solarseven/iStock via Getty Images

Thesis And Background

Now is a challenging time for investors. Stock valuation is at a record high, bond yields are surging, a major geopolitical conflict is underway, and several crucial macroeconomic uncertainties are unfolding. As mentioned in our newly launched

Check out our marketplace service

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 2x in-depth articles per week on such ideas.

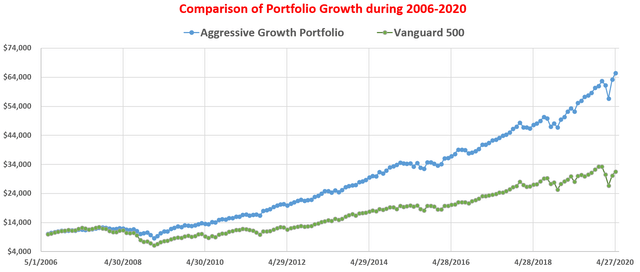

We have vetted and perfected our methods with our own money and efforts for the past 15 years. For example, our aggressive growth portfolio has helped ourselves and many around us to consistently maximize return with minimal drawdowns.

Lastly, do not hesitate to take advantage of the free-trials - they are absolutely 100% Risk-Free.