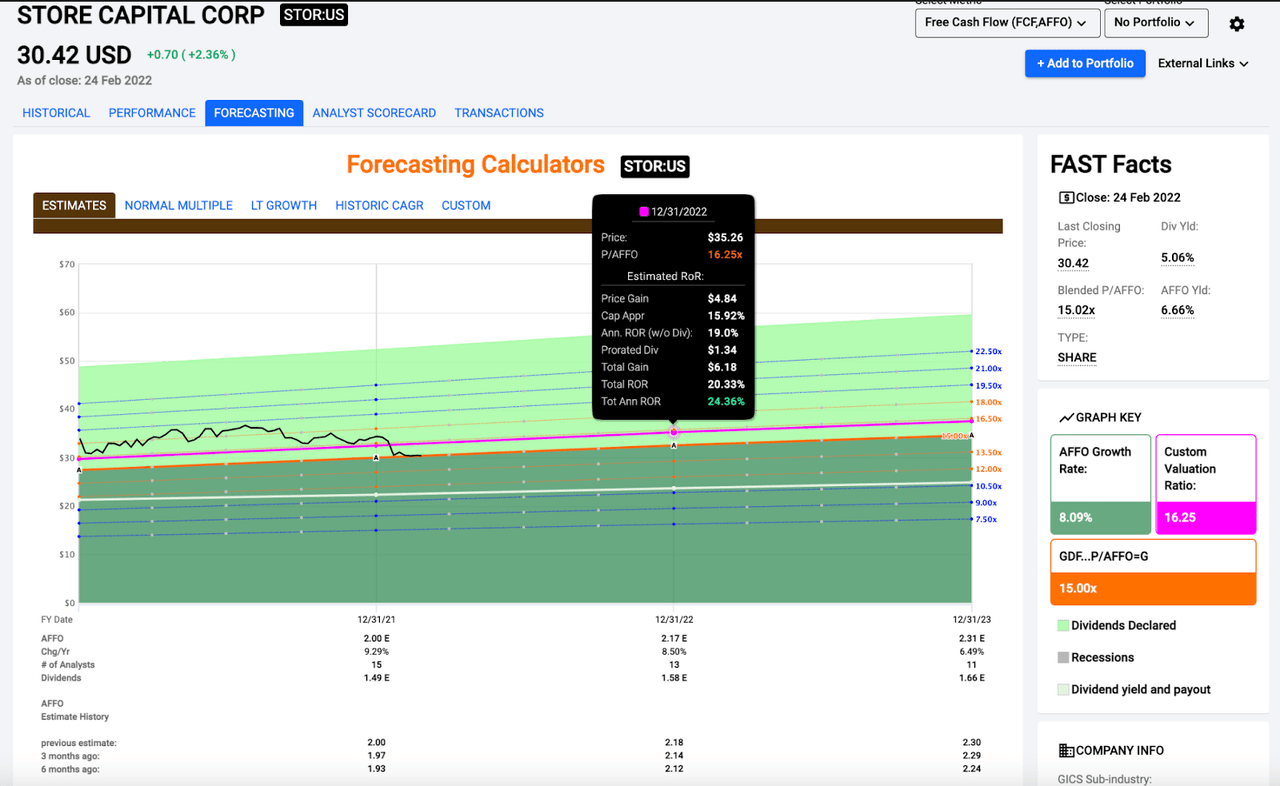

As you can see on the chart below, STOR's growth, its 5.06% dividend yield, and the potential for multiple expansion via mean reversion back up to its historical average of 16.25 result in forward looking total annualized return prospects north of 26.5% in the short-term.

FAST Graphs

And, even if it takes more time to see STOR's multiple expand back up towards historical averages, investors buying at today's share prices are still looking at double digit annualized return figures in the double digits.

Looking ahead, using current analyst estimates for AFFO and STOR's dividend payout in 2023, we arrive at a total annualized return forecast of 17.7%.

Conclusion

The bull/bear debate when it comes to this name and its relatively low valuation is always going to center around the quality of its tenants and the risks that are associated with management's unique focus on the middle market.

But, as shown above, any positive sentiment shift here has the potential to result in very strong total return figures for investors from these beaten down levels.

Although we have been on the fence (neutral/hold) since Volk's departure (as Chairman) we are nudging our recommendation up to Buy.

Keep in mind, back in May 2017, I wrote an article titled There's More Inside This STORE Than You Think, and this article I drew attention to STOR's cheapness and insisted on the upgrade from BUY to STRONG BUY.

Perhaps irony or maybe not, the legendary value investor, Warren Buffet gave a thumbs up to STOR, less than 60 days after my STRONG BUY upgrade. On June 26, 2017, Berkshire Hathaway (BRK.A) (BRK.B) invested $377 million (to become a 9.8% owner in Store).

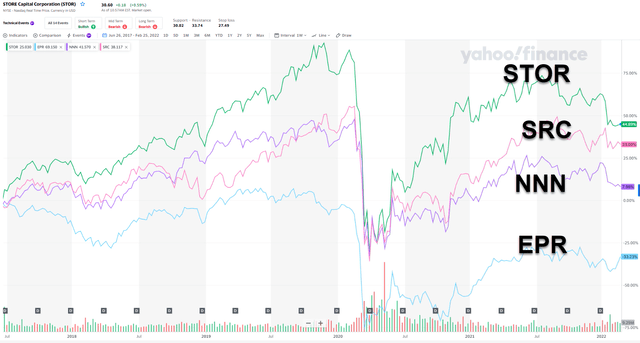

As you can see above, since the Buffett buy, STOR shares are +45.2% versus +78.7% for (SPY) and +21.3% for (O).

Notably, STOR has outperformed its closest peers since the Buffett buy. (EPR) is -33.4%, (NNN) is +7.9%, (SRC) is +32.5%, and STOR is +45.25%.

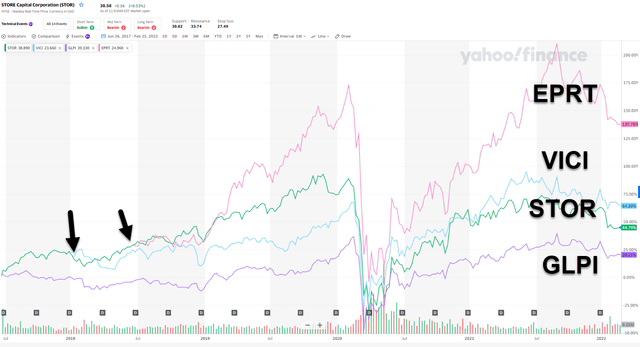

STOR has seen new competitors including VICI Properties (VICI) and Gaming & Leisure (GLPI) - both gaming REITs, as well as Essential Properties (EPRT).

Although STOR has not entered the gaming sector yet, we wonder whether or not the company will follow the same path as Realty Income that recently announced its first gaming acquisition.

This will certainly be one of the many questions I plan to ask her when we're able to schedule a Ground Up podcast (for iREIT on Alpha members).

Celebrate With Me!

Come celebrate with me! I now have over 100,000 followers on Seeking Alpha. Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Banks, and we recently added Prop Tech SPACs to the lineup. Direct message me about a great discount if you are a veteran or retiree.