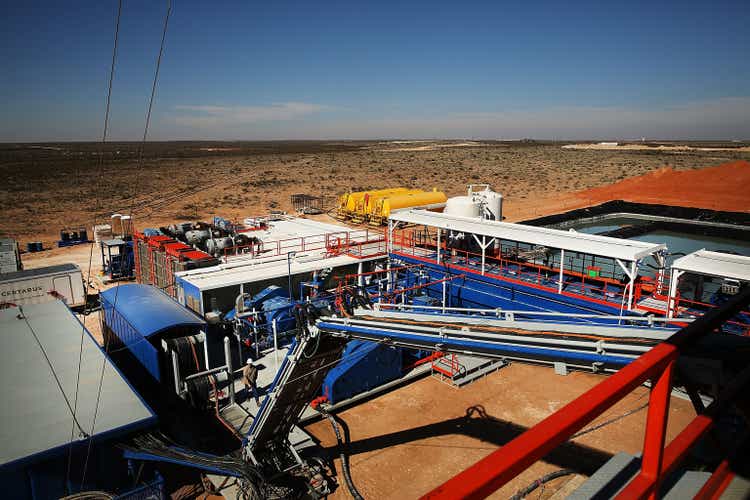

Spencer Platt/Getty Images News

APA Corporation (NASDAQ:APA) has been a volatile American energy company. The company's $15 billion market capitalization is still well below long-term highs even though the company's stock price has outperformed recently. However, the company does still have a unique

Create a High-Yield Portfolio Using Unique Investment Strategies, 2-Week Trial!

The Energy Forum helps you invest in energy, generating strong income and returns from a volatile sector. Our included Income Portfolio helps you invest in the broader market, finding high-yield non sector-specific opportunities.

Recommendations from a top 0.5% author on TipRanks!

Worldwide energy demand is growing and you can be a part of this profitable trend. Plenty of unique under the radar opportunities remain.

We provide:

- Model energy and market portfolios generating high-yield income.

- Deep-dive actionable research.

- Macroeconomic overviews.

- Summaries of recommendations and option strategies.