Fahroni/iStock via Getty Images

This article provides an update to my last investment thesis on FREYR Battery (NYSE:FREY). New energy stocks remain one of the most interesting areas of the market to me as a growth investor, and FREYR makes for an interesting candidate. While I'm not long FREY at the moment, I think it is worth tracking as a candidate for a Venture-Capital style investment.

Premise

FREYR Battery went public through SPAC acquisition by Alussa Energy Corporation last year. It is a pre-revenue company operating out of Norway, with a little more than a collection of foundational ingredients and cash to ambitiously chase becoming a major European producer of Lithium-ion battery cell capacity, seemingly in the 40+ GWhs per year by 2025.

For the uninitiated, what does this mean? If you think of an entry level Tesla Model 3, it would have a "50kWh" (kilo-Watt hours) battery. "kWh" is an industry-standard unit for the total energy capacity on a full charge of the battery. A giga-watt-hour translates to a billion-watt-hours. So theoretically, a 40GWh annual capacity could output the energy equivalent in battery cells for ~800,000 entry level Tesla Model 3s, or about ~400,000 Tesla Model S cars in a single year. This is big-energy stuff.

To expand on FREYR's vision, note the following:

- Ongoing Target of 43 GWh of output by 2025

- Norway offers some of the lowest costs of energy in Europe; and that energy happens to be quite green. This plays well for running costs for operating giga-factory manufacturing; and producing batteries that are actually green and de-carbonized throughout the supply chain.

- Norway is resource rich key Li-battery raw materials: Cobalt and Graphite in particular. Transportation to the factory locations from mining partners is simpler.

- European neighbors on the mainland have rich Lithium-ion deposits

- FREYR has lined up MoUs and offtake agreements across the full supply chain. From raw material sourcing with mining giant Glencore, to purchasers of capacity in the future with Scatec, Siemens Energy, and mega-shipper Maersk.

- The IP for the battery technology has been licensed through 24M, an MIT spinoff that invented "Semi-Solid" Li-batteries that are cheaper, energy dense, and cost-efficient to produce.

Information Source: Company Presentation Feb 2022

The early-2021 SPAC acquisition served as a very intentional capital injection to accelerate the process of deploying capital and putting plans to action in order to build giga-factories from scratch in Mo-i-Rana, Norway. The deal was announced in early 2021 when - you know, market conditions were favorable for moonshot SPACs of this nature.

Fast forward to 2022, and FREY has remarkably not lost most of it's value as an enterprise despite not having sold any batteries yet. It speaks well of the institutional shareholders in the venture who are likely long-term oriented, and it also speaks well of the progress made by the FREYR team over the past few quarters.

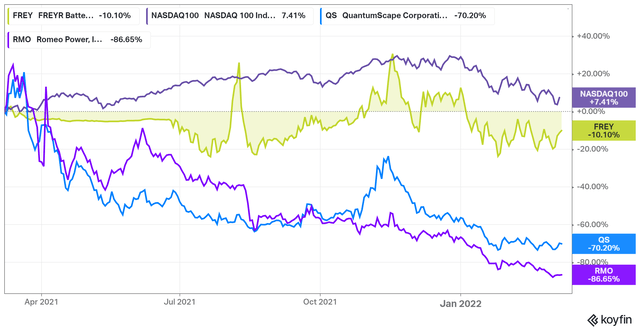

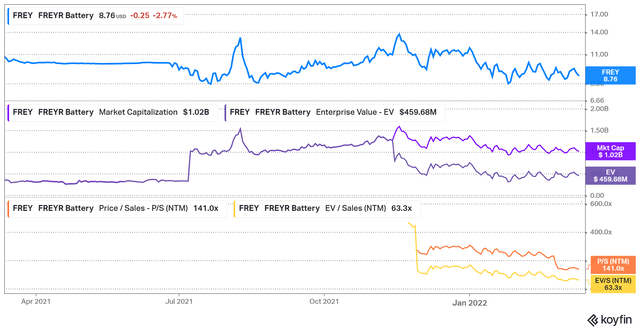

To put it simply, FREYR has been doing what they said they were going to do during their shiny SPAC presentation. That isn't something you can say of most-SPAC targets that are suffering today. Alas, the stock has kept up at a $9 price. This is a drawdown from the $14 it once was during last year, but with the current market conditions involving some major risk-off appetite (with some panic sprinkled in), it's a relative win; especially when you compare it to other battery-producer plays like Quantum Scape (QS) and Romeo Power (RMO).

1-yr Price Action FREY (Koyfin)

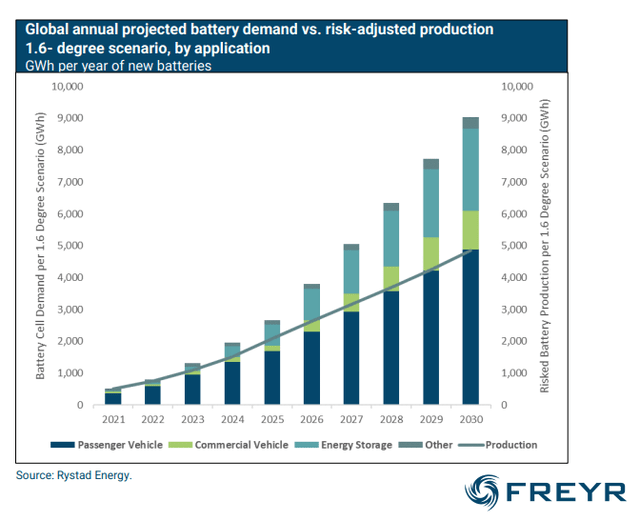

QS is currently at ~$15, and RMO at ~$1.50. All of these stocks started out as $10 blank checks. I haven't focused too much on competition in this article since I think there's more than enough future demand for any battery cell producer that executes well enough. Current EV production for instance, is bottlenecked by not enough battery capacity. Leaders like Tesla (TSLA) anticipated this a decade in advance and have built out giga factories globally. The others have relied on a handful of existing producers based in Asia (China, South Korea, and Japan) and are somewhat constrained given the speed of energy transformation that's set to occur. According to Rystad Energy, production capacity will be seriously constrained.

Battery Supply/Demand Projections (Rystad Energy)

Therefore, FREYR as an investment, needs to be judged against it's business execution and future narrative. Competition might be relevant in 2025 or beyond, but that's a non-issue given the present. I reckon if the company gets their execution right, the stock has serious compounding potential. For at the moment, it's only a $1 billion market cap company. Today's giga-factory businesses trade in the 10s of billions.

Breaking Ground

FREYR has already broken ground on Mo-i-Rana, and the development of their first plant is underway. Investor capital is being put to work, and steady progress has been made. To add, here are a few key quotes from the last earnings call.

So we are now well advanced in building FREYR's operational foundation. The Customer Qualification Plant, our first giga-scale facility is on track for starting up production later this year. The Gigafactory development, which will rest upon the development we have in the CQP, the Customer Qualification Plant, we are now pleased to announce that we're combining Gigafactory 1 & 2 into one larger facility with eight production lines and an upsized nameplate capacity of 18 gigawatt hours...

We anticipate to start and ramp up production during the first half of 2024. When we are ready to make the final investment decision, which we aim to do later this half of the year, we will be providing updated CapEx estimates and plant development time lines to our investors. We're well underway, however, in making progress in our Gigafactory site in Mo i Rana. We've already started groundbreaking, and the Board of Directors just recently approved additional capital investment in groundworks and early works commitments to ensure that we can move as quickly forward as possible on this 18-gigawatt hour Gigafactory...

The CQP will be the first point of production with the larger 18GWh giga-factory ramping up later. Management re-iterated 43 GWh for 2025 during the call and the net takeaway was quite positive.

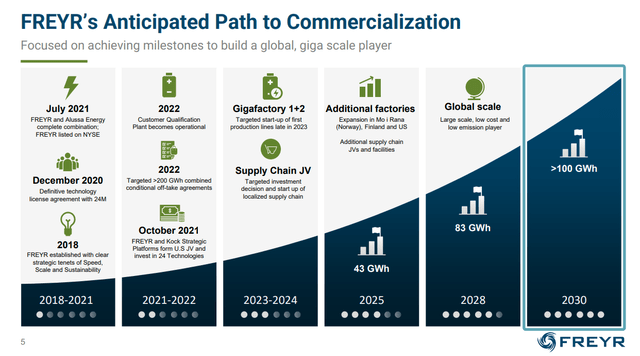

The Current State Of The Future

FREYR Investor Presentation (FREYR IR)

The slide above shows the plan of action ahead - and it's one of exponential capacity growth that will come to be meaningful 3-4 years from now.

Any investor in any growth stock has to weigh a thesis against the future and the probabilities associated with achieving that context. I think one part of the story that's been particularly re-assuring is the relationships and agreements that have been cultivated by FREYR.

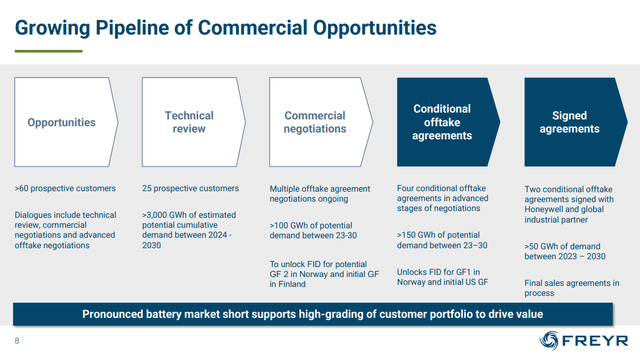

FREYR Investor Presentation (FREYR IR)

FREYR has signed on multiple offtake agreements for capacity, to the tune of 50 GWh with unnamed global industry players, and claim to have a line of sight of an additional 150GWh on future sales. Offtake agreements are pre-sales agreements which roughly translate to future capacity being sold when ready. One doesn't have to take my word for it as a plebian, but perhaps those of the names attached to FREY instead; whether through partnerships, investments, or agreements.

- Koch Strategic Platforms is an investor and JV partner

- Technology partnership with Honeywell

- Licensed IP from 24m, the creator of the Semi-Solid Battery, that in-turn recently announced a tech partnership with Volkswagen Group

- Siemens Energy, Maersk, Scatec Solar, Honeywell are among the offtake Partners

- Global mining giant Glencore will supply a fair chunk of the raw materials.

Perhaps missing from this list, is a direct vote from a major automobile manufacturer. However, this factor is secondary if most of the next few years' capacity is already positioned to be sold. While EVs have received all the hype in recent years, there's an immense demand for energy storage systems that rely on capacity to hold and regulate power delivery from solar or wind, which aren't exactly consistent sources (You need your lights and heating on when it's dark, while solar cells are at their daily lows for energy gen). Energy storage demand is as much on an exponential trajectory as EVs for instance. Siemens Energy and Scatec plan to use FREYR's output for exactly that. While most of the tough engineering, manufacturing development, R&D, and business execution lays ahead, these softer factors such as partnerships are strong indicators given the youth of the venture.

It's also worth remarking on the battery technology that shall make FREYR a viable business on economics. FREY is primarily going to be a manufacturer, while the key R&D component and IP comes from "24M" - an MIT spinoff in Cambridge, MA, that has claimed to have developed a better, cheaper, more energy dense battery along with a highly efficient manufacturing process designed to go along with it. Professor Yet-Ming Chiang, the man who cofounded 24M, has a history of successful serial entrepreneurship surrounding his area of materials science expertise. More importantly, the fact that Volkswagen piled in enough capital recently to hold 25% of the business is re-assuring.

Key Industry Tracking Metrics

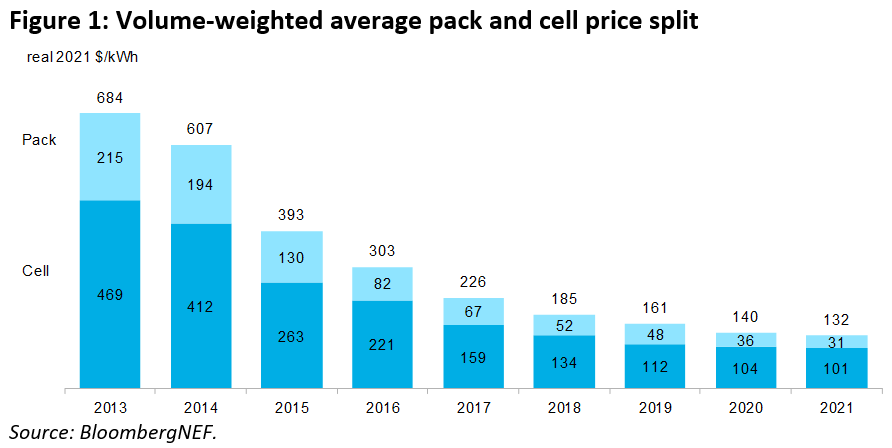

To get our thesis straight, it's worth keeping an eye on battery production costs and other key metrics. Bloomberg's New Energy Finance division published a chart in November highlighting the general trend of costs of battery production in $/kWh.

Battery Cost Curve (Bloomberg New Energy Finance)

- At the cell level, costs are at $101/kWh

- At the battery pack level, costs rise to $132/kWh

Most of the battery pack supply chain's value capture occurs at the cell level, and that's where FREYR plans to make a difference. The unit economics of FREYR's future output are strongly based on 24M's proficiency in Semi-Solid cell design. So how good is 24M, really?

Two metrics I'd really like to know pertaining to 24M's Semi-Solid batteries are:

- Energy density. The amount of capacity that can be filled in a kilogram of pack. A Tesla Model S is a 2000kg vehicle with a good chunk of the weight denoted to the battery pack. An EV battery pack not only has to haul you and your passengers in a car, but also it's own weight, which is pretty heavy. The higher the density, the further your vehicle will go on a charge, as less weight needs to be hauled for the same capacity.

- Cost/kWh. Tesla famously does not disclose these numbers for their own packs, though they are widely considered to be best in class. Many estimates put it at <$100, which is a whole lot better than general $132 in the chart above. Lower cost vs. competitors means better bottom lines for FREY.

I attempted to contact 24M through one of those website forms last year but never received a response. The company is also seemingly tight-lipped on such metrics with a bare-bones website which comes as little surprise, following the poker play in battery tech measurements set forth by Tesla. That said, I did find some other numbers online.

Advanced Research Projects Agency-Energy (or ARPA-E), the US government agency, recently funded 24M with a $9m grant. In their short descriptions of funded projects, this is what they had to say:

The current generation of Li-ion batteries is approaching performance and cost plateaus, however, just as new electrified transportation applications are emerging. The 24M team will develop and scale up batteries incorporating a Lithium Electrode Sub-Assembly and Semi-Solid cathode that deliver lower cost energy storage (<70 $/kWh), superior power (>1.5 kW/kg), and improved energy density (450 Wh/kg) for electric aviation.

$70/kWh is a highly respectable target given current trends, and $450Wh/kg is on par with QuantumScape's long-term target. FYI, Quantumscape only intends to come into financially material production in 2027. ARPA-e likely had a deep inside look into 24m who may have in turn provided these numbers, and they're excellent. Should FREYR be a valid beneficiary for this cost advantage at mass-scale manufacturing, we're in for a business model that will likely be sustainably free cash flow generative. A lot can happen over the next few years, and it's still early to call winners. However, this forms another piece of information that puts the odds in a FREY shareholder's favor.

A Fair Valuation For a Moonshot

Price and Valuation (Koyfin)

If FREYR is operating 43 GWh in capacity by end 2025 with a strong balance sheet, then it's not going to be trading at a $1B market cap. It'll be much, much more. I think there's a possibility it goes to 5-10x in five years, or 30-50x in 10 years even with further capital raises and dilution. The worst case scenario if this bet doesn't work out is an effective complete loss of capital. So I'd caution potential investors to treat this investment as one analogous to a mid-stage Venture Capital round. There's a strong probability of nothing happening. The execution of a giga-factory is a truly difficult undertaking that requires highly complex elements of strategy, supply chain, technology, talent, and more to work together.

Let's contextualize the moon, if this is a moonshot. The largest battery capacity manufacturer in the world today is China's CATL, trading at an equivalent of $170B in market cap, held 97GWh of capacity in 2021, and recently inaugrated a 120GWh manufacturing facility.

With these extreme outcomes in mind, an investment in FREY requires a whole lot of patience and a long-term outlook. It may require consistent execution and an influx of positive catalysts to realize capital gains. While on the other hand, the market can brutally punish FREY if they even slightly underperform expectations. With 2022's extreme volatility, anything is possible for this stock.

Risks

- Commodity prices: This is perhaps the most significant risk I see over the near term. When FREYR is operating on an exponential trajectory along with the rest of battery cell manufacturers, there's exponential demand of materials too. Nickel, Graphite, Copper.... and Lithium itself are key materials that have surged in recent months. Global supply chain constriction, the war, inflation, and the commodity super-cycle are set to apply pressure on battery raw materials. Miners win in this market, consumers don't.

- Macro & Geopolitics: Norway's local economy and dynamics play a role, and so does the rest of Western Europe. What's happening in Russia-Ukraine is directly impacting all the European economies through commodity prices and supply chains.

- Failure of relationships: Should mining giant Glencore, or 24M, or any part of this future supply chain underperform, it would effect FREYR directly. Delays will suck out cash from the company.

- Unit economics don't work: If manufacturing the Semi-Solid battery in Norway results in unfavorable costs, FREYR may not be a profitable enterprise until huge economies of scale are achieved.

- Financial Risks: With about $560m on the balance sheet, a lot is going to be spent over the next two years on Cap-Ex. If the speed of production output isn't quick enough, then the company will burn much more cash. Capital raises, dilution, and debt can quickly evaporate equity value.

- Systemic Risks: Through no fault of FREYR, markets can take the stock for a ride in risk-off scenarios. 50-75% drawdowns should be considered a real possibility even if the business is executing well at a stable pace.

Conclusion

FREYR Battery has delivered on expectations so far, which is commendable for a SPAC company with lofty promises. That doesn't necessarily mean they'll continue to deliver on expectations in the future. The next few years will test the business in unique ways as they navigate a complex environment in order to chase 43GWh's of giga-factory capacity by 2025.

For those investors who are willing to take a moonshot, FREY makes for a strong energy transformation play. Extreme risk, extreme reward. With the tremendous upside potential should it succeed, it might make sense as a small allocation of a broader tech portfolio.