shapecharge/iStock via Getty Images

This article was first released to Systematic Income subscribers and free trials on Apr. 28

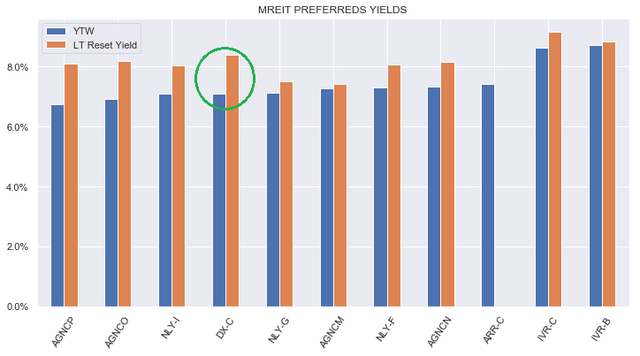

In this article we highlight the Dynex Capital Series C Fix/Float preferred (DX.PC), trading at a 7.1% yield. Dynex Capital, Inc. (DX) is a mortgage REIT with a leveraged agency MBS portfolio. In this, it is similar to a number of other household names, such as Annaly Capital (NLY) or AGNC Investment (AGNC). However, as we discuss below, it is also different in a number of key and favorable ways.

We have been overweight the mREIT preferreds sector for a while now due to the combination of the sector's relative resilience, relatively high yields, and consumer-facing exposure. For a quick primer on the sector, have a look at our earlier discussion as well as another article that discusses the important differences between agency and hybrid mREITs.

What Makes DX Different

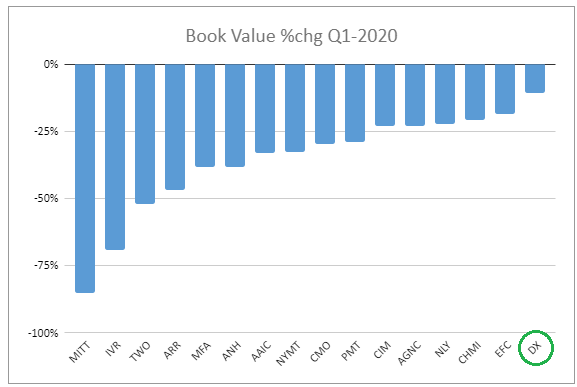

The first key difference between DX and the rest of the agency mREIT sub-sector (in which we include ARMOUR Residential (ARR), NLY, AGNC, and Invesco (IVR)) is a more nimble hedging approach by management in unfavorable market environments. This has protected book value over Q1 of this year just as it did over Q1 of 2020.

Recall that DX was a clear standout during the COVID crash because of its unusually resilient book value, as the chart below documents. This was due to it taking down leverage significantly heading into Q1 of 2020. Obviously, the company got somewhat lucky as they clearly did not foresee the coming pandemic and its impact on markets but it does highlight that it is prepared to sharply dial down its risk exposure to protect book value - a great feature for preferreds holders who are more focused on the downside in book value rather than potential upside.

Systematic Income Preferreds Tool

Something similar happened in Q1 of this year, although this time the company did not deleverage but positioned specifically in a way to prevent a sharp drop in book value in an unfavorable market environment.

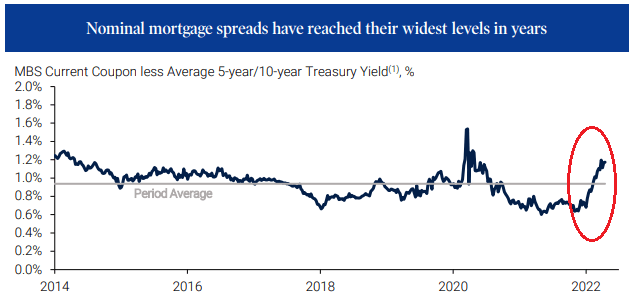

This environment was characterized by the widening in the so-called MBS basis, which is a metric of relative value between agencies and Treasuries. Many commentators have suggested that the recent book value drops across agency mREITs have been largely due to such factors as the rise in interest rates or negative convexity, which is not correct.

This cheapening of MBS relative to Treasuries can be seen in the chart below from Annaly (our highlight in red), which shows that after getting very expensive due to continued Fed QE through 2020, MBS cheapened significantly on the back of expectations of MBS sales by the Fed from its balance sheet.

NLY

The unique positioning by DX in the sector was composed of: 1) maintenance of hedges through the rise in interest rates; 2) a tilt to lower-coupon MBS which held in better than higher-coupon securities; 3) holding of interest rate swaptions which partially mitigated the negative convexity of the portfolio; and 4) an allocation to interest-only or IO securities which have negative duration.

The outperformance in lower-coupon MBS likely had to do with the fact that the bulk of the low coupon stack is held by the Fed and banks, with most of the current production being in higher coupons. This allowed the low coupon MBS to benefit from their relative scarcity in the market.

In the end, DX actually managed a 1.4% rise in its book value, while over the same quarter ARR saw an 18% drop, while NLY had a 15% drop in its book value. Other agency mREITs are yet to report as of this writing.

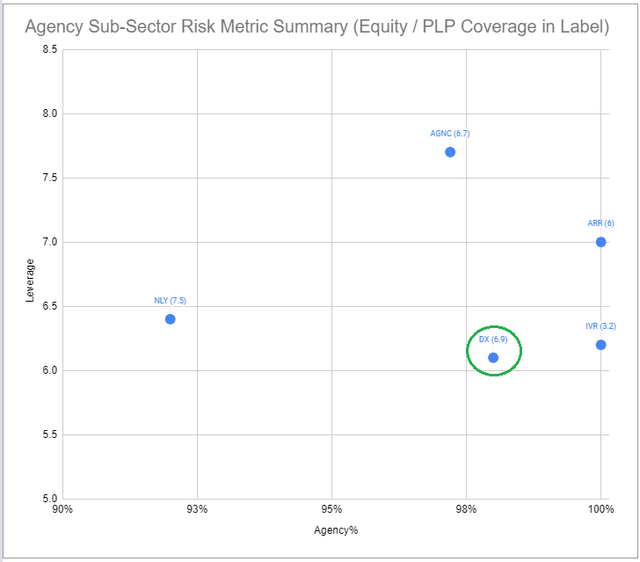

Another attractive feature of DX is its lowest leverage profile within the agency mREIT sector - something that DX has largely maintained over time. This is a big benefit for preferreds holders, as it makes book value more resilient.

Systematic Income Preferreds Tool

We can also see that the stock's equity / preferred coverage is the second highest in the sub-sector - only below that of NLY. This metric is shown in the labels in the chart above - an extract from our Investor Preferreds Tool.

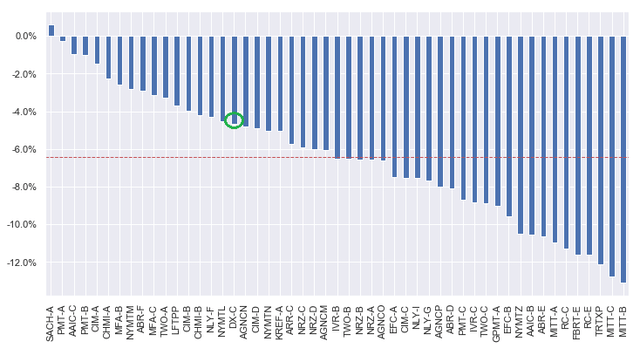

The preferred also boasts a relatively low duration, which has to do with 2 key features - its relatively high coupon of 6.9%, and its Fix/Float profile. This explains why the stock has outperformed the mREIT sector as well as the broader preferreds sector. For instance, DX.PC is down 4.7% year-to-date while the average preferred is down about 8%. Year-to-date total returns of the mREIT preferreds sector are shown in the chart below, with the average highlighted by the red line.

Systematic Income Preferreds Tool

Something else that makes DX.PC more resilient is the fact that it has a relatively high long-term reset yield. This metric, which we recently introduced on our investor Preferreds Tool, is simply the stock's stripped yield based on the longer-term expectation of Libor.

Systematic Income Preferreds Tool

The math is quite simple - over the longer-term Libor is expected to move out to around 2.68% (this is based on Libor forwards). This will make the stock's coupon after its first call date equal to 8.14% (= Libor of 2.68% + spread over Libor of 5.461%). To turn this into stripped yield based on today's stripped price, we have 8.14% x $25 / $24.30 = 8.37%. Although this number is below that of the IVR preferreds, the IVR risk profile is significantly worse than that of DX with equity / preferreds coverage at less than half that of DX.

What happens in case the stock is redeemed in 2025 before the coupon switches to its floating rate? In that case the stock will have delivered a yield-to-call of 7.95% - above its current stripped yield of 7.1% and not exactly a horrible outcome.

Takeaways

Much like in 2020, DX has once again demonstrated its ability to dial down risk in order to protect book value. This - from the looks of it, unique - ability in the sector creates an additional margin of safety for holders of its preferred, DX.PC.

In addition, the relatively low leverage of its portfolio and a high agency allocation in an environment of cheap agency valuations creates an attractive risk profile for shareholders.

Finally, its relatively high yield in the sector (both in terms of yield-to-call and its reset yield) is attractive in its own terms and allows the stock to maintain a lower duration profile relative to the broader preferreds sector. We continue to hold the stock in our Core Income Portfolio.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!